The Biggest Issue with Global Aging

IIS Executive Insights Life & Health Expert: Ronald Klein, Executive Director, BILTIR

Exploring why global aging and the associated protection gaps are not being appropriately addressed in society.

The World Economic Forum

Davos (emphasis on the “vos” not the “Da”) is a relatively small mountain resort located in the Graubünden Canton of Switzerland. It covers 284 square kilometers and sits at 1,560 meters above sea level, making it one of Switzerland’s highest elevated cities. It has a long and rich history dating back at least to 1280. To the locals, Davos is best known for the Spengler Cup, an international hockey tournament held each year since 1923. It is also known for its winter sports including downhill skiing, cross-country skiing and ice skating.

To non-Swiss, Davos is known, of course, for hosting the World Economic Forum (WEF) each winter since 1974. The WEF was first conceived by Klaus Schwab as a means for European companies to catch up with US management practices. Between 1974 and 1986, it was known as the European Management Forum. In 1987, it was renamed the WEF and quickly grew into a meeting for political and corporate leaders to solve the world’s problems. For example, in 1992, the Forum provided a venue for President F.W. de Klerk and Nelson Mandela to hold further discussions with the goal of putting an end to apartheid in South Africa. This meeting helped reignite stalled negotiations and led to the official end of apartheid a few years later and the awarding of Nobel Peace Prizes for Mandela and de Klerk the following year.

The Aging Crisis is not on the Radar Screen

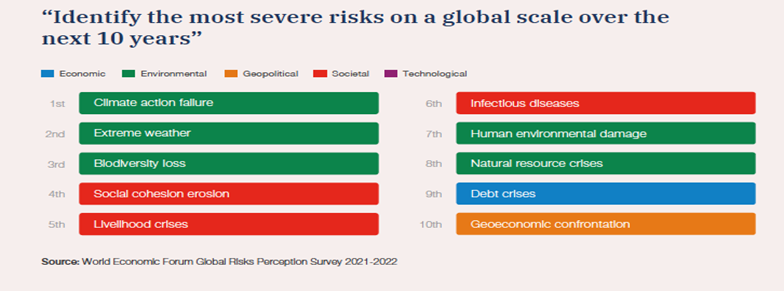

One output of the annual WEF is the Global Risk Report, which published its 17th edition earlier this year. Klaus Schwab continues to write the Preface of this report. The highlight of the 100+ page report is a listing of the top risks facing the world in the coming years. The 2022 report identified 10 risks most likely to have the greatest severity during the next 10 years.

Figure 1

This is a survey of 12,000 of the best and brightest economic minds that the world has to offer. The respondents are politicians that set policy for the world and business leaders who produce the lion’s share of global economic output in 124 countries. Major political and economic decisions are made based upon this report. Its importance cannot be overstated.

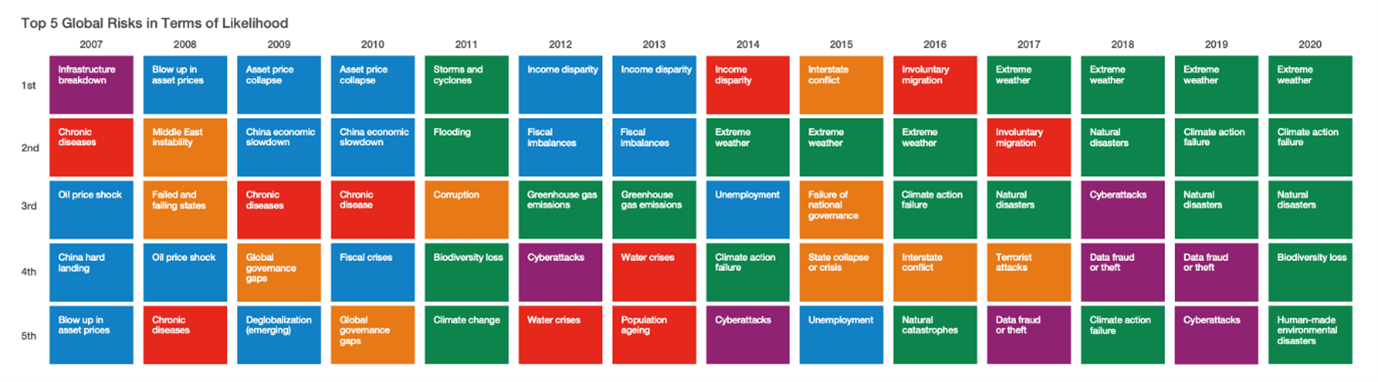

While one can argue whether or not Climate Action Failure should be bundled with Extreme Weather, or what exactly a Livelihood Crisis is, one thing is abundantly clear. There is no place on this chart that a global aging crisis, or its associated protection gap, can be found. Looking back at the top five risks identified by this report between 2007 and 2020, aging makes the list only once in 2013 as the fifth most important risk. Either people stopped aging after 2013, or this elite group determined that there were much more imminent threats to the world. In any event, this growing issue simply dropped off of the list.

Figure 2

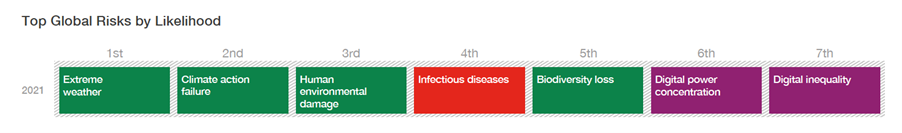

Even more interesting is that there is no mention of pandemic risk in terms of likelihood. So, in January of 2020 after COVID-19 already reared its ugly head in China, the top five risks that the WEF Global Risk Report could come up with were Extreme Weather, Climate Action Failure, Natural Disasters, Biodiversity Loss and Human-made Environmental Disasters. Is it any wonder why life insurance professionals who work for multi-line insurers always feel like the ugly step-sister compared to their non-life colleagues? Even the 2021 Report could only place Pandemic Risk, now called Infectious Diseases, in fourth position.

Figure 3

The latest report begins with a long discussion of the effects of the pandemic on the world, but it mostly points to possible “knock-on effects” of the pandemic and quickly talks about how the pandemic has caused increasing cyber risks, labor market gaps, protectionism, educational gaps, inflation, increased debt, etc[1]. Death, disability and long COVID are not important – just the effect on the economy. Instead of addressing the problem (infectious disease) the Report seems to address the symptoms. Interesting…

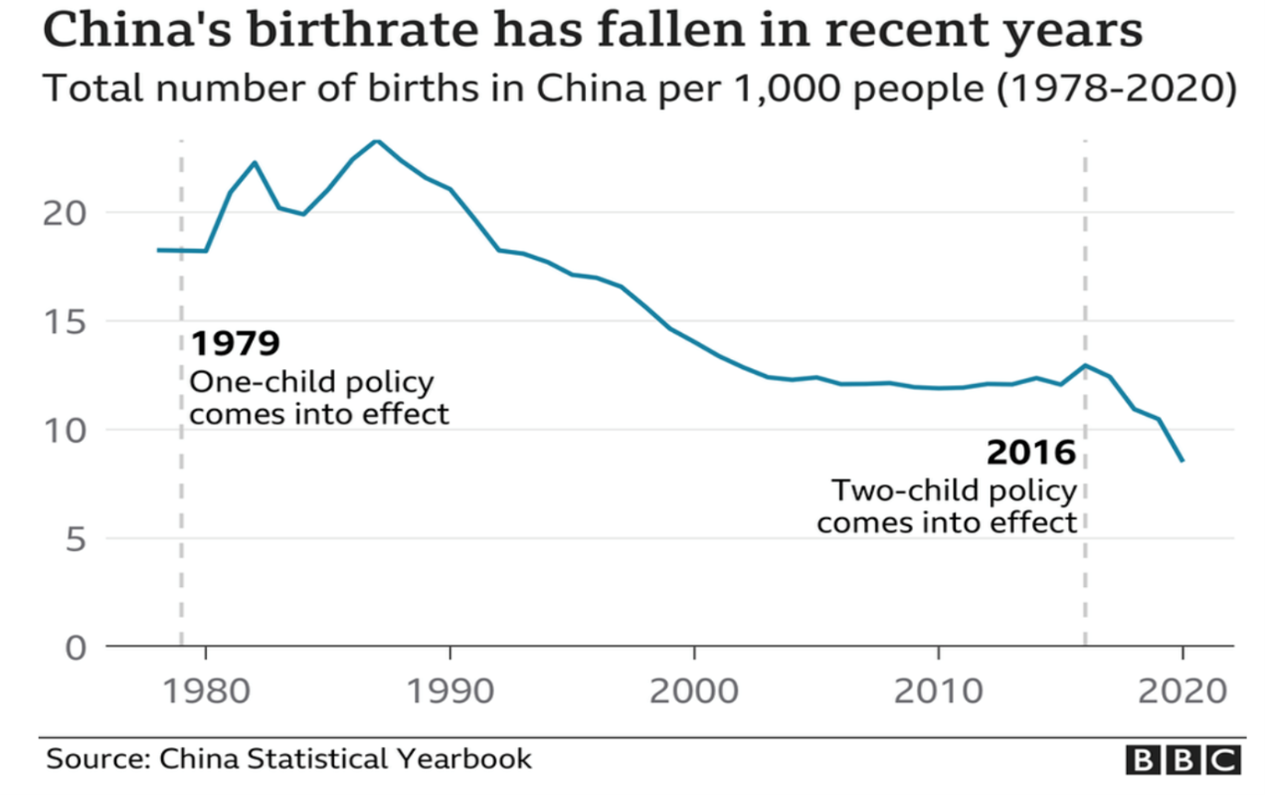

Aging an Issue in China

While the WEF seems not to care about aging populations, the New York Times International Edition apparently understands the issue and its threat to world gross domestic product (GDP). An article written in January of 2022 entitled China’s Births Hits Historic Low, a Political Problem for Beijing, points out that the number of births dropped to 10.2 million in 2021 (from 12 million in the prior year) and deaths reached 10.1 million[2]. It is projected that 2022 will begin a population contraction in China for the first time since the Great Leap Forward in the early 1960s.

Figure 4

After the disastrous effects of the Great Leap Forward, China exhibited tremendous population growth. Fear that a rapid rise in the number of people would mitigate economic growth and impede the standard of living, the government supported the one-child policy in 1979. This policy became ingrained in the population and reversing it has, to date, proven problematic. The recent relaxation of the infamous one-child policy and other incentives to bear children have not worked. To make matters worse, the one-child policy caused families to abort female fetuses in this male-dominated society causing an imbalance in the male to female ratio[3]. At birth, the male to female ratio in China is about 1.13[4]. The weighting toward males is even more dramatic at the child-rearing years as this imbalance filters through the population after the one-child policy took hold. Fewer children being born in conjunction with a larger percentage of these children being male leads to a projected population decline for years to come.

And, China is not the only country that is projected to decline in population. Other countries that are already declining in population include Japan, Greece, Italy, Poland and South Korea. The New York Times article points out that declining population will cause labor shortages which, in turn, will hamper economic growth. In addition, lower growth will yield less in tax revenue needed to support an ever-increasing aged population. Why this is so important is that China is expected to become the world’s largest economy in terms of GDP in the next few years. Worse than expected economic production from the world’s largest economy seems like an issue that the experts at WEF should be focusing on.

The pressure on countries such as China to support their aging population is exasperated by the large protection gap. Swiss Re Institute estimates that the mortality protection gap in China alone was approximately USD 40 trillion (yes, with a “t”)[5]. This gap will put pressure on the government to support families when a breadwinner dies prematurely. More importantly, these unfortunate families typically stop funding retirement savings adding even more stress to the old-age support system in China. Individual insurance would certainly allow governments to worry less about old-age support systems and worry more about economic output. Again, something that the intellectuals descending upon a beautiful alpine resort each January (except during an unpredicted pandemic) should understand. To make matters worse, the Global Risk Report is compiled by a majority of companies that focus on the insurance industry and are only too aware of this looming threat to the economy.

Stress on old-age support systems is not just an issue for China. Swiss Re also estimates that the US mortality protection gap was over USD 25 trillion based on 2016 data[6]. This number has been growing during the recent years. The protection gap is exasperated by a shortfall in contributions to America’s Pillar I, called Social Security, causing its reserves projected to be depleted by the year 2034, unless action is taken by Congress[7]. No action will result in an immediate reduction in payments by 22%. The age considered “normal retirement” has been increasing and contribution rates continue to rise, but the fund is still projected to run out soon. Projections from just a few years ago were derailed by the pandemic causing an acceleration of the shortfall. Any action that Congress takes will divert funds from other projects, including those addressing the WEF’s top five, as highlighted in its 2022 Global Risk Report. How this issue does not make the top five is unfathomable. It will become the most predicable surprise in a few years.

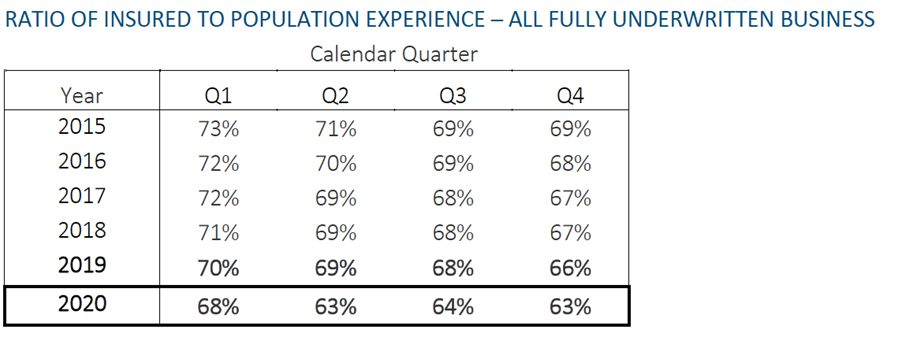

The Society of Actuaries recently published a report updating insured mortality experience in the US through 2020. Contributing companies account for over 70% of life insurance in force in the US. This study shows that while actual to expected number of deaths for fully underwritten life insurance tracked perfectly for 2015 – 2019, there was a large jump for the last three quarters of 2020. In fact, for the fourth quarter of 2020, actual deaths were 22% higher than expected[8]. But, when compared to the general population, insured lives compared much better in 2020 than in previous years. The pandemic has taken a larger toll on the uninsured than the insured in the US. This will add to the protection gap and put enormous pressure on the social insurance system in years to come. The same holds true for most countries. Yet, Infectious Diseases fell from fourth to sixth in the WEF Global Risk Report from 2021 to 2022.

Figure 5

Source: Society of Actuaries

Looking the top five risks identified in the WEF Global Risk Report, it is clear that Climate Change and associated affects monopolize the list. However, this was not true just ten years ago. The risks of a warming climate have been known to scientists for decades, yet convincing the economists and politicians who draft this report proved tricky for years. Major lobbying, studies, campaigning and demonstration of factual results finally persuaded this group to highlight Climate Risk as a major problem on its annual report.

Perhaps the life insurance industry should embark on a similar campaign. The industry is so focused on remaining quiet as to not attract further regulation or hurt its favorable tax treatment. Maybe it is time to “take off the gloves” and show the devastating effects an aging society will have on people, governments and the economy. The life insurance industry should begin by lobbying at the WEF using the same playbook that climate scientists used. There is nothing worse in society than to see the elderly population retire in poverty. It invokes an attitude of not caring during productive years if you are going to end up destitute anyway. Society owes its elderly population a comfortable life in retirement and the life insurance industry is a major player in this pursuit. In fact, the life insurance industry is the only industry that can provide guaranteed lifetime income to its policyholders.

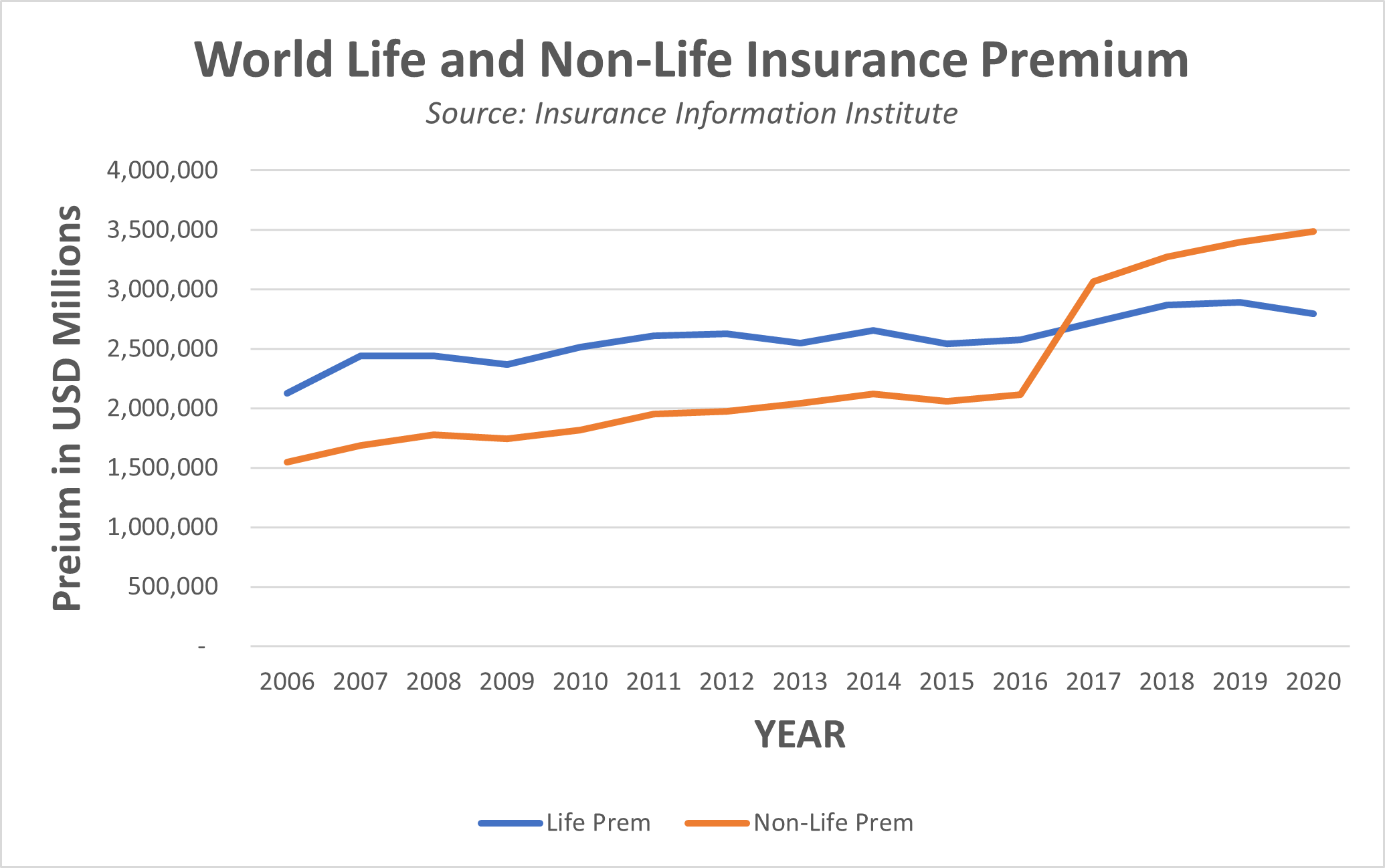

Highlighting this risk at the WEF could help smooth the way for new regulation to ease the purchase of much needed life insurance and annuities that will mitigate the effect of a straining governmental old-age support system. Even during a longer-than-expected pandemic, global life insurance premium sales are still disappointingly low. According to the Insurance Information Institute (Triple-I), worldwide life insurance premiums have grown on average by less than 1% per year during the past 15 years while non-life premiums grew by over 5%[9]. Since 2016, the divergence has been more dramatic with a 2% average annual growth rate for life and over 13% for non-life. This makes it more clear why life is always the bridesmaid to non-life insurance.

Figure 6

The growth in worldwide non-life premiums could be due to emerging and exciting lines of business such as cyber insurance or space insurance. Or it could be that non-life insurance is simply keeping up with increasing GDP whereas life insurance is not. Whatever the reason, sometime between 2016 and 2017 worldwide non-life premiums exceeded life premiums, according to the Triple-I. Many experts blame low interest rates for the lack of life sales. As interest rates begin to rise this year, we will see if this is actually true.

What is clear is that the life insurance industry must change the narrative worldwide by demonstrating that aging and the associated protection gaps are an imminent threat to society. The top economic powers will soon have difficulties making good on promises made to an ever-increasing aged society. How will these countries be able to address issues that the WEF identifies as top worldwide risks such as Climate Action Failure, Extreme Weather and Biodiversity Loss when they cannot even take care of their own elderly populations?

It is clear that Climate Change has an effect on everyone whereas problems of underinsurance and aging do not. The elite few that are surveyed to produce the annual Global Risk Report are most likely well-insured and have sufficient savings to ensure a comfortable lifestyle in retirement. Sometimes it is difficult to convince a person about a looming risk when he or she does not personally feel at risk. It is not an easy task, but worth the effort. Next January, life insurance professionals need to descend upon Davos with arrows in quiver (and ice skates) prepared to demonstrate that global aging is one of, if not the, biggest risks facing society. Only then will the issue have a chance to be taken as seriously as it needs to be.

[1] https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf

[2] https://www.nytimes.com/2022/01/17/world/asia/china-births-demographic-crisis.html?searchResultPosition=1

[3] https://www.scmp.com/news/china/politics/article/3144225/we-had-no-choice-chinas-one-child-policy-and-millions-missing

[4] https://statisticstimes.com/demographics/country/china-sex-ratio.php

[5] https://www.swissre.com/dam/jcr:6a844406-4898-4ffe-b45b-2e5696128624/SRI-Expertise-Publication-Closing-Asias-Mortality-Protection-Gap-July-2020.pdf

[6] https://www.swissre.com/institute/research/topics-and-risk-dialogues/economy-and-insurance-outlook/life-underinsurance-US.html

[7] https://www.ssa.gov/oact/TRSUM/

[8] https://www.soa.org/globalassets/assets/files/resources/experience-studies/2021/covid19-es2.pdf

[9] https://www.iii.org/publications/insurance-handbook/economic-and-financial-data/world-insurance-marketplace

2.2022

About the Author:

Ronnie has over 40 years of insurance and reinsurance experience having worked and lived in 3 countries. In his current role, Ronnie serves as Executive Director to the Bermuda International Long-Term Insurers and Reinsurers (BILTIR) association. He also is a Collaborating Expert of Health and Ageing for The Geneva Association located in Zürich. Ronnie is Co-Chair of the Programming Committee for the ReFocus Conference and served on the Board of Directors of the Society of Actuaries. Before this, Ronnie worked as the Head of Life Reinsurance for Zurich Insurance Group in Zürich, Head of Life Reinsurance for AIG in New York and Global Head of Life Pricing for Swiss Re in London. Ronnie began his career at Mutual of New York. A little-known fact is that Ronnie holds a patent (US20060026092A1) for the first Mortality Bond issued called Vita when he was with Swiss Re.