Multiparty Business Process Challenges Can Often Be Solved with Technology, but The Industry Needs to Team Up to Do So

IIS Executive Insights Innovation Expert: Patrick Schmid, PhD, President, The Institutes RiskStream Collaborative

The Current Challenging Economic Environment

After a year of extreme inflation and cost issues, the global economy appears to be slowing as we conclude 2023. The excessive inflation of the past few years compelled central banks to raise interest rates, as countries are aiming to place weight on inflation risks. Thus far, the international community’s interest rate increases have appeared to constrain global inflation a bit, but it’s likely the increased interest rates are simultaneously slowing real economic growth. The convergence of these global economic woes, amongst other emerging risks, have created challenges for the insurance industry.

While the higher interest rates may help insurer’s investment income, many insurers are dealing with underwriting losses. In the US, the second quarter showcased a 103% combined ratio according to S&P Global Market Intelligence 2023 US P&C Insurance Market Report. Underwriting results have been particularly troubling in personal lines, particularly within the auto sector. Inflation has driven up claims costs as the costs of materials and labor used to repair or replace damaged property has been elevated. According to APCIA, “auto claim costs are rising faster than the CPI and outpacing rate increases by car insurance companies”. This is occurring as frequency is also increasing in auto insurance. While much of this is playing out in US auto insurance, escalating frequency, and severity of risks in other insurance lines has also been occurring globally. This may result in society questioning insurance industry’s ability to provide economies with financial resilience when high-risk events occur.

As these economic challenges are playing out, job openings within the insurance industry are on the rise as the baby boomer generation moves towards retirement. Yet the skills gap and the ability to attract talent is becoming a significant issue for some insurance companies’ recruitment efforts.

The Potential for Technology Driven Efficiency

In light of the changing global economic environment and labor market challenges, many insurers are realizing traditional ways of doing business will not suffice, and they are now embarking on digital transformation initiatives aimed at proactively averting would be losses and driving operational efficiency. For the insurance industry to succeed with digital advancement and operational efficiency improvements, advanced technological adoption will be a necessary tool, particularly if it offers opportunity to reduced manual efforts. While much of the ongoing

efforts are focused internally within each insurance organization, technology and collaboration is also needed for multiparty business process improvements, which are often overlooked, yet hold sizable potential.

Multiparty Business Process Opportunities in Insurance

Multiparty business process challenges within the insurance industry extend to carriers, brokers and reinsurers, each facing unique complexities across the insurance value chain. For carriers, underwriting and policy issuance can be intricate. They must collaborate with brokers, agents and reinsurers to assess risks, set premiums and issue policies. The challenge lies in coordinating these interactions effectively while ensuring data accuracy and compliance with regulatory standards. Maintaining consistent records, data and communication with producers is crucial, as discrepancies or delays can lead to lost business. This is no easy feat, as managing the data exchange between producers, carriers and reinsurers can be very challenging. Yet, opportunity for greater efficiency exists, which could improve underwriting performance and lower operational costs.

Another key value chain area with challenges is claims processing. When policyholders file claims, multiple parties are often involved, these include the opposing carrier and their adjuster, service pro viders and the policyholder themselves. Coordinating data exchange across the parties for assessment, liability determination, approval, fraud detection and payment of claims is top of mind for customer satisfaction. Delays or security risks during the exchanges between these parties can lead to customer dissatisfaction and weaker cycle time. Overall, streamlining multiparty processes throughout the insurance value chain is essential to improving efficiency, reducing costs and enhancing the customer experience within the industry.

viders and the policyholder themselves. Coordinating data exchange across the parties for assessment, liability determination, approval, fraud detection and payment of claims is top of mind for customer satisfaction. Delays or security risks during the exchanges between these parties can lead to customer dissatisfaction and weaker cycle time. Overall, streamlining multiparty processes throughout the insurance value chain is essential to improving efficiency, reducing costs and enhancing the customer experience within the industry.

Brokers also encounter multiparty challenges in the insurance value chain. Acting as intermediaries between policyholders and carriers, producers strive to find the best coverage at the most competitive rates. In doing so, they are managing various carrier relationships and navigating their underwriting processes. This coordination across parties often has challenges in communication, data exchange, negotiations. The need to stay aware in real-time and automate processes is top-of-mind for the producer community.

Reinsurers are increasingly focused on the risk management aspect. In their collaboration with carriers to spread risk and ensure solvency, accurate and real-time data is incredibly important. Inconsistencies or inaccuracies in data can lead to pricing issues or financial repercussions. It’s often the case that reinsurers are also interacting with brokers and other reinsurers, complicating the multiparty dynamics. Opportunities to streamline these processes could lead to significant advantages to the reinsurer community.

Enterprise Blockchain as a Deep Technology for Multiparty Business Process Improvements

Blockchain technology is beginning to show signs of helping with multiparty business processes and the divergent roads of enterprise blockchain and public blockchain are beginning to merge. Enterprise blockchain usage in insurance is expected to increase in the next few years and, despite a rocky first five years or so, has a bright future.

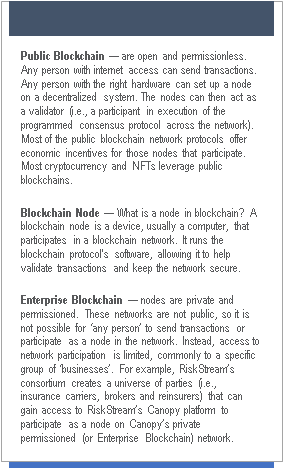

Increasing operational efficiency is a goal of all companies and the special sauce of enterprise blockchain (also known as private permissioned blockchain). The usage of enterprise blockchain is quite different from cryptocurrency or public blockchain projects in that the underlying protocol is generally not public; it’s a private, permissioned network of organizations (not people).

Commonly with a private permissioned blockchain network there are rules for which parties can set-up a node and be involved in the network’s shared version of the truth associated with decentralized system of data exchange. This is why it’s often referred to as “enterprise blockchain.”

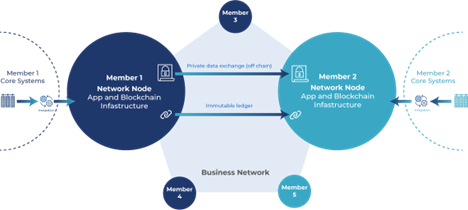

Enterprise blockchain allows network participants the ability to integrate block chain nodes to existing core systems; for example, an insurance claims or policy system. The private network ensures only parties relevant to the core mission can be onboarded to the network. The permissioned aspect allows participants the ability to share or verify information from one integrated core system to another in the case of certain events. There are many multiparty business processes within insurance where this can be useful.

chain nodes to existing core systems; for example, an insurance claims or policy system. The private network ensures only parties relevant to the core mission can be onboarded to the network. The permissioned aspect allows participants the ability to share or verify information from one integrated core system to another in the case of certain events. There are many multiparty business processes within insurance where this can be useful.

The level of transparency and flexibility within a private permissioned blockchain network are some key areas of consideration to ensure world-class security and privacy, which is paramount for network success. Given the effort associated with enterprise blockchain, start-ups within the space are often considered deep technology in that they aim to provide technical solutions based on large scale, scientific or engineering challenges. In this case, business cooperation.

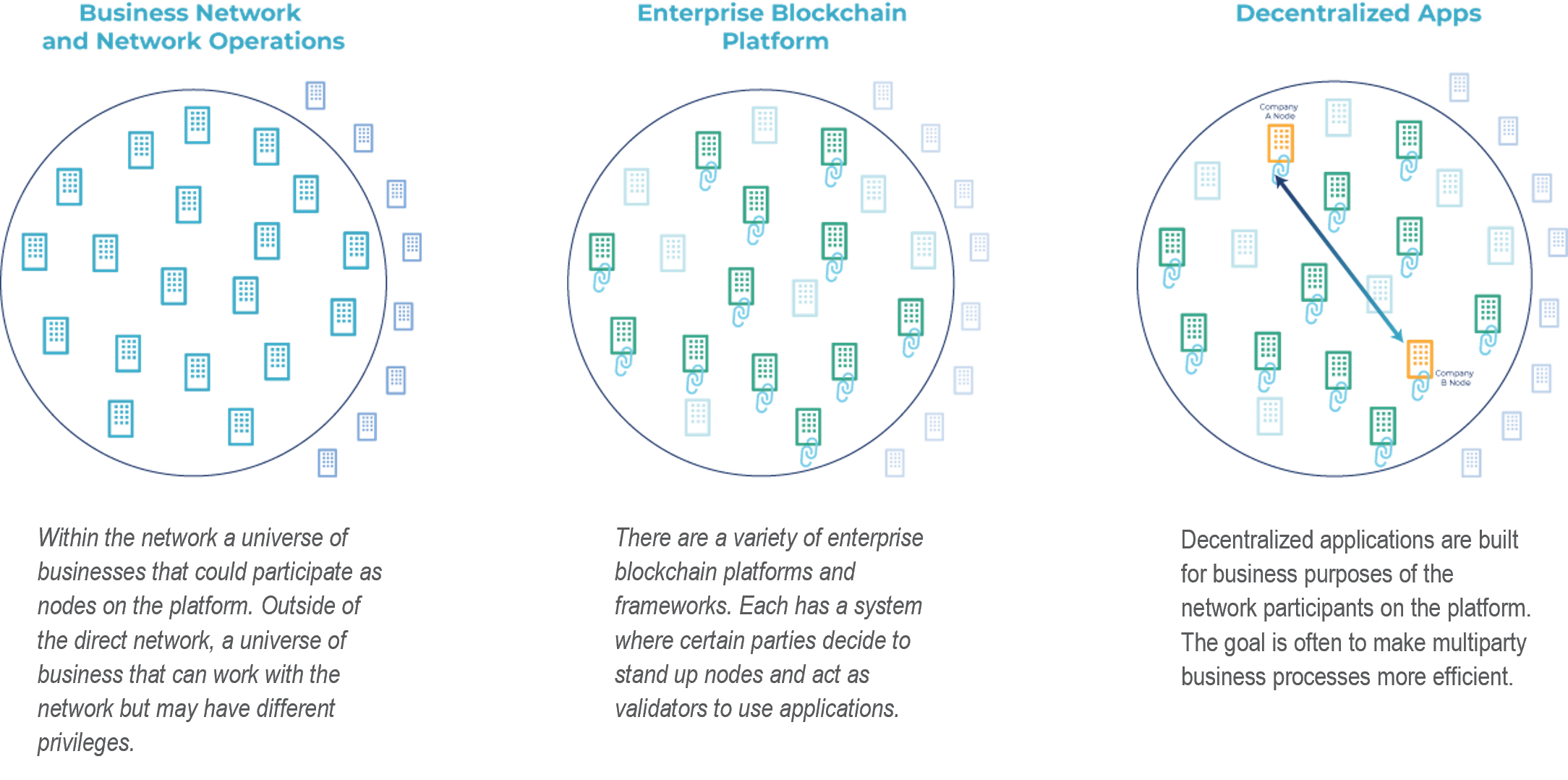

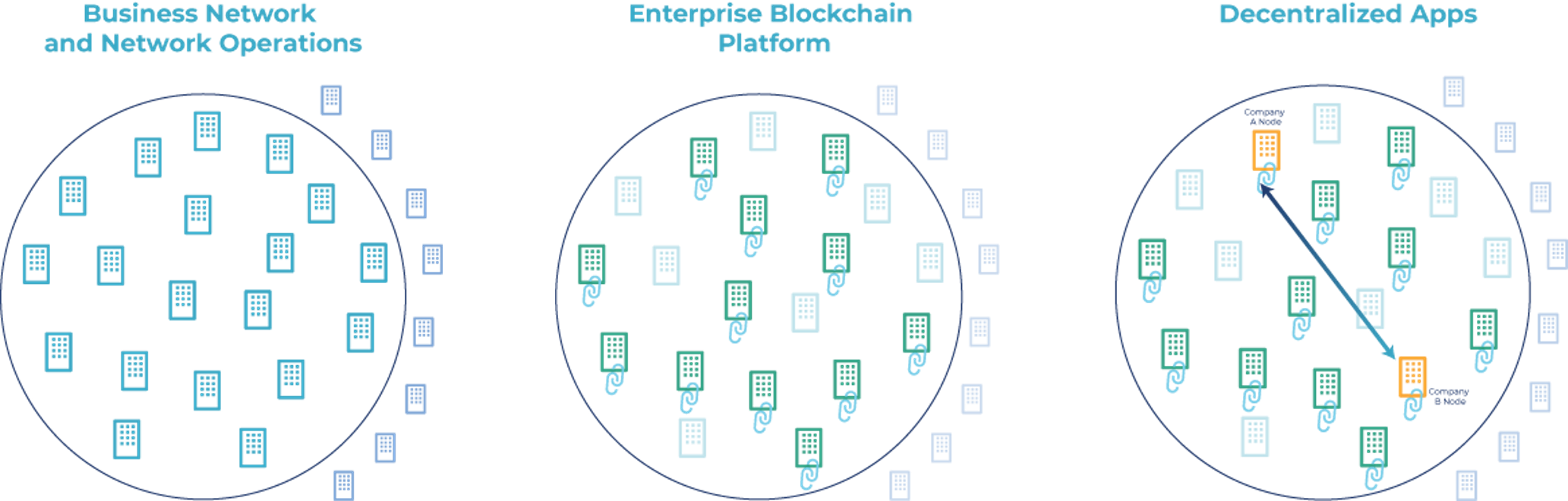

As with all efforts of great magnitude related to deep technology, there are challenges. But there are also opportunities and tools to overcome those challenges. The challenges in implementing enterprise blockchain are generally related to factors we can put into three large groups:

- Business Network and Network Operations

- Enterprise Blockchain Platform

- Decentralized Apps

Case Study: The Institutes RiskStream Collaborative

The Institutes RiskStream Collaborative (RSC) was formed over five years ago by The Institutes. It is the risk management and insurance industry's largest enterprise-level blockchain consortium. RiskStream serves the industry as a neutral, collaborative, and non-profit resource, focused on solving multiparty business process challenges. RiskStream has engaged with over 150 carriers, brokers and reinsurers over the last year. The Institutes goals in starting this consortium were threefold:

process challenges. RiskStream has engaged with over 150 carriers, brokers and reinsurers over the last year. The Institutes goals in starting this consortium were threefold:

- Develop a governance model for an emerging membership network that allows industry competitors to cooperate on transformative multiparty business processes in a way that emphasizes efficiency, compliance, and fairness.

- Develop and enhance an industry utility (Canopy) that provides a nexus and platform for developing decentralized technology solutions, which can uniquely solve long-standing industry problems in a cost-effective way for members.

- Assist with and propel the creation and adoption of applications (apps) by the consortium, or by members, who wish to develop their own proprietary apps on the platform.

RiskStream solutions and applications typically involve cross-party data sharing and verification from member’s integrated system of record, using Risk Stream’s private permissioned blockchain platform (Canopy). RiskStream members, which are carriers, brokers, and reinsurers, lead all areas of the consortium’s activity and governance through boards, committees, and application-specific working groups. Insurance member companies and leadership work with RiskStream staff to prioritize use cases across sectors and launch working groups to design solutions for various multiparty business process challenges. These working groups are facilitated by RiskStream product managers.

RiskStream aims to provide the industry with three key elements: a business network and network operations (The RiskStream Collaborative), a robust enterprise blockchain platform (Canopy) and various decentralized applications (RAPID X, Mortality Monitor, etc.).

RiskStream aims to provide the industry with three key elements: a business network and network operations (The RiskStream Collaborative), a robust enterprise blockchain platform (Canopy) and various decentralized applications.

Case Study: RiskStream Solutions

1: Auto

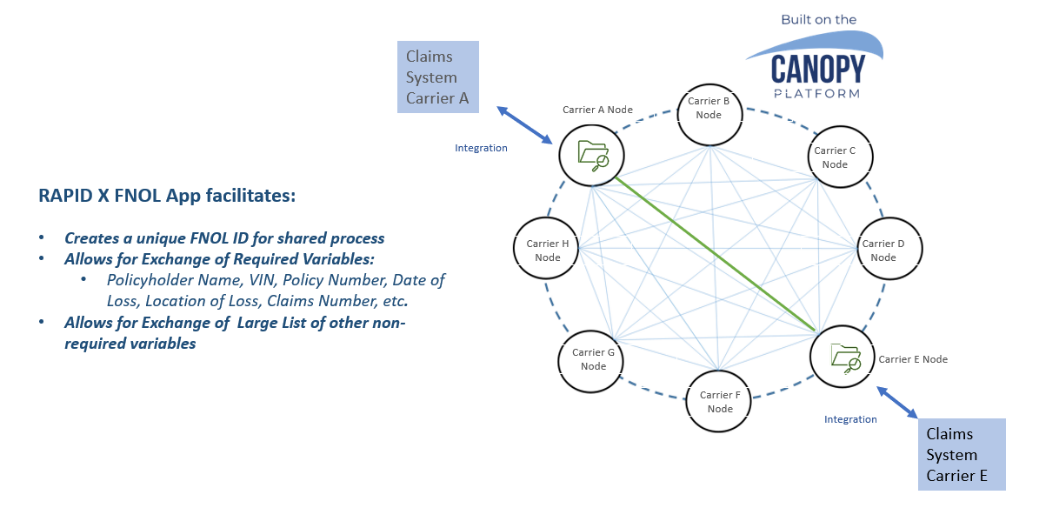

RAPID X – Personal Auto FNOL Data Exchange

Industry Problem: Personal auto insurance carriers lack an automated digital process for exchanging first notice of loss (FNOL) data with other carriers. Existing processes are overly manual and inefficient, resulting in higher operational costs, longer claim resolution times, less accurate data, and lower customer satisfaction.

Solution: The RiskStream Collaborative’s RAPID X solution eliminates the need for manual transfer of claims data between personal auto carriers. Using RAPID X, participating carriers can send FNOL data from their claims system to another carrier’s claim system and can receive information from other carriers in the same fashion. This is done securely, seamlessly, in real time and in compliance with GDPR, CCPA, etc. RAPID X leverages a private permissioned blockchain network where FNOL and loss data is shared from a system of record, matched with data from the other carriers participating in the loss event, and updated from the other carrier’s systems of record. The application also tracks simple liability, enabling straight-through processing. Currently, RiskStream is leading discussions about the adoption of this SaaS solution with carriers who comprise more than 50% market share of the US based private passenger auto insurance market. One can view a video of the solution here.

Solution: The RiskStream Collaborative’s RAPID X solution eliminates the need for manual transfer of claims data between personal auto carriers. Using RAPID X, participating carriers can send FNOL data from their claims system to another carrier’s claim system and can receive information from other carriers in the same fashion. This is done securely, seamlessly, in real time and in compliance with GDPR, CCPA, etc. RAPID X leverages a private permissioned blockchain network where FNOL and loss data is shared from a system of record, matched with data from the other carriers participating in the loss event, and updated from the other carrier’s systems of record. The application also tracks simple liability, enabling straight-through processing. Currently, RiskStream is leading discussions about the adoption of this SaaS solution with carriers who comprise more than 50% market share of the US based private passenger auto insurance market. One can view a video of the solution here.

An Extension - Universal Portal: RiskStream is working on an extension of RAPID X which aims to allow RAPID X users to be able to interact with non-network participants, similar to ‘third-party claims portals’. The idea is that all on the RAPID X network could replace their third-party claims portal with a universal portal (a single portal with drop-down menu for interaction with each RAPID X user company). Integrations to existing third-party portals can ease onboarding to RAPID X and replacing them with a universal portal would provide several other benefits. Currently, carriers who host their own portals are seeing low usage rate, while many other carriers do not have third-party portals at all. Therefore, a central portal for the industry could lead to 1). efficiency gains for portal users, 2). cost savings for carriers who would no longer need to host their own portal, and 3). reduction in phone call volume between insurance companies or resources spent advertising their third-party portal to their competitors.

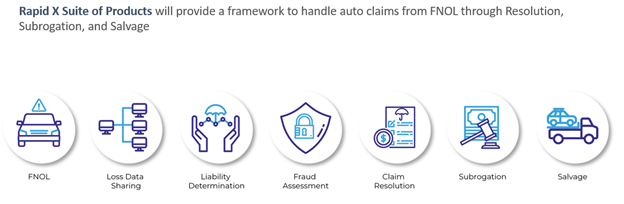

Towards a Suite of RAPID X Auto Products:

2. Surety Bonds

Power of Attorney Verification

Overview: Obtaining power of attorney is a necessary step in the bond execution process and the current process of registering, maintaining, and verifying powers of attorney is expensive, time consuming and an inefficient process. Imagine the high volume of requests, approvals, and ongoing maintenance of adding, removing, and updating powers of attorney, and the verification and tracking that follows while lacking a streamlined and automated process.

The Surety Bond Power of Attorney solution applies distributed ledger technology to advance the surety process away from ink and paper to an automated, streamlined, and digitize multi-party surety workflow processes between the principal, obligee and surety. The application manages the flow of data, removing the manual touchpoints and provides a single source of the truth, eliminating redundant rework and reconciliation efforts. The API enabled solution offers real-time connectivity providing the flexibility to take up last minute opportunities. And the secure, transparent, traceability features of the technology offers the trust and legitimacy, providing the assurance the Power of Attorney is viable.

In collaboration with the surety industry, the solution draws from the experience of over 40 industry organizations and support from surety associations, including The International Credit Insurance & Surety Association (ICISA), the Surety & Fidelity Association of America (SFAA), the National Association of Surety Bond Producers (NASBP), the Surety Association of Canada (SAC), and the Pan American Surety Association (PASA). Participants represent leading sureties that make up 74% of the US and Canada market share, in addition to brokers, agents and solution providers.

Bond Verification

Overview: The Surety Bond Verification solution is the first international blockchain application for the surety bond industry serving all entities by converging all channels, processes, and entities in a trusted and secure manner where data can seamlessly flow while ensuring the highest standard of data privacy and security. Power of Attorney and Bond delivery documentation is tracked and authenticated via non-fungible tokens (NFTs) on the Canopy platform, providing an industrywide accepted single source of truth across all geographies.

Power of Attorney and Bond delivery documentation is tracked and authenticated via non-fungible tokens (NFTs) on the Canopy platform, providing an industrywide accepted single source of truth across all geographies. The industrywide solution across all geographies provides an additional layer of authentication / verification that offers a blockchain backed proof of the bond.

3. Life & Annuities

Mortality Monitor

Overview: Today, the life insurance industry lacks a single source of truth for processing death benefits and claims. Family members and loved ones are burden with having to provide proof of death and carriers must collect and assemble pertinent information and documents from multiple sources, which means duplication of data, high rework and potential for errors. For all participants, including insurance carriers, the multiple handoffs between systems and people increase time, cost and risk.

RiskStream’s Mortality Monitor, a blockchain application, offers a single source of decedent information required to process a death claim. Instant notification helps carriers proactively identify potential deaths more quickly, reducing the burden on the beneficiary and shortening the claims cycle time. The solution sets the stage for a large-scale decentralized death registry, allowing entities with original sources of death information (such as funeral homes, state Vital Records departments, the Social Security Administration, and government agencies) to share decedent data with life and annuity carriers in real-time. To learn more, please read the study here.

1035 Exchange/Replacement

Overview: A 1035 / Replacement exchange involves transfer of funds from a life insurance or annuity to a new policy. New carriers manually review faxed/emailed paperwork to determine if it is In-Good-Order (IGO), and this process can take a couple weeks to a couple months.

The objective is to explore the potential to leverage blockchain technology to reduce manual tracking and wait times, eliminate the paper hassle, and address NIGO’s (or not in good order paperwork) that exists today by providing timelier access to data and documents, improved processes, and increased efficiency while ensuring the highest standard of data privacy and security through secure, trusted and transparent permission-based blockchain technology. The solution aims to simplify the process making it easier for all involved while increasing the customer experience.

4. Reinsurance

dRe – Lifecycle Dashboard

In partnership with

Initial Use Case: “Cat in a circle” homeowners parametric reinsurance application that aims to simplify the cedant and reinsurer operational process by leveraging a weather data feed from oracle dClimate. This weather data feed triggers a smart contract based on wind speed and location (zip code) for a specific peril event. Based on the coverage purchased, claim initiation, notifications, and loss calculations are automated, which calculates at the individual policy level and streamlines the payout process based on a reinsurance layer protecting the entire portfolio of the cedant.

dRe Lifecycle Dashboard: Is a decentralized application using RiskStream’s Canopy enterprise blockchain platform. dRe acts as a single source of truth for any reinsurance transactions shared amongst stakeholders. The dashboard offers benefits for contract management, real-time insights, customized access and views, seamless data integration and a customizable smart contract/oracle infrastructure (for various perils for parametric use cases).

The application is live and in production.

Conclusions

As we conclude 2023, the global economy appears to be slowing due to extreme inflation and the central bank policy response of raising rates to combat inflation. These challenges, which have begun to trickle into insurance are causing underwriting losses and are raising concerns about the industry’s ability to provide financial resilience in the face of rising risks. Insurance companies are recognizing the need for digital transformation to prevent losses and enhance operational efficiency in response to challenging global economic conditions, emphasizing the importance of advanced technology adoption and collaboration for multiparty business process improvements. Enterprise blockchain is a useful tool to help with multiparty business processes, however, a network provider is required to bring industry players together and set the rules of the road for engagement on the decentralized platform. Within insurance, The Institutes RiskStream Collaborative is playing that role in helping to bring industry participants together, design and implement solutions for auto insurance, surety bonds, life & annuities and reinsurance. While it’s taken a bit of time for enterprise blockchain solutions to make a splash, it’s becoming increasingly apparent that enterprise blockchain is a deep technology—which generally leads to large scale changes long-term once the roots are planted. The insurance industry is starting to see green shoots in enterprise blockchain projects and these, and others, should begin to bloom in 2024 and 2025, helping the industry to withstand the unprecedented economic conditions.

11.2023

About the Author:

Patrick G. Schmid, PhD is an economist and the President of The Institutes’ RiskStream Collaborative—a risk management and insurance blockchain & emerging technology consortium. He works with RiskStream’s member-led governance boards and oversees RiskStream’s products, relationship management, operations, and technology workstreams. Dr. Schmid offers blockchain and emerging technology thought leadership for The Institutes and coordinates the RiskStream’s consortium of insurers, brokers and reinsurers with industry participants and technical partners in developing production applications that can lower costs, improve customer experience and drive efficiency across the insurance industry.