Leveraging and Digitizing a Strategy for Traditional Life Insurance Companies to Compete in the New Age

by Kaori Sánchez Mano, Business Development Specialist, MAPFRE

Introduction

Who could foresee that something is going to happen that would lead us to digitalization so quickly?

Recent years have proven how difficult it is to anticipate trends. Much more than anticipated in a VUCA environment. Digital and cultural organizational processes have been challenged from one day to the next. The companies that were in this way have responded more agile while the ones that were not prepared have had to do it in record time. If something has been demonstrated through these years is that digitalization is the only future guarantee.

Technology has proven to be decisive and will be in the coming years. But technology is not an innovation but a requirement in the business model.

Insurance companies are in challenging times, especially the traditional ones. Those that turn a blind eye could end up the same as some big mobile companies that did not adapt their business models to the technological and social changes, whereas organizations that transform themselves and get the advantage of their strengths will be the ones that keep growing and succeed in the years ahead.

To overcome these challenges, traditional insurers must identify their strengths and concentrate their efforts on those areas where they have an advantage to increase their bottom line and beat the market.

Therefore, this paper aims to provide recommendations for traditional companies that want to succeed in the new age through four key pillars: distribution channels, the value proposal, operational intelligence, and technological infrastructure.

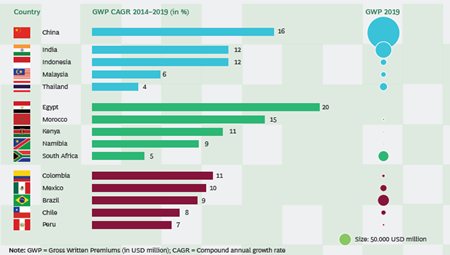

Exhibit 1 | Emerging markets hold promising growth opportunities for life insurance

1. Distribution Channels

1.1. TRADITIONAL CHANNEL: Digitalize agents & brokers

Strength to leverage: Capillarity of your salesforce.

Context

At present, it is not necessary to point out the customer’s high demands. They expect convenience, advice, and ease of contact when it comes to insurance companies.

The COVID-19 pandemic has promoted digital elements that were in their early stages and companies have adopted offline-online hybrid solutions. Customers now have a higher preference for digital channels than before.

However, offline channels still play a key role in reaching customers and offering them personal attendance, so traditional companies can provide the best omnichannel experience to the customer by combining physical and digital channels.

So, depending on the needs, the customers will require either physical or remote service.

How do you have to do it?

Get advantage of your wide salesforce by upgrading agents’ capability.

Provide them with digital tools such as screen-sharing platforms, video conferencing, webchats, and new-age tools to visually explain products, generate instant quotes, and offer e-signature flexibility.

By doing so:

- You will offer your customers more availability and convenience, letting them choose how to interact with you depending on their preferences at each moment.

- You will reduce customer service and administration time by agents.

- Customer satisfaction will increase just as your Net Promoter Score (NPS).

- Customer engagement will increase, and the churn rate will decrease.

Match customer leads to the channel or agent that best serves each customer’s needs.

Use advanced analytics on the customer leads to offer personalized customer interactions including assigning a physical agent if it is required, to increase the efficacy of lead conversion.

- You will increase sales and the average insurance premium due to professional personal advice.

- You will reduce customer acquisition costs by anticipating customer needs with customized proposals.

Exhibit 2 | Bionic operating models combine the best attributes of humans and technology to deliver superior outcomes

1.2. ONLINE CHANNELS: Improve digital user experience in online sales & customer self-service

Strengths to leverage: Company brand name.

Context

Digital channels offer the best alternatives and are among the most widely used for insurance product searches.

Smartphones use and familiarity with mobile apps have grown exponentially among different age groups in recent years.

An established brand name can be leveraged even better through digital media leveraging the trust of the brand.

How do you have to do it?

Enhance online sales processes with UX.

An established brand name is not enough if it is not joined by a good digital user experience.

Therefore, you must work hard on the user experience, keep it simple and build free-flowing processes.

Offer a seamless purchase experience with enhanced efficiency.

- You will increase sales from the digital channel.

- You will reach customers that are digital natives.

- You will increase your market share.

Support online processes by operational efficiency during the whole process.

From the onboarding stage by using KYC technologies that provide customer-identify, to subsequent stages of the process by offering customers easy means of payment to finish the purchase or digital signature of documents.

By doing so:

- You will reduce the costs of acquiring new customers.

- You will reduce administrative times and costs.

- Improved profitability.

Offer a great digital after-sales service.

Provide your customers with the most convenient way means managing their insurance policies through a digital channel.

Provide customers with the same functionalities but without the need to go to a physical office.

Be proactive through online communications, collect continuous information, and use it to meet their needs throughout their lives.

By doing so:

- You will increase customer loyalty just as customer satisfaction.

- You will expand opportunities for cross/up selling due to more interaction with the customer.

1.3. DISTRIBUTION AGREEMENTS: Boost Embedded insurance by searching for the customer at the sales point

Strengths to leverage: Reliability and consistency of an established company.

Context

In the last years, a big change has been produced regarding the consumption model. Digital sales have increased and consequently, the insurance market has been transformed and it has developed embedded insurance, which consists of joining insurance into any third-party product or service purchase as part of the customer experience.

Organizations in many industries such as e-commerce or telecommunications are looking for new ways to monetize their customer base. But they want to partner with established companies that manage their customers properly. And they also look for ease of post-sales and maintaining a high degree of satisfaction with both products and services.

This allows us to do partnerships and acquire new customers by bringing together ecosystems with large existing customer bases.

You are not going to find the customers at the same place as in the past anymore. Therefore, partner with third-party ecosystem players of other sectors, such as the educational or retirement ones to reach customers at the perfect time without being intrusive.

According to InTech London research, the embedded insurance market will increase to 722 million dollars (Gross Written Premium) in 2030, more than six times its current size. This will mostly be motivated by China and North America, which will represent two-thirds of the world market.

How do you have to do it?

Adapt your business to a model where the insurance is the one looking for the customer and not the opposite, as it has been traditionally.

- Integrate embedded insurance to new platforms, customer ecosystems, and shopping experiences of other sectors. Some sectors that can match properly with the life insurance sector are the educational, retirement, or doubtlessly financial services.

- Offer more personalized solutions aligning customers’ preferences depending on the product they are buying and the information you have about them from the third party.

- To make it possible, it is required the development of open APIs to connect them easily.

By doing so:

- Customers can sign up for the insurance product at the perfect moment and place, offering them a seamless and immediate process.

- It turns out to be a new channel for accessing new markets and increasing revenues.

- For the third-party companies, it allows adding the insurance product to its value proposal, providing them an additional revenue source, distinguishing by their competence, and improving customer loyalty.

Best practices in the sector

Embedded insurance. à Ping An Insurance Group of China is the biggest embedded insurance provider in the world. Ping An created a wide company platform ecosystem of different sectors such as telemedicine, car sales, bank, and commodities and integrated them into its insurance platform. Then, the company sold embedded insurance products on each of these platforms, which turned into its most important channel for insurance sales.

2. Value Proposal

Strengths to leverage:

- A wide and solid customer base with enriched information from the different business lines policies customers have from your company.

- Availability of a broad business line’s product portfolio.

- Superior bargaining position as a big company to get better economic conditions to offer your customers other products and services from third parties.

Context

Many life insurance companies are still trying to find customer needs to match their products rather than designing solutions to solve customer problems.

The tendency is to change to truly understand what problems customers face to honestly meet their needs.

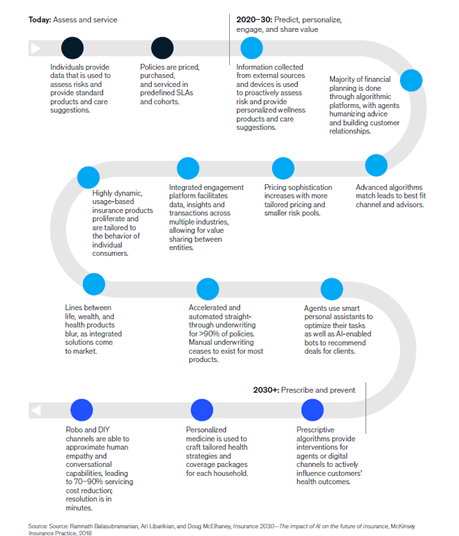

To do this, it is necessary to focus on your customer base. Currently, individuals provide data to the insurance company so they can assess risk and offer standard products. However, this is changing, and people are more willing to give their data if they get better value. The proliferation of data and connected devices, mainly wearables, will continue to make it easier for life insurance companies to play a proactive role in customer health – to everyone’s benefit.

Moreover, instead of limiting to the products you currently offer, consider offering an ecosystem of solutions during their entire life cycle, integrating different business lines your company has such as life, wealth, and health products as an integrated solution.

For example, in Asia and Europe, life insurance companies are already offering administrative support for medical visits, health management, and telemedicine.

Nonmonetary benefits are also growing because of the increase in retirement costs. For example, some companies from Asia and Europe are substituting capital payouts with services such as residences for the elderly. For big companies such as yours, obtaining advantageous fee conditions could be easier due to the higher business volume you can offer to third parties.

Regarding sustainability and ESG, some insurance organizations are incorporating ESG criteria in their investments and product portfolios to collaborate toward a sustainable and healthier world.

Exhibit 3 | Life insurance to transition from traditional ‘assess and service’ products to more customer-centric ‘prescribe and prevent’.

Source: Ramnath Balasubramanian, Ari Libarikian, and Dough McElhaney, Insurance 2030 – The impact of AI on the future of insurance, McKinsey Insurance Practice, 2018.

How do you have to do it?

Use AI tools to build a customized proposal for the customer.

You have solid databases of your customers. Combine internal information and collect from external sources such as devices like wearables, PSD2, etc.

Once you have processed them, apply Big Data and Artificial Intelligence to build algorithms and predictive models that will help you to be proactive with your customer portfolio by offering a personalized solution the customer need at the perfect moment.

By doing so:

- You will increase the wallet of share of your customers by offering them solutions in every stage of life.

- Customer engagement will get better by increasing the touchpoints with them during their policy lifecycle.

Change the approach from offering products to a holistic solution.

Support customers’ healthy lifestyles to improve their policyholder sickness.

Contact with your customers more regularly by collaborating with wellness platforms that encourage customers to eat better, exercise, quit smoking, and ultimately, promote healthy habits.

You can also provide other added-value services such as medical visits, health management, or telemedicine.

As a consolidated company, you have superior bargaining power to achieve better economic conditions in making agreements with companies of related sectors such as health. Furthermore, as a reliable and stable company, companies will want to collaborate with you for a win-win relationship.

You also have different independent business lines at your company that can be turned into an integrated solution: change the approach and offer life, health, and wealth as a holistic solution “from protection to prevention”.

By doing so:

- You will improve customer experience by creating an ecosystem of wellness and prevention.

- You will achieve customer centricity, growth, and profitability by expanding your role from just a payer to a partner and preventer.

- Data collected through engagement will help you identify risk factors more efficiently and identify customer segments with more granularity.

- You will get more premiums through cross-selling and upselling opportunities.

- You will reinforce a positive brand image and increase customers’ trust.

Be innovative in creating saving products in a low-interest market situation.

Offer customers the possibility to replace financial payouts in services such as senior living communities.

By doing so:

- You will be able to offer great services with better conditions in this financial context that meet customer needs and are very convenient for them and increase customer satisfaction.

Include ESG criteria in response to growing global concerns.

By doing so:

- You will get a lower cost of capital through risk reduction.

- You will get better financial performance.

Lastly, apply pricing sophistication. Work on your customer portfolio and leverage your wide database to develop new methods of tailored pricing and test their elasticity of them for optimization.

By doing so:

- You will optimize the benefits and can control the risk more efficiently.

Best practices in the sector

Agreements with third parties:

SBI Life, one of the biggest life insurance companies in India, has joined YONO which belongs to the State Bank of India. YONO is a huge digital ecosystem that allows customers access to a wide range of services such as travel, banking, and medical services. It has around twenty million users, while SBI has three hundred million bank accounts. SBI Life has achieved around four hundred thousand insurance policies through this agreement.

Creating wellness ecosystem:

Vitality is a successful case at creating an engaged wellness ecosystem with Discovery Group. Its program is in twenty-two markets, and it has achieved reducing the 35% mortality of its customers.

Japanese life insurance organizations are encouraging the “pay as you live” business model with dynamic pricing. For instance, customers who demonstrate regular healthy habits, such as doing exercise or medical check-ups, are rewarded with advantageous prices in their insurance policies.

3. Operational Intelligence

3.1. Underwriting

Strength to leverage: Historic patterns customer database.

Context

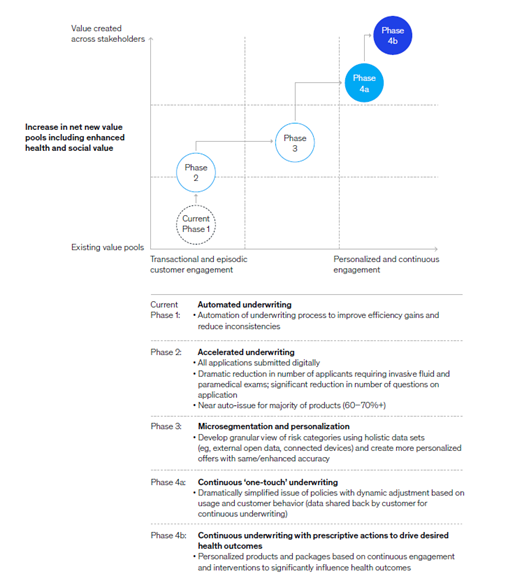

Despite insurance companies managing massive data sets, insurers’ ability to achieve useful insights from data has not been leveraged at all. Pricing still takes a long time, the processes are rough, and underwriting models are many times useless to identify customer segments.

Most underwriting and pricing models have hardly progressed. Some processes have been automated and required documents have been simplified, but still, there is a large opportunity for enhancement.

Analyzing customer habit patterns can be very useful to know the customer better and identify its needs.

Nowadays, mortality underwriting has two main data gaps:

- It is limited to just one moment in life, the moment of the contract.

- It does not consider the customers’ lifestyle changes.

Mckinsey&Company shares its vision about the evolution of underwriting in four phases that will increase personalization and customer engagement in the coming years in the following exhibit:

Exhibit 4 | Underwriting will evolve in four phases to drive increased personalization and customer engagement.

How do you have to do it?

Apply Data Analysis with AI and Machine Learning

- Implement dynamic underwriting models led by AI and Machine Learning collecting data from internal and external data on customer behavior and demographic trends to analyze customer behavior patterns and trends.

- You currently have a lot of information about your customers in your databases. Combine and integrate them with third parties designing a flexible structure to refine the models.

By doing so:

- You will improve customer experience through a fast, convenient, and hassle-free underwriting process.

- You will reduce the underwriting process time.

- You will diminish customer acquisition costs.

Best practices

Dai-ichi Life, a Japanese insurance company, worked together with Hitachi on new underwriting models by combining customers’ medical registers and medical knowledge with Hitachi’s prediction tools to identify customers who have usually been excluded from insurance because they were considered as high risk and offered personalized proposals for them.

Unqork, is an American insurtech that provides software and helps insurance companies to digitize their processes such as the onboarding and the underwriting ones. Due to this collaboration, underwriting time has been decreased by 65% and costs by 30%.

3.2. Claims and fraud prevention

Strengths to leverage: Financial strength to acquire new technological solutions.

Context

Nowadays, claims processing is not efficient and takes a lot of time.

While insurance companies have progressed in digitalizing data and documents, manual interventions are still very common in the back office, and large amounts of paperwork and investigation are required.

Medical verifications are not automated, and they are not integrated with external information that would ease these processes.

Then, it leads to customer satisfaction because companies don’t make it easy for customers in a personal hard moment in their lives where they need to be focused on other issues.

Companies must work on this to enhance customer experience.

How do you have to do it?

Analyze the main pain points and introduce advanced technologies to improve processes.

- Combine new technologies such as robotic process automation (RPA), AI, natural language processing (NLP), and computer vision with advanced analytics, to improve the documents review. In this way, you must focus on claims that have high fraud risk.

- Integrate insurers’ systems with public data sources where possible: health ministries and large hospitals; provinces and municipalities; and even social media. Consequently, verification times can be greatly reduced.

- NLP, Machine Learning, and computer visioning of medical images can enable straight-through processing (STP) for coverage and claims assessment, dramatically improving productivity.

- The productivity of back-office operations will rise by between 30 and 40 percent.

- Customer experience will improve considerably in a moment where they just need to focus on the difficult personal moment they are living.

4. Technological Infrastructure

Strengths to leverage: Financial strength to access IT third-party agreements

Context

Insurance companies have been improving their technological systems in the last few years. Despite this, it still takes a long time to launch their products, which means they can’t respond quickly to changing market demand. Moreover, processes are still manual and not optimized.

Review your current processes and use data to identify the main bottlenecks that cause the most problems for customers leading to customer dissatisfaction, low efficiency, and high costs.

Technology upgrades and collaboration with third parties could help solve these bottlenecks and replace manual processes with Artificial Intelligence and automation.

How do you have to do it?

Acquire the technology capability through IT third parties.

- Move to a technology architecture that is low-cost and scalable to be able to react rapidly to market changes and you also must migrate to a Cloud Model and efficient API utility.

- Create an ecosystem with technological players to acquire the technology capability because creating it internally requires a lot of resources, high investment, and a long time.

By doing so:

- You will get the flexibility and the ability to quickly integrate with third-party partners.

- You will increase the agility to go to market

- You will achieve the IT capacities you need while you can focus on your core business.

Conclusion

We are immersed in a challenging environment for the life insurance industry where innovation and technological solutions are crucial and where customer expectations are higher than ever. Yet the coming years expect to be even more transformative.

Therefore, traditional insurance companies must build urgently a USP (unique selling proposition) to play with and win in this competitive market by capturing emerging opportunities and meeting and exceeding evolving customer expectations.

Distinguishing value proposals, digitizing the sales force, and embedded insurance distribution strategies will enhance customer relationships and become lifestyle partners, which means stronger customer loyalty and additional sales opportunities.

What is mentioned before, combined with operational excellence composed of intelligent processes and technologies such as AI, ML, NLP, or RPA will increase customer satisfaction while boosting company profitability.

This changing environment requires accelerated digitalization, faster go-to-market strategies, and partnerships with other ecosystem partners. Building open APIs to collaborate with different partners for greater experiences can optimize processes and get higher earnings.

Big Data management is the core to obtaining valuable customer information and hyper-personalized customer value proposals.

Be a real customer-centric leader, apply processes continuous improvement, work with agile methodologies, and collaborate closely with ecosystem partners.

If not now, when?