The Internet of the Sky: Space, Remote Sensing, ESG, and Cybersecurity

Click here to read David Piesse's bio

View More Articles Like This >

Abstract

Sustainability is driving the confluence of the environmental, social, and governance (ESG) pillar landscape; cybersecurity; and satellite remote sensing data. Business moves faster than weather data flows, and delays in accessing current data create a broken value chain. Changes are required regarding how data is accessed, integrated, and analyzed, with attention to mapping of cyber/data integrity to ESG requirements varying across geographic markets.

Emerging regulation will require companies to measure ESG risks across corporate investment portfolios while taking into account the ecosystems and operating environments invoking independent reporting. Satellite technology is one of the key operating areas in sustainability. This technology is prevalent across all three ESG pillars, as the data created from space generates economic value from risk and perils created by extreme weather-driven events. This data can indirectly and directly affect customers because it can lead to the creation of innovative products and requires cybersecurity governance.

ESG ushers in a new era for investment with a wider impact than previous compliance-driven investment verticals that only concentrated on customer identity, anti-money laundering, and sanctions. By addressing the investment process at its core, ESG alignment allows for a holistic portfolio approach, representing a tangible means of evaluating corporate behaviour by benchmarks.

This approach focuses on environmental data by managing Earth’s resources in a responsible manner; social data by focusing on how the company treats workers and clients, aligning to diversity; and governance data by holding information about company internal management, share class structure, and methodology for mandating data integrity of digital assets and cyber risk mitigation.

Overview

Principally, ESG data from Earth is best captured from the vantage point of satellites, making space a key driver for the sustainability trend. Weather data is limited in frequency and quality, so forecasting is insufficient across various industries, including aviation, shipping, and supply chains. For example, satellite observations can be obscured by cloud and weather models, so forecasts are based on sparse and infrequent observations that are prone to errors or miscalculations. Often, there is no data integrity or provenance tracking of the data, which can lead to a breach.

The United Nations’ 17 Sustainable Development Goals (SDGs) are a key driver for ESG factors, particularly for developing countries.1 SDGs provide access to affordable loans, insurance, and other financial services in rural areas. For the inclusive financial market, especially insurance, the lack of consistent, reliable weather data and proper real-time pricing and claims assessments, parenthesized by resistance to change, has caused many global insurers to be reluctant to expand into rural developing areas; the margins would negatively affect their balance sheets. There is a need to work toward volume and exponential technology to meet revenue expectations.

Optimization and multiplying factors are required to bring together a full value chain of weather-derived service and product offerings. Consumers demand more life needs be met at one-stop transaction points, which can be achieved by commonality of core data, standardized technology architectures, and intertransferable decision applications.

Food security is a macro trend that demands improvement. Farmers must be able to find loans, insurance, and crop-monitoring services via a mobile device. Such bundled services are available in many service sectors, but not in rural agricultural markets. Thus, group product offerings can become a dynamic marketplace, creating higher per-individual value addressing food security. The World Economic Forum’s Edison Alliance, for example, is prioritizing digital inclusion for one billion people.2

This article discusses the benefits, uses, and goals of low Earth orbit (LEO) satellite data in addressing the 17 SDG’s with cross-interaction between ESG and cyber risk factors.

ESG and Cybersecurity

Cyber risk is an expeditious and financially material sustainability peril that all organizations face. Cybersecurity concerns investors, as businesses may not be transparent when it comes to reporting cyber data breaches due to fear of reputational risk.

Businesses face increasing cybersecurity risks daily. Thus, cyber mitigation and resilience is a priority for most organizations. Investors are becoming more educated about cybercrime’s impact on company sustainability, making it fundamental to conduct ESG analysis, which demonstrates good cyber governance. Developing best practices and, over time, standards for cyber incident reporting is paramount.

Cyberattacks rose during the COVID-19 pandemic due to increased digitization and remote working. This trend invigorated the investment community to observe ESG and cybersecurity efforts, which is recorded by corporate governance at Principles for Responsible Investment (PRI)—a United Nations-backed organization that promotes sustainable investment in parallel with the Principles for Sustainable Insurance (PSI).3,4 Cyber risk is systemic because of digitization, and the potential severity of risk accumulation impact is high.

Meeting ESG expectations catalyzes businesses to improve cybersecurity to satisfy investors. This governance must come from corporate boardrooms, as company resilience against cyberattacks depends on whether leadership agrees that raising the ESG score should be a goal. Red flags can be raised ex ante and consequences of not disclosing information will come under the scrutiny of regulation and rating agency domains, not just shareholders.

ESG disclosures reveal opportunities and risks that escape traditional financial analysis. As the world becomes cloud-based, internet-connected, and device-driven, multiple ESG risks lie on the inverse of technology benefits—especially with respect to data about critical infrastructure, such as ports and terminals, oil and gas production, manufacturing, chemical production, and marine systems.

A significant cyberattack on critical infrastructure can inflict a black swan effect on the environment—causing fire, explosion, hazardous material release, or navigation errors. Such a cyberattack can result in death, bodily injury, property damage, environmental clean-up costs, and legal liability with class-action claims coupled with reputational risks.

Digital society is replete with intangible assets that now form 90 percent of organizational value with intellectual capital and data at the forefront. Cyber risk poses a security threat as consumers rapidly adopt digital transactions. Insurance is a secondary risk transfer solution and not a substitute for mitigation and good cyber governance.

Greenwashing—a company falsely marketing itself as environmentally friendly—elevates an organization’s risk of being targeted for a cyberattack, and cyber resilience reporting could be used to cyber-greenwash companies. Since ransomware and other cyber threats have become a priority for boardrooms. Corporate social performance (CSP) can affect an organization’s affinity to a cyberattack where greenwashing efforts hide poor social performance.

Measuring an organization’s CSP by ESG is an emerging metric for evaluating organizations. Driven by civil society, shareholders, and the U.N., most of the reporting standards and metrics developed to date have not addressed technological issues, whether cyber or digital transformation. A snapshot of current standards shows the approach to cyber-incident or other cyber-related categories just grazing the surface; much more consideration is required for governance of digital assets.

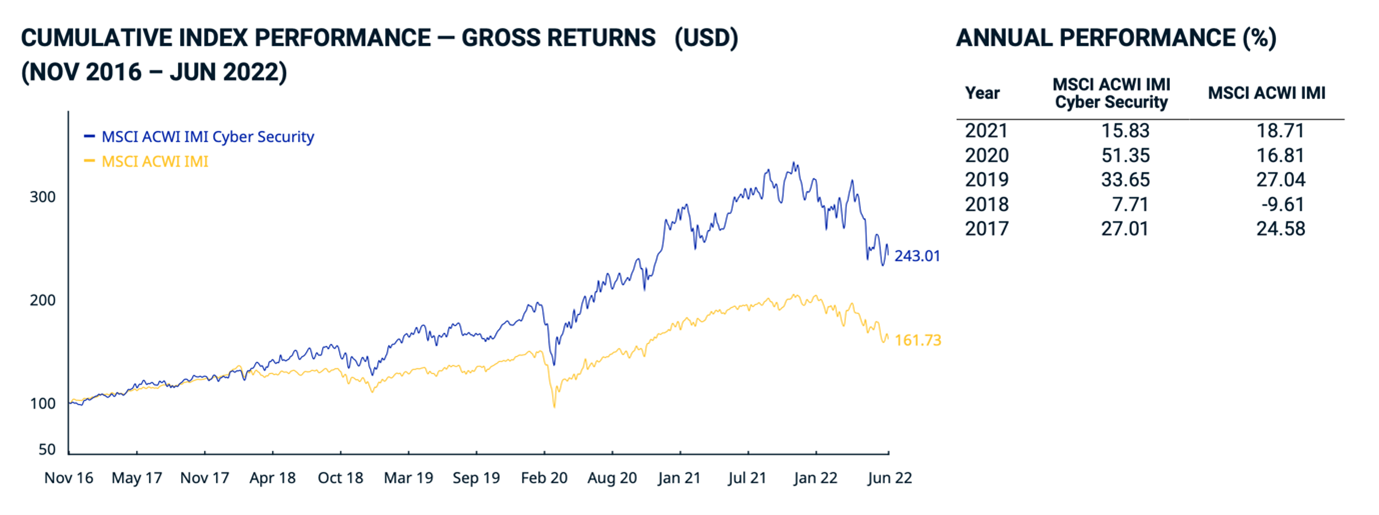

The MSCI ACWI IMI Global Cyber Security Index represents the performance of companies that could benefit from increased investment in systems, products, and services that protect against cyber-attacks.5 The index includes companies from the MSCI parent universe that have high exposure to business activities such as providing cybersecurity hardware and software products, providing cybersecurity services, implementing and managing network security protocols, and ensuring data integrity and holistic cybersecurity. This helps determine which networks are exposed and susceptible to a security data breach.

Space system cybersecurity has not maintained the same pace as Earth-based counterparts, which benefit from sophisticated protection against malicious actors and exploitation. Using model-based systems engineering, virtual duplicates of satellite systems can be designed to replicate aspects of a satellite’s operation. This creates scenarios designed to reveal vulnerabilities and identify methods to protect the system with digital twins,6 as deployed by NASA.7

Deployed satellite constellations that focus primarily on communications and expanding the reach of the global internet include Starlink, OneWeb, LeoSat, Project Kuiper and Iridium Next.8,9,10,11,12 These LEO satellites benefit from lower latency and higher bandwidth.

Orbital Micro Systems specializes in weather-based microwave satellite data, capturing three-dimensional passive microwave observations for every point on Earth every 15 minutes, even through cloud cover. This can innovate our understanding of the planet.13 SKYMET uses satellite data to map and forecast weather for farmers.14

While LEO satellites can help improve communications, weather forecasting, catastrophe observation, and ESG reporting, they also increase the cyber-attack surface. The challenge is to raise the bar for these newly connected networks for company reporting.

On the ground, companies have multiple entry points and connections, which must be protected to reduce infiltrations. This needs to be reflected in the cyber index (see figure above), like nonsatellite networks.

ESG and Space

Space, via remote sensing, has a significant role to play in the environmental pillar of ESG as a visible asset component so that satellite operators can help companies track and meet climate change targets through analytics. As ESG trends expand the satellite market, many new businesses are looking at space capabilities, as they need to measure carbon emissions and climate impact. Remote sensing provides a scalable, low-friction data source to begin to quantify and measure climate and decarbonization risks.

Digital twin technology models correlate digital assets to physical entities in the real world by simulating behavior and performance in a real-time environment. This enables ESG reporting by analytically simulating weather forecasting capabilities. This technology can assist, for example, shipping companies with planning efficient routes that save on fuel costs, helping them meet increasingly stringent emission standards from the International Maritime Organization (IMO)—the U.N. agency that sets standards for shipping. SKYTEK has brought a significant amount of satellite-based services to be adopted by marine and related insurances.15

Taking this further, a digital twin of Earth allows for modeling of space objects and environmental impacts on a global scale. This can help agriculture through traceability and detection of deforestation using AI, location data, satellite imagery, and computer vision; it also provides complete visibility upstream and downstream to the whole supply chain.

While the environmental part of ESG is a natural fit for space capabilities, it also feeds the other two pillars by combining Earth observation data with additional data sources. This can result in insights regarding human trafficking and identification of owners of plantations, mines, industrial sites, or palm oil concessions around the world.

The space industry has an opportunity to provide markets with real-time asset-level monitoring, rather than annual, self-reported public disclosures from companies. Space debris is also emerging as a target for ESG investors. As more satellites are sent into near-Earth orbit, the clean-up challenge could be the next opportunity for an environment-minded investment community.

The race to improve global interconnectivity and, in parallel, create better weather data will ultimately result in more satellites, which will require more space asset situational awareness. This means cryptographically signing data in space at point of origin from cameras fitted by design at manufacturing time to put a timestamp on the satellite data and record the original.

How Space Supports the Financial Sector

The global financial sector is committed to playing a decisive role in the transition toward a sustainable economy. Sustainable finance is data-driven and integrates ESG factors in investment and decision-making processes. The challenge is the source, provenance, and integrity of the data collected.

Unregulated sources of ESG data rely on corporate voluntary disclosure through corporate social responsibility (CSR) reporting. However, this reporting has proven ineffective due to bias and omission of negative details such as fines. Regulations arising from COP 26 to achieve net-zero emissions by 2050 are improving the methodologies that compare data between different companies across business sectors and are increasing reporting frequency.16

Public data is available from third-party sources, but private company asset data is not commercially available across industries. Artificial intelligence (AI) and machine learning algorithms are needed to develop datasets more efficiently and to capture original data from space with a provenance trail. Identifying broad planet-based assets is a challenge for the ESG landscape.

With the exponential growth of space-based remote sensing, computing power, and the complexity of machine learning algorithms, analysis will be available to address physical risk with location of actual goods in the supply chain, across cold chains and heatwave spots, to inherently improve the greenness of trade finance and associated financial services.

Satellite technology can verify the accountability of companies that engage in evasive environmental behaviors by collecting frequent and independent data without people in place. Time series measurements can track the impact of human activities in specific areas.

The uptake of green and sustainable finance will be assisted by strong regulatory support, public awareness, social pressure, and the harmonization of private standards to prevent greenwashing and brown-spinning (selling off assets) behaviors. This can lead to climate risks assessment developments in the investment and banking industry and utilizing them as warranties in weather insurance products.

Space technologies traditionally support the insurance industry for climate-related physical risk assessments. They are also valuable for portfolio and project monitoring as well as damage assessment. Banks are testing large-scale project-based investments on their portfolios for climate related risks.

Developing countries tend to leapfrog developed countries in payment innovation. This can be seen in Africa, which accounts for 70 percent of the world’s $1 trillion mobile money market. The value of Africa’s mobile money transactions grew 39 percent to $701.4 billion in 2021 from $495 billion in 2020.17 M-PESA is Africa’s most successful mobile money service and fintech platform.18 It provides more than 51 million customers across seven countries with a safe, secure, and affordable way to send and receive money and other services.

Internet connectivity remains a challenge as traditional providers struggle to build infrastructure in remote areas. LEO satellites embrace financial inclusion by connecting mobile phones used for business so that they are economically viable and sustainable at a more affordable rate than their larger, deeper space predecessors.

Satellite Cybersecurity Risk Register

Satellites are cyber-physical systems in the same way as smart cities and connected vehicles. Each space network consists of satellites, ground stations, user reception dishes, and communication link segments.

A satellite cyberattack can target any of those segments covering both physical and cyber assets. These attacks have a triangular purpose:

- Break confidentiality and encryption of data.

- Tampering with data integrity.

- Disrupt services by breaking availability

In the physical world, cyberattacks can jam satellite navigation signals but, in the cyber world, they can intercept and breach unprotected data and compromise the entire network.

Cyberattacks on satellites affect societies, particularly those in remote areas because they depend on communication systems, global positioning systems (GPS), and critical infrastructure that rely on satellites for synchronization.

Cyber-physical attacks that were formerly state-sponsored can now be performed by common hackers. The hardware needed—such as high-frequency modems, routers, and transceivers—is now available at low cost and can be easily assembled into a space network. Therefore, many small satellites and spacecraft are now launched with a corresponding increase in satellite cyberattacks.

Cybersecurity should be embedded into the design process of all space-based systems as information technology and operational technology converge. Staff should also be trained in cyberattack scenario exercises. Human error causes a large percentage of cyberattack surfaces, especially around software patching and misconfiguration of multi-cloud systems. These errors open gaps that can be exploited by a threat actor.

Exposure to cyberattacks is especially problematic in supply chains. Their vulnerabilities from satellites can occur at manufacturing time when there is an extensive bill of materials. Both the on-orbit and ground components must mitigate this threat to stop contagion of automated malicious code from ground station to space components.

Innovation in the space sector has enabled small satellites to be assembled with off-the-shelf hardware and open-source software, and data to be collected at a low cost through a ground station-as-a-service business model—significantly increasing the cyberattack risk surface.19

The mitigation required depends on a space project’s purpose. Thorough risk analysis and assessment modeling of all possibilities is essential. Worst-case scenarios differ by sector from military, communications, weather, and media, as do attack vectors, cyber-physical techniques, and safeguards.

Adopting the National Institute of Standards and Technology (NIST) Cybersecurity Framework and implementing an active set of ISO 27001 (the international standard for information security) physical and cyber controls will help mitigation.20 Damage inflicted in the satellite sector can be systemic, accumulative, and lead to heavy financial losses and/or comprised data.

Satellites are an extension of a cyberecosystem for organizations, but rarely is there direct control over satellite cybersecurity. The uplinks and downlinks that are transmitted through open telecommunications network security protocols can fall prey to cybercriminals that use satellite communication devices, creating additional entry points. This is the nature of a collective network of connected devices that facilitates communication between devices and the cloud, as well as between the devices themselves—commonly referred to as the Internet of Things (IoT).21

If malicious actors can interrupt satellite signals through their devices, they can gain access to downstream systems connected to the satellite and penetrate an organization’s network, from the infiltrated satellite ground station across the cyber-physical assets.

Connecting the Unconnected LEO Satellites

LEO satellites are the future of internet connectivity. This is especially true in rural areas where LEO satellites are expected to connect the unconnected, thereby bridging digital divides.

The European Union has announced plans for an LEO satellite system.22 Starlink (SpaceX) uses satellites to provide low-latency broadband in remote locations, and Project Kuiper (Amazon) provides high-speed low-latency broadband to individuals and organizations in places lacking reliable internet connectivity by combining them with small customer terminals and a secure ground-based communications network.

This connectivity is affordable, and these small satellites fly closer to Earth. The distance a signal travels between ground station and satellite is less than other existing satellites, resulting in less delay.

LEO constellations form a high-speed internet backbone in the sky, exchanging broadband data with each other and ground assets. They operate in a revolving network where multiple satellites are needed to provide internet coverage. This allows them to provide connectivity during air travel and in the middle of the ocean, delivering images every 15 minutes. Like terrestrial internet protocol (IP) networks, the LEO satellite networks will experience maintenance outages and require windows for updates.

The LEO global satellites market is expected to grow from $3.5 billion to $9 billion by 2026 at a compound annual growth rate of 21.5 percent due to its adoption across business sectors and the integration of IoT, machine learning, rapid advancements in aerospace, robust government support, and growing advancements in payload systems.23

The COVID pandemic accelerated digitalization globally, but 2.9 billion people still do not have internet access. Affordability remains one of the primary barriers to connectivity. Broadband requires underground cables, but in remote areas, satellite-based connectivity can be the only option. LEO satellites can connect people to high-speed internet where traditional ground infrastructure cannot reach, thus closing the rural connectivity gap.

While satellite broadband systems are in various stages of development, the affordability of services must be a key component in global rollout strategies. No single government or company can bridge the digital divide on its own. Partnerships, both public and private, that invest in the future of the internet are vital to connect unserved and underserved communities around the world, including refugees and people who migrate from coastal areas.

With the generation of high volumes of data, quantum encryption should be introduced to ensure data integrity; current encryption may need to be replaced in another five years. Systemic and accumulation risk should be mitigated across the manufacturers, the number of ground station points, and the size of the satellite ecosystem. If access is gained to a single device, other devices could also be compromised.

Large tech companies have a greater reach in the number of engaged customers and yearly revenue than large countries. Government regulations alone cannot manage all companies due to the complexity of continuously evolving business models.

Satellites play an important role in Earth observation, which is a way of detecting and measuring biological, chemical, and physical factors on a global scale. Satellite data can be used to help improve smart farming and protect the planet against climate change. According to the United Nations, the world population is expected to reach 9.7 billion by 2050, resulting in a 69 percent increase in agricultural production between now and then.24

ESG and Regulations

ESG regulation has been forming over the past two decades. The twin standards of the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) are leading to mandatory reporting as asset owners and investors are seriously engaging and leveraging.25,26

The SASB focuses on reporting and quantifying outward ESG impacts and risks, while the TCFD addresses how climate change impacts an organization’s value creation. Together they address financial materiality.

Regulators have placed less emphasis on cybersecurity and ESG than on carbon emissions and supply chain decarbonization risk. However, recently, regulators like the U.S. Securities and Exchange Commission (SEC) are issuing guidance for companies regarding disclosure of international intellectual property and technology-related risks.27 The outcome of a private/public cyber resilience dialogue will inure to the greater benefit and value of businesses; all the assets of global companies are expected to be mapped using this methodology.

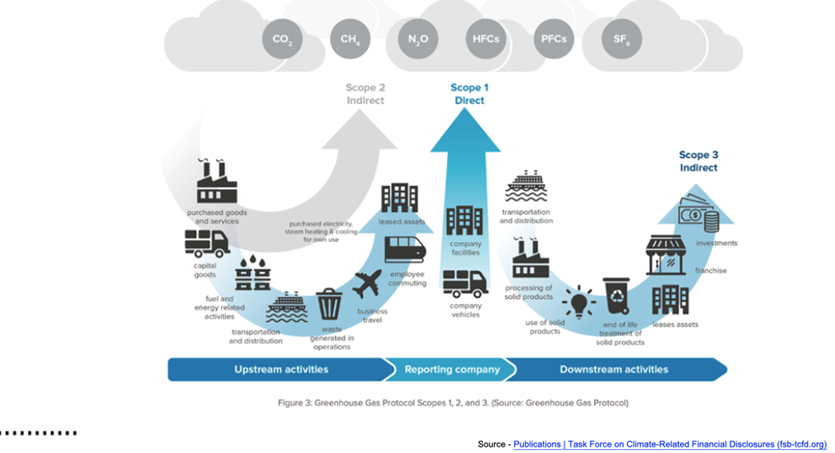

Aggregation portals such as STACS and BlueOnion are innovating the regulatory space by partnering with data providers.28,29 Refinitiv provides ESG reporting solutions.30 The standard emissions map (see figure below), as well as cyber and physical assets, can be added to supplement emissions reporting across supply chains.

Many ESG platforms rate and score, but they do not apply stewardship. Transparency and disclosure are paramount for portfolios to become responsibly green. Privacy laws apply to data, which has collection issues. Engagement over divestment is the business driver focusing on ownership quality.

Regulation is aiming to align all ESG factors to measure financial risk to relate to net zero in 2050 as well as identify greenwashing or brown-spinning in portfolios. It is not only institutional investors who benefit from ESG reporting; subject matter experts and family offices need help building green portfolios. Commodities, and their source, must be added to the platform.

The Earth observation industry is regulated. In the U.S., the Federal Communications Commission (FCC) regulates telecommunications satellites, and the National Oceanic and Atmospheric Administration (NOAA) regulates the remote-sensing sector.31,32 Under these regulations, agencies can claim imagery collected over a designated area during a finite period of time and prevent satellite companies from distributing imagery to others.

Extreme Weather Solutions, ESG, and Insurance

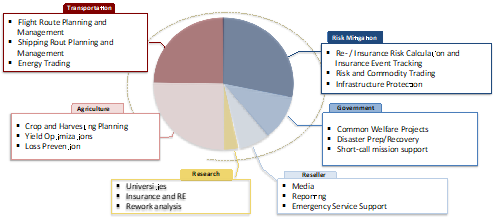

LEO satellite data enables weather risk transfer hedging for agricultural supply chains, construction, transportation, and water utilities. Extreme weather affects gross domestic product (GDP), so the social impact of drought and excessive precipitation must be addressed. Global, raw weather data needs to be trusted, cleaned, backfilled, and curated into bespoke datasets.

The satellite is the data creator that enables the curation of global weather data that underpins weather risk trading contracts and the application of parametric insurance. Parameters can include wind speed, temperature, precipitation, hail size, wildfire burn area, cyberattack, or even transport-related delays correlated to multiple triggering events.

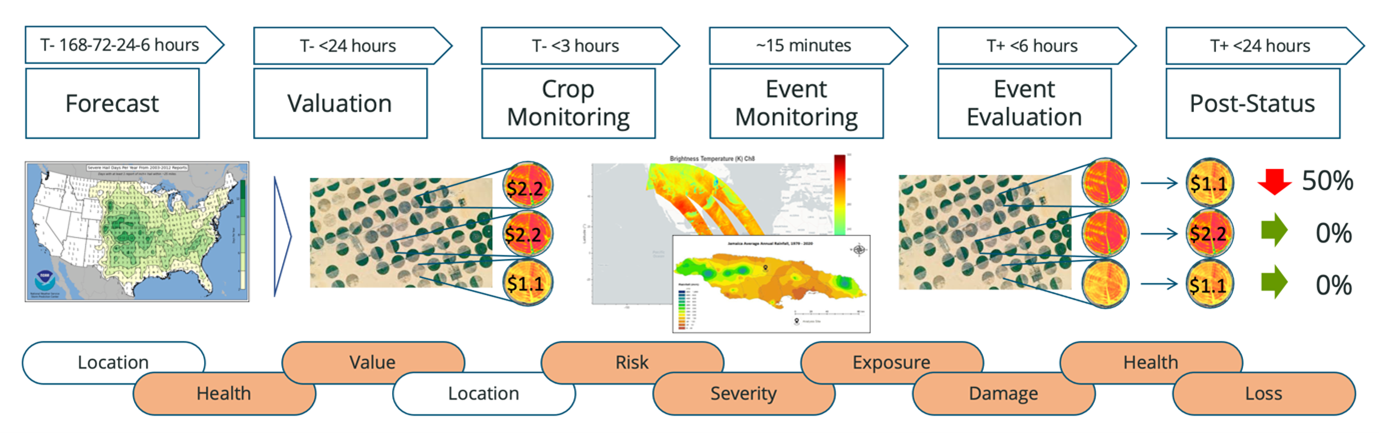

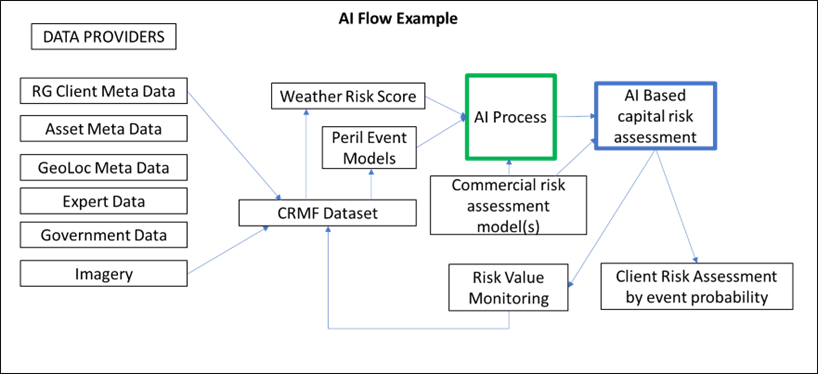

This diagram shows the value of timely satellite data:

Extreme weather events have affected the traditional reinsurance industry capital surplus, requiring a shift to uncorrelated, diversified investments akin with the capital markets. New investors, such as family offices, pension funds, and wealthy individuals, could also participate in insurance-linked securities (ILS) to enable insurance companies to transfer a portion of risk premiums to the capital markets.

Satellite data mobilizes securitization of weather-related insurance liabilities by providing the ILS market access to stable, predictable returns from new digital asset classes. This data is uncorrelated to macroeconomic trends and, in turn, provides higher returns than traditional fixed income.

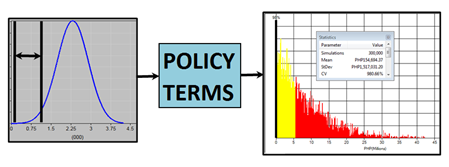

A parametric solution is one where a single peril, such as a flood or typhoon, is well-defined and includes predefined terms and conditions that trigger a claim payout. This simplifies the underwriting process by using real-time data-driven pricing that reduces the amount of time required to bind a policy and the need for any traditional loss adjustment process.

The granular, trusted satellite data that constructs the triggers, such as wind speed, has provable data and cyber integrity that mitigate hacking of key performance data and reduce basis risk.33 Satellite data accuracy removes uncertainty in markets where data quality is poor, thus defining the original risk of the peril with insurable interest and moving long-tail liability to short-tail liability regarding claims.

The biggest benefit in the wake of an extreme weather event is the speed of a cash claim payout. Cash-flow disruption is the biggest challenge facing businesses after a natural disaster; it can determine whether a business becomes insolvent or continues operations.

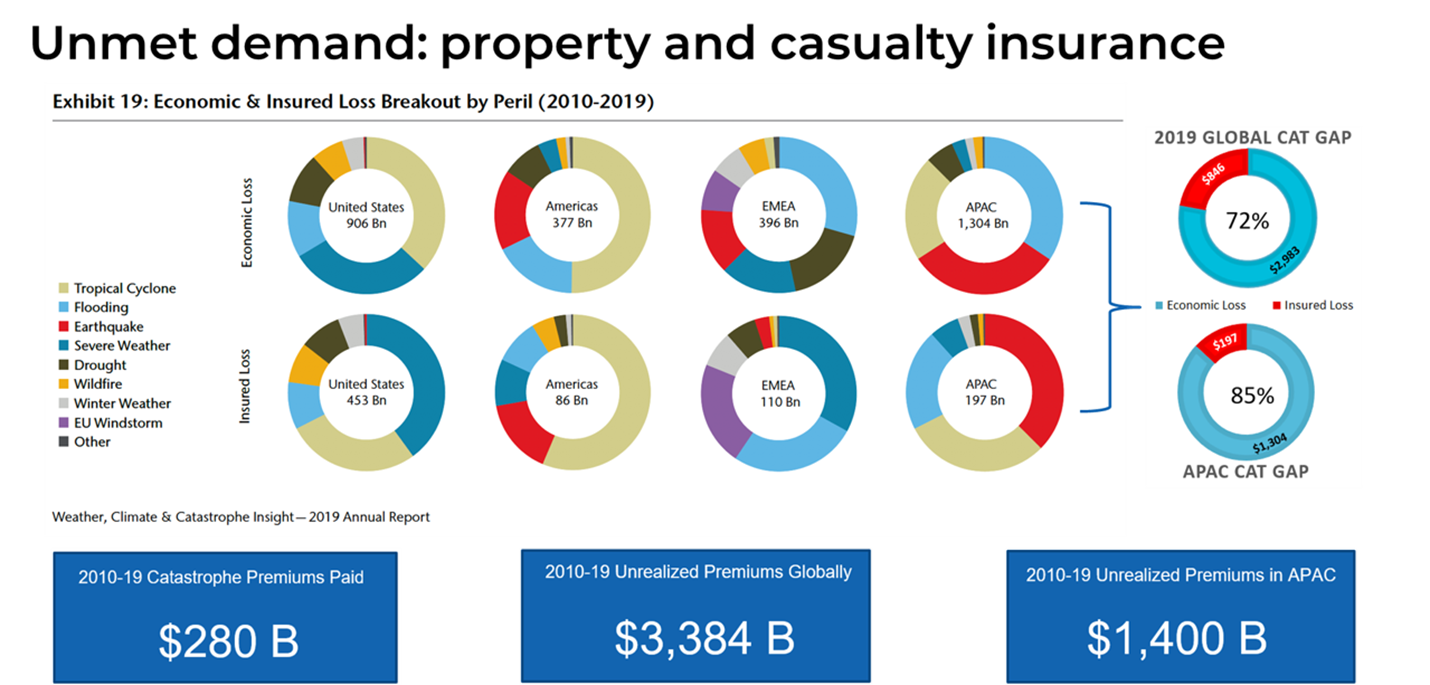

The evolution of LEO satellite data can address the insurance protection gap shown in this figure:

According to Morningstar, large institutions are facing pressure from external shareholders to better manage exposures to environmental risks.34 This shows the impact of insured catastrophes on an insurance company’s financial strength, claims predictability, claims frequency, and claims severity.

Social risk factors can have a significant impact on an insurance organization’s customer and employee base. Financial institutions with retail operations are closely scrutinized by regulators to manage social risk factors fairly. If they fall short of expectations due to a data breach or products being sold incorrectly, then insurers could be subject to fines and penalties. Additionally, financial institutions could face irreparable damages to their reputation which, in turn, could have a negative impact on their investment capabilities. This is the ESG touchpoint.

Data analytics can model more accurately on a stochastic basis by taking into account geographic concentration risk via a direct-to-consumer acquisition of new policies. Pricing is derived directly from expected annual loss. Currently, satellite data, in the form of NOAA historical hurricane data, is used in the modeling process.

LEO satellite data brings a new perspective to modeling with AI capability and modeling partners by providing accurate real-time data and modeled risk probabilities for each peril. Catastrophe exposure has to be aggregated across the enterprise and correlated with other emerging perils such as cyber and pandemic.

LEO satellite technology houses multiple sources of predictive data with an active feedback loop leveraged by machine learning to rapidly build robust propensity models and compute expected loss ratios. Insurance regulators should have an actuarial analysis ready for review to fit their existing regulatory paradigm.

Because parametric coverage does not indemnify against loss to specific assets, the real issues become risk assessment, data analytics, and probability evaluation. Risk needs to be spread across geography and products to limit the number of policies in high-risk areas versus low-risk areas. This allows for predictive modeling using historical catastrophic events and an independent, objective measurement of the parametric trigger. The modeling process also provides a secondary source of data and indices on trigger events.

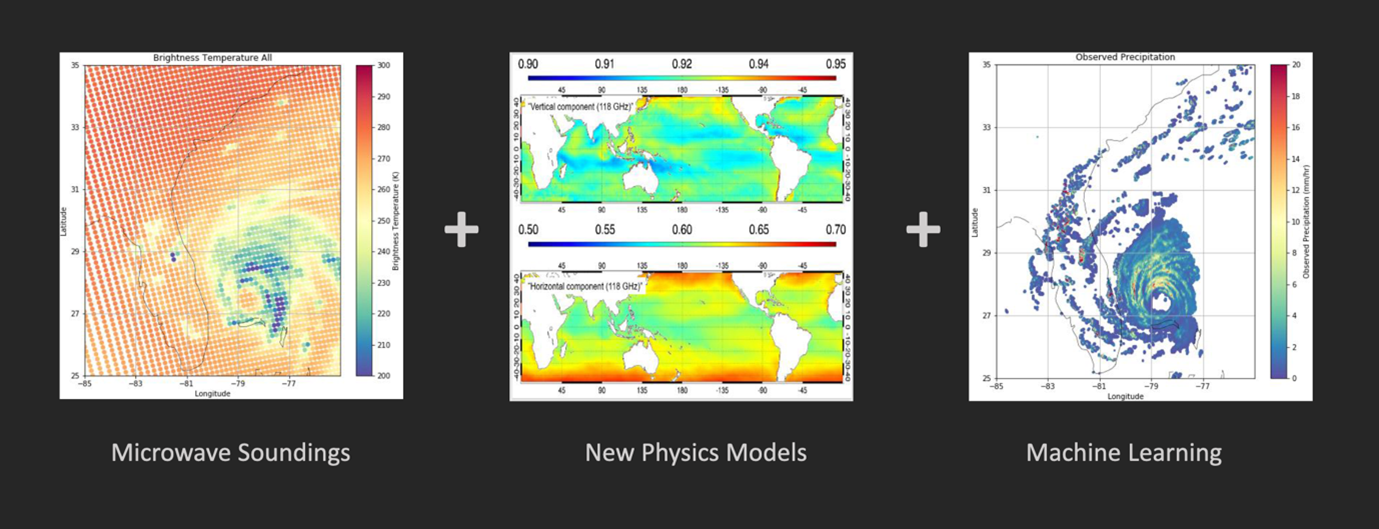

This diagram shows the satellite data in confluence with models and AI:

There is a lack of credible and verifiable data on small farmers to support agriculture lending. This lack of transparency, as well as inaccurate baseline data on crop yields and health mean that devastating crop losses are not being fairly assessed. This results in low utilization of space-based geospatial data, an inadequate ground sensor network, inaccurate drought maps, and the absence of quality soil moisture maps. Swiss Re Sigma annual research provides further information about the global weather and flood landscape.35

Space data can be used to create the weather index. Because an insurer’s loss depends on the value of the index, the behavior of the index must be modeled. Existing historical data must be collected from the NOAA and the LEO satellite data (predictive) used in stochastic index scenario creation, via a model, to determine future behavior.

For each index scenario, calculate the insurer’s loss to each policy using the policy terms. Then, multiply the loss by the number of policyholders to determine the total loss. It’s important to consider that the risk is co-variate, which can affect many individuals or businesses in the same area at the same time.

Use of LEO Satellite Data

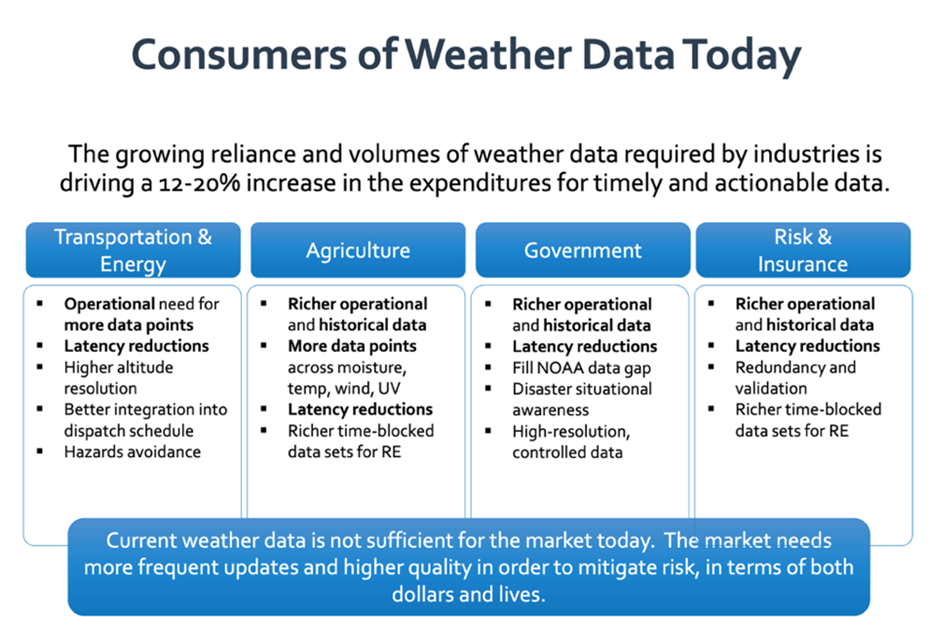

The current use of weather data is inadequate, as is shown in the chart below.

Businesses are facing major difficulties identifying meaningful, qualified datasets in order to create coincident data. The use of multiple or blended observations of Earth is not simply a matter of obtaining and loading data; the data must be aligned with respect to projection, gridding, and time via an intense series of processes to make it usable.

Value is created by leveraging weather data from wholly owned weather satellite constellations across multiple segments via a linked business ecosystem. Weather knowledge advantage is critical to insurance, banking, agriculture, maritime, aerospace services, and application providers.

By integrating business risk and decision processes across multiple companies, the ecosystem is better positioned to lead the market, as full logistics and financial return-on-investment chains can be optimized to work together. This can lead to a cascading benefit for data analytics products created by each company using the satellite data in the sharing community ecosystem.

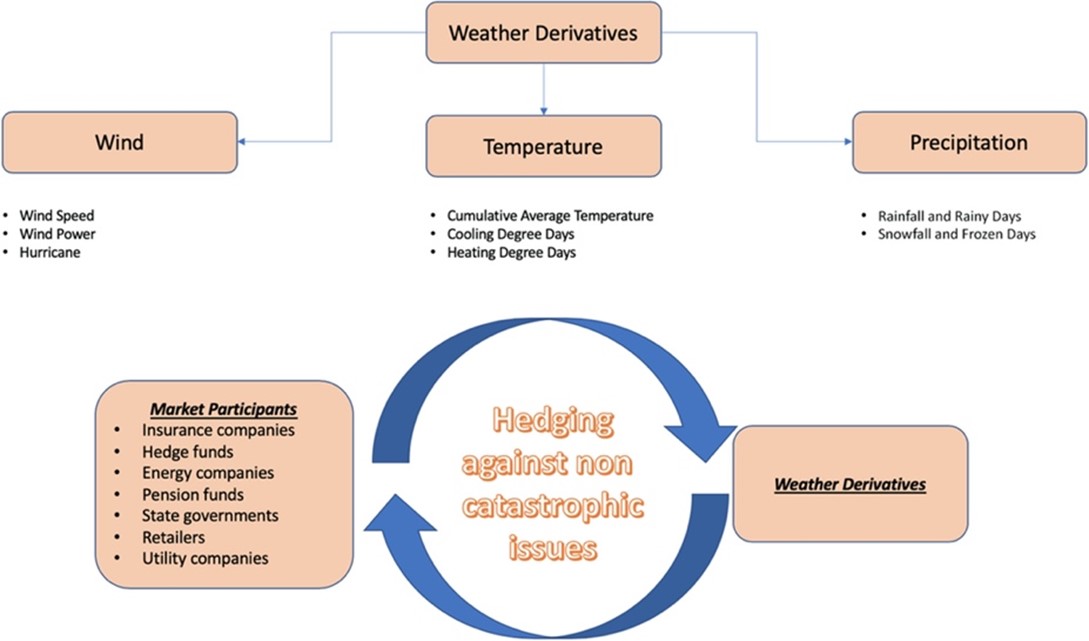

Weather Risk Transfer

Weather risk transfer is used for balance sheet protection against financial losses caused by a weather event. The contract defines the policy term, the type and severity of the weather, and the amount of payment an entity receives when the defined peril occurs. Independent, reliable data from LEO satellites measures variables such as temperature and precipitation. Such products are used by businesses and governments to smooth earnings by hedging, reduce volatility and costs, and enable moving to a weather risk trading market.

Water utilities, for example, in exchange for paying a risk premium, will receive a cash payment that would strengthen financial standing when weather adversity affects the water supply, customer demand, or company infrastructure. The water risk, such as a changing volume due to rainfall or snowpack, or a lack thereof, and how it translates into serious financial risk, must be well-defined to investors.

A reduced water supply creates operational costs such as increased customer demand and outside water transportation. Excess rainfall causes floods and infrastructure damage, with business interruption affecting credit ratings and capital expenditure decisions. Retaining the weather risk and managing it directly can lead to rate increases and restrictions. Capital reserves are drawn down in adverse weather and replenished in good weather.

By deploying weather risk transfer, when the measured water exceeds the severity defined in the contract, the water utility company receives a cash payment from a creditworthy protection seller within days of the contract expiry. Payment reaches the utility company quickly because there is no extensive claims process to determine the payment. LEO satellite data can improve weather accuracy and be used to create a weather trading market.

The Future

Correlation of the two largest emerging risks, climate change and cyber risk, can be reported by ESG frameworks. Although each risk requires its own specific mitigation, the governance aspect of data is prevalent. Data is the common factor. Satellites the size of bread baskets, flying at low orbit, can provide real-time granular data for ESG reporting.

The ESG approach is expansive, and the most substantial growth area in this investment century, as it affects all traditional and alternative investment classes. It is not a “comply or not comply” type of model; rather, it is a complex, multistandard ESG targets versus performance versus investment purpose triangle that comes with both quantitative and qualitative aspects. This requires a powerful analytic platform based on big data, AI, and a multistakeholder model.

Currently, there is no uniform ESG standard requiring agnostic analytics platforms that can cater to all available standards as much as to a single investor’s own benchmark weighted to its individual investment purpose-driven ESG approach.

Many governments, corporations, and consumers are unprepared for catastrophic events caused by extreme weather. Indemnity insurance currently available does not cover critical infrastructure in the aftermath of a catastrophe, deductibles are high, and power outages can affect automated teller machines and cell phone systems.

For developing countries and rural areas, the problem is magnified because insurance has low penetration, so a catastrophe becomes a capital or GDP event for the country rather than an earnings event for the insurance industry.

People in rural or semi-urban areas are subjected to covariate risk where all in a region are affected. Alternatives are therefore required to provide consumers immediate access to cash in the event of a catastrophe. Payments should be automatically triggered based on third-party data rather than on a traditional insurance policy. LEO satellites can provide this data in near real time as tailored datasets are curated from raw data.

As climate change alters global weather patterns, more accurate higher resolution climate models can help societies prepare for future extreme weather events and build resilience into critical infrastructure. The frequency and intensity of convective storms and wildfires will change as the climate warms.

Current climate services lack detailed data and are built on coarse assumptions. However, a new generation of climate models—convection-permitting models (CPMs)—are providing a step change in our ability to project changes in high-impact weather extremes.36 LEO satellites are positioned capstone to foundation with CPMs, atmospheric convection, and high-resolution models.

In order to simulate the Earth’s climate, a model divides the Earth’s surface and the overlying atmosphere into a giant grid. The model then calculates climate variables, such as temperature, humidity, and rainfall for each grid cell.

CPMs better represent small-scale processes in the atmosphere. This includes convection, which is a key process in many damaging extreme weather events. CPMs provide robust projections of future changes in short-duration precipitation extremes. These real-time grids can be transferred to captive-protected cell structures to better transfer climate risk. This basically fuses all the data and creates a digital replica of the Earth’s environment from ocean, to atmosphere, to cryosphere, all the way to space weather.

Some space systems were built focusing on speed-to-market rather than cybersecurity. Space systems are increasingly interconnected, so a malicious attack can easily spread from a single point of vulnerability in a ground station to the satellites. A standard framework for measuring cyber risk would help organizations and regulators understand and manage it as part of their ESG strategy.

China’s vast untapped catastrophe market can create an enhanced weather derivatives market using satellites. Industries hedge their weather risks with robust data and indices.

Treaties exist with the National Met Information Centre of China and commodity exchanges to develop weather derivatives and weather index futures. To do this, the value of weather data has to be unlocked for exposed Chinese industries. In order to hedge, buying futures and then obtaining temperature and rainfall data are required. The focus should be on making weather derivatives available to the agriculture and energy sectors. This is a global hedging tool to develop a strong weather derivatives market in China.

AI has a big role to play in critical infrastructure protection, and satellites are no exception as they are cyber-physical. The same applies in the sky as on the ground with regards to concerns about the adversarial world of bad threat actors and the accidental world of error.

AI is dependent on data integrity. If data is tampered with, then the input and the results will be wrong. There are massive volumes of data moving at high velocity, so veracity is required, and AI helps to monitor these volumes of data.

For critical infrastructure, there is a great deal to do to improve cybersecurity. This may require redesigning the architecture and retrofitting the entire security landscape to zero trust. AI exists to learn reason without the need for human intervention. AI should be embedded in networks for cyber defense.

The time taken to train people to use AI may appear to be a downside at the outset; however, AI ultimately increases efficiency. People dislike monitoring networks, so AI is a big enabler here, but there remains a need for human augmentation.

Critical infrastructure needs to have intrusion detection, network behavioral analysis, vulnerability identification, malware detection, and analytics. Currently, AI is narrow intelligence around data discovery, and monitoring. The basics of cybersecurity continue to apply: back up data, monitor it, and ensure data integrity. There is a need for governance, data integrity, and confidentiality, as well as ensuring AI cyber solutions cannot be hacked by perpetrators.

The last word lies with blockchain technology in terms of community trust. The ESG movement can benefit from blockchain governance properties. Decentralized autonomous organizations (DAO), the digital twin of a traditional limited company, can deliver a more inclusive and scalable means of organizing, governing, and empowering online ecosystems.37

While the governance component of the ESG movement focuses on addressing conflicts of interest within status-quo centralized governance structures, blockchain technology unlocks a new, decentralized alternative that promises to deliver a more inclusive and representative governance paradigm.

The ESG movement evaluates governance factors that drive decision making in corporations. The traditional governance framework considers the role and diversity of the board of directors, compensation and oversight of top executives, and identification of conflicts of interest.

DAOs allow groups of people of virtually any size and from any region to form communities that act toward a unified purpose. Fully decentralized community consensus, not the CEO in isolation, drives decision making. As technology continues to evolve and address these challenges, blockchain innovation brought forward by DAOs will certainly play an important role in enhancing the “G” in ESG.

REFERENCES

Special thanks to William Hosack and Dr. Tom Ludescher for their contributions to this article.

1 https://sdgs.un.org/goals

2 https://www.edisonalliance.org/home

3 https://www.unpri.org/

4 https://www.unepfi.org/psi/

5 https://www.msci.com/documents/10199/86561fb0-31ba-c32b-15b0-877fd5f26882

6 https://ntrs.nasa.gov/api/citations/20120008178/downloads/20120008178.pdf

7 https://www.nasa.gov/

8 https://www.starlink.com/

9 https://oneweb.net/

10 https://www.leosat.com/

11 https://www.aboutamazon.com/news/tag/project-kuiper

12 https://www.iridium.com/blog/2019/02/08/iridium-next-review/

13 https://www.orbitalmicro.com/

14 https://www.skymetweather.com/

15 https://skytek.com/space-overview/esa-portal/

16 https://ukcop26.org/uk-presidency/what-is-a-cop/

17 https://qz.com/africa/2161960/gsma-70-percent-of-the-worlds-1-trillion-mobile-money-market-is-in-africa/

18 https://www.vodafone.com/about-vodafone/what-we-do/consumer-products-and-services/m-pesa

19 https://www.cloudflight.io/en/blog/ground-station-as-a-service-a-data-guide-for-space-startups/

20 https://www.nist.gov/cybersecurity

21 https://en.wikipedia.org/wiki/Internet_of_things

22 https://techblog.comsoc.org/2022/02/15/european-union-plan-for-leo-satellite-internet-system/

23 https://www.globenewswire.com/news-release/2022/03/01/2393893/0/en/Low-Earth-Orbit-LEO-Satellites-Global-Market-Report-2022.html

24 https://www.un.org/en/global-issues/population

25 https://www.sasb.org/

26 https://www.unepfi.org/climate-change/tcfd/

27 https://www.sec.gov/

28 https://stacs.io/

29 https://www.blueonion.today/get-started/

30 https://www.refinitiv.com/en/sustainable-finance/esg-scores

31 https://www.fcc.gov/

32 https://www.noaa.gov/

33 https://www.indexinsuranceforum.org/faq/what-basis-risk

34 https://www.morningstar.com/en-nl/try/direct?utm_source=google&utm_medium=cpc&utm_campaign=morningstar_direct_trial_request_apac&utm_term=phrase&utm_content=brand_corporate&gclid=EAIaIQobChMIkN3AyJeK-QIVtplmAh2DHQ5REAAYAiAAEgLFUfD_BwE

35 https://www.swissre.com/institute/research/sigma-research/sigma-2022-01.html

36 https://rmets.onlinelibrary.wiley.com/doi/full/10.1002/met.1538

37 https://www.investopedia.com/tech/what-dao/

9.2022