Retiring is Exhausting

Click here to read Ronald Klein's bio

The Three-Legged Stool

The life insurance industry prides itself on preparing people for retirement. It offers life insurance to protect policyholders from the financial consequences of the pre-mature death of a breadwinner. It offers disability products to protect policyholders from the financial consequences of pre-retirement disability. And, it offers annuities to protect policyholders from outliving their assets post-retirement. These products would typically fall into the category of the third pillar in most countries. In the US, it would be referred to as the third leg of the three-legged stool or personal savings.

Employers also prepare employees for retirement by offering tax-advantaged savings plans and, in many cases, death and disability benefits. This is typically referred to as a work pension or Pillar II. Social Security offers a monthly payment to eligible retirees, disability benefits before retirement and even a small death benefit in some cases. Other countries refer to this governmentally provided benefit as Pillar I (see Figure 1 below).

Figure 1: Three-Legged Stool of Retirement

Source: Personal Illustration

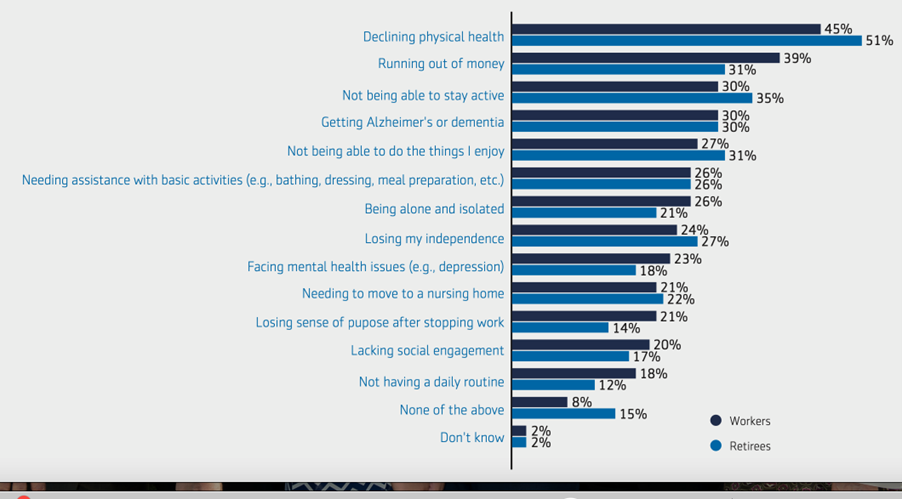

With all of these sources of saving for retirement available, it is interesting that 39% of pre-retirees surveyed are concerned about running out of money during retirement, according to the 2021 Aegon Retirement Readiness Survey (see Figure 2)[1]. What is even more interesting is that this percentage drops to 31% for retirees. This decrease could simply be a fear of the unknown for pre-retirees, it could be because retirees will know what their retirement income and assets are and can live within their means or it could be a combination of both. There is another possible reason. The number of decisions that must be made by the average retiring individual are so complicated that after researching all of the alternatives, the retiree finally understands his or her financial position. This transition of an 8 percentage-point drop for retirees versus pre-retirees will be explored in a case study below. I have just gone through this exercise personally and will use my own experience to highlight some of the issues and opportunities for the life insurance industry.

Figure 2: Retirement Concerns

Source: Aegon Retirement Readiness Survey 2021

Actuaries Can Actually Help

As I approach the ripe old age of 65, it is finally my turn to retire. Sure, I will continue to accept work from clients. I also expect to continue to support my professional organizations through volunteerism and I will attend professional meetings to keep up with education requirements. But beginning next year, the bulk of my income will be from retirement earnings.

Retiring, however, is exhausting. I have been fortunate to have had a long career working for some of the largest insurance and reinsurance companies in the world. Because I began my career in 1980, I am also fortunate enough to have been a member of some defined benefit pension plans. One would think that being a participant in a defined benefit pension plan would be easy. Turn 65, sit back and collect. It is not that simple.

Being an actuary does not make one the most exciting person at a party. My friends that are lawyers, accountants, salespeople, teachers and doctors have all offered advice and services to others. There are always questions about legal matters, taxes, and medical issues. My friend who worked for Nike was able to get that sold-out pair of sneakers or a free t-shirt. And, my friends that are teachers always have something interesting to tell us and always have great stories about students or their parents. Not many people care to ask about life insurance to the actuary in the group.

Things changed, however, as my friends neared retirement. Questions began to pour in. “My company is offering a buyout of my pension plan. Should I take it?” “Should I defer my Social Security benefits until age 70?” “How much should I draw from my 401k plan (Pillar II)?” These are all good questions and I really enjoyed being “needed” by my friends, finally. While each situation is different, I am never a fan of taking an offer of a lump sum. The first question I ask is, “what will you do with the money?” The longer it takes to answer the question, the faster I respond with “take the annuity.”

Too Many Choices Can Be Confusing:

In a recent discussion with a younger friend on this topic, my friend said that he would always take the lump sum. He explained to me that if he died the next week, he would get nothing. I had to explain to him that he would be dead and get nothing either way. If you want to provide for your family if you die, there is a product for that called life insurance. We should remember as an industry not to mix up life insurance, which provides benefits for your family if you die prematurely and an annuity, which provides monthly income while you and/or your spouse are alive.

Last month, I was approached by the employer for which I worked longest in my career with an offer of a lump sum buy-out of my defined benefit pension. To many people, this lump sum looks like a lot of money. Luckily my wife and I are both actuaries and understand that the lump sum gets a lot smaller when spread over our lifetimes. And, what would I do with the money? So, we summarily dismissed this option. But then the next set of questions came up. Would I like to retire six months early for a slightly smaller monthly benefit? Would I like a single-life annuity, a 50% joint-and-survivor, a period certain annuity, a joint-and-50% annuity (where the monthly benefit would reduce to half upon the death of either my spouse or me) or some other option not mentioned? Yes, this was actually one of the options. “If you would like an annuity option not offered, please contact us.”

Being an actuary, the first thing I did was choose a mortality table and interest rate and then check the calculations. All of the annuity options were virtually identical, actuarially speaking. The lump sum, however, had a value of about 85% of the annuities. Hmmmmmm. It looks like someone is trying to release a liability. Then my wife and I had to make the decision. It finally came down to a decision between the joint-and-50% annuity and the single life annuity.

You may ask why we would consider a single life annuity when US law mandates at least a 50% joint-and-survivor annuity without spousal consent. The argument was that if I die early, we currently have life insurance to cover it. To me, a 50% joint-and-survivor annuity is actually a single life annuity plus a deferred contingent annuity. Was it worth the reduction in monthly income to purchase this deferred contingent annuity? What if we decided to cash in the life insurance policy at some point? These are the issues that my wife and I discussed at length. With no emotion. Like two actuaries.

In a few months, I am certain that we will have some of the same decisions to make for the remainder of my defined benefit plans. At least we did a lot of the groundwork. But then other decisions will arise. At what age should I begin to receive Social Security benefits? Since I live in another country, I must make the same decision on the local Pillar I benefits. We also have some 401k plans that will need decisions – should we purchase an annuity or withdrawal monthly amounts (and, if so, how much)? Finally, do we cash in our life insurance policies or continue them?

Some of you reading this will say that we are very fortunate and that everyone should have such “problems.” That is not the point. The point is that if these are difficult decisions for a bunch of actuaries, how is the average person supposed to understand all of the options and make the correct decisions?

The average 40-year-old will not be interested in learning about retirement options. He or she is too concerned with supporting himself or herself and the family. There are other concerns such as aging parents to assist and to which schools to send the kids. Retirement seems a far way off. But a good financial plan takes years of savings and a huge commitment. It also takes strong financial literacy, something that is just not taught is schools.

Insurance Associations Can Help

The life insurance industry must re-double its efforts to educate employees about the benefits that their companies offer and where, if any, gaps exist. This education should include the options that workers will face at retirement and which of those options should be elected depending upon the situation. To make sure that the classes do not appear to be biased, the instructors should probably not be life insurance agents. There will be plenty of time for agents to become involved. The goal at this point is education, not sales.

Worksite marketing does exist, but how many of you reading this article have had an agent at your place of employment explain retirement options? This effort would be better led by industry associations such as the American Council of Life Insurers in the US, the Association of British Insurers in the UK or Fédération Française des Sociétés in France. These associations could get volunteers from the industry to educate employees in person using a standard set of materials. Online sessions would also work and can be required learning as are anti-money laundering, sexual harassment and ethics courses are today.

With the recent passage of the SECURE Act 2.0 in the US, it will become easier for 401k plans to offer in-plan annuitization of funds with the purchase of a Qualified Longevity Annuity Contract (QLAC). Until the SECURE Act, purchasing an annuity with 401k funds would be considered a withdrawal of funds and taxed immediately. The QLAC may be purchased with pre-tax funds, within limits, which are taxed when benefits are received. A similar option is very common in Europe. For example, in Switzerland, Pillar II savings have a mandatory minimum annuitization percentage (a percent that is multiplied by the total fund to determine the annual annuity currently set at 5%) for the required minimum contribution amount. It assures retirees of lifetime income at a fair rate. And, the entire fund can be annuitized and only taxed as benefits are received. The US could also require a minimum annuitization percentage and this would take pressure off of the individual to make decisions that he or she may not be able to fully understand.

Sometimes options are good. But if there are too many options and these options are complex, they will not be perceived as helpful. Social Insurance Benefits are quite basic and easy to understand. Contributions are mandatory. The contribution rate is set. Benefit payments are pre-determined. The only real decision to make is at what age to retire. Perhaps the US could learn from Europe and have fewer options for a set mandatory basic work pension or 401k. Contribution rates should be mandatory and payout rates should be pre-determined. For contributions in excess of the basic amount, companies and employees could have more options. With the passage of SECURE Act 2.0, it appears that the US is moving in the correct direction.

In the interim, life insurance associations around the world need to step up with educational opportunities at the workplace, online and perhaps at social events. These unbiased classes could assist pre-retirees to better understand the options and give more individualized attention. This will surely benefit the life insurance industry and, therefore, would be an excellent use of member dues. Better education and better regulations could help ease the complicated decisions facing retirees. If the life insurance industry can achieve this, perhaps a future Aegon Retirement Readiness Survey will show only 20% of pre-retirees are concerned about running out of money during retirement and even fewer retirees. And then, maybe retiring will not be so exhausting.

10.2022

[1] https://www.aegon.com/siteassets/the-new-social-contract-future-proofing-retirement.pdf