World Trade, Re-Globalisation, Cyber Risk, Countertrade and the Digital Barter Economy

IIS Executive Insights Cyber Expert: David Piesse, CRO, Cymar

Abstract

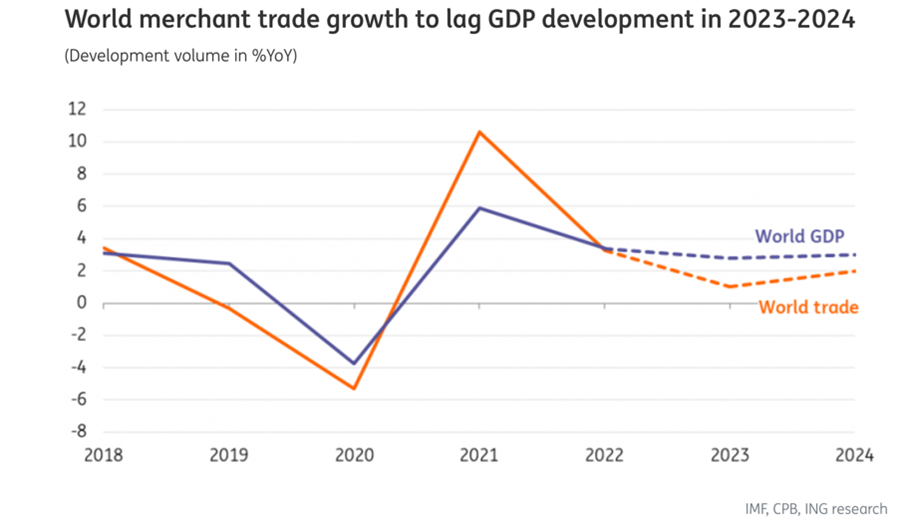

World trade faces risk of fragmentation amid a backdrop of polycrisis, combining geopolitics, ongoing wars, climate change, energy transition, post-pandemic economy (inflation and interest rates rises), and cybercrime. Unilateral trade agreements reduce world trade, create commodity vulnerability, and increase supply-chain risk.

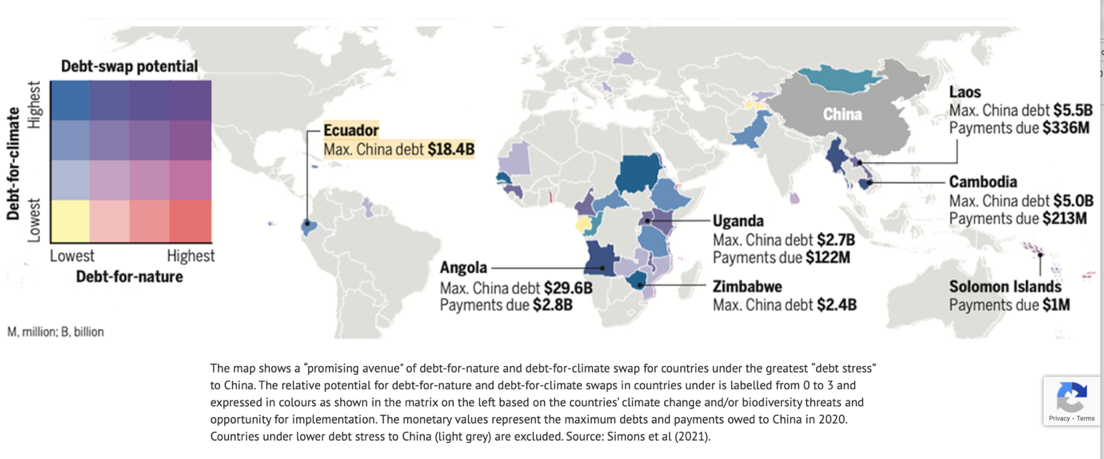

Technology solutions are needed for an inclusive and sustainable reglobalization program.1 This includes recalibration of human value curation using blockchain-protected artificial intelligence (AI) and adapting supply chains with the insurance that backs them, covering natural and cyber disaster events via capital markets. Green-based economic growth can reduce poverty for future generations; and a new financial ecology, regenerative finance2, is emerging.

Reduction in global trade means nations become protectionist with money, so new forms of trade are evolving based on digital asset exchange, such as digital barter and countertrade, as trade aligns to geopolitical actions. Reglobalization must focus on circular manufacturing3 and agriculture to mitigate supply-chain risk and preserve food security while reinventing money in a digital world.

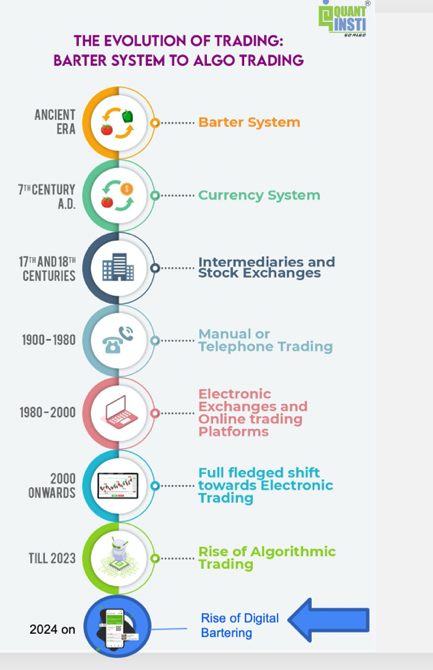

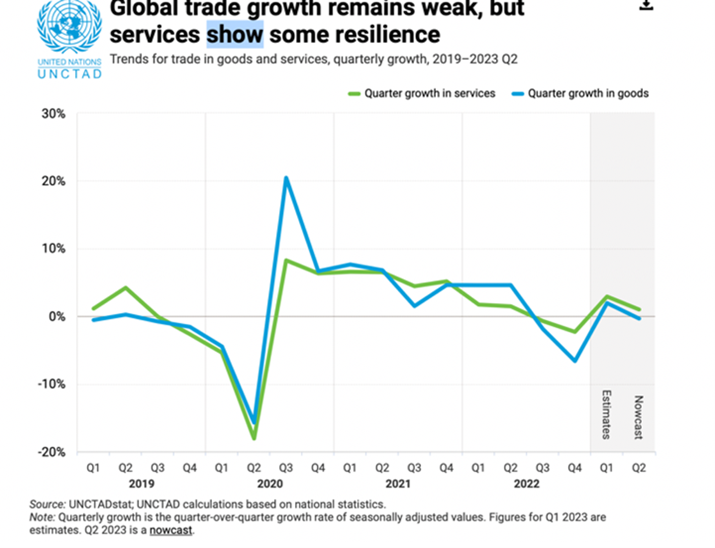

As the diagram below shows, trading patterns are changing, and deglobalization is a risk factor. This paper examines technology evolution dynamics during economic downturn and the various inversion models emerging to address the issues.

Definitions

- Automated market maker (AMM)—Allows digital asset trading and bartering automatically on a decentralized exchange (DEX) using decentralized liquidity pools without intermediaries.

- Atomic swap—Allows two people to trade tokenized assets securely and immutably across different blockchain networks without relying on a centralized intermediary.

- Carbon offset—A token to compensate carbon emissions by funding equivalent carbon dioxide savings in places where high-emission companies have carbon credits issued.

- Causal AI—Reasoning by utilizing causality that goes beyond machine learning predictions and directly integrates with human decision making, moving away from statistical correlation.

- Central bank digital currency (CBDC)—A wholesale digital currency issued by a country's central bank and a digital twin of a nation’s fiat currency.

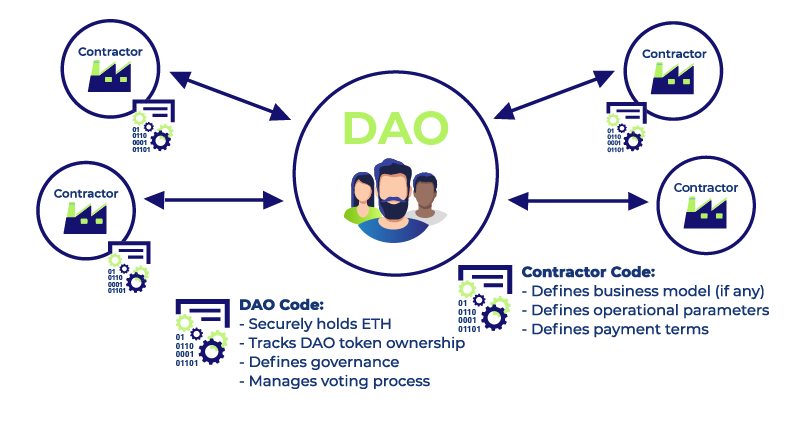

- Decentralized autonomous organization (DAO)—Web 3.0 corporate governance structure where token holders democratically participate in management and decision making.

- Decentralized finance (DeFi)—A blockchain-based finance model on Web 3.0 that enables digital asset base exchanges and financial services without a centralized authority.

- Decentralized exchange (DEX)—Part of DeFi, where traders can swap assets without a centralized intermediary, and closely connected with the AMM, which is a subset of DEX.

- Global value chain (GVC)—A full range of trade activities that bring a product to market.

- Metadata—The identifying part of data that enables provenance; data about data.

- Near field communication (NFC)—Short-range wireless technology that enables communications using tags.

- Nonfungible token (NFT)—Unique cryptographic tokens that exist on a blockchain and represent real-world items as digital twins; they reside on smart contracts.

- Off chain—Digital exchange that does not take place on the blockchain (on chain) and is executed instantly, such as offline payments; important for emerging economies.

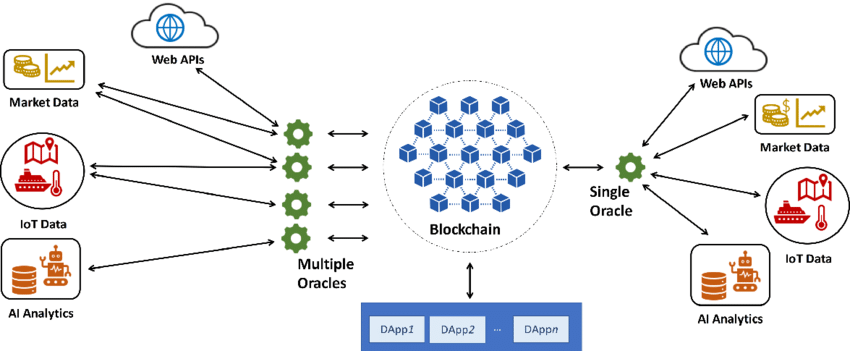

- Oracle—A third-party service connecting blockchain smart contracts to the outside world with data feeds such as weather patterns or rainfall levels indicated from a sensor.

- Public key infrastructure (PKI)—Signs data with a private key and verifies it with public keys. PKI is the current method of confidentiality, but this will likely change with quantum computing.

- Regenerative finance (ReFi)—An emerging alternate finance model based on DeFi and tokens that promotes green sustainability and financial inclusion by impact investing.

- Smart contract—Coded programs stored on the blockchain that trigger when predefined parametric conditions are met, either on chain or using an off-chain oracle.

- Stablecoin—Collateralized crypto assets backed by real-world assets for stability and to reduce volatility. Can be backed by fiat, securitized crypto and commodity or NFT.

- Trading pairs—Two digital assets that can be traded or bartered with each other on a digital exchange across borders at scale.

- Virtual asset trading platform (VATP)—A regulated trading exchange for digital assets that includes mandates for custody, insurance, and governance.

- Web 3.0—The next generation of the internet that embraces DeFi, ReFi, metaverse, blockchain, and tokenization. Often known as the Fourth Industrial Revolution; replaces Web 2.0.

What Is a Digital Barter Economy?4

A barter economy, the direct exchange of goods and services without money, is the oldest, most natural form of economy. However, because this finance model is local, it can’t scale over large distances.

A digital barter economy, however, reindustrializes the barter economy model with blockchain technology that digitizes physical goods and services as tokens that can be exchanged as proxies for the real asset and redeemed. Tokens owned are traded for tokens desired through decentralized marketplaces. Tokens can include intangible assets, such as intellectual property (IP)5, or physical items too large for payment use such as a painting.

Patents can be tokenized, traded, and monetized. Digital assets on a blockchain can be fractionalized, but this is impractical because the underlying physical asset would be devalued.

In a digital barter economy, stakeholders trade anything acceptable, such as a tokenized fragment of the painting. As data becomes an asset on the balance sheet via International Accounting Standard (IAS) 386, the data will eventually become a currency acceptable for trade within digital wallets.

Current Barter System

A barter transaction happens when two parties exchange goods or services. Barter doesn’t assign a measure of value to goods or services exchanged, fractionalize, or defer payments, which is challenging when matching trades.

In the 19th century, economist William Stanley Jevons7 demonstrated the lack of barter trade scalability. Today, transactions are performed as total or partial barter, providing exchange of goods and services on an organized, cross-exchange ecosystem called multilateral or financial exchange barter.8 This system records member transactions as accounts receivable, which could transform the economic resources of countries and for-profit companies. Members trade within credit limits and receive the product in a set time or pay money in default.

Corporate barter9 is trade finance in which wholesalers, distributors, and producers exchange goods with known parties. International barter involves countertrade agreements between two countries or companies across borders, avoiding money by exchanging goods or services with prices fixed in fiat currency.

Barter is a good system for trade finance for small- and medium-sized businesses (SMEs) entering foreign markets, as liquidity issues mean products can’t be monetized.10

A bill records the products or services exchanged in a barter. The bartered amount must be compared to historic cash transactions to determine a fair market value, which can be done via digital payment platforms. Estimated barter dollars are treated as fiat currency and reported as income. The bill can be tokenized for advantage. Barter economies superset monetary economies and can experience rich trading patterns not possible in traditional economies.

Viability of the Digital Barter Economy

Changes in trade trends represent a confluence of countertrade, mobile money, and digital bartering parenthesized within Web 3.0 technology like NFT and DeFi, with all roads leading to ReFi. Developing countries adopt new trade methods during crises, and the junction of digitization and protectionism opens floodgates for digital barter, removing traditional barter barriers and facilitating global trade of physical and virtual items.

Climate risk has created a digital carbon exchange market, providing opportunities for the low-income sector through barter-like transformation at the grassroots level, where technology and shifting social norms create diverse forms of currency and offline payments to meet the needs of the underserved. Integration of mobile banking, mobile money, and electronic wallets has transformed the financial services sector, lowering the cost of international remittances on which many communities rely.11

CBDC is digital money that enhances financial inclusion by optimizing digital payment systems. The crypto surge has spawned demand for CBDC platforms, decreasing cash and money laundering but increasing cybersecurity risks. Wholesale CBDC facilitates real-time interbank settlements, reducing settlement risk and optimizing cross-border fund transfers. For example, Africa needs between $750 billion and $1.3 trillion per year of digital barter and impact investing by 202512 to mitigate, adapt, and meet its climate change targets.

As blockchain-based trading becomes mainstream, houses, corporate bonds, racehorses, artwork, sports cars, and more can be purchased directly and fractionalized for share of ownership, transferred securely on real-time borderless networks. These tokenized shares enable any asset owner to make gains.

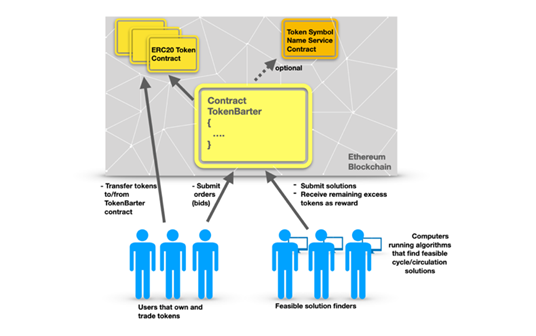

The peer-to-peer (P2P) system leads to more ownership and financial stability via a distributed, autonomous direct barter exchange operated by communities with escrow and swapping services. Participants are rewarded with excess tokens that remain after tokens are exchanged. This facilitates a global barter economy as the provenance and ownership of items is kept on the blockchain for global transfer.

The blockchain has become the new community marketplace—a place where traders once exchanged physical items, such as corn. The likelihood of rapidly finding trade matches is increased by using causal AI-powered search engines. Cross-country transfer of money by banks can also be implemented as a bartering process by exchanging tokens of the same fiat currency in one country bank with tokens in another country bank; this is especially effective for rural banks.

Bartering is a viable trade model in distributed environments and P2P networks, especially in conjunction with large-scale barter capability.

Global Activity in Modern Bartering

The United States dollar may be diminishing as a main reserve currency.13 Many countries now engage in barter trade, and countries like China and Russia are geopolitically reluctant to store wealth in dollar reserves.

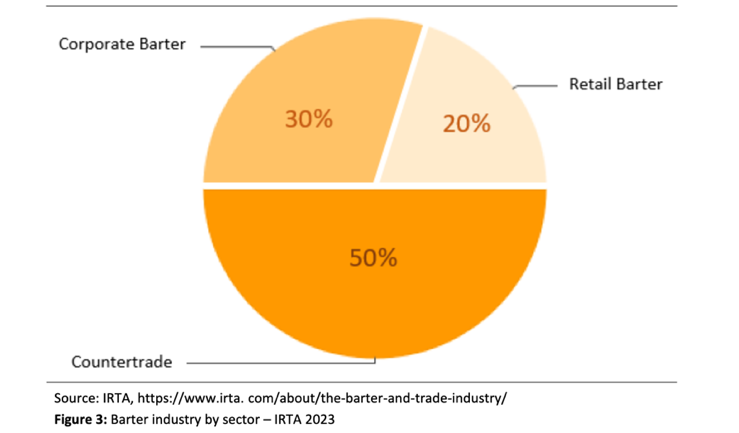

Barter traditionally revives in times of war, sanctions, and economic crisis, emerging as countertrade during the Global Financial Crisis (GFC) of 2008.14 The International Reciprocal Trade Association (IRTA) estimated the value of barter in excess of $12 billion to $14 billion globally in 2023.15 Private Bartering Systems (PBS)16 and IRTA reported that 20 percent of businesses engage in bartering17, especially since the GFC, because when trade growth is low, bartering steps in and fills the vacuum.

Barter aligns well with the ReFi circular economy. Tokenization and NFT bartering via smart contracts are growing with new lending protocols, utilizing NFT as a unique certificate of ownership. Binance launched integrated NFT lending as a bartering service.18 Ginoa rolled out Barterplace for NFT owners to generate earnings19 when users exchange one or multiple NFTs, including cryptocurrency, so traders can barter without requiring liquidity. Blur20 is a professional-level trade barter experience with high market share.21

NFT bartering requires no liquidity, which is attractive to traders after the FTX22 bankruptcy in 2022, where liquidity was at risk. NeoSwap23 AI has an NFT barter and auction service that uses AI for personal trading, closely resembling the ancient bartering system but in token form.

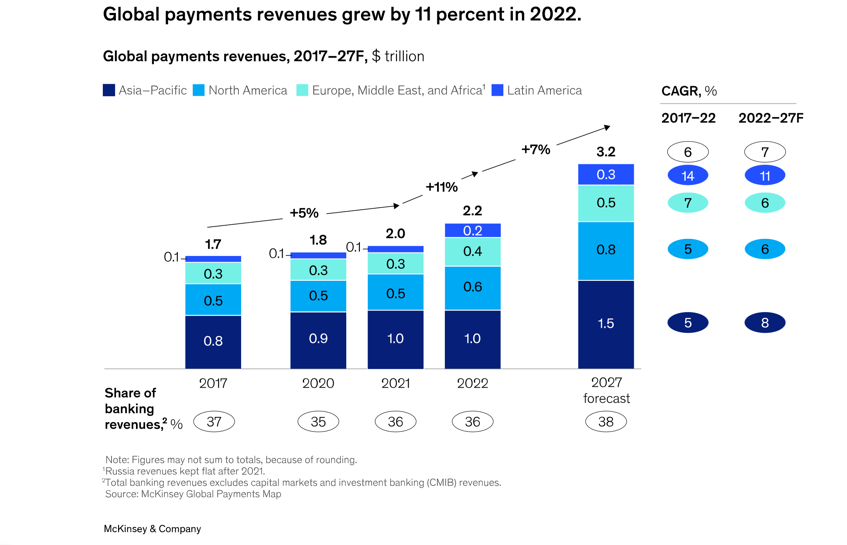

Millions of payments are made digitally, transferring investment funds at scale while transacting and trading digital currencies, boosting the global financial system with new assets. Global digital payments are projected to cross $10 trillion in 202324 at 12 percent compound annual growth rate, and $15 trillion in the next three years25 with the global market cap for digital currencies around $1 trillion to $1.3 trillion.26

Bartercard27, a digital barter exchange founded in Australia in 1991, operates internationally, with 55,000 cardholders worldwide.28 Digital currency platform Qoin29 and payment gateway Flutterwave30 are both used in Africa and associated with digital barter, operating with mobile phones., In October 2023, Microsoft announced a five-year strategic technology partnership with Flutterwave to use the Microsoft Azure cloud to accelerate SME growth in Africa.31

Similar P2P payment apps are becoming more accessible as an instant payment option in Latin America—such as Pix32 in Brazil — and in Southeast Asia, where GCash was developed in the Philippines and had 76 million registered users with a gross transaction value of $110 billion in 2022.33 These regions are reviving the barter concept in line with mobile money.

Changes in Digital Money and Tokenization

Money in all evolving forms has been crucial to human civilization, as the chart below shows. It is a fair assumption to bring digital bartering at scale onto the radar in 2024.

Data integrity guarantees cybersecurity inside data repositories; to apply this to digital money, the mathematics of money must be grasped. Cryptocurrency twin pillars Bitcoin34 and Ethereum35 use double accounting and are arguably not a digital twin to physical cash. An alternative idea is to use bills (as proposed by Alphabill36) as digital tokenized monetary units on the blockchain.

In the physical world, bills are a single purchase unit, meaning the bill value is static but ownership of value changes. Verifying this in a single transaction zero-trust model37 doesn’t scale, as the entire blockchain is needed to verify a correct transaction, creating exabytes of information. In the real world, you don’t go to the whole economy to verify everyone’s money. By using bill tokens, the security level model remains, as tokens are extracted from the blockchain to verify ownership uniqueness. This can enable instantaneous crypto offline payments using stablecoins, which is now happening in Africa38 on nonsmart mobile phones.

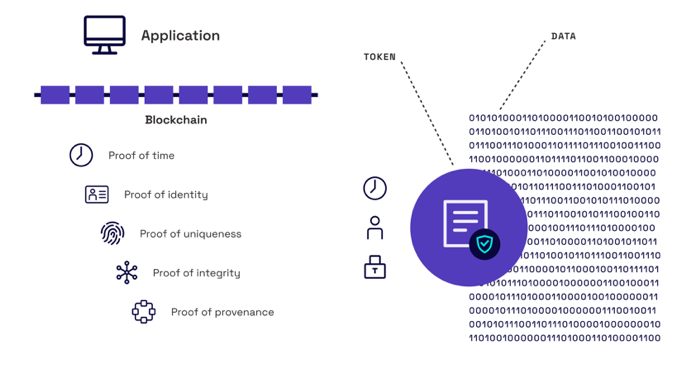

Tokens are separated from the blockchain, as bills can exist on multiple machines, but settlement is local, verifying off chain and eliminating cross-machine communication. A token is created, representing data with metadata39 attached, tracking its life cycle so anyone anywhere can confirm that the data is correct, a prerequisite in digital trade. Metadata travels with the token, but the data stays in the country of origin.

Source: AlphaBill

A trusted authority, as in stablecoin centralization, allows transfer of bill tokens from device to device completely offline, as adopted in Africa. Blockchains must settle the trade in one second and be embedded infrastructure used only to create, transfer, and verify tokens. A liquidity pool (AMM) performs the trade.

Tokens are separated from execution by downloading to a wallet, verifying provenance, and checking the cash in the wallet because proof of uniqueness comes with the token. For example, booking a trip on a ferry would lock in a token from a digital wallet; the ferry operator extracts the token, verifying the ownership transfer in a zero-trust model enabling offline payments.

Tokens can be minted under Web 3.0 and then utilized in Web 2.0. An example is to tokenize a satellite image and place it directly into a legacy system or traditional database, cross the internet, and store it in Web 2.0 infrastructure as NFC tags, which can then be scanned. Bills are the main recording mechanism in current barter and in the real world everyone uses a bill payment system.

Automated Market Makers

Enabling digital barter requires a digital exchange mechanism. AMMs form part of DeFi and barter trading ecosystems, facilitating tokenized digital asset trading using decentralized liquidity pools instead of a buyers, sellers, and intermediary market. Stakeholders supply the pools with tokens in return for trading fees. The token price in the pool is determined by a math formula, keeping it at a fixed relative value so buying or selling a digital asset increases or decreases the price.

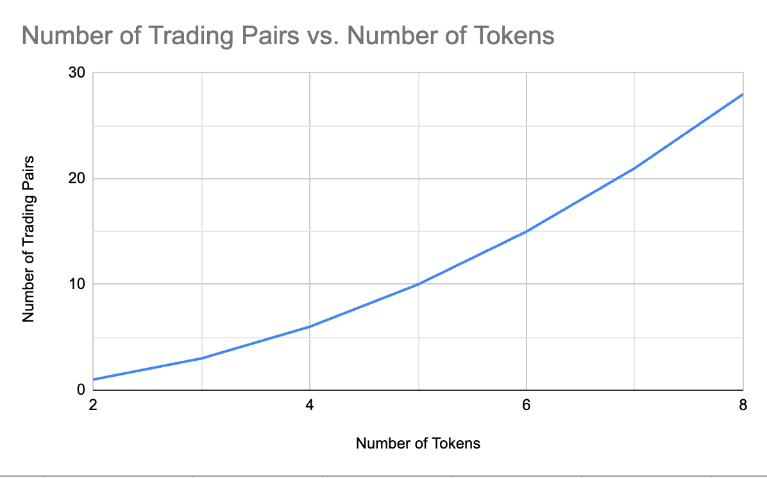

Tokens are staked on an institutional investor’s behalf, providing a tokenized representation of the investor’s staked assets. Market makers facilitate liquidity for trading pairs as underlying protocols power DEXs, helping users directly exchange digital assets. Trading pairs that existed on centralized exchanges are now individual liquidity pools in AMMs, and algorithms combine multiple digital assets into one liquidity pool, setting up a foundation for digital barter.

Source: Balancer Labs

Reimagining the Financial System With Tokenized Barter

The financial system, once relied on and trusted, no longer functions well. National economies are in debt with ongoing risks, and COVID-19 highlighted supply-chain systemic failures. Hyperinflation and stock market volatility is a siren call for communities to revert to original forms of trade. Blockchain-powered scalable barter systems are inversion models for cash-strapped societies as demand is met directly by a supply between two parties (trade pair).

As supply adds more goods and demand adds more people, trade pairs increase, resulting in a complex mesh. Tokenized digital assets have value backed by real asset collateralized stablecoins which are stable by value, not by denomination. Traditional uncollateralized financial products often collapse on economic shocks or downturns and gold and Bitcoin become safe havens as hedges against inflation.

Digital assets translate into liquidity, providing digital barter alternatives to existing monetary systems with scalable matchmaking. In traditional bartering, the recipient often rejects goods offered, leaving the match outstanding. But with digital tokens, physical asset owners can exchange part of the asset for the token. By digitizing (tokenizing) trade pairs blockchain-secured, a mathematical protocol can instantaneously map out maze-like trade routes for the items, identifying all possible exchanges for desired items and selecting the best path. Trust and speed are ensured, as all trades take place simultaneously, cryptographically secured.

If trades don’t happen all at once, they’re backed out automatically using the concept of atomic swap40, an inversion model for direct trade. Instead of relying on a third party or centralized authority to work out the matchmaking, the algorithm does it P2P, making anything tradable for anything in any location. The components exist and are ready for mass adoption. Dijkstra’s Algorithm41 is embedded, which finds the shortest path between trade pairs.

In 2019, research was done in the use of a prototype tokenized barter known as the BarterMachine42, which enables bartering stakeholders to select their own trading patterns. The contract accepts orders in the form of NFT tokens and the quantities to be traded, offering excess tokens as rewards. A digital wallet is used to collect and transfer the tokens in a decentralized exchange (AMM), as shown below. This is valuable research for future digital barter development.

Source: Can Ozturan

Insurance: Token-Based Solutions on Blockchain

In parallel to the barter system, risk pooling was managed two thousand years ago by Indian, Chinese, and Babylonian traders, where sea merchants pooled their goods into a collective fund that would pay out if there was damage to any members’ ships. This became the Lloyds of London model in 1688.43

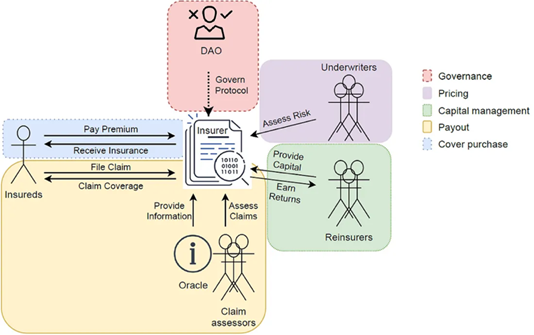

This mutual model today becomes a Web 3.0 protocol-based virtual insurance company (VIC) in a DeFi landscape using embedded insurance44, which guarantees the digital barter by attaching an insurance token to the digital asset. Premiums from liquidity pools can redistribute funds to insureds with approved claims. VIC underwriters assess risk and use AI to determine coverage based on historical and predictive data, linking underwriting to pricing.

Reinsurers provide secondary protection and share in the protocol’s profit. Claims can be approved on chain or off chain with third-party data oracles using parametric insurance45 through a group governance approach, decentralized autonomous organization (DAO), which self-governs the insurance protocol. Insureds pay premium with payment tokens and receive insurance tokens, representing certificates of cover. For a loss event, insureds file a claim to receive payment. The approval or objection of that claim can be handled through automatic DAO data provision or processed manually by human claim assessors as immaturity of oracle technology requires careful oversight to avoid basis risk.

Source: researchgate

Every VIC protocol has a capital model that determines the minimum capital to be held, a metric set to similar standards as European Insurance and Occupational Pensions Authority (EIOPA)’s Solvency II or risk-based capital (RBC), which ensures a confidence level of 99.5 percent in solvency over a one-year period.46

Every insurance product and set of policies is backed by a mandatory amount of reserve capital to ensure claims can be processed. This reserve is provided by insurance premiums and placing a percentage of staked contributions into a reserve pool. The concept of reserve capital is modernized by tokenizing the underwriting process and opening insurance investment to a wider group of investors that provide capital to a portfolio of insurance products offered by a VIC. The diagram below shows a high level of a tokenized VIC insurance protocol.

Source: Simon Cousaert The Block

Tokenization of Assets, Barter, and Carbon Markets With ReFi

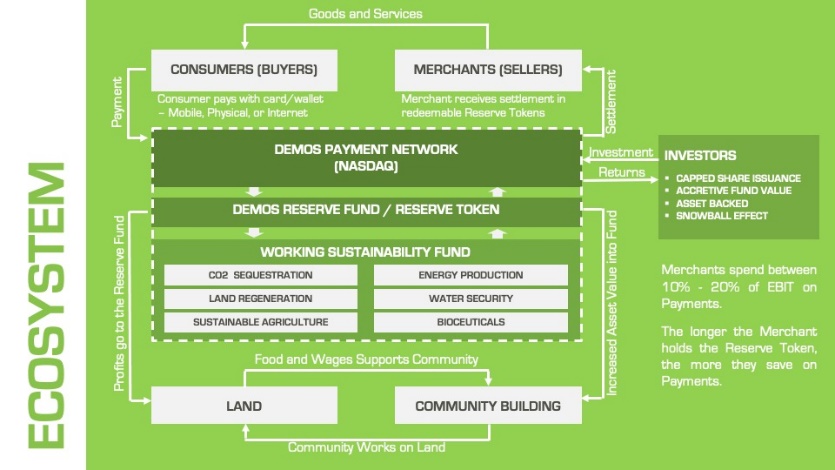

ReFi is a Web 3.0 reglobalization finance model that embraces the environmental, social, and economic impacts of financial decisions, including climate change, financial inclusion, and impact investing. This translates to tokenized digital assets and carbon credits/offsets by taking a community approach to inclusive finance, building resilient carbon supply chains, and mitigating unforeseen shocks.

The DAO governance is a control center, and regulations are at an early stage; but the state of Wyoming has this pari passu with limited companies.47] The example shows a DAO which could represent a digital twin of a rural village, a digital protected cell captive structure, a VIC itself, a digitized regulatory body on the internet, a digital limited company, and more, and is a significant digital insurance model asset.

Source: Ethereum

Value exchanges occur P2P and is an inversion model for inclusive finance and microinsurance.48 Blockchain promotes a mutual and parametric insurance model. Tokenized transparent carbon credits/offsets, proof-of-impact certificates, and community-based tokens can build a regenerative component for carbon neutrality where carbon assets are pooled, traded, and integrated with other Web 3.0 project assets for a frontal assault on climate change.

Digital verification processes monitor project impact which includes land restoration, reforestation, soil health, renewable energy, water conservation, and biodiversity. This unlocks low-interest-rate capital flows to attract impact investors who can transition from linear economic models to circular systems, preserving natural capital. Debt financing against company assets can invest in sustainability offshore renewable energy projects such as wind/wave power, reducing ocean acidification, and strengthening coastal resilience against rising sea levels or extreme weather events. This supplies clean energy and generates jobs for communities. The diagram below shows an example of a ReFi project known as the Demos Platform49, which integrates all these components with payments.

Source: Cranium Ventures

In ancient communities, tribes and societies used barter trade systems when farmers exchanged their crops for other goods. Lack of scale led to the creation and distribution of money, but inversion occurs when it comes to ownership of data and decentralization of that data to digital wallets so tokenized carbon credits/offsets can be used in barter at scale. ReFi aligns with the United Nations’ sustainable development goals (SDGs)50 that are related to conserving the environment. One tradable carbon credit equals one tonne of carbon dioxide, or the equivalent amount of a different greenhouse gas reduced, sequestered, or avoided. Tokenized, validated carbon credits/offsets to back stablecoins as collateral are a carbon currency51-based development in progress.

Virtual Asset Trading Platforms

For digital asset exchange to be effective, regulated platforms are required. Hong Kong recently announced the Virtual Asset Trading Platform (VATP).52 Regulations cover token admission, investor protection, custody, trading, corporate governance, insurance, and anti-money laundering. The online platform facilitates buying, selling, and trading of virtual assets, referring to digital representations of value traded/exchanged, such as cryptocurrencies (for example, Bitcoin and Ethereum), digital tokens, carbon assets, video game virtual currencies, and other blockchain-based Web 3.0 assets.

A VATP is an intermediary between buyers and sellers for a safe setting to trade virtual assets. Order placing, price discovery, market analysis tools, and wallet services for storing and managing virtual assets allow users to trade. VATPs provide liquidity, market access, and a trusted environment for participants as a regulated AMM, bringing transparency on governance and admission of new virtual assets. This aligns closely with custody measures for protection of assets and private keys.

Custody of Virtual Assets as a Precursor for Cybersecurity

2023 was the year of private key hacks53 and the advent of real-world asset tokenization. This is driving regulation and custody protection of private keys.

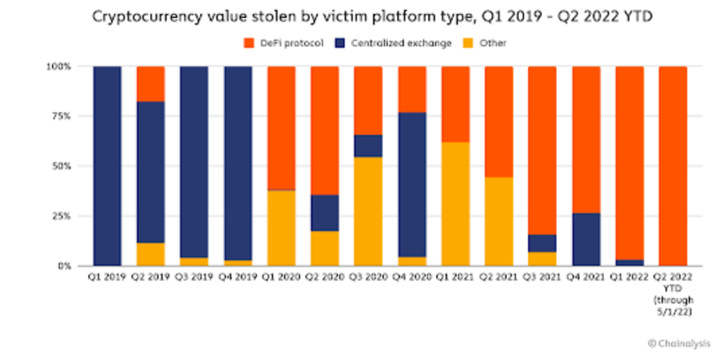

Since early 2022, the amount of funds stolen from cryptocurrency platforms via DeFi protocols increased to $3.8 billion.54 The Poly Network protocol was hacked in an attack resulting in a $611 million55 loss. In 2021 the ISO 23195.202156 standard was introduced to define security for third-party payment providers. The theft of private keys was most prominent in 2023 as attackers transferred assets out of digital wallets to attacker-controlled addresses such as the Mixin Network57 trading platform, which involved the theft of an estimated $200 million due to compromised private keys from a cloud provider attack. Storing digital assets in a hot wallet managed by a single private key is high risk. In Q1 2023 hackers stole $197 million from Euler Finance58, but the funds were recovered.

Custody wallets are traditionally classified as hot (online) and cold (offline). Recently warm wallets have emerged that combine the transactional speed of hot wallets with a layer of security akin to cold wallets. The keys are online and transactions automatic, but human involvement such as biometrics are required to sign the transaction and send it to the blockchain.

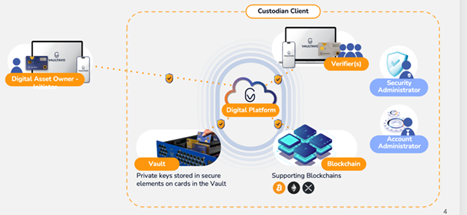

The warm approach is well suited to the growth in the trading platform sector. Best practice is required to get custody of crypto assets and recover lost wallets while restricting backdoor access by malicious actors. There is a benefit of accessing crypto assets through a regulated VATP that uses custody services. The holder of the private key is the crypto asset owner, so protecting the alphanumeric key is critical. Self-custody uses an external hardware device or is owner managed, which is vulnerable to wallet hacks and high risk because blockchain transactions can’t be reversed or altered, so losing the private key loses the crypto asset. Innovations today utilize bank-type cards to get the right level of security, such as Tangem59 and Vaultavo60, which have biometrics and use the digital equivalent of a Swiss safety box utilizing a vault approach for the cards. Warm wallets are fast growing, with many new companies entering the space, and are a vital area for digital asset owners participating in trades.

Source: Vaultavo

The FTX collapse forewarns us of the provenance of assets on exchanges and whether assets are lent out or frozen during bankruptcy. Full-service third-party custody solutions using warm wallets provide best practice security, especially for regulated products such as exchange-traded fund (ETF)61 providers, reducing the risk of loss to investors.

Trusted custodians have a deep understanding of compliance obligations and know how to protect digital assets from cyberthreats. Insurance arrangements cover potential loss of client virtual assets in hot, warm, and cold storage as third-party insurance. This protects against loss arising from hacking incidents on the platform, theft, fraud, or defaults resulting from negligence or human error, to build client confidence.

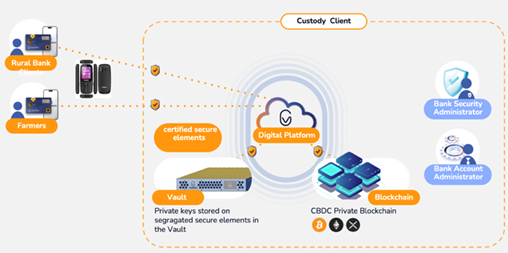

If insurers are reluctant to provide coverage for cryptocurrency-related risks, alternative bank guarantees must be obtained. Applying this to ReFi, community bartering, and financial inclusion, custody protects off-line payments. This is especially prevalent on mobiles in Africa, in accordance with the central banks for farmers, fishermen, and mining communities, as shown below where the same example now operates with communities and CBDC.

Source: Vaultavo

Advancement of Digital Commercial Trading Platforms

Commercial or international barter requires robust systems such as those used in trade finance, where a protection gap exists of US $1.75 trillion62 as a shortfall between supply and demand. The International Finance Corporation (IFC) states the gap is $5.2 trillion.63 SMEs are often omitted as perceived as high risk by banks.

Trade credit is an agreement between a trade pair where one business purchases goods or services from another without paying cash up front, paying later. The XDC blockchain network64 is an open source, carbon neutral, fully regulated enterprise trade finance platform using tokens to fractionalize pools of securitized trading assets, enabling cross-border trades and efficient flow of goods between digitally interconnected trading partners. The trade tokens are interchangeable as each has the same value as similar tokens at trade time and are stablecoins backed by collateralized funds.

The buyer or its bank issues digital tokens to pay the supplier. Tokens convert to cash once they meet a proof of delivery trigger. Suppliers retain uncashed tokens, sell, or pass them down through the supply chain. Once triggered, token holders receive cash, and the tokens are removed from circulation.

XDC adheres to the United Nations Commission on International Trade Law’s Model Law on Electronic Transferable Records (MLETR)65, a cross-border electronic record standard whose adoption is widening. The Asian Development Bank (ADB) actively supports the standard and the Islamic Development Bank Institute (IsDBI)66 has an Organization of Islamic Cooperation (OIC)67 smart countertrade system which facilitates digital transactions between OIC member states, operating under the guidelines of the U.N. Commission on International Trade Law, creating new export/import markets.

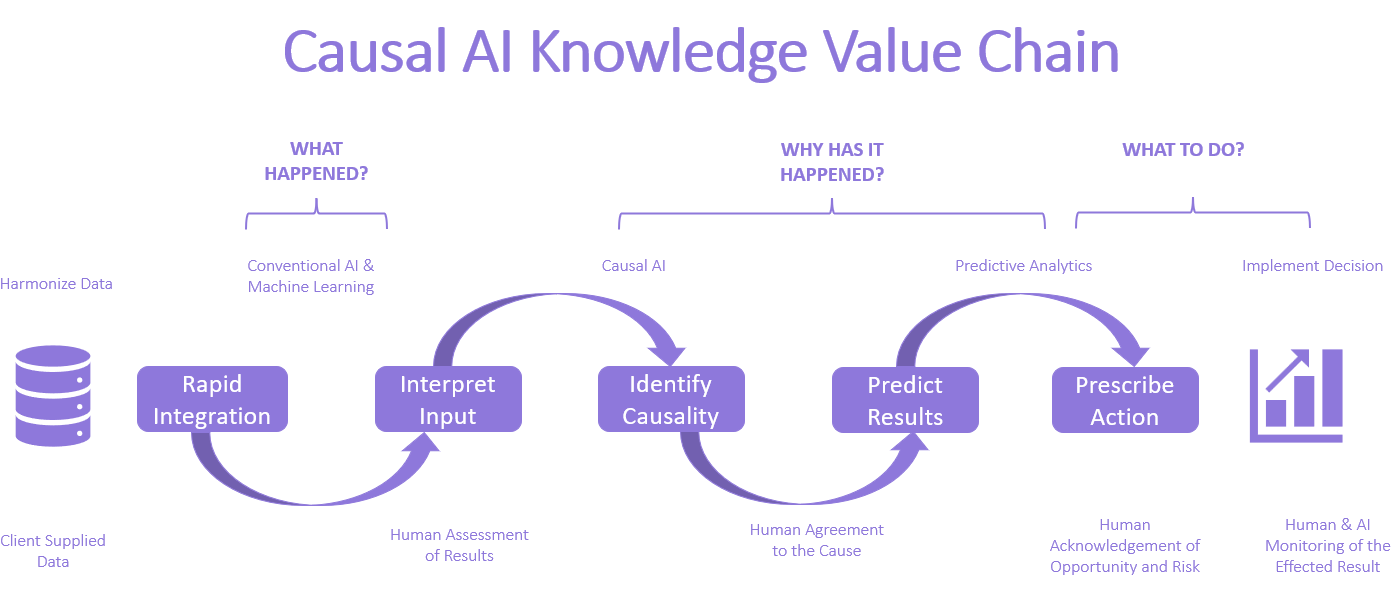

Activity in the trade credit insurance sector is creating digital platforms for financiers and corporations to request insurance with multiple underwriters. An example is LiquidX trade credit insurance marketplace68, which is a virtual trade route across the entire insurance ecosystem. Causal AI can detect trade signals to predict information about the state of the trading market and how it may move, creating triggers for entering or exiting a trade. This extracts knowledge from data, combining human domain expertise and technology to identify causality in the data to help insurance pricing.

Causal analysis predicts future outcomes and back tests and validates those predictions against observed behavior in prior periods. This is an advanced approach to machine learning that focuses on understanding and modeling the underlying causes of the data rather than just the correlations or associations between variables. The relationships between different variables are understood and how they affect each other, making predictions about how a change in one variable affects another variable. This builds fully explainable models for decision making and developing advanced trading algorithms, creating event-oriented predictions to be made along the supply chain. The diagram below shows the steps involved.

Source: Eumonics

Cybersecurity and Digital International Trade

Whichever form of trade is being conducted, the real cyber risk is the ability to verify and authenticate data integrity. Companies claim protection using trusted insiders to manage data using encryption (PKI). Complexity and cost of key management negates authenticating data at rest so without data integrity, all data is naked with no mechanism to verify.

When the internet was created, no one thought about data at rest, only about data in motion; so the concept of an internet information supply chain doesn’t exist. Estonia69 was one country that thought this through using mathematics for formal security of data. This mitigation must be applied to all tokens used in digital trading for cyber-hygiene and preserving privacy.

Mitigating Web 3.0 cyber risk with Web 2.0 tools doesn’t work; so, the distributed cybersecurity mesh architecture70 is used to protect the decentralized trading ecosystem from misconfiguration across protocols, blockchain vulnerability, and reputational risk. Interconnectivity risk across borders in the digital supply chain is a consequential cyber risk as an attack on one part of the chain is a material event to the entire supply chain.

Cyber is a dynamic risk requiring a dynamic response, especially from insurers. Data integrity breaches are serious threats. Frequency/severity models determine if the risk is insured in a captive or through the capital markets in a cat bond71 to mitigate against financial loss, reputational damage, and regulatory/legal consequences. It can take time to detect a breach72, and dwell time of invasion can be as low as 24 hours. Sharing sensitive data with third parties in the supply chain increases cyber risk.

Foreign states or corporations can abuse digital products to collect privacy data or critical infrastructure vulnerabilities, which increases border scrutiny and controls. Any sensor device connected to the internet creates supply-chain risks. Cybercriminals know endpoints are an attack surface, so an average sensor gets attacked as soon as it goes live.73 For devices running industrial systems, a cybersecurity breach can lead to physical damage and bodily harm. Endpoint security is paramount, with energy, utilities, telecommunications, and ports subject to systemic risk.

In November 2023, DP World in Australia suffered a cyberattack74, causing ports to be closed across the country. Ships were unable to get into the port and containers left on the dock, realizing the worst fears that ports are a growing target for cybercriminals. Access to data sharing and use of analytics and machine learning to monitor network activity plays a role in cyberdetection.

Cybersecurity standards can build a common approach to addressing cybersecurity risks based on best practice, such the National Institute of Standards and Technology (NIST) Cybersecurity Framework, based on international standard ISO 27001.75 A global standard, not U.S.-specific, this can be reinforced in trade agreements while minimizing the onus on the import/export process.

The dynamic nature of cybersecurity threats means that regular reassessment of risk is required. Building an effective approach to cybersecurity also requires engaging government and business leaders and building cyber-risk management into the core of corporate boardroom and government practice, closing the gap between business leaders and chief information security officers (CISOs) and making sure they all align on the understanding of the risk.

Cybersecurity, Trade Restrictions, and Geopolitics

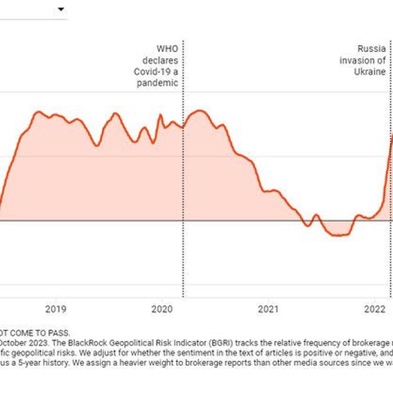

Digitizing the economy changes thinking on competition, IP, taxation, industrial policy, labour, investment, cybersecurity, and trade. Any formal trade relies on the internet, so fresh trade rules can support risk-based cybersecurity regulation while minimizing barriers to trade across countries. Geopolitics and poly-crisis affects trade, as shown by Blackrock; now, with conflict in Middle East, this further affects the global risk indicator exponentially.

U.S. and Chinese cybersecurity measures, plus higher tariffs, restrict cross-border data flows and digital trade on technology products that pose systemic cyber risk along supply chains, with a view to deter cyberattacks. This can breach World Trade Organization (WTO) free trade agreement commitments, forcing governments to invoke a WTO cybersecurity regulation general exception provision, which can disrupt the global security environment.

Cyber is a national security issue, so using trade policy to address cyber risk blurs the line between genuine cybersecurity measures and protectionism. The WTO security exception was designed to address traditional security measures, not cybersecurity. A reset of conflicts of digital trade and cybersecurity is needed to ensure international trade rules are aligned with the policy needs of the digital economy. Commercial trade and cybersecurity are intertwined, so separating concerns of protectionism is key in the interests of world safety.

Digital technologies are transformational, making public and private sectors reliant on resilient digital infrastructures for development of smart cities’ cross-border data flows. The development NEOM76, a new urban area planned by the Kingdom of Saudi Arabia, transforms social and economic activities into data, increasing cyberprotection need. Cyber risks in supply chains of critical industries are threats to the integrity of national critical infrastructure amid 5G networks and intensifying geopolitical tensions. At post-conflict time, Gaza City could be rebuilt as such a smart city along the lines of NEOM.

Cyberleaders across the industry need to articulate cyber risk to their organizations that boardrooms understand. The cybersecurity concerns created by geopolitical fragmentation influences global business operations and executives must understand that geopolitical tension causes bad actors to adapt. Board members must understand how cyber risk affects their supply chains. The threat landscape has become volatile, with professional cybercriminal groups growing with new attack types. Data and cyber integrity are essential in the digital economy to create trust in the digital environment.

Africa and Digital Trade

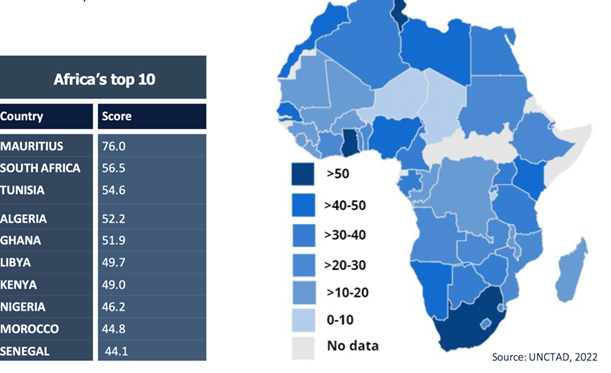

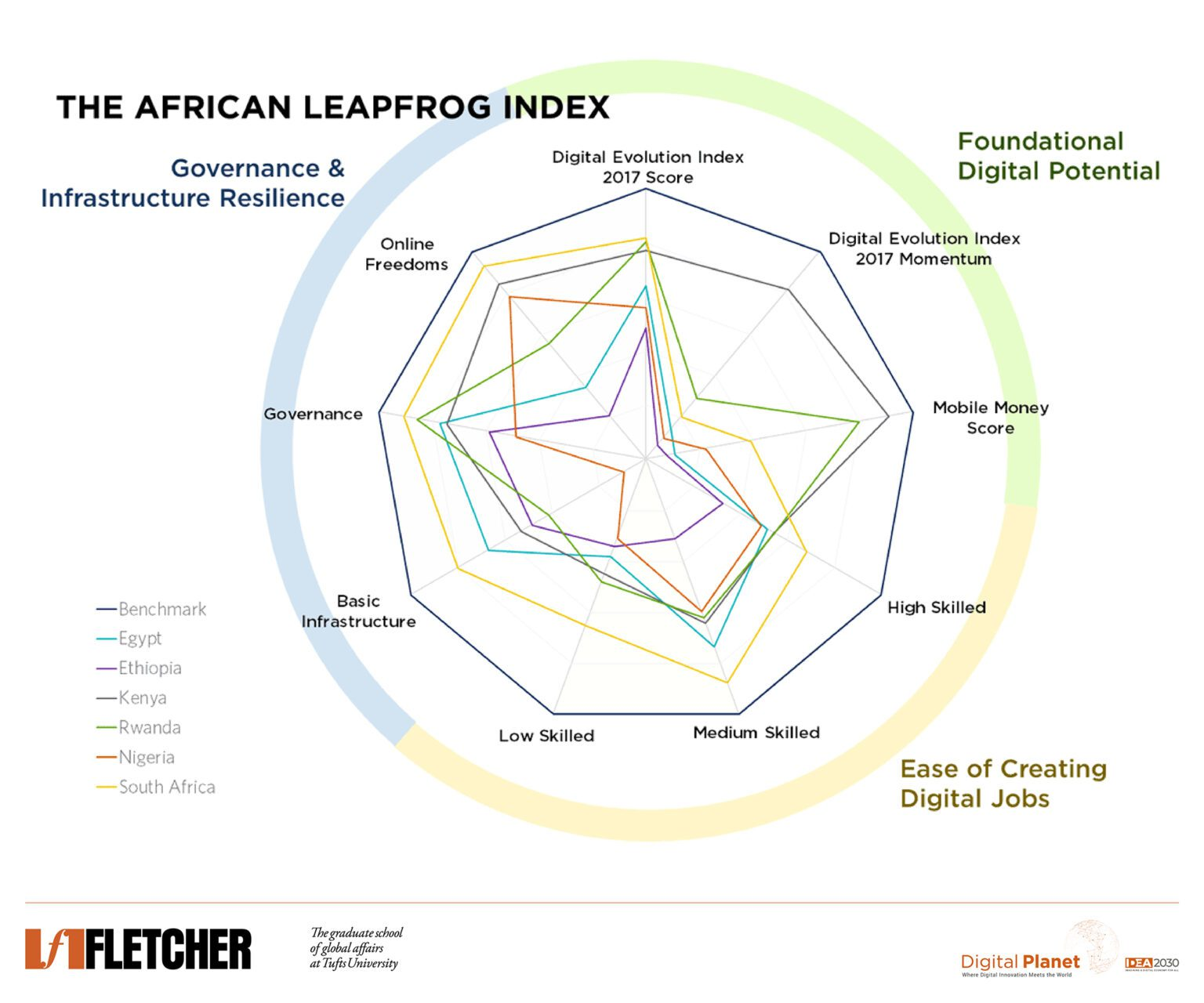

Africa’s leapfrog into digital trade and digital bartering is an arbiter of change. The United Nations Conference on Trade and Development (UNCTAD) released a table of digital readiness in Africa. In 2018, Common Market for Eastern and Southern Africa (COMESA)77 adopted a digital-free trade area (DFTA) which consists of three pillars: e-trade, e-logistics, and e-regulation.

In February 2020, the Executive Council of the African Union endorsed the Digital Transformation Strategy for Africa 2020-2030 (DTS)78 to harness digital technologies and innovation to transform African economies and generate financial inclusion for the continent. This strategy synergizes with ReFi. DTS is expected to trigger digital trade, financial services, agriculture, health, and digital governance, promoting pan-African integration in cross-border e-commerce and digital financial services. Mobile money is an enabler of financial inclusion in sub-Saharan Africa, especially for women, as a driver of account ownership and account usage through mobile payments, saving, and borrowing.

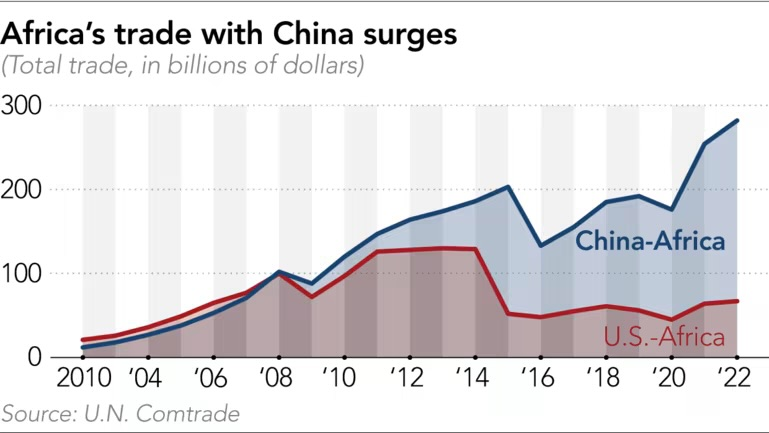

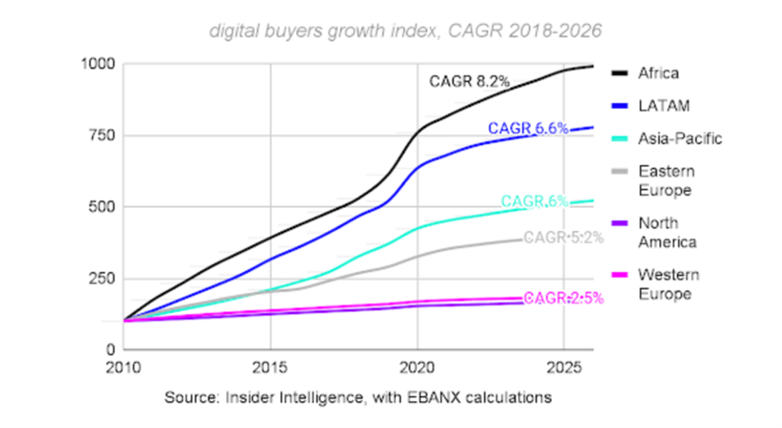

Given this leapfrog and formalized development, Africa has much to gain from the digital economy and digital barter in trade with the developed world, as seen in the chart below.

China/Africa trade was $282 billion in 202279, and a WTO global trade model says digitization will increase African exports by $74 billion to 2040 at a growth of 7 percent per year.80 By 2035, predictions are that exports will grow to $1 trillion.81 Stablecoin is achieving mass adoption. Africa is experiencing socioeconomic challenges coupled with an innovative financial technology sector which saw a 1,200 percent82 uptick in P2P Bitcoin trading volumes in 2020, indicating a growing digital currency appetite.

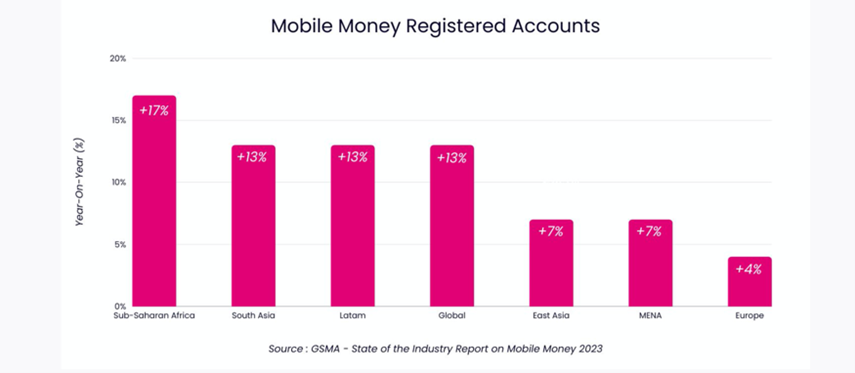

Mobile money is a payment solution built in Africa to provide financial access for the unbanked population. Currently $1.26 trillion83 is transacted annually, predicted to reach $2 trillion in 2027. The technology is accessible to those without internet connections using stablecoins as a frontier to bridge the poverty gap. World Bank says only 43 percent of subSahara Africans have access to formal banking services, relying on remittances, totalling an estimated $100 billion84 in 2023. Cinch Markets85 gives farmers credit advances at low interest rates via DeFi directly to mobile money. Kotani Pay86 facilitates the onboarding and off-ramping to mobile money wallets in local currency.

Conclusion

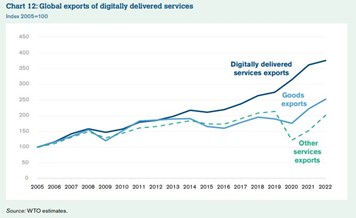

The world needs to reglobalize to a circular economy based on natural regeneration, financial inclusion, and impact investing. A polycrisis has resulted in decline in world trade, protectionism, reduced security, and unleashed inflation that was checked for years because of buoyant world trade and globalization practices. Services are showing resilience, which is a good signal for the rise in digital services for world trade.

This occurred against the backdrop of a pandemic that threatened fragile supply chains which must be de-risked from cyberattacks as they rapidly digitized during COVID. If supply chains or ports are cyberattacked, as 90 percent of goods go by sea, food security is threatened. Recent attacks on ports shows this to be reality.

The irony is that technology has matured to a tipping point so the barriers that existed in the globalized world are now solvable. But geopolitical trade exceptions are being invoked to prevent competition and sharing of innovation. This could slow down advancements in quantum computing, which is a technology addressing major risks of finding new renewable energy sources and addressing critical disease cure.

No one country can approach these issues in isolation. The global digital growth is headed by Africa, which is leapfrogging the world in trade innovation. Reglobalization will promote diversification in trading partners, boost resilience, and mitigate countries using trade exceptions or weaponizing trade policies. Global problems require global solutions, greener trade methods, and digitally delivered services.

The world is on the brink of inverting to a digital society, but in a fragmented fashion.

Inversion Model 1—Digital barter or countertrade with scalable cross border technology is a reality given the state of the world economy and protectionism, not to mention the 2024 expansion of BRICS87 (the combined economies of Brazil, Russia, India, China, and South Africa) with six new countries. A significant driver in digital bartering across borders is the exchange of tokenized assets leading to an alternate financial inversion model with no fiat money but use of stablecoins and CBDC backed by insurance tokens as a guarantee.

Payment methods here draw tokenization parallels with historical bartering practice, adding loyalty points and use of data ownership for discounts; but the concept remains the same in the modern economic scenario as products and services are still exchanged.

Although barter is associated with economic downturns, the solving of scalability means it’s here to stay in digital form. The barter economy during the GFC was $3 billion.88 Digital bartering will help restore the GVC and improve economic convergence, as digitally delivered services are more resilient. Globalization led to poverty reduction as offshoring brings in grass root supply chains; but now this is undergoing a potential reversal.

Inversion Model 2: Fourth Industrial Revolution (Web 3.0)—Blockchain technology is well past the hype and disillusionment phases and is accelerating toward mainstream adoption, with international standards providing hope for reglobalization. When implemented properly, this brings stability to data integrity to address cyberhygiene, as cybersecurity is a major risk. Blockchain provides embedded plumbing and wiring under the hood, similar to the internet network (TCP/IP) and does not need to be understood by the user.

The internet, invented for academic exchange and to restart civilization after nuclear attack, lacked a security layer. Cryptographic technology via Estonia89 had to be wrapped around the internet as a lie detector for data. Embedded blockchain is a basis for balanced regulation of crypto and decentralised networks platforms, especially around trade and tokenization. Web 3.0 via DeFi provides new data asset classes and liquidity on a cross- border basis. It provides a new global financial model based on less cash and more digital money at government levels, but wide adoption of collateral-backed stablecoins for financial markets. This is the springboard for regenerative finance.

Web 3.0 brings scale to digital trade by using tokens attached to real-world assets. DeFi is a marketplace processing millions of trade pairs in real time, immutably and atomically swapped. This enables cash-strapped countries to continue trading without money leaving the country, and an attachment point to bridge the divide between the current downturn and reglobalization. With the blockchain “plumbing” in place, the taps are turned on to trade securely and openly, guided by advancements in AI.

Predictive analysis and back testing are part of all models, whether they be catastrophe, climate, or dynamic financial analysis, stretching beyond historical probability. The evolution of third-wave AI and causal AI leads to better explanations for regulators and third parties, leading to accurate parametric insurance solutions that look at underlying cause of the existing and emerging perils.

Inversion Model 3:Regenerative Finance—ReFi encompasses climate change and financial inclusion (poverty) and impact investing aligned to the major world risk issues being worsened by deglobalization. ReFi is the face of reglobalization and not only addresses climate change through circular supply chains at the grass roots up level but brings the underserved into the global financial model.

Previous efforts such as micro insurance failed because of technology immaturity, inability to monetize small-ticket items, and scalability. Emerging nations can leapfrog and invert the world status quo by operating on a P2P basis at village community level. Few technical barriers exist; just a willingness to innovate and improve lives with a safety net.

African countries and the Philippines invented mobile money to get their citizens operating in an offline secure payments environment to kickstart their economies. Tokenization in the form of money and goods/assets is the way to trade digitally, and tokenizing bills for efficient offline payments off chain with security on chain may prove to be the key to reglobalization.

Bitcoin as a currency is limited edition and becoming a reserve digital currency; but carbon digital currencies are also emerging in the same vein. New technologies help convergence of trade: railways, steam, electricity, internet e-commerce, and now Web 3.0 to combat near-shoring, on shoring, decoupling—all of which are likely to bring concentration risk to the GVC and global supply chains.

Morai Logistics

Inversion Model 4: Digital Money—Regulations such as the Markets in Crypto-Assets Regulation (MiCAR)90 in the European Union toward CBDC and stablecoins are looking favorable in 2023 as laid out in the PricewaterhouseCoopers (PwC) digital money report.91 CBDCs are wholesale from central banks but have retail forms to engage citizens.

Challenges to these currencies are around the blockchain challenges of speed, scalability, and transaction fees on the platforms. There are alternative approaches using blockchain layer 192 solutions using bills as monetary units or carbon backed currencies.

Cash is declining; as PwC points out, 93 percent of central banks are currently engaging in CBDC. Digital money is emerging and is irreversible. Stablecoins, issued as private offerings, are getting recognition as faster and cost-effective solutions for cross-border payments and remittances, transforming how funds are sent and received, operating effectively in developing countries for financial inclusion and allowing SMEs to access capital through P2P lending platforms.

For trade, stablecoins enable secure and transparent supply chain finance, ensuring timely payments to suppliers. This provides a solution to the problem of SMEs being excluded by banks and causing a trade protection gap to widen. An example is Mojaloop93 in East Africa, which includes SMEs in digital trade. This extends further than Africa as can be seen by the growth of mobile money below.

Statistics show that market capitalization of stablecoins has reached $180 billion94, with a cumulative value of $7 trillion settled, according to 2022 figures.95

These are just four of many inversion models to be identified in global trade. The emergence of a global digital economy brings multiple challenges to governments. Value crosses borders in real time and colocation isn’t needed in the business-to-consumer relationship. Digital transformation has reduced the costs of engaging in international trade, enabled the coordination of GVCs96, but has invoked complex international trade transactions and geopolitical issues.

Underpinning digital trade is data in motion, a tradable asset itself, and a mechanism to deliver services through a GVC. Data at rest, which has reached its destination and is not being used, is a cyber risk. It’s important to have data integrity where the metadata travels with the data, but the data remains in the country of origin for verification. Digitally deliverable services are those that can be delivered remotely over computer networks. Many developing countries lack adequate infrastructure and financial resources to tap the potential of digitally delivered trade. Goods produced by 3D printing could cross a border as a design service and become a goods item at point of consumption.

Trade and cybersecurity are increasingly intertwined. Disentangling national security from trade policy is difficult in the current geopolitical environment, leading to trade barriers and implementing WTO exemptions. Telemedicine and education across borders post pandemic are examples where useful new forms of regional trade are complementing the old. Digital bartering is already happening and asset exchange without fiat money is occurring between China and Africa and other countries such as the Middle East to Asia, and at a regional level.

The author would like to thank Mike Gault, Tony Horrell, and Philip Meyer for their contributions to this paper.

References

1https://www.weforum.org/agenda/2023/05/young-global-leaders-reglobalization/

2https://www.investopedia.com/what-is-regenerative-finance-refi-7098179

3https://www.plataine.com/glossary/what-is-circular-manufacturing/#:~:text=Circular%20manufacturing%20or%20circular%20economy,economy%20instead%20of%20discarding%20them.

4https://coinmarketcap.com/academy/glossary/digital-barter-economy

5https://ipwe.com/

6https://www.iasplus.com/en/standards/ias/ias38

7 https://www.sciencedirect.com/science/article/abs/pii/S0304406810000522

8https://www.wto.org/english/thewto_e/history_e/history_e.htm

9https://www.baggl.com/what-is-corporate-barter/

10 https://www.researchgate.net/publication/370954631_The_Reincarnation_of_Barter_Trade_Barter_Economy

11https://odi.org/en/insights/more-action-is-required-to-lower-the-costs-of-remittances-through-mobile-money/

12https://www.uneca.org/stories/african-group-of-negotiators-consolidate-common-draft-position-in-lead-up-to-cop-27

13https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization

14https://en.wikipedia.org/wiki/2007–2008_financial_crisis

15https://www.irta.com/about/the-barter-and-trade-industry/

16https://www.pbslearningmedia.org/resource/ket-earlychild-ss2/lets-trade/

17 https://www.economist.com/business/2002/02/07/juicy-stuff

18https://www.binance.com/en/blog/nft/nft-loans-how-to-use-your-nfts-to-borrow-crypto-731716857816869668#:~:text=Binance%20NFT%20Loan%20is%20a,selected%20blue%2Dchip%20NFT%20projects

19https://app.ginoa.io/

20 https://blur.io/

21https://beincrypto.com/blur-nft-marketplace-dethrones-opensea-months-launch-how/

22 https://www.investopedia.com/what-went-wrong-with-ftx-6828447

23 https://neoswap.xyz/

24https://wearetechwomen.com/with-10-trillion-in-digital-payments-expected-over-2023-we-need-fairer-systems-today/

25https://www.mckinsey.com/industries/financial-services/our-insights/the-2023-mckinsey-global-payments-report

26https://www.cib.barclays/our-insights/should-the-federal-reserve-create-fedcoin.html?cid=paidsearch-textads_google_google_themes_fedcoin_apac_research_fedcoin_nonbrand_402562939917&gad_source=1&gclid=EAIaIQobChMI_sjltcLFggMVDaqWCh0u4ACqEAAYASAAEgI45vD_BwE&gclsrc=aw.ds

27https://en.m.wikipedia.org/wiki/Bartercard

28 https://bartercard.com/

29https://qoin.world/

30https://www.premiumtimesng.com/promoted/636689-flutterwave-launches-earth-day-pledge-partners-africa-upcycle-community-to-celebrate-2023-sustainability-week.html

31https://cioafrica.co/microsoft-announces-partnership-with-flutterwave/#:~:text=Through%20the%20new%20collaboration%2C%20Microsoft,small%20businesses%20across%20the%20continent.

32 https://en.wikipedia.org/wiki/Pix_(payment_system)

33https://www.gcash.com/

34https://bitcoin.org/en/

35https://ethereum.org/en/

36https://alphabill.org/

37https://news.microsoft.com/en-xm/2023/10/12/microsoft-partners-with-flutterwave-to-power-payment-innovation-in-africa/

38https://www.linkedin.com/pulse/5-transformative-impact-stablecoins-economic-growth-africa

39https://moralis.io/ultimate-guide-to-token-metadata/

40 https://blog.chain.link/atomic-swaps/#:~:text=Atomic%20swaps%20are%20a%20way,the%20multi%2Dchain%20Web3%20ecosystem.

41 https://neo4j.com/docs/graph-data-science/current/algorithms/dijkstra-single-source/?utm_source=google&utm_medium=PaidSearch&utm_campaign=GDB&utm_content=APAC-X-Awareness-GDB-Text&utm_term=&gad_source=1&gclid=EAIaIQobChMIj82TrefMggMVyA17Bx2RnwfBEAAYASAAEgJvm_D_BwE

42 https://www.researchgate.net/publication/342218380_Barter_Machine_An_Autonomous_Distributed_Barter_Exchange_on_the_Ethereum_Blockchain/download?_tp=eyJjb250ZXh0Ijp7ImZpcnN0UGFnZSI6InB1YmxpY2F0aW9uIiwicGFnZSI6Il9kaXJlY3QifX0

43https://www.investopedia.com/terms/l/lloyds-london.asp#:~:text=With%20its%20roots%20in%20marine,them%20with%20reliable%20shipping%20news.

44https://insuranceblog.accenture.com/embedded-insurance-brief-overview

45https://corporatesolutions.swissre.com/insights/knowledge/what_is_parametric_insurance.html

46 https://www.eiopa.europa.eu/browse/regulation-and-policy/solvency-ii_en#:~:text=Solvency%20II%20is%20the%20prudential,protection%20of%20policyholders%20and%20beneficiaries.

47https://wyomingllcattorney.com/Blog/What-is-a-DAO#:~:text=A%20DAO%20or%20Decentralized%20Autonomous,on%20the%20type%20of%20DAO.

48https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2434501

49https://www.craniumventures.com/

50https://sdgs.un.org/goals

51https://globalcarbonreward.org/carbon-currency/

52https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=23EC28

53https://cointelegraph.com/news/700-m-loss-crypto-hacks-exploits-scams-q3-certik

54https://www.chainalysis.com/blog/2022-biggest-year-ever-for-crypto-hacking/#:~:text=In%20last%20year%27s%20Crypto%20Crime,up%20from%2073.3%25%20in%202021.

55https://decrypt.co/147059/poly-network-attack-conjures-billions-of-dollars-in-tokens-that-did-not-exist

56https://www.iso.org/news/ref2698.html

57https://www.bleepingcomputer.com/news/security/mixin-network-suspends-operations-following-200-million-hack/

58https://www.chainalysis.com/blog/euler-finance-flash-loan-attack/

59 https://tangem.com/en/?promocode=SECRETSALE&utm_source=google&utm_medium=cpc&utm_campaign=ag:tangem%7Cnetwork:google%7Cplt:search%7Csem:brand%7Csem1:all%7Cformat:tgb%7Cgeo:all%7Cdev:all&utm_term=tangem%7Ckwd-1168514846331&utm_content=cid:20781456131%7Cadid:680991479919%7Cgid:155321737323%7Ctgid:kwd-1168514846331%7Csrc:%7Cdev:c%7Cpn:%7Ckeyword:tangem%7Cmt:e%7Cexpansion:%7Csite:%7Ccsite:%7Cdevmod:%7Clockw:%7Clocphy:9069537%7Cnw:g&gad_source=1&gclid=EAIaIQobChMItZDHtYfNggMVlNkWBR21cwvSEAAYASAAEgIO-fD_BwE

60https://vaultavo.com/

61 https://www.blackrock.com/hk/en/ishares/education?cid=ppc:sem_hk_nb_ish_etf_2023_eng:ish:google:nonbrand_nonprod:ei&gclid=EAIaIQobChMIwK7okorNggMVwd8WBR0PrQuzEAAYASAAEgIkZ_D_BwE&gclsrc=aw.ds

62https://www.adb.org/news/global-trade-finance-gap-widened-17-trillion-2020

63https://www.worldbank.org/en/topic/smefinance

64https://xdc.org/

65https://www.tradefinanceglobal.com/posts/status-update-mletr-adoption-in-the-g7-and-emerging-markets/

66https://www.isdb.org/

67https://www.oic-oci.org/home/?lan=en

68https://www.liquidx.com/

69https://klauberg.legal/wp-content/uploads/2023/08/newsletter_august_estonia_data-protection-in-estonia.pdf

70https://naorisprotocol.com/

71https://www.artemis.bm/news/beazley-cyber-cat-bond-hits-the-market-75m-polestar-re-ltd/

72https://www.ibm.com/reports/data-breach

73 https://www.netscout.com/threatreport

74 https://www.bleepingcomputer.com/news/security/dp-world-cyberattack-blocks-thousands-of-containers-in-ports/

75https://www.itgovernanceusa.com/iso27001-and-nist

76https://www.neom.com/en-us

77 https://www.comesa.int/

78 https://au.int/en/documents/20200518/digital-transformation-strategy-africa-2020-2030

79 https://www.scmp.com/news/china/diplomacy/article/3207403/china-africa-trade-hits-record-us282-billion-boost-beijing-and-soaring-commodity-prices

80https://unctad.org/system/files/official-document/aldcafrica2023_en.pdf

81https://www.sc.com/en/media/press-release/africas-total-exports-expected-to-hit-close-to-usd1-trillion-by-2035-standard-chartered-report-reveals/#:~:text=Chartered%20report%20reveals-,Africa%27s%20total%20exports%20expected%20to%20hit%20close%20to%20USD1,2035%2C%20Standard%20Chartered%20report%20reveals

82https://www.linkedin.com/pulse/5-transformative-impact-stablecoins-economic-growth-africa

83https://www.digitalvirgo.com/5-key-points-about-the-mobile-money-market-in-2023/

84https://www.un.org/osaa/news/reducing-remittance-costs-africa-path-resilient-financing-development#:~:text=The%20strategic%20importance%20of%20remittances%20to%20Africa&text=Over%20the%20last%20decade%2C%20remittance,Foreign%20Direct%20Investment%20(FDI).

85 https://www.idhsustainabletrade.com/publication/ldn-insights-cinch-markets/

86 https://kotanipay.com/

87https://www.usip.org/publications/2023/08/what-brics-expansion-means-blocs-founding-members

88https://dergipark.org.tr/tr/download/article-file/370257

89https://e-estonia.com/solutions/interoperability-services/x-road/

90https://www.ftitechnology.com/resources/blog/micar-an-overview-of-everything-important-about-the-crypto-regulatory-framework#:~:text=MiCAR%20aims%20to%20regulate%2C%20simplify,a%20uniform%20set%20of%20rules.

91https://www.pwc.com/gx/en/financial-services/pdf/pwc-global-cbdc-index-and-stablecoin-overview-2023.pdf

92 https://www.blockchain-council.org/blockchain/blockchain-layer-1-vs-layer-2/?gad_source=1&gclid=EAIaIQobChMI2JStmK3RggMVZAt7Bx1GFggGEAAYASAAEgLIhPD_BwE s

93 https://mojaloop.io/

94https://cointelegraph.com/news/total-stablecoin-supply-hits-180-billion-report#:~:text=Move%20aside%20Bitcoin%20(BTC),,in%20the%20past%2030%20days.

95https://cryptoslate.com/adoption-grows-as-more-than-7t-settled-with-stablecoins-in-2022/

96 https://www.oecd.org/trade/topics/global-value-chains-and-trade/

1.2024

About the Author:

David Piesse is CRO of Cymar. David has held numerous positions in a 40-year career including Global Insurance Lead for SUN Microsystems, Asia Pacific Chairman for Unirisx, United Nations Risk Management Consultant, Canadian government roles and staring career in Lloyds of London and associated market. David is an Asia Pacific specialist having lived in Asia 30 years with educational background at the British Computer Society and the Chartered Insurance Institute.