Rise of Intangible Assets, Causal AI, and Cybersecurity

IIS Executive Insights Cyber Expert: David Piesse, CRO, Cymar

“The value of a business is a function of how well the financial capital and the intellectual capital are managed by the human capital. You’d better get the human capital part right.”— Dave Bookbinder, author i

“Any CEO who cannot clearly articulate the intangible assets of his/her brand and understand its connection to customers is in trouble.”—Charlotte Beers, author, and speaker ii

“Machines’ lack of understanding of causal relations is perhaps the biggest roadblock to giving them human-level intelligence.” - iJudea Pearl, Turing Award winner and AI pioneeriv

“You are smarter than your data. Data don’t understand cause and effect; humans do.” - Judea Pearl

Definitions:

- 144A bond—a debt issuance for capital investment and insurance around a specific event

- Brand capital—leveraging aggregated brand equity to accelerate business growth

- Causal AI—technology that reasons like humans, utilizing causality for better decisions

- Causality—the relation between a cause and its effect, or between regularly correlated events

- Consolidated balance sheet—financial statement presenting the combined financial position of tangible and intangible assets for an organization

- Embedded intangibles—nonliquid assets consisting of data, employee skills, IT (information technology) infrastructure, corporate culture, and innovative ideas embedded in projects and internal processes

- Fair value—the actual value of an asset agreed upon by buyer and seller during a trade

- Goodwill—the difference between the value of a whole business enterprise and the sum of the current fair value of its identifiable tangible and intangible net assets

- Human capital—employees and employee skills in an organization

- IAS 38—accounting standard requirements and treatment for intangible assets

- Information capital—value of IT and data with intrinsic value that can be leveraged and shared

- Intangible assets—a nonmonetary asset that is not physical in nature

- Intellectual capital (IC)—the sum of an organization’s intangible assets such as patents, processes, employees’ skills, technologies, and information about customers and suppliers

- Intellectual property (IP)—intangible creations of human intellect, such as patents

- Knowledge-based capital (KBC)—total business investment in intangible assets

- M&A—mergers and acquisitions, also known as business combination by accountants

- MNC—multi-national corporations and large domestic companies

- NFT—nonfungible tokens, representing unique items; when wrapped and combined with fungible crypto data assets, they can be traded or exchanged

- Parametric insurance—an insurance contract covering a specific event paying a pre- agreed amount based on the magnitude of the event or measurable trigger

- Organizational capital—information and knowledge based in corporate culture

- SME—small- and medium-size enterprises

- Wrapped Token – cryptocurrencies, pegged to the value of an original crypto or assets like gold, contained on a blockchain in a digital vault.

Synopsis

The rising significance of intangible assets impacts the value of corporations, highlighting the need for effective management and protection of these assets. Intellectual capital (IC) plays a crucial role in business success. Accurate valuation and representation of intangible assets on balance sheets enables corporations to extract their value and gain a competitive edge.

However, challenges exist with managing and protecting intangible assets, as their complex nature makes their valuation and risk assessment difficult. Traditional approaches fall short in accurately capturing the value and potential risks associated with intangibles. Additionally, the growing threat of cyberattacks poses a significant risk to the security and integrity of intangible assets. An emerging branch of artificial intelligence (AI) technology can be utilised to help with the analytics to model these assets more accurately.

Overview

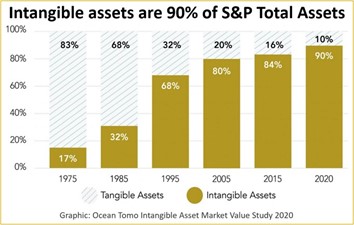

Intangible assets, based on knowledge and subject matter domain expertise, represent 90 percent of the Fortune 1000 assets ,v with less than 20 percent insured.vi They help business increase innovation to take advantage of new markets. The International Accounting Standards Board (IASB vii) has established practices to value and represent intangibles on balance sheets to extract value for corporations and provide a competitive edge. This makes trading and collateralization of intangible assets open to bank loans and structured investments.

Innovative approaches are emerging to address intangible challenges. Causal AI is a technology that leverages human domain expertise in determining causality and can be employed to model intangible assets accurately. By understanding the causal relations within these assets, organizations can develop more precise risk transfer solutions.

Furthermore, the protection of intangible assets from cyberattacks can be enhanced through the implementation of data integrity measures and blockchain technology. These more granular models can be recalibrated to run dynamically and improve risk transfer efficiency and regulator communication.

The protection and de-risking of intangible assets from cyberattacks is ingrained in data principles of integrity, ownership, and provenance. Blockchain technology protects data assets and causal AI ingests the results of cyber network data scans for predictive analytics, leading to bespoke cyber insurance solutions for multi-national corporations (MNCs) and composite solutions for SME markets. This includes reputational risk protection, which enables data integrity mitigation to be perceived as a profit center from the security budget.

Data integrity is a boardroom issue as IT departments, unless visible to the board, will not see the full strategic value of specific datasets to an organization, but often mandate and control security budgets.

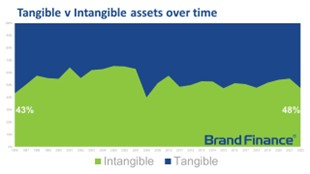

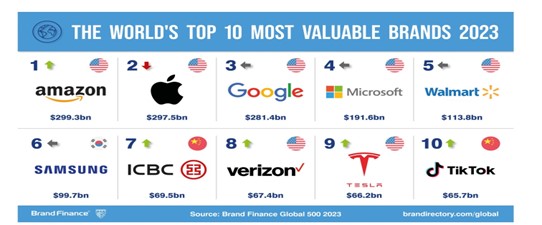

Brand Finance's 2023viii analysis found global intangible value increased 8 percent from $57.3 trillion USD in 2022 to $61.9 trillion USD in 2023,ix while the value of global tangible net assets remained stable. In 2022, 25 percent was wiped off global intangible value as high technology firms made staff reductions and investments waned. The recovery in intangible assets reflects their growing importance in the global economy. Intangibles were 17 percent of the S&P 500 in 1975 and are now 90 percent .x This growth represents advanced economies, not the world economy. On average, 48 percent of the global stock market value is derived from intangible assets, but due to regulations for purchased intangibles to be booked on balance sheets, higher growth is expected. In the overall United States stock market, 73 percent of total asset value is accounted for by intangible assets.

Source: Brand Finance

MNCs play a significant role in leveraging intellectual property (IP), and it becomes imperative for countries to focus on the development of intangible assets to enhance their competitive advantage in the global market. Many countries have low or nonexistent levels of intangible asset development.

Overall, the proportion of intangible value in companies increases and much needs to be done to realize increased company value. The Ocean Tomo report xi says intangible assets as a percentage of total assets are currently 75 percent of the S&P Europe 350, 57 percent of the KOSDAQ Composite Index in Korea, 44 percent of the Shanghai Shenzhen CSI 300 in China, and 32 percent of the Nikkei 225 in Japan.

Until recently most attention was paid to the IP intangible as it could be measured. But IP is a non-correlated asset and represents a small percentage of IC, so other forms of intangible assets are driving change at a capital level, with implications on the company pattern of knowledge evaluation. Intangible assets dominate the top global brands.

At $2.5 trillion USD, the New York Stock Exchange (NYSE) is the largest exchange by intangible value, in conjunction with the OTCQB (The Venture Market) securities exchange platform, with 78 percent intangibility. xii It is key to get ahead of geopolitics to unlock embedded intangible value in emerging markets, combined with those already present. Many changes in macroeconomic policies are occurring or exist across different countries, so businesses will face unpredictable political outcomes. Derisking intangible assets is crucial to unlock their value and mitigate unpredictable political outcomes. This involves implementing strategies and safeguards to protect these assets from potential risks and losses.

What Are Intangible Assets?

Intangible assets have value but no physical substance and are considered long-term assets because they provide embedded value to a company without being quickly converted to cash. Intangible assets can be defined as being human capital (skills and staff in the company), information capital (value of IT and data), organizational capital (company culture), and customer capital (reputation), which show interconnections of intangible capital items into overall intellectual capital (IC).

In the knowledge era, IC is synonymous with intangible knowledge resources and IP is the legal protection. Intangibles are worth more than tangibles and when combined, difficult to imitate, leading to competitive advantage. By estimating the intangible value, executives can manage organizational competitive position more easily. Data value can be embedded and aligned with organizational strategy. Data integrity mitigation, coupled with ownership and provenance, means data is tamper free as part of the derisking process. With that warranty in place, the valuation of data becomes a quantitative practice.

Human Capital | Organizational | Information Capital | Customer | ||

| Employees | Intellectual property * | Value of data * | Customers | ||

| Education | Copyright, trademarks, patents * | Information systems * | Reputation/Loyalty * | ||

| Employee skills * | Corporate culture | Networking systems | Brand recognition * | ||

| Innovation | Goodwill | Management process | M&A activity | ||

| Knowledge | Financial relations | Business supply chain | Distribution channels | ||

| Employee Layoffs | Domain names * | Cyber mitigation | Business partnerships | ||

| Purchased/exchanged assets * | R&D assets * | Licensing agreements/ contracts/franchise * | |||

| Government grants* | Value of IT | Stock price | |||

| Software development * | Credit rating / regulatory fines |

*-Can be valued as intangible asset separable from the business and not recorded as expense

Valuation of Intangibles

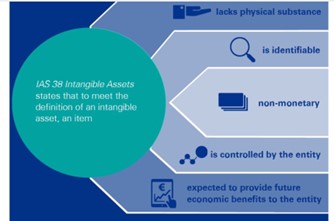

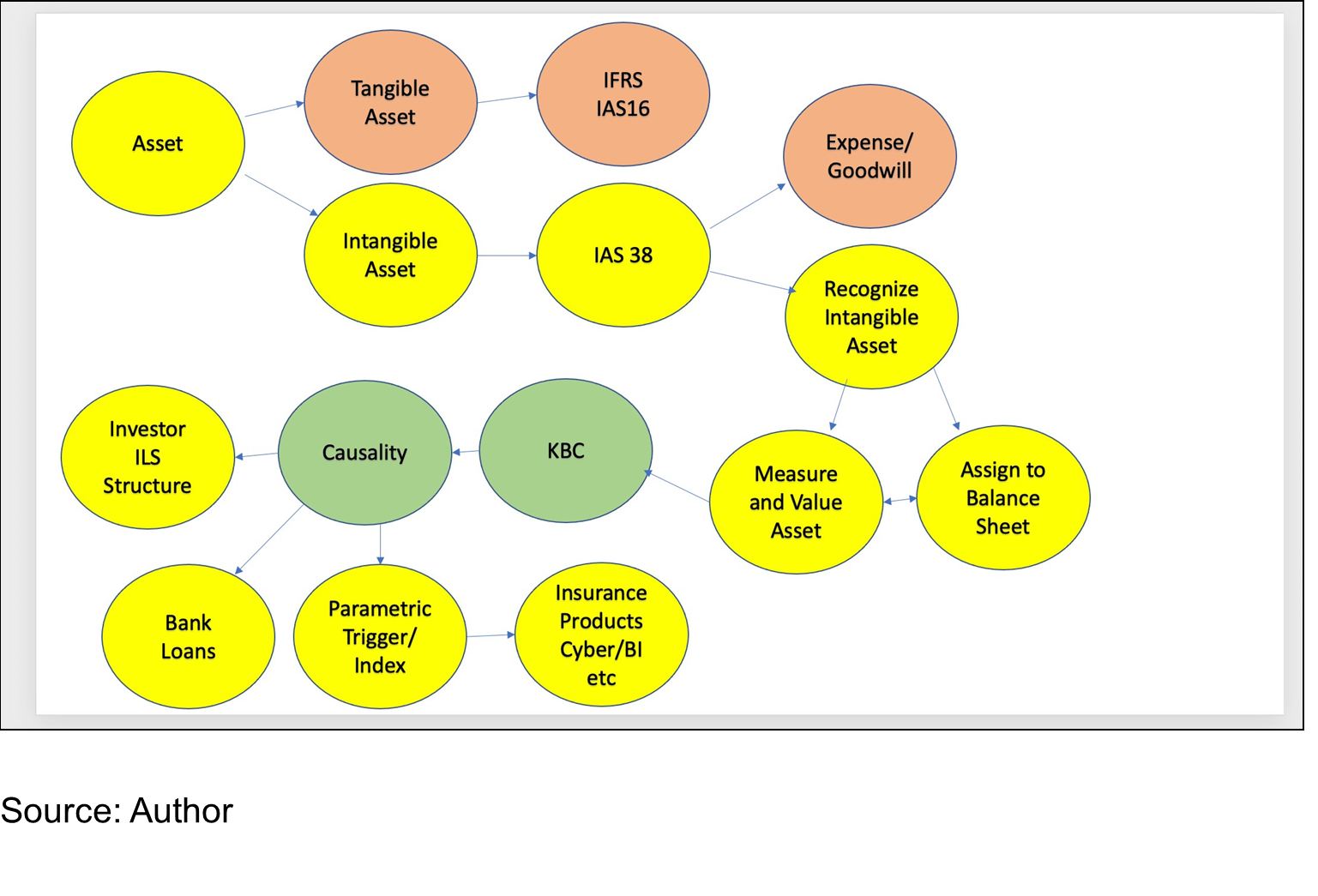

Measuring intangible asset value is an accounting function moving value to the balance sheet for stakeholders and investor attention but is technically a decision of the directors who are responsible for the company accounts. International Financial Reporting Standards (IFRS) outlines the recognition and measurement of intangible assets via accounting requirements through the IAS 38 standard xiii to find reliable, replicable valuations behind a company’s financial progress. According to IFRS, these assets are “identifiable and measurable when separated from the business within contractual and/or legal rights.”

Historically, intangible assets have not been favorable to debt financing as they are hard to collateralize and have been financed through equity. However, change is on the horizon due to digitization.

Valuation of intangible assets can be done three ways: (1) by estimating the replacement cost of the asset, (2) by benchmarking by comparing the asset owned to those recently sold by similar businesses on the market, and (3) by converting any expected cash flow or royalty benefits that can be recorded on the balance sheet.

Source: KPMGxiv

Many intangible assets never reach company balance sheets due to current accounting standards not recognizing them outside of a purchase or M&A. Amortization reduces intangible asset value over a fixed period, based on a predetermined useful life. Patents and copyrights are considered limited-life intangible assets because they have expiry dates. Others are unlimited life but are regulated to undergo an annual impairment test which looks at market changes affecting the fair value price.

Intangible assets are recorded on a balance sheet as long-term capital assets. When M&A occurs, the amount that exceeds the fair value of the target's net assets is known as goodwill, accounted for in accordance with IFRS 3.xv IAS 38 states internally generated goodwill cannot be recorded as an identifiable asset.

While goodwill represents a more general asset and is non-separable in nature, intangible assets are specifically identifiable assets such as customer lists, brands, R&D, software, data, employee skills, and IP, which can be transferred separately from the business. Digitization increases the importance of these assets. The Global Innovation Index xvi quantifies corporate intangible assets worldwide. Tangible assets such as IT equipment fade in value compared to intangible assets as they can be replaced quickly at reduced cost. Cybersecurity risk increases with intangibility and strategic derisking to preserve long-term business is a priority to protect know-how, reputation, brand, relationships, processes, and digital assets. Assets can be company owned or borrowed from third parties. The consolidated balance sheet is a key component to record intangible assets.

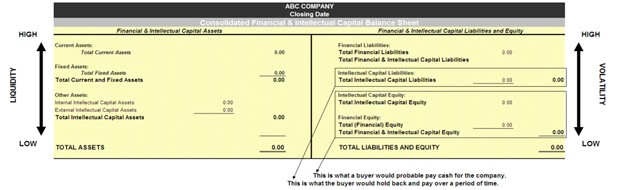

Source: AREOPA

The chart above shows the total value of the enterprise, combining financials with IC elements. The asset side shows relative values of all assets. The liability side shows how assets are financed and the ownership. Balance sheet analytics evaluate the true value, enabling SME to reach full potential based on IC collateral for financing. The value of intangibles and goodwill represent the value of the business less the value of identifiable net assets. You cannot separate goodwill from the business, but the consolidated balance sheet shows the true value at M&A.

In March 2023 the Financial Accounting Standards Board (FASB) issued guidelines on measuring and accounting cryptocurrencies as intangible assets. xvii Up to that time, crypto assets were defined as unlimited intangible assets, which are subject to impairment and not treated as separable or represented as fair value. Measuring acceptable crypto assets separately means they must meet the definition of an intangible asset, be blockchain based for data integrity, and fungible. Non fungible tokens (NFT) and wrapped tokens currently fall outside of being recognized as intangible assets because there is a legal right to an underlying asset.

Crypto assets can be aggregated on the balance sheet separable from other intangible assets. This is an important guideline as these assets need to be recognized and bring in the importance of blockchain and data integrity. Digital custody platforms such as Hex Trust xviii and Vaultavo xix provide protection of private keys and lead to bank guarantees and insurance solutions and will play an important role in the future of virtual asset tokenization.

Data Valuation: The Ultimate Intangible

Data are critical intangible assets, and they should be valued on a balance sheet, making them tradable on regulated exchanges and recognized by stock markets. Companies hold a corpus of evidence generated from business activities or M&A and utilize data analytics to create business value and generate future income.

Investors and lenders do not always get a full picture in making decisions, so accounting treatment needs to be revised to recognize data in financial statements while observing relevance. Unlike other asset classes, business data appreciates, with the value of the business tightly coupled with the amount and value of data held. Businesses rely on and leverage historical data and this value has been equated to “a new oil economy” and exploited accordingly. As data are valuable, governments create regulations and compliance obligations to manage them, and violation creates fines, litigation, and business risks.

Unlike the simplicity which depreciates tangible asset value, the monetary value of data in an increasing appreciative backdrop must be measured. Drawing parallels to KYC (Know Your Customer), there is a need to MYC (Measure Your Customer). To perform MYC, businesses need to create an accurate asset inventory of both structured and unstructured data to get an accurate picture of the value of their assets to manage them.

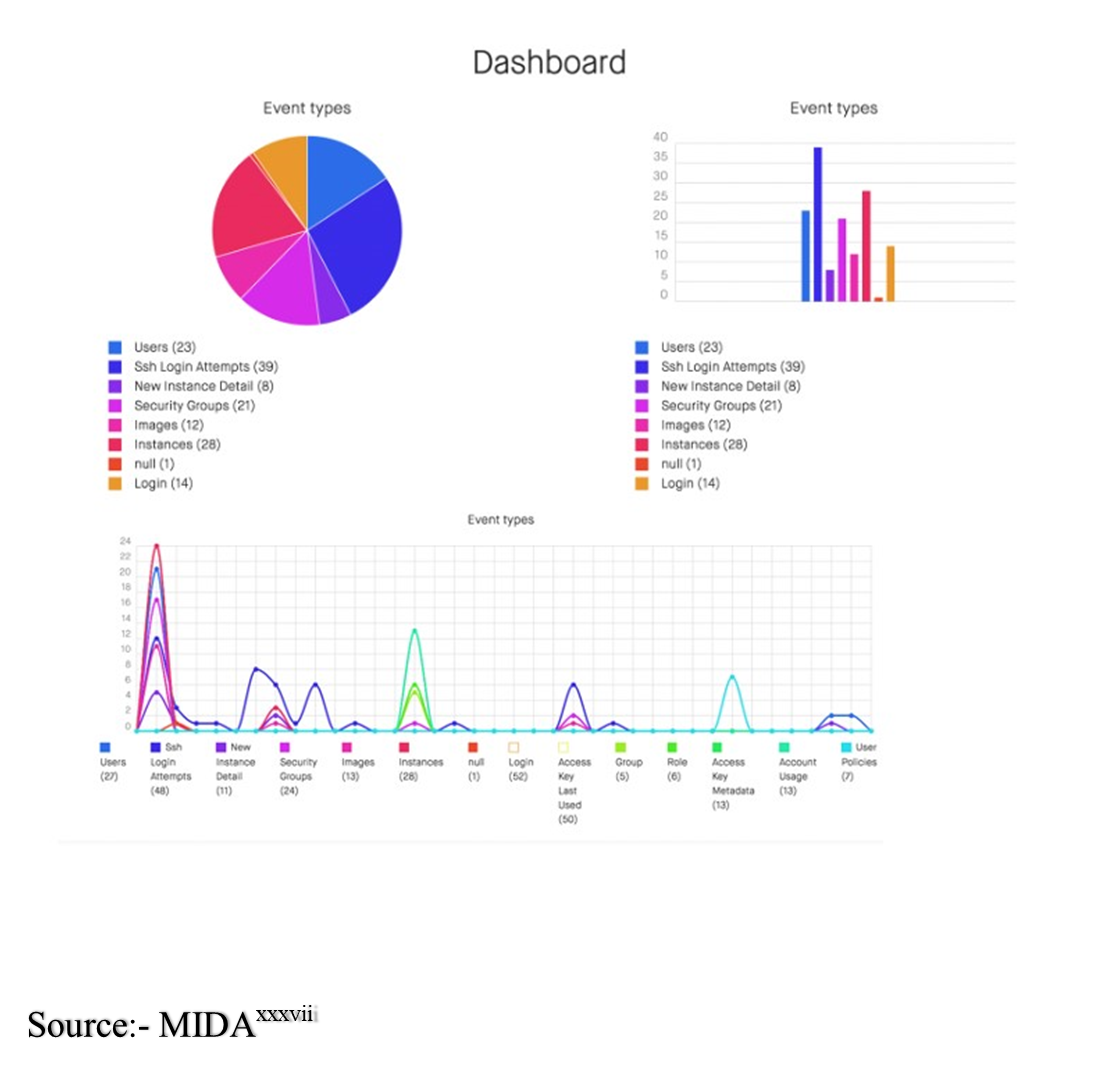

As data are transient by nature, such inventory needs to be automated and maintained continuously to measure the monetary value of the data. Unmeasured and unvalued data are not considered separable, unlike measured and valued data. When an asset can be measured, it is easier to protect and insure. The integrity and provenance of the measured data must also be ensured using certified means. The following dashboard diagram courtesy of IDPS shows the monetary valuation of data.

Source: https://sybergrc.com/

Confidence in the valuation of data means business leaders must trust systems and controls generating the original data and its provenance. Confidentiality (permission and data access) and integrity (digitally signed) of measured and valued data are trust anchors. xx Digitization puts data assets at risk from cyber theft, which can lead to regulatory fines, and holding data longer than a required retention period can be a legal liability. Access needs to comply with privacy regulations, cross border, and disclosure requirements, showing data collected is used as directed (California Consumer Privacy Act [CCPA],xxi General Data Protection Regulation [GDPR]xxii).

Across supply chains, OEMs xxiii must control confidential information shared with suppliers, as data can be misused or compromised. Signing data and metadata for integrity is a simple function but essential as a trust-but-verify strategy.

Source: Guardtimexxiv

Data cannot be valued without this integrity factor, which checks for tampering. Once ownership is determined, the data is cleaned, and security data standards applied to the resulting digital assets. Accounting issues will arise when data is on the balance sheet, along with cash, equities, bonds, and real estate, such as taxation, amortization of data value, and rating/scoring data.

Stakeholders often underestimate the size and value of data assets or lose track of ownership, especially when embedded in social media. Data can be valued by buy/sell market value, cost of collection, or creation of indices used in predictive analytics. A data life cycle exists from collection to archive where the value appreciates or depreciates, and usually the most recent data is the highest value for decision-making.

Data can be rated depending on its integrity and importance to be reviewed by regulators and rating agencies. Analyzing data from multiple sensors and then mapping to an organization’s network, rating can be given based on security performance. IAS 37 xxv identifies contingent assets that are recognized, using thresholds, as future benefits become clear.

Data assets improve timeliness of reported accounting information; and because data can be used multiple times, there is a spread of future benefits for determining the remaining economic life of the data and estimated future cash inflows it brings. Protecting and derisking data formally is key without just relying on general rules of data ownership.

Intangibles and Cybersecurity

Intangible assets bring value but carry significant cyber risk and are involved in every cyber incident. Data, IP, customer information, and specific knowledge must be protected from cyber threats. Financial institutions incorporate loan requirements to obtain a cyberattack plan; cyber insurance cover plus third-party service contracts as vendors limit their liability. M&A buyers must ensure by due diligence that there are no cyber liabilities in the target and there is scalability in the purchase.

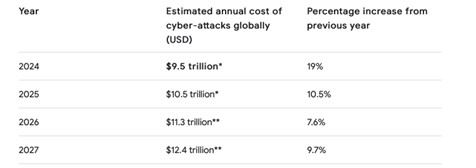

The value of intangible assets and the risks associated with them are accelerating. Globally, cybercrime is expected to cost over $9.5 trillion USD annually by 2024.xxvi

Source: ExpressVPN

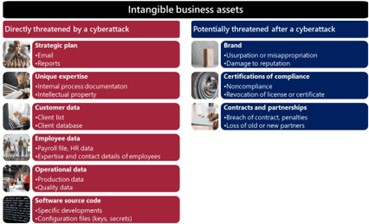

The cyber insurance market will be $90 billion USD in gross written premium by 2033,xxvii revealing a protection gap dovetailing with increased valuation of intangible assets and mounting exposures from expanding Web 3.0 digitization. xxviii Common threats to cyber assets include ransomware, business interruption, cyber warfare, biometric privacy lawsuit costs, regulatory fines, and evolving cyber security regulations. The diagram below shows a risk register example.

Source: Coresiliumxxix

An intangible asset classification is done to estimate the cyber risk and the loss if they are to be replaced. The “crown jewels” data should be protected by encryption of data at rest, multifactor authentication, data integrity hashkey signatures, and immutable backup strategy. Cyber security asset management identifies all cyber intangible assets across networks and data repositories.

Revenues from a software-as-a-service (SaaS) software company expects recurring cash flows over time. SaaS companies xxx are a vital business model in the digital era and their model includes the subscription and onboarding costs to acquire new customers, the annual recurring revenue (ARR), the lifetime value, and customer churn rate. Investors and lenders like companies where lifetime value exceeds the acquisition cost, and cyber integrity will protect future cash flows over time.

Knowledge-Based Capital (KBC)

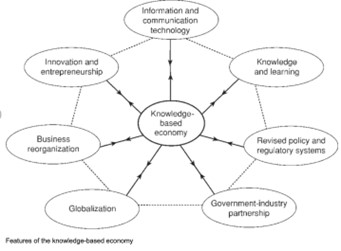

Knowledge-based capital (KBC) is a fundamental commodity that everyone ingests, and it is constantly changing.

Source: Researchgate

Investments in KBC revolve mainly around intangible assets, being drivers of economic growth and stability, and creating a financial foundation for knowledge as companies develop digital and advanced analytics strategies. Companies that are invested across all categories of intangibles are less likely to be disrupted as they are innovative and retain top talent.

The shift from tangible to intangible assets increases the thirst for knowledge infrastructure and governments will need to focus on education, digital infrastructure, high-speed connectivity, and high-performance computers to manage, transport, and process data respectively.

Knowledge that exists in an organization can be used to create differential advantage by capturing and leveraging IC to produce a higher-valued asset using causal AI as the enabler. Here the various components of intangible assets or IC are identified, and indices are generated and reported in scorecards or graphs.

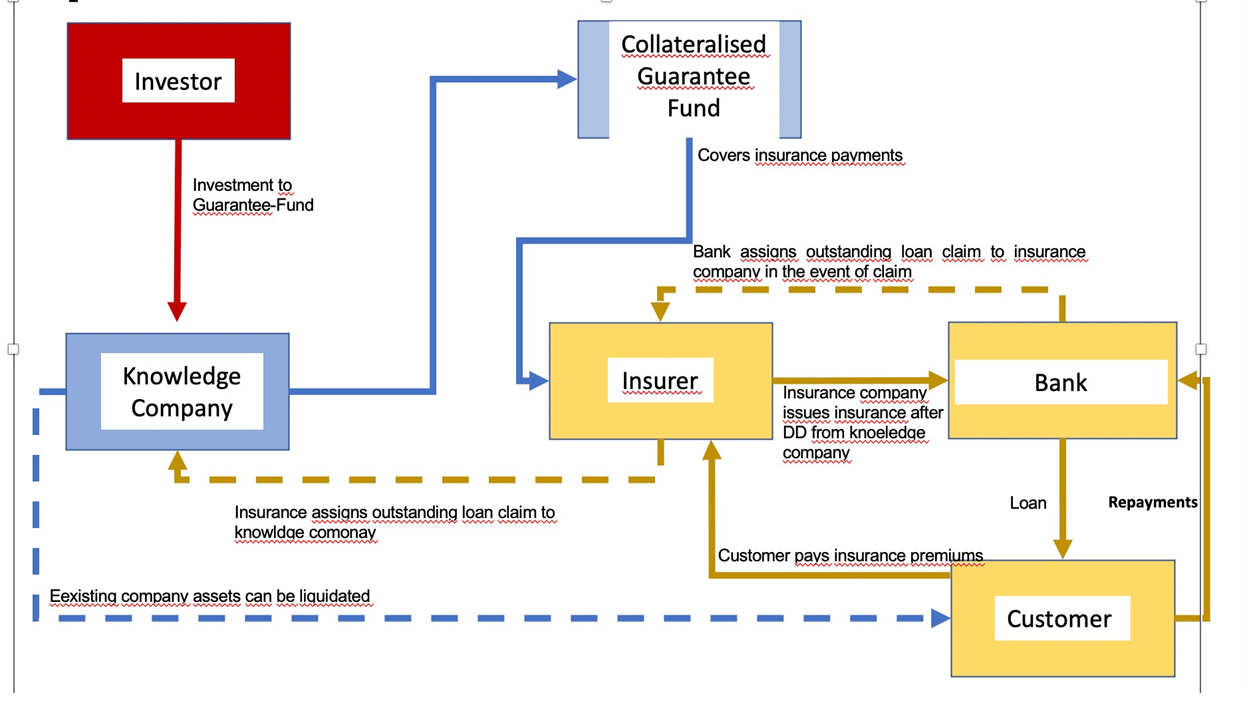

This process is moving closer to scientific accuracy as current AI models rely on proxies that are far removed from the actual event or action that caused the phenomenon. IC intangible asset recognition enables innovative, technology-driven start-ups to reach their full potential by facilitating guaranteed loans from commercial banks, with IC as collateral, including insurance with a surety bond backing.

Human intelligence is a crucial asset in the digital era and companies must strike the right balance of automated technology and human insights. The World Economic Forum states, “Understanding knowledge means to distinguish where machines do the mundane work and where humans perform intuitive tasks.” xxxi Causality begets human reasoning and keeps the human in the loop.

Causality and Intangibles

When you know the cause of an event, you can affect its outcome. Unwelcome outcomes can be anticipated by shaping them with mitigation. Business models that use causality identify critical data and discard irrelevant or misleading correlations. Knowledge is extracted, stored, and reused, while causality looks for causes in the data, predicts future outcomes, and is a pathfinder to explainable AI (XAI) for regulation clarity.

Causal AI is the telescope to find things not visible to the naked eye and uses scientific hypothesis testing, where domain experts put knowledge into datasets, analyze them, and output as graphical representation. This improves company IC risk valuation and revenues by creating indices based on dynamic baselines for better forecasting or hedging.

Data can be ingested from many sources such as macroeconomic, demographic, and climate, and added to the casualty datasets, scaling to the size of the internet. However, the process needs a human hint to get moving. Humans limit the search space and combinatorics; by machine alone requires a long time as it searches all options.

Causality makes future predictions based on the direction and magnitude of risk. An example would be combining air quality and toxicity data into healthcare claim data to explain the most efficacious and cost-effective treatment.

Causality is a stepping-stone for the next generations of machine learning, enabling fairness and bias removal and giving better control over AI systems, ensuring they behave as intended. Feedback loops of learning from risks are incorporated when modeling the risk.

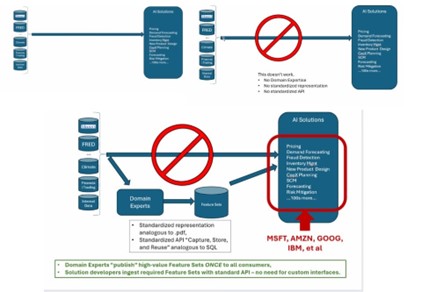

AI is not about taking data and creating solutions because domain expertise, standardization, and application program interface (API) should be added, as shown in the diagram below.

Source: Eumonics xxxii

Causal AI models combine statistical data, time series, and domain expert knowledge and move beyond correlation of random variables to get better results with forward-looking, explainable, predictive models. For example, this plays a role in investment analysis, enabling portfolio managers to generate alpha from bull stocks by identifying new causal relationships in economic, financial, and alternate data.

For cyber risk, causal AI is applied to aggregation loss based on multiple interdependencies of cyber losses resulting from interconnectedness of cyber intangible assets. Frequency-severity models have limited suitability for modelling systemic cyber risks. Risks arising from new technologies are not represented in historical data of cyber loss.

Finanncial services use AI for industrial strength pattern recognition in small specialist data sets to insight for better decision making. Generative AI tools are not yet verticalized and are centered around textual data interpretation, so they're best used for that purpose. Specialty insurers have privacy concerns so will utilize proprietary AI explainable solutions utilizing the intangible asset valuations as operational triggers alongside the datasets in the public domain.

Risk Transfer and Cyber Intangibles

Traditional indemnity (re)insurance is applied to tangible assets, but intangibles lend themselves to more alternate sophisticated risk transfer mechanisms. A cyberattack is to digital assets what a natural catastrophe is to physical assets. Both cyber assets and data are intangibles, so a breach leads to reputational risk and potentially goodwill impairment. Digital assets need to be derisked by cyber hygiene before risk transfer to capital markets, captives, or traditional (re)insurance. A cyber reserve has capital set aside to cover the costs of future claims, including legal expenses which can affect solvency if the data breach is not mitigated, detected, or notified.

Analytics and modeling techniques can be used to simulate the effect of cyberattack shocks on the company, market, supply chain, and the ecosystem. The results of this exercise would indicate the amount of risk transfer required in such a situation and allow the risk appetite of the senior executives to make capital risk allocation assessments and strategies.

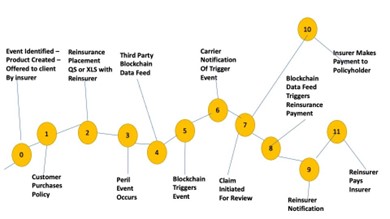

Parametric insurance models were designed to handle natural catastrophic events such as earthquakes and hurricanes but are well suited to measured intangible asset value which can be used in parametric triggers. For cyber solutions there needs to be clear explanation on whether there was a cyberattack and resultant damage.

Parametric insurance for cyber outages will depend on close monitoring of global cloud-based services. The following steps are required: (1) a pre-agreed coverage definition of how much compensation will be paid to the insured per hour of downtime, according to the insured’s IT architecture, (2) clear trigger events that would constitute a cloud outage and identify independent data verifiers, and (3) after these steps are fulfilled, the insured receives compensation on a relatively automatic basis, usually within 15 working days, according to the pre-defined payout structure without exclusions or deductibles.

The data generated from the cyber monitoring system powers parametric insurance for more frequent attritional cases of an outage. There is a transparent determination of the insurance payout once the threshold is met, providing certainty both to the insurer and the insured and removing long-tail claims negotiation without any restrictions on how the compensation payment is used.

Source: Author construction from B3i collaboration with The Institutes Riskstream xxxiii

Underwriters gather data about cyber risk using a dashboard in digestible form for the client to understand. Business interruption due to third-party IT outage is a peril where digital supply chains can become breached, resulting in unplanned service disruption and material harm to operations. Microsoft Azure cloud xxxiv is utilized by 95 percent of Fortune 500 companies, xxxv posing an aggregate risk of Microsoft service to contingent business interruption, leading to income loss or fixed costs consumed during the outage. Recently Microsoft had a hack by a state actor and this event is still ongoing for mitigation and resolution. xxxvi

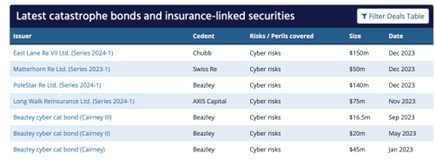

The global cyber insurance market is benefitting from a growing pool of available reinsurance capital to cover cyber risks with the emergence of a cyber catastrophe bond market. The launch of 144A cyber catastrophe bonds is critical capacity to encourage reinsurers into the market.

Source: Artemisxxxviii

This is of utmost relevance for (re)insurers as the resulting portfolio-loss distribution is influenced by dependencies between individual policies. ILS is less than 20 percent of reinsurance capital, but effective use of capital gives more access points via global capital pools. Causal AI will provide better real-time insight into actual risk level underwriting and allow capital providers to do portfolio management in real time, creating more liquidity of capital into the primary insurance space. Insurers need to link underwriting to claims in real time to obtain dynamic pricing recognizing and measuring claims as early as possible.

Reputational Risk

Digital assets affected by cyberattack can damage reputation, leading to financial loss and goodwill impairment. Reputation is an intangible asset and can be made separable, measured and managed by the business. Strength of reputation can be quantified by AI as a risk score used in underwriting as a parametric index trigger. There is correlation between reputation and customer trust so causality can be applied to explain why the risk score went up or down, understand the business impact, and whether reputation decreased slowly or with a single event.

To trust the resulting index, there must be reliable time series data across different jurisdictions. Reputation is controlled by social media, so the challenge is how to determine an actual reputation loss payout trigger. Customer loyalty, regulatory fines, and employee churn can indicate quantum of business loss, so it is not only stock price fluctuation but also credit rating.

Causality uses a baseline of companies across different countries to see the volatility of reputation to set a threshold. A parametric solution to reputation and cyber risk more broadly could be based on the cost of immediate crisis management. Time is of the essence and emergency budgets are required. Reputation is 63 percent of market value xxxix, but baselines show company reputation is relatively stable, with 2 percent to 4 percent of companies experiencing massive reputation decline over a muti-year period. These events show a maximum loss of almost 50 percent of reputation. A threshold for trigger design could be set at a value less than 50 percent loss where anything above would require insurance protection as high impact on the business. From a regulatory point of view, this gives insurers confidence to reserve against an intangible asset loss. Causality meets the challenge of standardization, making that available to all clients/companies.

Case Studies

Borrowing using intangible assets is a necessity for many companies, including technology companies. In a knowledge-driven economy, intangible assets occupy business balance sheets, so intangibles-rich companies get third-party valuation of IC/IP to give lenders a sense of value.

The residual value of an intangible asset is the remaining unamortized amount up to the end of useful life. Knowledge-based companies assist SMEs to obtain commercial loans by offering guarantees to the lender based on a due diligence mitigation and advise the company taking a loan how to best manage their company and pay back loans. In the event of a loan default, the bank may require the knowledge company to take over the majority shareholding and manage the SME back to non-default status, so mitigating the quantum of any final claim by having recoveries.

Case Study No. 1: Intellectual capital exchange The AREOPA Group (AREOPA xl) helps innovative technology-driven SMEs reach their full potential by facilitating collateralized guaranteed loans from commercial banks based on their IC. It is the sum of intangible assets that contribute to a company bottom line. Data acts as a competitive edge and a new revenue stream plus building brand capital which will add to the overall valuation of the business.

Case Study No. 2: Patent technology company IPwe xli tokenized 25 million global patents as dynamic non fungible tokens (NFT’s) to get stakeholders to consider the IP intangible asset as a store of value. Intangible assets are a catalyst for the acceptance of the tokenization of real-world assets (RWA) to make crypto and the underlying technology more tangible. Companies make more efficient use of their patent portfolios using predictive analytics, AI, and blockchain technology.

Patents are underutilized, undervalued, and generally misunderstood, resulting in low transaction, commercialization, and financing due to a lack of transparency, liquidity, and no standardized valuation metrics. IPwe tokenized publicly available data on the existing patents to provide market participants (owners, buyers, sellers, and investors) with a digital representation of asset ownership. Future product innovation, fractionalization, IP trading, and wrapped tokens are enabled. Lending against the patent is a reality as the valued asset can be used as collateral, and MNC and SME patents can be pooled to enhance innovation.

Case Study No. 3: AkinovA xlii is an electronic marketplace for the transfer and trading of insurance risk matching capital to risk. This type of product will increase in usage as insurance buyers transition from the insurance of physical assets to protecting intangibles; plus the capital markets have an appetite for this type of risk. This creates a scalable ecosystem around corporates, (re)insurance companies, and other sources of capital to deliver innovation to a new digital world insurance market. The proportions of the risk are transformed into capital market products such that insurers can access deeper pools of capital to lay off the gross exposures acting as a digital bridge between corporates to “mutualize” risks.

All three case studies allow innovative access to lending and investment capital. Top growth comes from intangible solutions in the climate change, IP, and cybersecurity space. The European Commission is launching a grant scheme fund to provide SMEs with financial support for services to manage and protect their IP rights, xliii allowing for the value of their intangible assets. The fund will partially reimburse the representation costs charged by legal professionals relating to the preparation and the filing of European patents to help combat IP infringements.

Macroeconomics and Intangibles

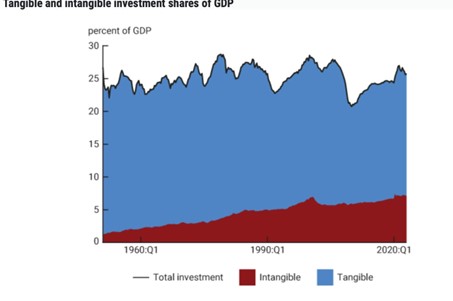

In stochastic modelling of macroeconomic variables, interest rate movements are often assumed to drive all macroeconomic volatility, while values of other variables are determined through correlations captured from underlying processes. Macroeconomic shocks creating recessions or overheated economies are the real driver of volatility. Interest rate movements reflect response of governments to these shocks. The causality linked to interest rate-centric models assume the same correlations in the past, but real-world correlations between any pair of macroeconomic variables change with time. The diagram below depicts total investment as a share of GDP between intangible and tangible investment.

The rise of intangibles results from IP value and high technology infrastructure. Intangible and tangible investment differ in responsiveness to changes in interest rates. The expected lifetime of intangibles is shorter than tangible capital and intangibles amortize faster than tangibles depreciate. In the past intangibles have been financed using equity rather than debt, as tangible capital is regarded as easier for collateral for loans and more sensitive to interest rates. However, the case studies show measurement and valuation of intangibles is changing the equity-to-debt argument and collateral situation. Climate change and cyber risks, intangible in nature, need to be recognized as future shocks to these models.

Financial Inclusion (The Informal Sector)

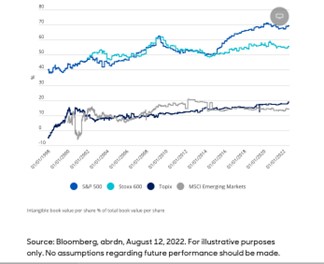

The MSCI Emerging Markets Index shows that the intangible book value of emerging markets is way below that of the developing countries.

Embedded intangible assets have existed for decades in financial inclusion projects with a mission of poverty alleviation. xlv The value of human and information capital deployed in these projects seldom reached the balance sheet of organizations. The short-term quarterly needs of MNCs do not match long-term systematic re-engineering of new economies. Government engagement needs to recognize the value of embedding intangible assets in emerging markets as they are the distillate of decades of social and fiscal investment by developed societies.

MNCs control access to global markets for their IP; but SMEs, when given unique paths, will lead to domestic innovation. Scale is critical because of the fragmented and immature nature of the markets. Commercial incentives need to match the policy and strategy goals of the sovereign nations to allow commercial freedom to operate, utilizing know-how and IC as a lubricant and pre-negotiated free passage, critical for open and unique development of new culturally distinct markets.

MNCs create monolithic solutions around their chosen IP path and historically much of the IP was never leveraged except to stop competition. Measuring this once idle intangible value allows engagement with national and cultural markets in an inverted model with the analogy of teaching a person to fish. Once taught the long-term outlook, the person creates an improved sustainable risk model to protect their family and village against intangible risk and should not be prohibited from using it as new IP.

Developed countries may resist this inversion but the incentive is to create and foster the organic need to develop and initiate social stability through mutuality rather than legal enforcement. IP and know-how are critical but cannot be used later as obstacles against development success. Incentives to developed markets must be made by governments to derisk and offer incentive businesses to support the transfer of intangible capability by recognizing value and benefit within their tax schemes.

Until now, many “top of the pyramid” companies have no clue what the grass roots need at the bottom of the pyramid, what price it will bear, what data are needed, how distribution occurs, and what marketing practices exist. Embedded intangible value recorded on balance sheets may encourage more investments and the intangible assets of Fortune 500 companies can be used as a baseline with causal AI. Parametric solutions can then address covariate risk. The fair value and true cost of embedded intangible assets in financial inclusion projects should be valued, otherwise innovation may not result in mainstream activity to alleviate poverty. The emergence of regenerative finance (ReFi) is an important recognition of financial inclusion and climate change. xlvi

Conclusions

The market shift from an economy measuring material goods to intangible assets is a product of the new industrial digital revolution .xlvii Companies that predate the internet have tangible asset inertia and a digital technology debt. Internet-era companies are synonymous with knowledge- based intangible assets which are often unrepresented on financial statements or excluded in risk assessments.

Governments recognize the value of making data tradable and most companies have onboarded digital business models. Correct management of intangible assets is a value creation in corporate business development. Conversely, digital entrepreneurs face emerging risks, with protection products evolving around business liability, cyber, IP, and climate change. To unlock the potential of intangible assets, they need to be identified and protected. The speed of digitization explains the tendency to underestimate intangible asset value and cybersecurity risk.

The following diagram connects the dots in this white paper in the identification of intangible assets, how they are recognized in accounting, and measured and valued on a balance sheet. With human domain expertise, this value can be ingested by knowledge management and causality to provide predictive analysis leading to more accurate and granular financial services products.

Intangible assets extend beyond the geopolitical curve, and clear paths need to be enunciated to commercialize these assets. Supply chains are affected by digitization, cyber disruption, regulation, ongoing wars, geopolitical realignments, technology bans, and raw materials, which can affect dependable markets and distribution channels. When KBC is embedded in corporate culture and combined with existing intangible assets, it can unleash multiples of value on a balance sheet. This greatly assists in M&A due diligence and gives a true picture of company financials in a snapshot of time. With supply chains it allows measurement of cross-border arrangements involving the movement of intangible assets held offshore where other entities benefit from the intangible assets. Taxation implications involving intangible assets is an area of government focus and in time could stretch to data itself.

In conclusion, intangible assets will continue to dominate in the digitized and virtual world. Capital expenditure increase will also expand the share of tangible assets on corporate balance sheets, causing a pendulum effect between the intangible/tangible asset mix for investors.

Ultimately, assets generate profits and the discounting of resulting cashflows provides business value, whether it be a technology company or a legacy company. However, intangible assets have swings in valuations and goodwill accumulation between purchase price and fair market value, and this is now represented on consolidated balance sheets. Once measured, the predictive ability of intangible assets on these balance sheets can utilize causality and machine learning to forecast corporate profitability in a data-driven world.

Overall, recognizing the rising significance of intangible assets and adopting effective management, valuation, and protection strategies, including the use of causal AI and cybersecurity measures, will help businesses maximize the value of their intangible assets and ensure their long-term success.

References

The author would like to thank John Spence of Asian Capital Advisors (https://hk.linkedin.com/in/johnrspence) for his contribution and review.

i https://newroi.com/about-the-author/

ii https://en.wikipedia.org/wiki/Charlotte_Beers

iii https://www.linkedin.com/posts/san2010_causalai-sixsigmastory-innovationjourney-activity7157714570277519360-yzHz

ivhttps://www.msengineering.ch/de/theoriemodule/2024-2025-tsmcausai#:~:text=“Machines%27%20lack%20of%20understanding%20of,Award%20winner%20and%20AI%20pioneer)

vhttps://oceantomo.com/intangible-asset-market-value-study/

vi https://www.mapfre.com/en/insights/commitment/intangible-important-companies/

vii https://www.ifrs.org/groups/international-accounting-standards-board/

viiihttps://brandirectory.com/reports/gift-2023

ix https://www.wipo.int/global_innovation_index/en/gii-insights-blog/2024/corporate-intangible-assets.html

x https://brandfinance.com/insights/how-much-value-is-there-in-intangible-assets

xi https://oceantomo.com/intangible-asset-market-value-study/#:~:text=Intangible%20assets%20are%20now%20responsible%20for%2090%25%20of%20all%20business%2 0value.

xii https://brandfinance.com/press-releases/value-of-global-intangible-assets-regains-some-ground-after-sharpdecline#:~:text=The%20New%20York%20Stock%20Exchange,exchange%20overall%20in%20relative%20terms.

xiiihttps://www.iasplus.com/en/standards/ias/ias38

xiv https://kpmg.com/mt/en/home/insights/2021/05/capitalisation-of-internally-generated-intangible-assets.html

xvhttps://www.iasplus.com/en/standards/ifrs/ifrs3

xvihttps://www.wipo.int/pressroom/en/articles/2022/article_0011.html

xvii https://dart.deloitte.com/USDART/home/publications/deloitte/heads-up/2023/fasb-asu-crypto-asset-guidance

xviii https://hextrust.com/

xixhttps://vaultavo.com/

xx https://venafi.com/blog/what-are-trust-anchors-and-how-can-they-protect-you/

xxi https://oag.ca.gov/privacy/ccpa

xxiihttps://gdpr-info.eu/

xxiii https://www.hpe.com/hk/en/whatis/oem.html#:~:text=OEM%20definition,the%20microprocessor%20nor%20the%20OS.

xxiv https://guardtime.com/

xxv https://www.ifrs.org/issued-standards/list-of-standards/ias-37-provisions-contingent-liabilities-and-contingentassets/#:~:text=Contingent%20assets%20are%20possible%20assets,inflow%20of%20benefits%20will%20occur.

xxvi https://www.expressvpn.com/blog/the-true-cost-of-cyber-attacks-in-2024-and-beyond/

xxviihttps://www.infosecurity-magazine.com/news/cyber-insurance-marketworth/#:~:text=The%20global%20cyber%20insurance%20market,of%20%2412.1bn%20in%202023.

xxviiihttps://www.onething.design/blogs/web-3-0-the-next-iteration-of-theinternet#:~:text=The%20key%20to%20the%20innovation,be%20easily%20exchanged%20across%20networks.

xxxix https://www.coresilium.com/en/2023/02/intangible-assets-you-cant-protect-what-you-dont-know/

xxxhttps://www.techtarget.com/searchcloudcomputing/definition/Software-as-a-Service

xxxi https://www.weforum.org/agenda/2021/01/knowledge-is-power-why-the-future-is-not-just-about-the-tech/

xxxiihttps://vulcain.ai/

xxxiiihttps://www.prnewswire.com/news-releases/riskstream-collaborative-collaborates-with-b3i-in-a-lab-series-toexplore-parametric-homeowners-reinsurance-301512888.html

xxxivhttps://azure.microsoft.com/en-us/resources/cloud-computing-dictionary/what-isazure#:~:text=Of%20the%20Fortune%20500%20companies,Azure%20in%20their%20digital%20transformation.

xxxv https://fortune.com/2024/03/09/microsoft-admits-russian-state-hack-still-not-contained/

xxxviihttps://digiexpo.e-estonia.com/cyber-security/mida-cloud-security-and-compliance/

xxxviiihttps://www.artemis.bm/deal-directory/?_sft_perils=cyber-risks

xxxixhttps://www.prnewswire.com/news-releases/reputation-accounts-for-63-percent-of-a-companys-marketvalue-300986105.html

xl https://areopa.com/

xli https://ipwe.com/

xliihttps://akinova.com/

xliii https://single-market-economy.ec.europa.eu/news/commission-launches-2024-sme-fund-protect-small-andmedium-sized-enterprises-intangible-assets-2024-01-22_en#:~:text=Entrepreneurship%20and%20SMEs-Commission%20launches%20the%202024%20SME%20Fund%20to%20protect%20small%20and,protect%20their% 20intellectual%20property%20rights.

xliv https://www.chicagofed.org/publications/chicago-fed-letter/2023/482

xlv https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2434501

xlvihttps://www.investopedia.com/what-is-regenerative-finance-refi-7098179

xlviihttps://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-torespond/

4.2024

About the Author:

David Piesse is CRO of Cymar. David has held numerous positions in a 40-year career including Global Insurance Lead for SUN Microsystems, Asia Pacific Chairman for Unirisx, United Nations Risk Management Consultant, Canadian government roles and staring career in Lloyds of London and associated market. David is an Asia Pacific specialist having lived in Asia 30 years with educational background at the British Computer Society and the Chartered Insurance Institute.

View More Articles Like This >