Life Insurance Protection Gaps - What they are and why they exist

IIS Executive Insights Life & Health Expert: Ronald Klein, Executive Director, BILTIR

The COVID-19 pandemic has taken lives, strained healthcare systems, closed businesses, caused massive unemployment and greatly increased political pressures globally. Now, more than ever, people should understand the value of secure life insurance and annuity products. However, the vast life insurance protection gaps have been growing leaving too many people un- or under-insured. Ronnie Klein, Executive Director of the Bermuda International Long Term Insurers and Reinsurers (BILTIR) highlights the cause and possible solutions to this enormous threat.

History of Life Insurance

In Ancient Rome, burial was considered a rite of passage from this life to the next. If a proper burial was not conducted, it was believed that evil spirits would rise from the dead. Of course, these funerals were quite expensive. It was at this time, well before the Common Era, that the concept of life insurance emerged: Romans formed burial “clubs” whereby members would deposit funds to pay for the next funeral amongst its members. There was no company or government intervention. One might call these clubs mutuals or fraternals.

The concept of “modern” life insurance emerged in the mid-1800s when breadwinners purchased policies to protect their families in case of their premature death and the resulting loss of income. Some of the oldest life insurance companies established at this time still exist today. Not long after the re-emergence of life insurance came the concept of a retirement annuity introduced in Germany by Otto von Bismarck in 1889. Von Bismarck needed to introduce a social program to stave off political rivals and it worked. Some criticize the program for paying retirement benefits beginning at age 70 when the life expectancy in Germany at that time was closer to 40 years. However, the low life expectancy was mainly due to high infant mortality rates and, in fact, the life expectancy at age 65 was 12 years – this was a valued benefit.

Introduction

Not much has changed since the concept of life insurance arose in Ancient Rome and the concept of a pension in the late 1800s. Life insurance still protects against the financial hardships of premature death of a breadwinner, disability or outliving one’s retirement assets. The industry is critical to society and reaches vast numbers of people and businesses. In the US alone, insurers paid out over USD 130 trillion of life insurance benefits to policyholders and another USD 406 trillion to annuity holders1. In addition, the life insurance industry manages over USD 28 trillion of assets worldwide, investing in important sectors such as local infrastructure and green technology2.

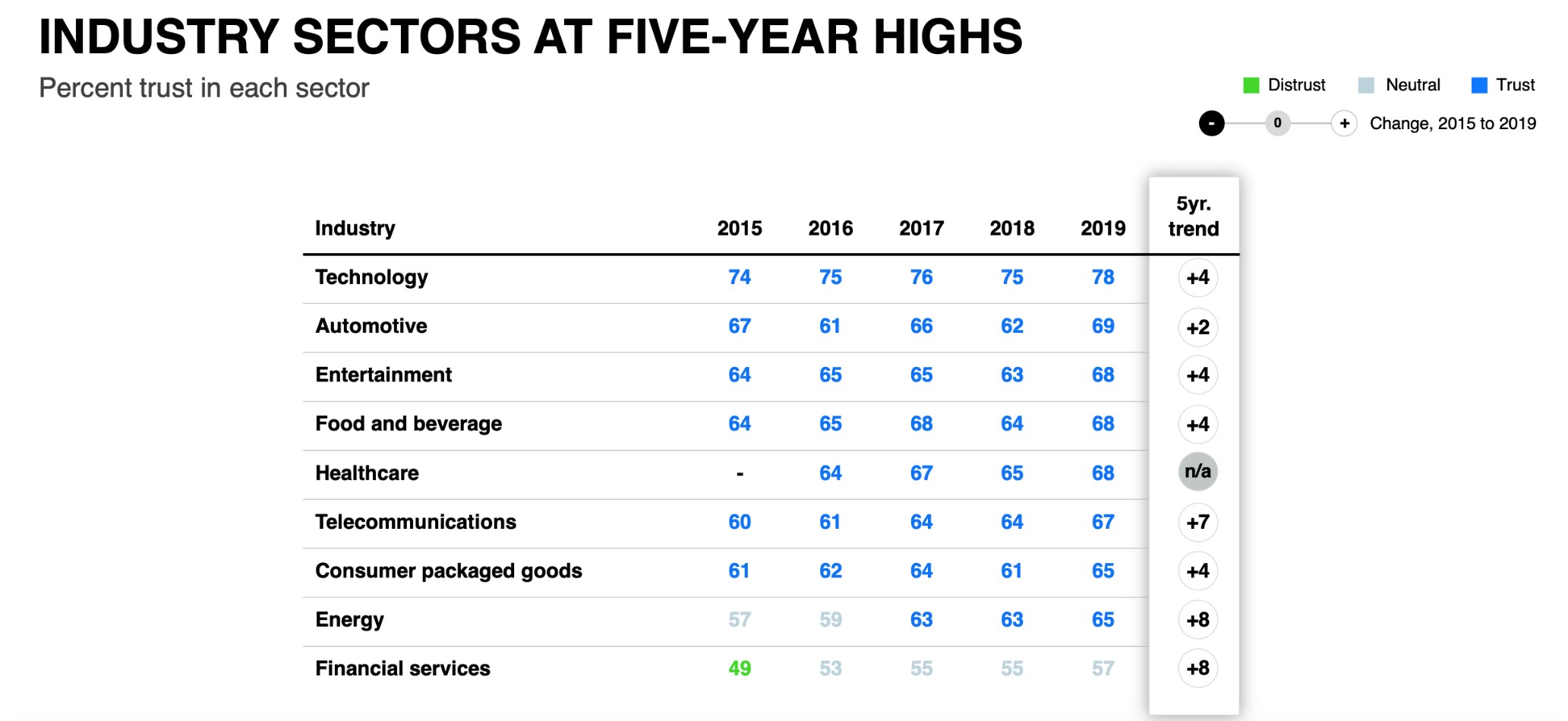

With this laudable resume, one might expect the life insurance industry to rank highly in customer satisfaction and trusted industry surveys. However, according to the Edelman Trust Barometer 2019, the Financial Services Industry ranks lowest amongst those sectors surveyed (see Figure 1 below)3. While the trend is definitely moving in the correct direction, banks typically rank higher than insurers on surveys leaving insurers at the bottom of this list.

Figure 1

Source: Edelman Trust Barometer 2019

A lack of trust in financial institutions could be one reason for the well-documented “protection gap” that plagues the entire world. What actually is a protection gap, why does it occur and what can be done to close the gap?

The Protection Gap

The definition most cited for the protection gap is the difference between economic losses and insured losses. However, this definition is much better suited to property losses after a natural catastrophe. How does one calculate the economic loss of a breadwinner or the amount of money should be saved for retirement?

For life insurance, a better definition of the protection gap might be the amount of protection needed to maintain one’s standard of living after a life event (death, disability or retirement) for a certain period of time. In this case, the word “protection” may mean the present value during that period of time.

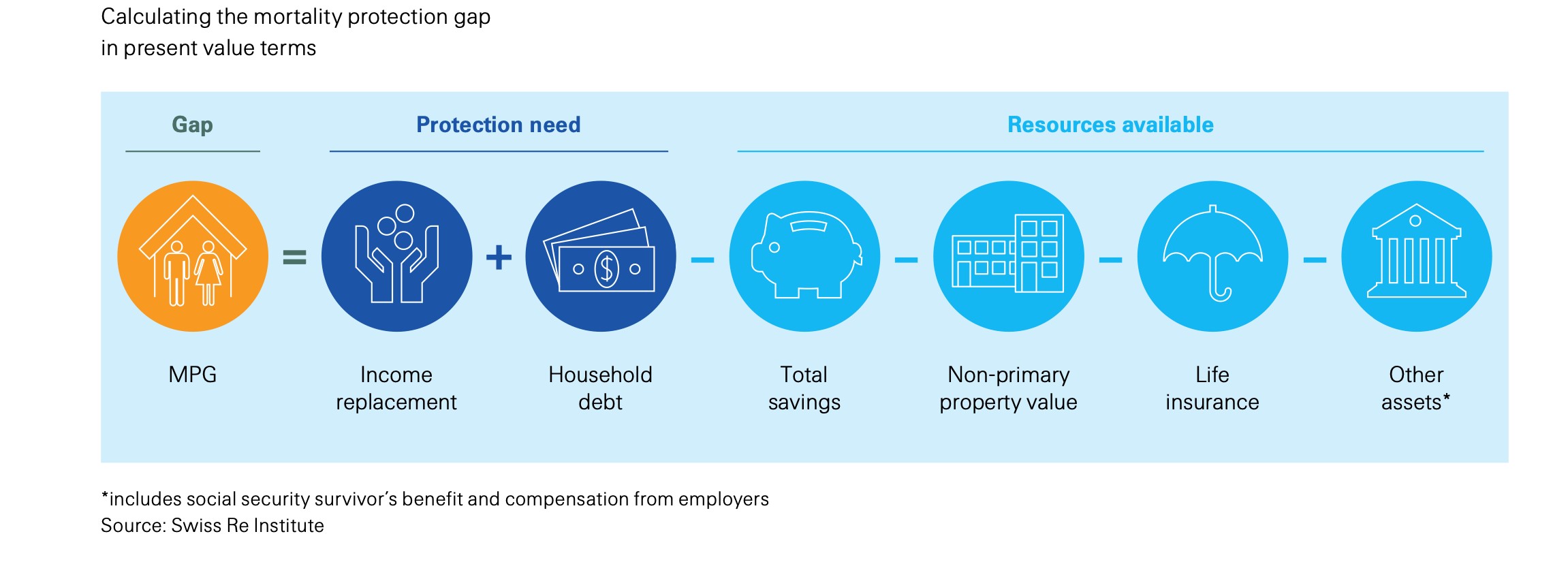

A 2020 paper entitled Closing Asia’s Mortality Protection Gap estimates that the gap for the entire Asia Pacific region is USD 83 trillion4. Swiss Re defines the mortality protection gap in this paper as the present value of income replacement + household debt – total savings – investment real estate – life insurance – other assets (see Figure 2 below).

Figure 2

In a similar paper covering the US only, Swiss Re estimates a USD 25 trillion coverage gap5. This amounts to over USD 100 trillion without including Europe or Africa. Of course, these calculations are performed on averages which really does not tell the entire story. One extremely wealthy family can offset many poorer families in the calculations. The incredible magnitude of the protection gap figures reported overshadow any calculation errors.

The World Economic Forum estimated that the retirement savings gap, calculated as the unfunded government pensions plus unfunded corporate pensions plus the shortfall in personal retirement savings, was about USD 70 trillion in 2015 and expected to grow to USD 400 trillion by 20506. This huge gap only covers eight of the largest economies which have reliable data. The mortality gap and pension gap are related in that the premature death or disability of a breadwinner will most certainly cause families to lower or stop payments to retirement programs.

One might expect that the sheer scale of these daunting figures would cause an immediate call to arms. Governments should be enacting legislation, companies should improve access and people should run to protect themselves. But this is not the case. It seems that the only industry highlighting this grave issue is the insurance industry. To the average consumer, this is akin to Apple writing papers on the “iPhone Gap.” Who is really the audience for these protection gap studies? Will people wake up one morning and vow to purchase life insurance or an annuity for the sole reason of closing the protection gap?

Reasons that Protection Gaps Occur

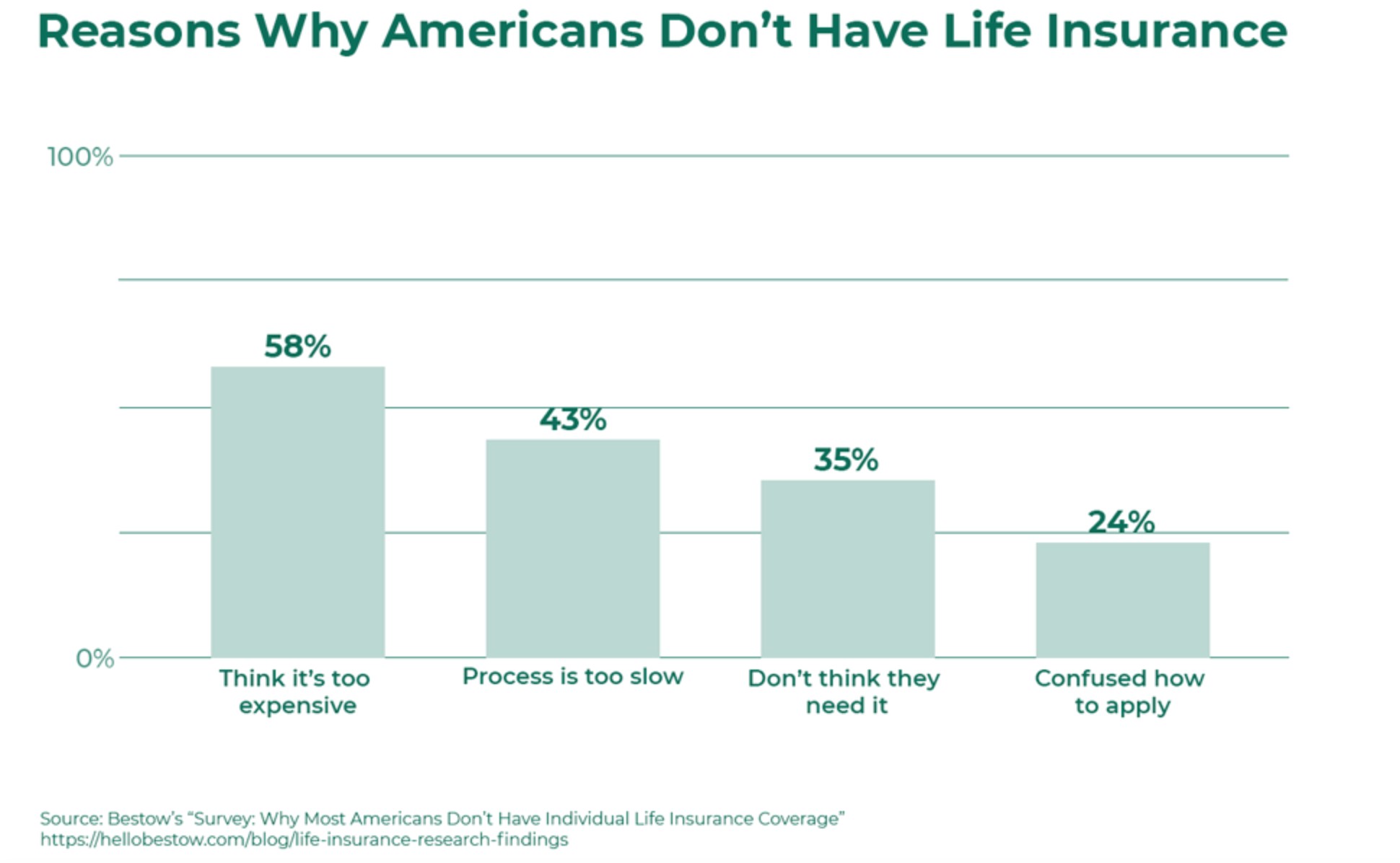

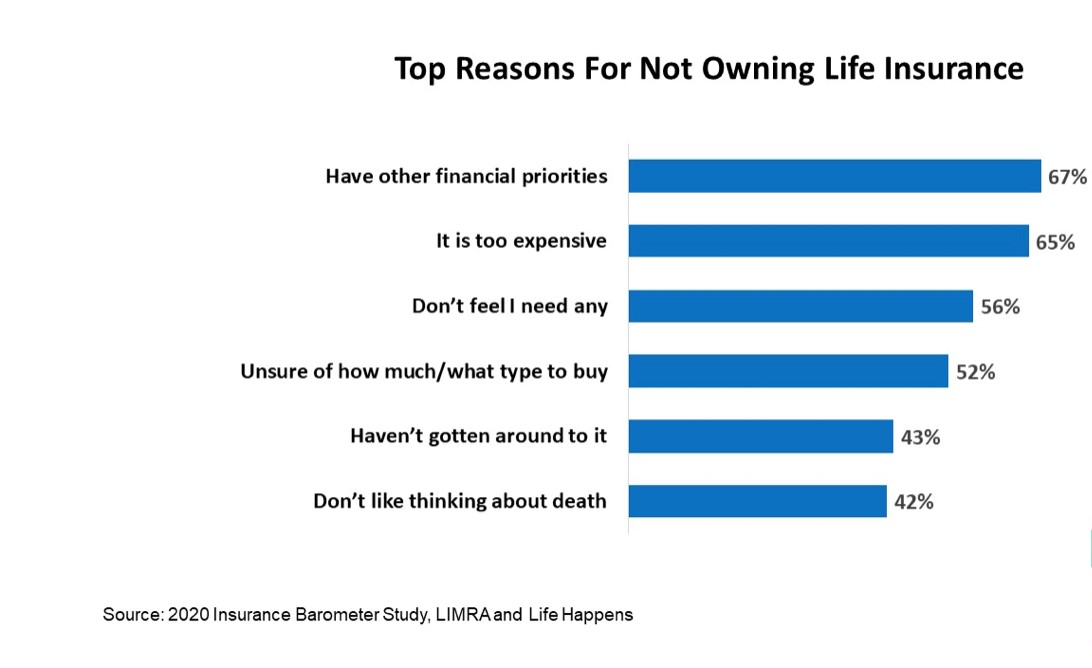

Many consumer surveys, for example those performed by Bestow7 and LIMRA8, show that the primary reason for non-purchase of life insurance products is price or “have other financial priorities” (see Figure 3 and Figure 4 below).

Figure 3

Figure 4

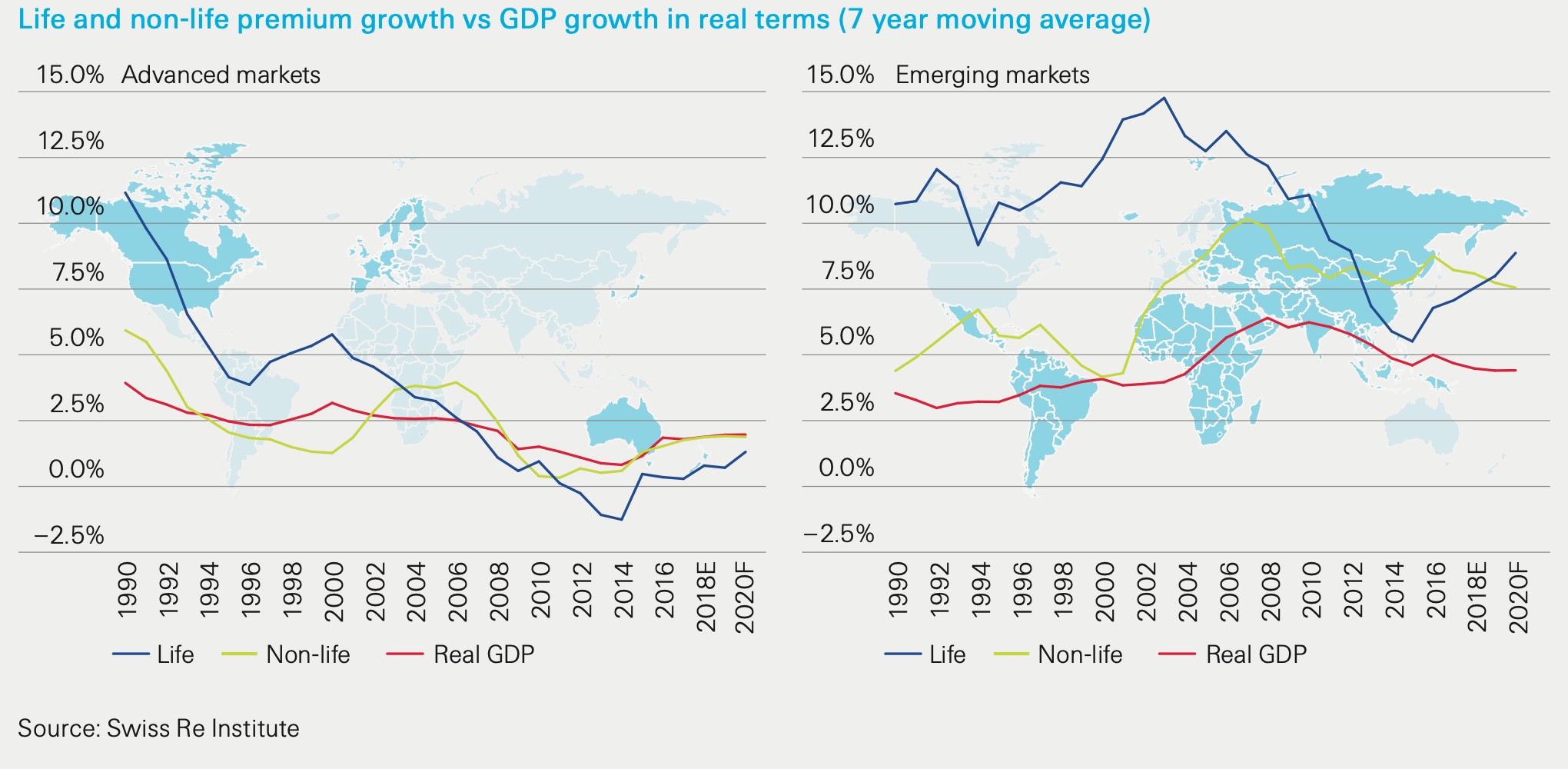

With decreasing mortality rates in mature insurance markets comes lower pricing for protection life insurance products. There has been little evidence of increased sales through the lowering of prices. In fact, life insurance sales have been relatively flat for decades (see Figure 5 below)9.

Figure 5

Economists like to point to the great financial crisis of 2008 as a cause for poor insurance sales. The fact is that life insurance sales have been level or even declining prior to 2008 and, in mature markets, have not even kept up with GDP growth since 2005. This suggests that there is an even stronger underlying reason for the reluctance to purchase life insurance.

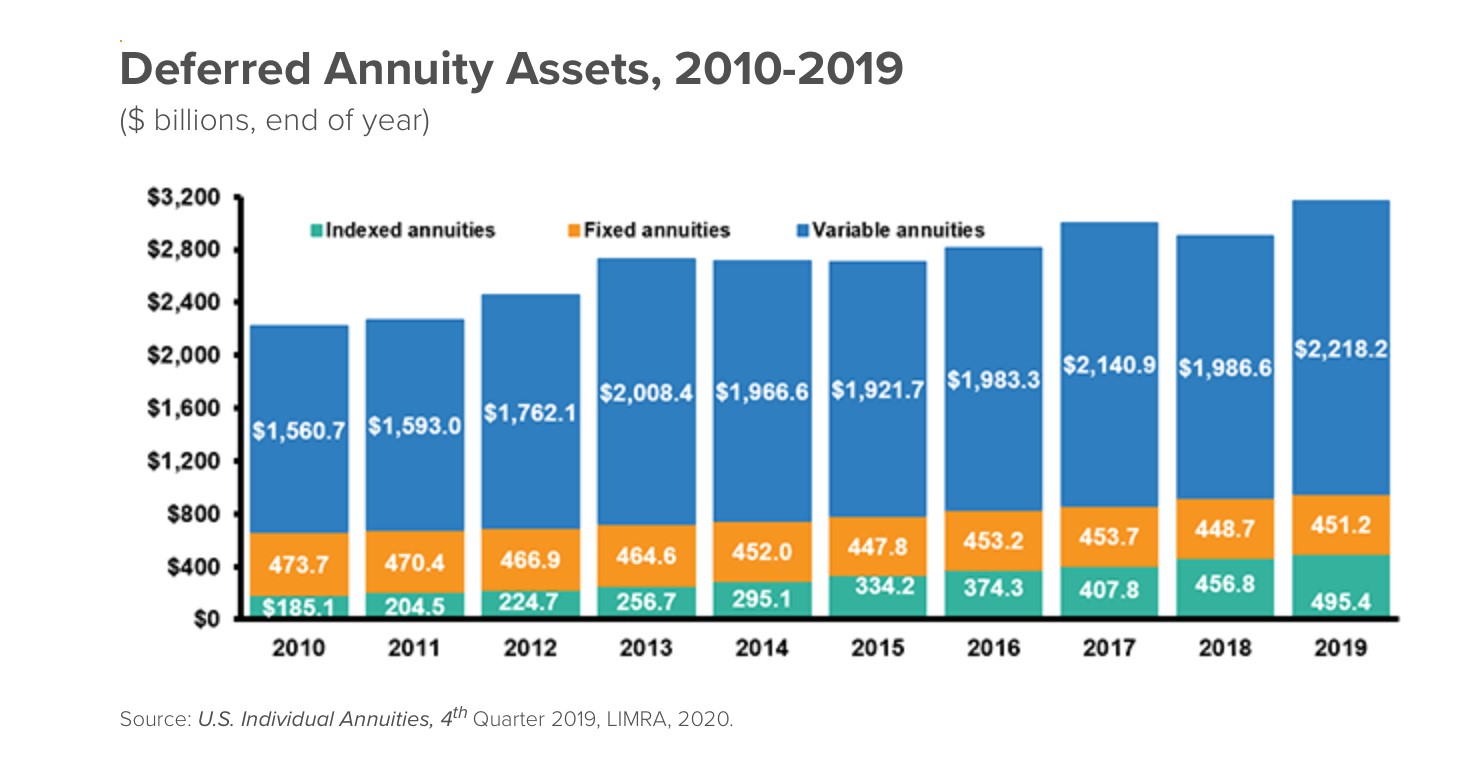

Annuity sales are a bit more difficult to decipher. Many of the newer variable annuities are sold as investment products and, while savings is an important element in the fight against the protection gap, this money can be spent in ways other than to ensure that the owner does not outlive his or her retirement assets. Fixed annuity sales have been relatively flat and this could be due to persistency low interest-rate environment (see Figure 6 below)10. When interest rates tend toward zero, life expectancy assumptions become more transparent. Many potential annuity purchasers regard products as investments instead of insurance against outliving outcome. In addition, it is difficult for some to part with a large sum of money that could be completely lost if death occurs in the not-too-distant future. These reasons are causing a reluctance to purchase fixed annuities which adds to the protection gap.

Figure 6

Trust is clearly one reason why sales of insurance and annuities have not kept up with inflation - trust in insurance companies, trust in insurance agents and trust that products will perform as stated. While the ACLI says that less than 1% of life insurance claims are denied in the US, consumers tend to lump all insurance together. Health and non-life insurance (home, auto, etc.) deny or settle for a lesser amount on policies more often as claims are much more difficult to determine than life insurance. A former CEO of Swiss Re was noted as saying that life insurance is easy: “You die, we pay11.”

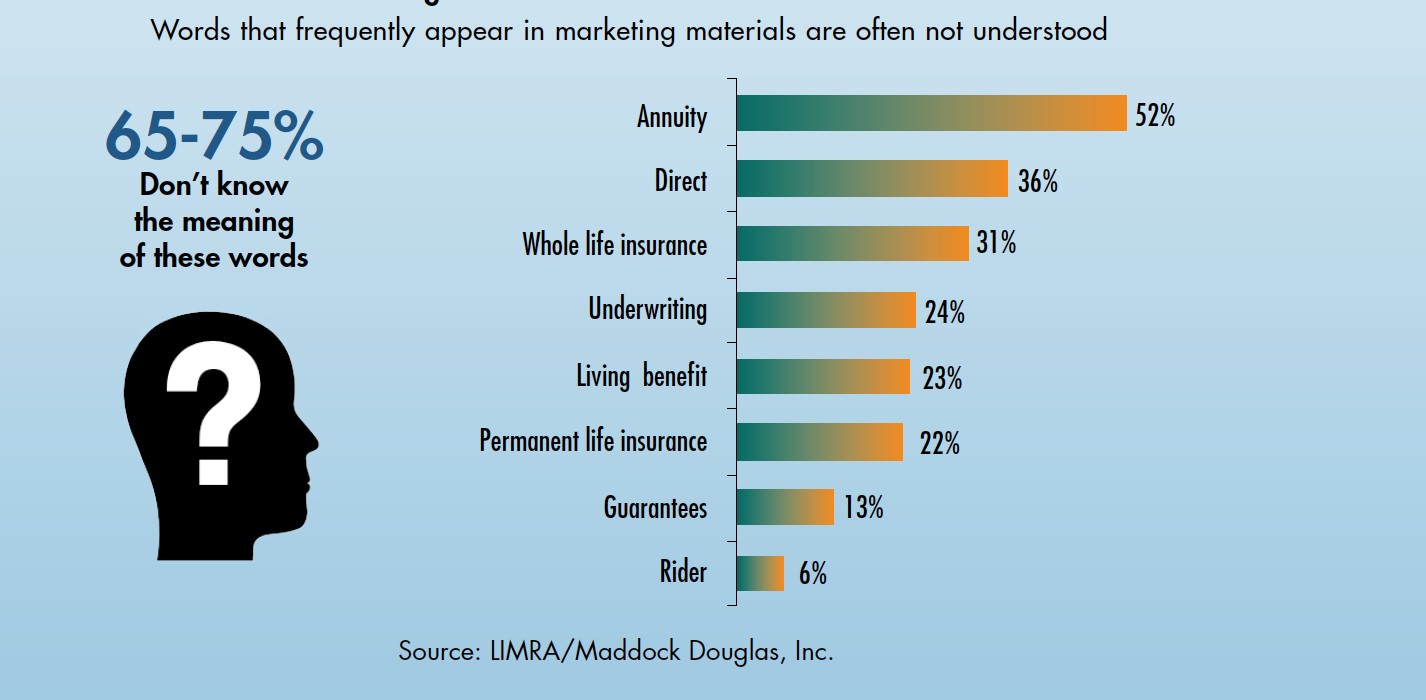

Another reason could simply be that people do not understand life insurance and annuity products. A recent Maddock Douglas – LIMRA survey found some shocking results about general population knowledge of terms that the insurance industry uses in selling its products (see Figure 7 below)12.

Figure 7

The chart shows how often these words are used in marketing material, with 65-75% of those surveyed not confident that they fully understand the meaning of the terms. This survey further discusses the nearly 19 million “stuck shoppers,” defined as those who know insurance is important and intend to buy one day, but still do not own a policy. Could it be that this “intention gap” is caused, in large part, by confusing language used by the life insurance industry?

Words not on the list that will have similar or worse results are the industry standards of “protection” or “premium” or “reserve.” These words have meaning in daily life that are not related to insurance. Political leaders have been known to berate insurance companies for having so much money in “reserve,” not realizing that this is a liability for future claim payments. To the average person, a reserve is a cushion against something bad happening – akin to a solvency margin, in insurance speak.

The industry is just beginning to realize that there are behavioral reasons for not buying insurance. Ever since Princeton University psychologist Daniel Kahneman won the 2002 Nobel Prize for Economics, behavioral economics has become a new ‘buzzword’. Richard Thaler, a behavioral economist inspired by Kahneman, won the Nobel Prize in 2017. Kahneman’s book entitled Thinking, Fast and Slow and Thaler’s book, co-authored with Cass Sunstein, entitled Nudge: Improving Decisions about Health, Wealth, and Happiness, have catapulted this field of social science into the forefront of decision-making philosophies.

Product development teams in life insurance companies are technical and rationally-thinking experts. These are critical skills necessary to create well-performing life insurance products. However, these teams tend to develop products that they, themselves, would buy – that is, the products appeal to rational and knowledgeable people. Unfortunately, the majority of consumers may not possess these traits to the same degree as product development teams.

There is a theory that people will only make decisions that maximize their own utility – sometimes called the Rational Axiom. However, people are known to act irrationally. Kahneman, Thaler and Sunstein would call these biases. Many books have been written and studies performed on these biases to better understand them. The question is if life insurance companies can better predict this irrational behavior – what Dan Ariely calls “predictably irrational” in his 2008 book of the same title13.

Developing products that are more easily understood and appeal to the predictably irrational side of consumers could be a winning strategy for the life insurance industry. This should not be done at the expense of eliminating current products as the life insurance industry is still quite successful. It is not an “either or” scenario. In order to grow the industry, some creative ideas must be employed to deal with consumer biases.

Possible Solutions to Close the Gap

Why does the insurance industry perpetuate in practices that it knows does not help? Why do we not hear the heart-warming stories of life insurance claim payments allowing families to send children to college, maintaining a residence or putting food on the table after the premature death of a breadwinner? Companies such as AIA even added a free benefit to victims of coronavirus for all policyholders14. Why is this not in news headlines? Instead, social media is abuzz with posts about denied life insurance claims due to coronavirus deaths.

- A Softer Approach

Life insurers have a spectacular record of paying claims through health and financial crises. This is due to a combination of long-standing companies and strict worldwide regulation. It would not be prudent for governments to allow insurers to take money from policyholders for decades only to squander the funds prior to a claim payment. It is rare to hear of a life insurance company failure, let alone to hearing about a valid claim that has not been paid. Yet, the life insurance industry would prefer to “let sleeping dogs lie” as opposed to touting its impressive accomplishments.

The life insurance industry is really selling peace of mind that a breadwinner’s family will be protected against the financial hardships of premature death, disability or outliving one’s retirement assets. However, many insureds consider a policy as a net-zero sum game. If the insured does not die, the company “makes money” from the policyholder.

What if the CEO of the life insurer sent out an annual correspondence to each policyholder discussing how premium payments were used to pay other claims:

Dear Mr. Jones,

…thank you for your premium payment. We are very happy that you

did not incur a claim this year. Please rest assured your premiums

were used to help pay claims to families that were not as lucky as you.

Mrs. Smith died unexpectedly, but her children will now be able to

attend university because of her life insurance policy with our company

and the premium payments from customers like you… ABC Life is here

to protect your family, if the need ever arises.

CEO, ABC Life Insurance Company

This type of communication would educate customers about the pooling characteristics of insurance. These customers do not realize that their premium payments are used to cover other insureds’ claims and that premium payments from those other insureds are what will guarantee a benefit payment if they, themselves, suffer a claim. In addition, the insurance company could issue a small token of appreciation by means of a gift certificate for a cup of coffee at Starbucks or a few songs from Apple. A simple gesture like this builds loyalty and may appeal to the “irrational” side of consumers.

- Providing Services vs Cash for Life Insurance

The unexpected death of a loved one is a very difficult event to endure. There is emotional distress in losing a partner. There are financial uncertainties due to the loss of income. There may be parenting issues, household issues and educational issues as well. Assuming life insurance is involved, the industry typically provides a lump-sum cash payment. In many ways, this can add to the stress. When dealing with all of the issues of the premature death of a loved one, suddenly there is an added major decision of what to do with the life insurance claim settlement.

The life insurance industry could change the customer experience by offering services instead of cash—even if only for a limited duration. At the time of uncertainty after the death of a partner it might be better if the groceries were paid for and delivered, the monthly rent or mortgage payments were covered and savings toward higher education for any children continued to be funded. Access to an accountant and lawyer, along with the bills being paid, could really help mitigate stress during this difficult time. The surviving spouse could use this time to get the family back to a fully functional status and then a lump-sum payment could be made. Instead of throwing cash at a problem, the insurer is really helping the family.

- Providing Services in Addition to Cash for Annuities

Families struggle with aging parents in many ways. Probably the most stressful decision is when to place and aging parent in a full-time care facility. This difficult decision can be delayed if there was an annuity that provided services in addition to cash. A recent Forbes Magazine article outlined the eight challenges of aging15. A typical annuity would cover only one (2. Financial Wellness) of the top four on this list. Adding certain services can help with the other three (1. Engagement and Purpose, 3. Mobility and Movement and 4. Daily Living and Lifestyle) and more.

What if insurers could contract local restaurants to allow the annuity recipient “free” dinner 3 times per week? This would alleviate the chore of self-cooking, give the senior a reason to get dressed and get out of the house and provide much needed companionship at the restaurant – even if only by the server. Many hotels and theme parks offer a “meal plan.” Why not annuities? This idea could easily be expanded to include a personal trainer, an accountant, housecleaning services and laundry. It would also give children peace of mind that their elderly parent is being attended to a few days per week.

- Digitalize Agents

A lot of time and money is being spent on digitalization of the insurance industry. Once a beacon for technology, the insurance industry has lagged in its investment in technology. Whereas one can easily check a pending credit card charge on a smartphone seconds after the purchase, policyholders struggle to see vital data for insurance products that they have tens of thousands of dollars (or other currency) invested in. A better user experience will definitely help sell and retain policies.

However, the life insurance industry is working hard to develop direct-to-consumer capabilities, faster underwriting techniques and quicker claim payments. As much as those deeply involved with the life insurance industry would like to think that life insurance is a simple and easy to understand product, it was best described by the CEO of the life division for AIG at a recent meeting: “We sell a complicated financial tool and try to make is sound simple16.” That is why surveys, such as a 2019 study by True Blue, show that potential life insurance purchases would prefer to buy from an agent17.

Therefore, life insurers should be focusing part of their technology budgets toward better tools for agents. These tools could help with the sales process, improve transparency and generally provide a better user experience.

- Financial Literacy

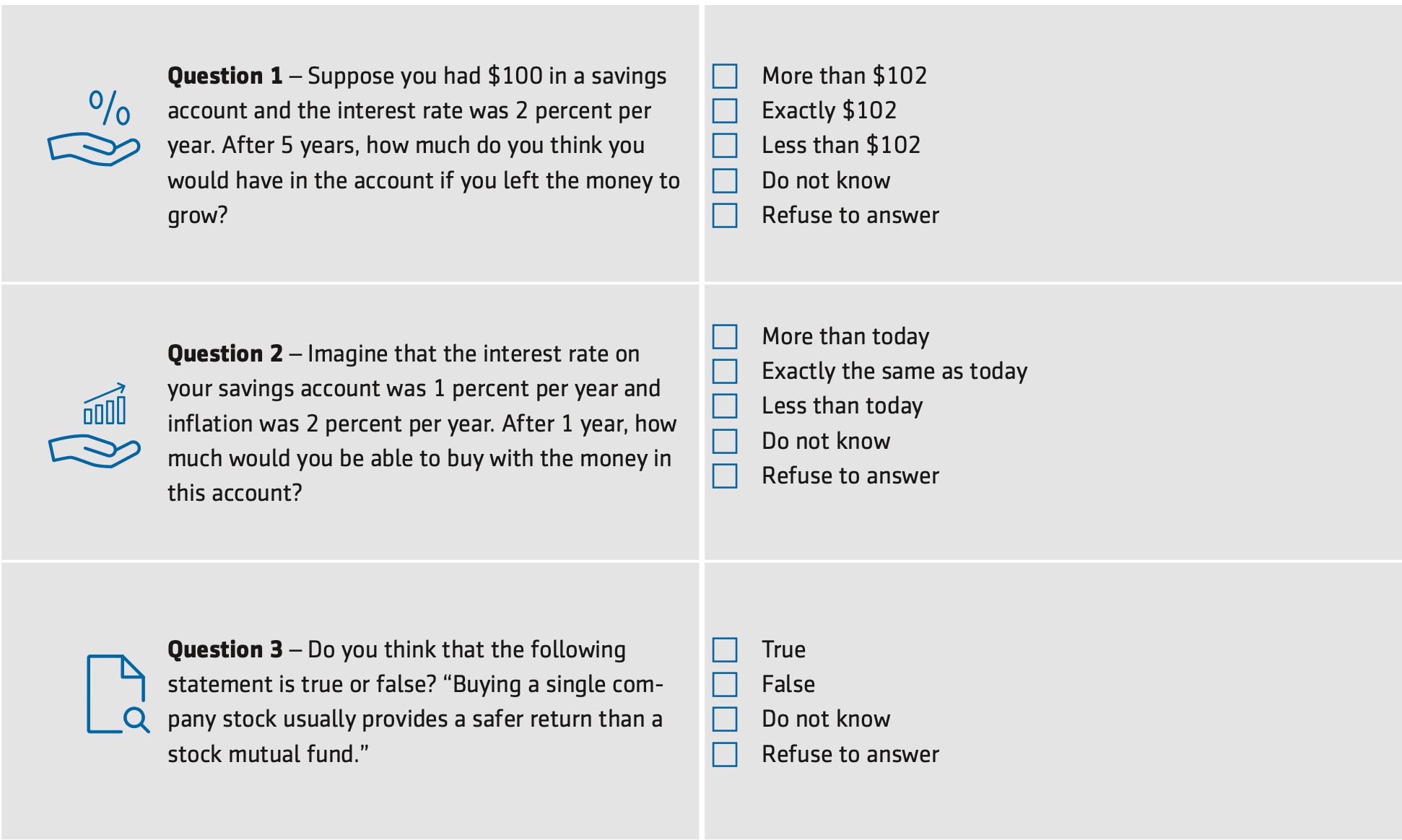

Earlier in this paper the notion of the “intention gap” was introduced, where consumers researched and expected to purchase a life insurance product but failed to follow through. The complexity of products and confusing jargon have a lot to do with this phenomenon. However, if there was an improved worldwide effort to better educate people on financial issues, it could help consumers make better decisions. Since 2012, Aegon has conducted an annual Retirement Readiness Survey covering 16 countries and over 16,000 respondents. For financial literacy, Aegon asks the “Big 3” questions (see Figure 8 below) first developed by Dr. Lusardi and Dr. Mitchell in 200418. Any insurance professional looking at these three questions will find it shocking that only 30% of respondents answered all questions correctly and an astounding 12% answered no questions correctly.

Figure 8

Source: Aegon Retirement Readiness Survey 2019

Source: Aegon Retirement Readiness Survey 2019

While most insurance companies have education programs and donate to charities that specialize in financial education, there is no worldwide effort to improve financial literacy. Life insurers should band together through their national insurance associations to lobby to finally put financial literacy on the mandated curricula of all schools. This will not only increase insurance sales, but it will help improve diversity and inclusion in all financial services industries. Associations could even arrange volunteers to assist with these programs by developing the curriculum or even teaching the classes.

Finally, it is about time that the life insurance industry worked to eliminate jargon as much as possible. Insurance associations could work to create a universal set of terms that better explain the purpose of a premium, claim, cash value, surrender value, protection, face amount and other confusing language. This would go a long way to improving transparency and trust in the industry.

Conclusion

The protection gap in life insurance and annuities is a very serious worldwide problem that seems not to gain any attention except from the insurance community. This problem has been steadily growing each year and will only be exasperated by the current pandemic. Now, more than ever, people should realize the value of financial protection. The industry needs to highlight the importance of protection with actual stories that have occurred during the pandemic.

The life insurance industry plays a vital role to families, businesses, the government and the economy. Yet sales have been flat for more than a decade. To reach more people and close gaps, life insurers must change the business model. They must offer services instead of cash for some products, provide better digital tools for agents and customers, have a better human touch with greater transparency and improve worldwide financial literacy. Aging populations are putting a steady strain on governmentally-provided benefits. Add the financial stresses of the current pandemic and people will learn that they have to provide for themselves more than ever.

The concept of life insurance has been around since ancient times and has survived depressions, pandemics, wars, natural disasters and financial crises. Protection gaps are a mighty obstacle to overcome. But, with the proper tools, management and creativity, this too can be achieved.

8.2020

1 ACLI 2019 Life Insurers Fact Book, Document ID: RP19-010, October 21, 2019

2 https://www.statista.com/statistics/421217/assets-of-global-insurance-companies/, July, 27, 2020 and IMF estimate of 85% of assets attributed to life insurers in 2016

3 https://www.edelman.com/sites/g/files/aatuss191/files/2019-02/2019_Edelman_Trust_Barometer_Global_Report.pdf

4 https://www.swissre.com/dam/jcr:6a844406-4898-4ffe-b45b-2e5696128624/SRI-Expertise-Publication-Closing-Asias-Mortality-Protection-Gap-July-2020.pdf, July 29 2020

5 https://www.swissre.com/institute/research/topics-and-risk-dialogues/economy-and-insurance-outlook/Bridging-the-US-mortality-protection-gap.html, July 27, 2020

6 http://www3.weforum.org/docs/WEF_White_Paper_We_Will_Live_to_100.pdf, July 28, 2020

7 https://bestow.com/blog/life-insurance-research-findings/, July 30, 2020

8 https://lifehappens.org/blog/barometer-2020/, July 30, 2020

9 https://www.swissre.com/dam/jcr:b8010432-3697-4a97-ad8b-6cb6c0aece33/sigma3_2019_en.pdf, August 4, 2020

10 https://www.iii.org/fact-statistic/facts-statistics-annuities, August 4, 2020

11 Swiss Re Group Executive Meeting, 2005

12 Maddock Douglas – LIMRA presentation 2015, 009578-0115 (50180-10-407-23000)

13 BF448.A75 2008

14 https://www.aia.com.my/en/help-support/important-announcements/novel-coronavirus-extra-coverage-no-cost.html, July 31 2020

15 https://www.forbes.com/sites/nextavenue/2018/04/06/the-8-challenges-of-aging/, August 5, 2020

16 Personal conversation in London on

17 https://www.truebluelifeinsurance.com/life-insurance-industry-trends-insurtech-survey-2019/, August 6, 2020

18 https://www.aegon.com/contentassets/082fbfef69e647f4abc586c7d88cdc77/global-report-200519.pdf,

August 6, 2020