The Lives of Low-income Earners Matter - Using Microinsurance as a tool to protect the lives of Low-income earners (Africa Perspective)

by Oluremi Owolabi Fadi, Team Lead, Oil&Gas and Financial Institutions, Custodian Life Assurance Limited

EXECUTIVE SUMMARY

Being insured is one approach for low-income households to protect themselves against risks and economic shocks. Even in the midst of extreme vulnerability, microinsurance can help low-income households preserve a sense of financial security. Insurance must be one of the tools used in the fight against poverty if governments, donors, development agencies, and others are serious about it.

Microinsurance focuses on the demographic group most at risk of slipping into poverty in the case of a loss. This suggests that microinsurance is best suited for the poor who make a living but are still below the poverty line and have insurable risk exposures.

Through the provision of financial protection against hazards that may otherwise drive people further into poverty, microinsurance tends to have the capacity to increase the resilience of low-income populations in developing nations in Africa. The creation of sustainable and efficient microinsurance products still faces obstacles, such as low insurance penetration and awareness, a lack of understanding of insurance among low-income populations, a lack of trust in insurance, unfavorable regulations, poorly suited products, and insufficient delivery infrastructures.

In Nigeria, the microinsurance sector is still in its infancy and there is very little insurance coverage. In terms of insurance penetration and density, the majority of the population is generally "un-insured" or "under-insured," which presents both an opportunity and a problem for the stakeholders to plan for and offer insurance services to the general public, especially to low-income earners. To help with penetration and reach the market segment that has not been provided with the right items for their needs, it is necessary to close the recognized existing gaps.

To maintain premiums within a range that the low-income market would find affordable and provide better than break-even operations, microinsurance demands efficiency in marketing, delivery, service, and management—more so than many other products. Institutions launching the development of microinsurance must always strive to lower operating expenses. To satisfy the requirement for increased cost-effectiveness, businesses must innovate in process, product, or people.

This essay explores the notion that low-income earners may recover more quickly from disasters if microinsurance services were accessible before they occurred rather than just relying on relief. It is encouraging to note, however, research on the effectiveness of microinsurance as a risk management tool have been undertaken by a variety of development agencies, including the World Bank and the International Labor Organization. This shows that significant institutions see value in microinsurance initiatives.

INTRODUCTION

Microinsurance is typically characterized as risk pooling solutions that are purposefully created for low-income individuals, families, and companies in terms of pricing, coverage, distribution, and marketing. (2020 Milliman, Inc.).

According to United Nations Development Programme (UNDP), those living below USD 3.65 per day (USD 1,332.25 per annum) are said to be living in poverty. For the purpose of this paper and due to the recent removal of fuel subsidy and unification of foreign exchange in Nigeria which led to the devaluation of Naira, low-income earners can be categorized as those with disposable income between USD 1,500.00 to USD 2,000.00 per annum.

Some have questioned the necessity for low-income households to purchase insurance and spend their few resources on premiums. In order to refute these claims, we must consider the variety of risks that a person with poor nutrition, limited access to healthcare, unregulated housing, and the like must deal with. Only then can we begin to understand why low-income households might desire to have access to insurance as well as other types of risk reduction.

We must comprehend the idea of family vulnerability and how microinsurance works to lessen exposure to negative shocks and losses in order to properly grasp why microinsurance must be offered. Household vulnerability was defined as the capacity of the household to manage and respond to certain hazards, with the capacity to manage risks relying on the asset base of the household.

We may categorize the effects of negative shocks into two stages to better comprehend the sensitivity that low-income families experience.

The immediate effects of the loss and the need for funds to offset the household's losses come first.

The second is the medium- and long-term effects, which require households to make strategic decisions as they reallocate resources in response to reduced cash flow and asset losses and try to get back on their feet.

Low-income households are more vulnerable due in large part to the fact that many of their measures are ex-post procedures (managing risk after the shock or loss has occurred), as opposed to ex-ante ways (risk management method undertaken before occurrence of loss). Access to microinsurance for low-income groups can encourage the use of ex-ante rather than ex-post means of protection. Giving low-income families more effective ways to lessen the negative effects of shocks and losses and enabling them to progress through the various stages of reacting to shocks more rapidly can therefore help to lessen the financial effects that they would otherwise endure.

When low-income persons have access to financial services, it can help them avoid relapsing into poverty and open up new opportunities for previously neglected groups of people. Developing nations, particularly those that are prone to disasters, have developed systems and institutions to assist disaster management efforts. For instance, natural disasters like hurricanes, typhoons, and floods have historically occurred often in the Philippines. The low-income segment of society was nonetheless urged to set up microinsurance plans in 2010 since it is more cost-effective, calls for lower premiums, and has a speedy settlement time. Thousands of residents benefited from these initiatives during 2013's Typhoon Haiyan as a result. In this catastrophe, microinsurance claims totaled about $12 million in settlements. There might occasionally be a delay between the occurrence of catastrophes and the arrival of local or international relief operations. This makes it clear how people in low-income areas cope with major shocks in the absence of any help.

The creation of products for individuals, families, and enterprises that belong to the low-income demographic is known as microinsurance. In order to achieve considerable savings in administration and transaction costs and thus make these sorts of goods feasible for the population for whom they are designed, they need be backed by contemporary technological basis. In this sense, the feasibility of microinsurance can be supported by technical platforms created for the manufacturing and delivery of standardized mass-market goods. A phygital approach—physical and digital—is equally crucial. Even while technology can bring value, the market should never forget that certain customers prefer a personal touch.

THE OVERVIEW OF MICROINSURANCE

Several poor and emerging economies may be found throughout the African continent, but the insurance sector's growth is still primarily stumbling. However, the expansion seen over the past ten years has been slowly opening up new options for the region's insurance sector. One of the major forces influencing the insurance business in the African area is the existence of several unexplored markets. Only the stakeholders and the solutions they choose to implement to address the requirements of low-income communities will determine the future of microinsurance.

Nigeria, the country with the highest population in Africa, has a very low insurance penetration rate which is below 1%. This penetration rate is among the lowest in West Africa and is lower than both the African and worldwide norms, which are 2.6 percent and 7.4 percent, respectively. Lack of awareness, a poor public view of insurance, low purchasing power, and poorly suited products, complex claims procedures, and inappropriate premium collecting techniques are some of the reasons limiting the expansion of the insurance market in Nigeria. Regulations have always presented a significant challenge for microinsurance, notably in Nigeria.

There is a need to concentrate on two crucial components in order to comprehend the dynamics of microinsurance and its development in Africa.

(i). The development of microinsurance and the kinds of goods sold in Africa come first, which will assist classify and explain the recent sectoral expansion on the continent. There is a sizable insurance gap that requires customized solutions to address certain risk types that were not covered by conventional insurance offers. Before being released on the market, all microinsurance products must be created with the SUAVE principles in mind: simplicity, understanding, accessibility, value, and efficiency. Some of the things that can be provided with microinsurance include the ones listed below.

- Life Microinsurance

- Health Microinsurance

- Agricultural microfinance

- Livestock microfinance

- Property microfinance

- Personal Accident microfinance

(ii). The second is the development of new distribution methods, which demonstrates the kind of activities and efforts taken by various parties to improve their accessibility and profitability. In Africa, partnership arrangements are crucial to the distribution networks. Micro-insurers also encounter expenses associated with policies as a hurdle. This price restriction affects the costs of policies in a way that is not proportionate to the value or kind of the insurance. Because there is essentially no individual underwriting in microinsurance and just population underwriting, micro-insurers must provide low-premium policies.

Microinsurance providers are progressively using more digital platforms and technology in their operations to address this. Additionally, Mobile Network Operator (MNO) agreements that let micro-insurers facilitate product distribution while reaching out to new consumers situated in rural regions are of tremendous importance to them. In order to digitalize the premium collecting and claims payment processes that are part of the insurance value chain, Microinsurers have started forming partnerships with Mobile Money Operators (MMOs). Integrations of technology into the microinsurance experience seem to be a significant chance for micro-insurers to expand their clientele and make more money.

BENEFITS OF MICROINSURANCE TO LOW-INCOME EARNERS

What happens when the breadwinner in a low-income family dies, when a family member in that family gets sick, or when a fire or other tragedy damages the family home? Low-income people's very survival is threatened by every catastrophic disease, accident, and natural disaster, and this typically results in them falling into greater poverty. The goal of microinsurance is to provide low-income groups with simple, useful, inexpensive insurance solutions that will help them manage and recover from frequent risks. Here are a few advantages of microinsurance for those with low incomes.

Poverty Reduction: Low-income persons are prevented from making everyday decisions because they lack proper access to financial services. Low-income people may benefit from having more control over their own lives by gaining access to financial services that may help them save money, pay bills on time, and plan their own paths out of poverty. While financial services cannot cure all the issues brought on by poverty, they can help.

For instance, take Mr. A, who makes a living by performing odd chores for neighbors and receiving a daily payment. Some of these odd occupations involve cleaning roofs and working with electricity, both of which carry a high risk of harm and mishap. To cover his costs in the event of an injury or workplace mishap, one of his clients suggested that he get health microinsurance. A few months later, Mr. A was repairing an electrical line when he fell from the ladder. He was able to pay the medical and overnight hospital expenses and thanks to microinsurance. If the policy had not been in place, this means Mr. A must pay for his treatment, which will invariably be more costly than the premium paid for the policy. Where he has no money to treat himself, the illness will continue, and he will be unable to work and take care of his family.

Better access to Health Care: According to the Atlas 2022 estimates, by 2030 there would be 390 maternal deaths for every 100,000 live births in sub-Saharan Africa. This exceeds the 2030 Sustainable Development Goal (SDG) target of less than 70 maternal deaths per 100,000 live births by more than five times. One of the main obstacles to achieving the SDG on health is the lack of money and investment in health initiatives.

Reduced infant mortality, improved maternal health, and the fight against HIV/AIDS, malaria, and other illnesses are all health-related goals that may be addressed through microinsurance. People who have poor or no access to healthcare are less likely to seek assistance until their ailments are severely incapacitating. When persons with illnesses have access to healthcare through Microinsurance, they may seek treatment sooner and avoid becoming very ill, which frequently results in fewer sick days and greater and more effective performance at work.

Provision of Social Protection: One of the tools for providing social security to the underserved is microinsurance. Microinsurance fills a critical need in the absence of official social safety while keeping governments accountable. Due to the majority of people working in the informal economy and the lack of efficient means of reaching them systematically, most developing nations in Africa have significant hurdles when it comes to providing comprehensive social safety.

Creation of job opportunities: The majority of the low-income population in most developing nations, including Nigeria, depends on self-employment for a living since there are so few options for wage work in the official sector of the economy. The low-income people may build and grow microenterprises, which will increase their income levels and provide employment, with better access to microinsurance services. Underemployed/unemployed youths within the underserved areas can also be recruited and trained for selling microinsurance products and act as middleman during the process of claims settlement.

Access to loan / capital: Credit life Microinsurance is necessary for microfinance organizations to guarantee the repayment of their loans. The benefit goes to the lender (the microfinance institution) to cover the repayment of the loan's outstanding balance if the insured person (the borrower) passes away or becomes handicapped before the end of the specified period. As a result, the family of the dead borrower is freed of the responsibility of loan repayment, helping to protect the MFI's loan portfolio. For example, a local farmer borrowed N500,000.00 (USD 550) from micro-finance bank to support his farm produces and later passes on before full repayment of the loan due to civil unrest. The microinsurer settled the loan balance while the family was able to carry on with the business without the burden of repayment.

Promotion of Gender Equality: Microinsurance can help advance gender equality and give women more influence. It will be less probable for disadvantaged households to have to decide which kid to send to school if insurance can prevent them from slipping back or deeper into poverty. The low-income people can also build up assets that can be utilized to fund education and care for both daughters and sons through long-term savings and insurance plans.

CHALLENGES FACING MICROINSURANCE IN NIGERIA & AFRICA

Low-income people are vulnerable, and Microinsurance has a significant role to play in reducing that vulnerability and assisting them from being unable to adequately manage their risks. These dangers include anything from illness and death to asset loss, agricultural risk, and lifecycle occurrences like marriage or old age.

Currently, the majority of low-income earners do not view insurance as a practical risk management choice; instead, they prefer using less efficient self-insurance and informal insurance as their main risk management instruments. The following are some obstacles that microinsurance must overcome in order to increase its uptake among low-income African communities.

The general public is not well-informed on the benefits and purposes of insurance. The market has to be educated and its prejudice against insurance needs to be overcome if low-income families are to choose insurance as risk management tool. The majority of low-income households believe that the market lacks suitable and valuable goods and services.

In general, people have little faith in institutions. Many people are hesitant to pay a premium for an illusive good with potential future advantages that may never be realized. People do not have trust in Insurance.

The majority of micro-insurers neither provide any policies specifically aimed at the lower-income population nor actively engage with this group. The fact that most goods are not straightforward, easily understood, beneficial, or efficient, and that payment is typically demanded ahead and on a regular basis, is one of the fundamental problems with the product providing.

Low amounts of publicity and insufficient distribution methods that restrict reach. Accessing the target market with microinsurance products has been identified as one of the challenges facing microinsurance penetration in Africa. There is a lack of information technology relative to microinsurance and a lack of reliable information or data thereby making it very difficult to assess people’s risk.

Product centricity is one of the major challenges of microinsurance. There are so many focus on the details of the products above other considerations, including customers' needs. For instance, A company’s decisionmakers spend less time talking to the customers and doing market research and as a result of this, they lose sight of what customers want from their products.

The government does not provide an adequate enabling environment to support microinsurance.There are inadequate government supports such as development of favorable regulations, providing subsidies or incentives, and integrating microinsurance into social protection schemes for local players and multinational companies to enter African markets and develop the sector. Regulation remains one of the most important barriers for microinsurance services to overcome for growth.

Adverse selection, fraud, and moral hazard. In microinsurance, particularly health insurance, moral hazard, adverse selection, and fraud are frequently cited as issues, but other elements like risk selection also play a significant role in market failures.

THE WAY FORWARD

Microinsurance has seen an increase in inventions and technology that help low-income people overcome their different issues. For Microinsurance to improve its penetration in rural populations in Africa, some challenges must be overcome. The viability of microinsurance, therefore, requires:

Community-Based Organizations: Engaging community-based organizations, such as self-help groups, cooperatives, or community associations, can be an effective way to reach the target population. These organizations have established trust and influence within their communities and can help in raising awareness about microinsurance, enrolling members, and facilitating premium collection and claims settlement.

Government and Regulatory Support: Regulation remains one of the most important barriers for microinsurance services to overcome for growth. Collaboration with government agencies and regulators can create an enabling environment for Microinsurance interventions.

Governments must support microinsurance by developing favorable regulations, providing subsidies or incentives, and integrating microinsurance into social protection schemes. Such support enhances the affordability and sustainability of microinsurance products, making them more accessible to the target population. The role of the government and regulators are critical in ensuring the positive impact of microinsurance is maximized.

According to UNDP Administrator Achim Steiner, countries that could afford to invest in safety nets have kept a sizable number of people out of poverty during the past three years. Debt servicing makes it more difficult for governments in heavily indebted nations to provide for their citizens by making expenditures in

health, education, and social protection. Therefore, microinsurance is required to prevent people from relapsing or sliding deeper into poverty.

Given the fear of government break of promise or failure to carry out its roles or pay for microinsurance premium, this paper recommends a partnership with government only for an extended policy cover and benefits. This implies that the policyholder pays for the lowest cover/benefit but could get an extended cover if the government adds to the premium paid. Example: The low-income earners living in Lagos could purchase a unit of microinsurance policy of =N=5,000.00 annual premium for Death benefit of =N=250,000.00 and medical expenses of =N=100,000.00. The partnership with government can double the benefit for an additional premium of =N=5,000.00 payable by the government.

Financial Education: A crucial first step in microinsurance market activation is consumer education. In addition, those who are unfamiliar with the ins and outs of insurance are less likely to recognize its worth as a risk management tool. Investments in education are anticipated to increase low-income people's comprehension of insurance benefits and therefore spur product acceptance.

Microinsurance uptake depends on a degree of financial literacy that enables customers to evaluate what they are getting when they pay a premium, in addition to making sure that products are appropriate and cheap. Strategic consumer education initiatives are essential if microinsurance is to succeed in shifting these views. It is necessary to enhance the attitudes and understanding of low-income families and insurance brokers.

Premium payment frequency: The target market for microinsurance frequently experiences erratic and unexpected financial flows. They do not have a fixed income or get wages on a regular basis like salary or wages do. The premium payment process must identify methods to time payments to coincide with times when households have some extra money, and provision should be given for premium payment in parts in order to reduce lapses and increase renewals. Incentives can also be used to motivate them to pay their premiums in full when they are able to.

Building Trust: The fact that policyholders do not know if the insurer would honor the benefits in the case of a claim is one of the issues with selling insurance. Early on, not everyone would embrace or have faith in insurance. As a result, it's crucial to mobilize the local community and inform them of the significance and advantages of this product. Micro-insurers must devise strategies for persuading their target audience that they are reliable. Microinsurers must implement policies, services, and procedures that will promote confidence.

Claims Management: Therefore, claims management is a crucial component of an insurer's attempts to offer excellent customer service and keep customers. The handling of fraud in the insurance claims process is a major challenge. A method to stop fraudulent claims should be a crucial part of the risk management and product design for microinsurance. Products must be made with clear, objective standards that enable coverage and claims validation. Utilizing the connections between microinsurance schemes and community structures is one method for putting in place cost-effective fraud controls. This paper also recommends the partnership with government and local hospitals in verifying claims documents for death and medical expenses. The partnership can be driven by data around residential addresses.

Common strategies include requirements for extra supporting documentation, restrictions on identification verification and coverage eligibility, automated system checks, physical verification of loss or services supplied, and physical verification of loss. Microinsurance providers must weigh the possible trade-offs between tougher fraud controls and factors like turnaround time and the ease of claims procedures and documentation. These measures can be time-consuming and expensive. Instead of adding extra checks and controls after the fact, one efficient method of fraud management for microinsurance is to reduce the causes of fraud through improved product design.

The case study participants provided the following eight recommendations to help micro-insurers with their claims management duties:

Utilize current social networks and avenues for dissemination.

Make sure that clients, claims managers, and intermediaries can understand the notification and filing procedure for claims.

Documentation required for balance claims: Simple claim requirements should follow from simple product design.

Pay close attention to turnaround time and keep in mind that from the client's viewpoint, the overall amount of time from loss to payment counts more than the internal processing speed.

Implement optimized, effective workflow procedures, and continuously assess them.

Keep in mind that a loss event is a trying moment for the customer, therefore the procedure should be quick, easy, and cater to their needs.

Keep procedures and data under your control. Make sure technological investments are well-considered and will produce the intended results.

Set clear management viewpoints to concentrate on the claim's operations after balancing the company and client perspectives.

Improvement or Development of products: Micro-insurers must be innovative with microinsurance products. Before hitting the market, microinsurance products must be developed with SUAVE (simplicity, understandability, accessibility, value, and efficiency) in mind.

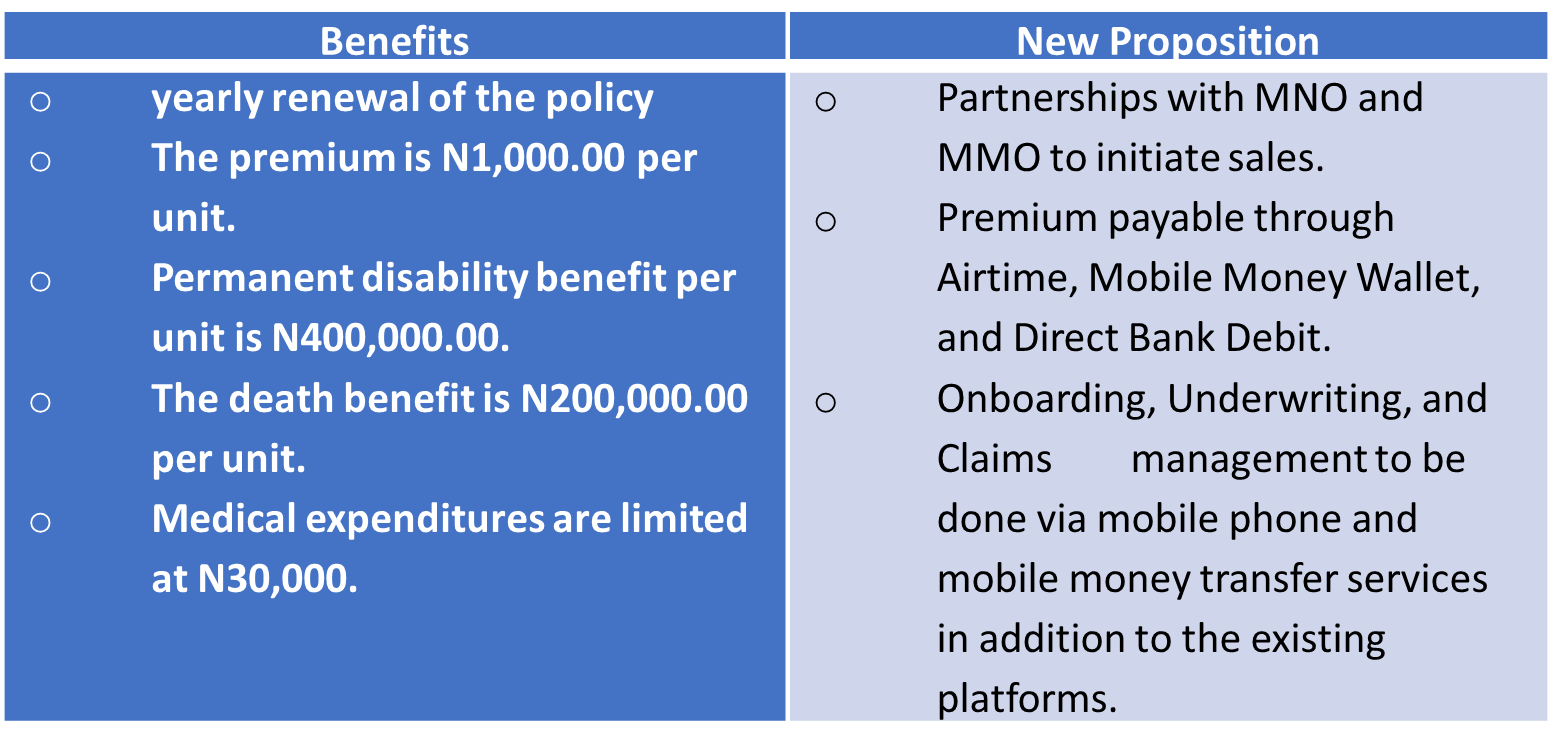

For example, The Custodian Safety Plus Plan launched by Custodian & Allied Insurance Limited (Nigeria). The product is targeted at low-income populations. The Insured will receive financial support in the case of an accident thanks to this Personal Accident Insurance policy. The coverage pays for funeral costs, medical bills, and disability if the insured dies or becomes permanently disabled in an accident. Sales and claims processing are done through agents and online (official website). Below is my proposition to boost sales and increase the market target.

Efficient Distribution channels: There must be efficient service delivery channels to help market the microinsurance products. Microinsurance products or interventions can reach the target population through various strategies and channels. The key is to ensure accessibility, affordability, and relevance of microinsurance offerings to effectively serve the needs of the target population. Here are some ways in which microinsurance products or interventions can reach the target population:

Partnership with Microfinance Institutions (MFIs): Microfinance institutions have existing relationships and networks within the target population. Collaborating with MFIs allows microinsurance providers to leverage these networks and integrate microinsurance products into their existing microfinance offerings. This enables reaching a wider customer base and facilitate access to insurance services.

Agency Networks: Establishing a network of agents or intermediaries in underserved areas can help promote and distribute microinsurance products. Agents act as a bridge between the insurance provider and the target population, offering product information, facilitating enrollment, collection of premiums, and claims settlement. These agents (e.g., self-help groups, kiosks, retailers, volunteers, insurance agents, employers, credit unions, unemployed youths etc.) within the underserved areas can be recruited and trained locally to enhance trust and understanding among the target population.

Mobile Technology and Digital Platforms: Leveraging mobile technology and digital platforms can significantly enhance the reach and accessibility of microinsurance products. Mobile phones can serve as a medium for product information dissemination, enrolment, premium payment, and claims processing. Mobile money platforms can facilitate seamless premium collection and payout mechanisms, reducing transaction costs and improving convenience for the target population. The aim is to take advantage of technological platforms as much as possible to incorporate products into the offering with more suitable coverage for the low-income population, seeking the economies of scale that will allow these policies to be issued at a reasonable cost.

Partnerships with Mobile Network Operator (MNO): Mobile Network Operator (MNO) agreements that enable micro-insurers to streamline product distribution and reach out to new consumers residing in rural regions are also very valuable to them. Here are some real-world instances of cooperation in African nations.

aYo & MTN

Product launched: in 2020.

Solutions offered:Health Microinsurance solutions for common conditions across Africa such as malaria, upper respiratory tract infections and viral infections.

Key attribute: Cover includes access to telemedicine consults, drug discounts, screening, and instant claims settlement via 1 200 local pharmacies as points of care.

Starting from: $1 per month

Presence in: Nigeria

User base: 14 million customers

Claim: Claim is processed directly from cellphone via USSD

"MTN Life after Life," a life insurance product that allows policyholders to insure their lives at a microinsurance level using MTN airtime as the mode of payment, was developed in Zambia as a result of a cooperation between MTN and African Life Assurance. With the help of this effort, every MTN subscriber in Zambia may purchase Life Assurance for as little as $0.30 USD each month, with a payment of $200 USD. The MTN Life after Life product offers instant insurance by African Life Assurance Zambia once the premium is paid using MTN airtime, with no transaction costs, no difficult papers to execute, and no fuss. African Life Assurance Zambia will pay any claims in Kwacha, and the entire procedure will be straightforward and simple to manage.Partnerships with Mobile Money Operator (MMO): A fresh method for Microinsurers to digitalize elements in the insurance value chain, such as premium collection and claim payments, has emerged: partnerships with mobile money providers. The microinsurance options offered by M-Pesa and Safaricom are a prime illustration of this. The microinsurance products available include personal accident, life, disability, and health insurance as well as weather index insurance for maize and wheat farmers. Through these collaborations, Microinsurance providers are able to immediately collect premium payments from policyholders using the mobile money transfer service M-PESA. Additionally, Frontline SMS and Payment View, two integrated open-source software packages, are used to administer, monitor, and alter rules.

Mobile Health (mHealth): Another endeavor is to leverage mobile technology, sometimes referred to as mobile health, as instruments to improve low-income people's access to care and the delivery of that care. In order to handle patient information and deliver healthcare services, mobile health utilizes portable electronic devices with software applications. One of the best mHealth features is telemonitoring. It "involves using an electronic device to produce remote, real-time monitoring of medical conditions, enable disease management, and give patient education. Additionally, the management of chronic diseases benefits greatly from mHealth. Many chronic illnesses require long-term, regular monitoring and treatment. To overcome the physical distance between patients and clinicians, portable health monitoring devices that continuously and accurately report physical activity as well as a wide range of other biomarkers, such as temperature, blood pressure, heart rate, electrocardiogram, weight, and glucose, are essential tools for clinicians and researchers.

This study also suggests that the microinsurance industry participants establish medical clinics or community-based healthcare programs to deliver healthcare services and provide free health screenings for customers, including assessments for blood pressure, body mass index, eyesight, blood sugar (diabetes), and hepatitis B. Use telemedicine and artificial intelligence (AI) as well while delivering medical services. Numerous studies have already shown that AI is capable of doing important healthcare jobs including illness diagnosis as well as or better than humans.

CONCLUSION

Improved risk management alternatives for the low-income population can be provided in part via microinsurance. The low-income population will likely continue to employ a variety of risk management techniques, according to early lessons learned from microinsurance experience and advancements in microfinance. However, none of the current approaches will offer complete coverage. Potentially, microinsurance can close these gaps.

However, for the insurance providers to fully tap into this available market, it must provide solution to the earlier identified problems, the industry must continue to innovate products that provide values to the low-income population, build trust while given greater attention to reducing operating costs and enhancing efficiencies amongst providers. So also, continuous improvement in technology is highly essential.

The government and regulatory bodies must continuously play prominent roles in providing favorable or enabling environment, subsidies, or incentives, and integrating microinsurance into social protection schemes for the growth of microinsurance products and services.

It is very important to conclude that all stakeholders including the government and communities must work together to address the challenges facing the industry and ensure that consumers are informed, well served, and protected. Hence, Microinsurers must embrace innovation, customer-centricity, and excellent service delivery at all levels.

BIBLIOGRAPHY

Microinsurance Market: Global market size, forecast, insights, and competitive landscape.

"Driving Inclusive Insurance: The untapped potential within the microinsurance market." (“Driving Inclusive Insurance: The Untapped Potential within The ...”)

Churchill, C. (2006). Protecting the poor: A Micro insurance Compendium, International labor organization, Geneva

Prathima Rajan,"Micro insurance to the Last, the Least and the Lost – a case study of Rural India", Report published by Celent, a division of Oliver Wyman, Inc., 2011.

Oscar Joseph Akotey, Kofi A. Osei, Albert Gemegah, "The demand for micro insurance in Ghana", Journal of Risk Finance, The, Vol. 12, Issue 3, 2011.

Bettina, N. U. (2017). Factors affecting the low demand and the penetration of life insurance in Burundi.

Mbugua, D. K. (2021). Effect of Microinsurance Growth on Insurance Penetration in Kenya (Doctoral dissertation, University of Nairobi).

Anderson, D. R.,"The national flood insurance program – problems and potentials", Journal of Risk and Insurance, 41, pp. 579-599, 1974

The Atlas of African Health Statistics 2022 report

McCord, M.J.,"Microinsurance NOTE 4: Product development – Making microinsurance products successful", USAID, 2007.

Delloite: African Insurance Outlook 2022.

Kishor, N. R., Prahalad, C., & Loster, T. (2013). Micro insurance in India-Protecting the poor. Journal of Business Management and Social Sciences Research.

Suarez, P., & Linnerooth‐Bayer, J. (2010). Micro‐insurance for local adaptation. Wiley Interdisciplinary Reviews: Climate Change.

De Bock, O., & Gelade, W. (2012). The demand for microinsurance: A literature review. Retrieved from https://www.droughtmanagement.info/literature/ILO_the_demand_for_microinsurance_2012.pdf.

Landscape of Microinsurance 2023

Halliday, Timothy. "Migration, Risk, and Liquidity Constraints in El Salvador." Economic Development and Cultural Change Vol. 54.No. 4 (2006): 893-925. Web. 14 Nov 2010.

Cohen, Monique, and Jennefer Sebstad. "Reducing Vulnerability: The Demand for Microinsurance." Journal of International Development Vol. 17.No. 3 (2005): 397-494. Web. 14 Nov 2010.

Siegel, Paul B., Jeffrey Alwang and Sudharshan Canagarajah. “Viewing Microinsurance as a Social Risk Management Instrument.” World Bank Social Protection Discussion Paper, No. 0116. Jun. 2001. Web. November 10, 2010.

Milliman and Microinsurance: Insights from Milliman Asia Microinsurance Supply-side Study 2020

United Nations Development Programme (UNDP), titled “The Human Cost of Inaction: Poverty, Social Protection and Debt Servicing, 2020–2023”.

https://www.ilo.org/wcmsp5/groups/public/---ed_protect/---soc_sec/documents/instructionalmaterial/wcms_secsoc_93.pdf

Impacts of Community-based Health Insurance on Poverty Reduction – Andinet Woldemichael

https://www.eajournals.org/wp-content/uploads/The-Role-of-Micro-Insurance-on-Poverty-Reduction.pdf (pages 50-51) - (Published in 2020, Data gotten in 2018)