Bridging the Protection Gap with Embedded Insurance & Super Apps

Adrian Hill, Chief Digital & Consumer Officer, MSIG Asia

Lessons from Southeast Asia

Market Context

Banking and Digital Financial Services in Emerging Markets

Like many emerging markets around the world and even some developed markets with large, underserved populations like China or the US, Southeast Asia is Underbanked and Underinsured.

Despite the rapidly growing middle-class, traditional financial service adoption in Southeast Asia remains massively underpenetrated… if measured by traditional definitions.

Of the 12% of population added to the middle-class, more than half (56%) are informally employed [1] and therefore not eligible for the traditional banking criteria created for a salaried worker. Compounding this; card fees, minimum balances, low interest rates and clunky ‘proprietary’ mobile apps leave the traditional white-picket fence dream of opening a bank account and approval for a credit card, inaccessible and frankly, unappealing.

Instead, consumers in Southeast Asia are adopting e-wallets on a mass-scale and displacing cash and cards for more convenient digital payments options. A 2024 study found e-wallet usage in Southeast Asia averaged 79% and has seen over 300% growth in users between 2020 and 2025 — the fastest globally [2]. The Philippines leading (63%), followed by Malaysia (55%), Indonesia (49%), Thailand and Singapore (~45%), and Vietnam (32%) [3].

Globally, total mobile wallet usage is growing rapidly and projected to exceed 50% of world population by 2025 [3], but growth is slower in mature markets like North America and Western Europe, where nearly everyone has a bank account with comprehensive services and card-based wallets like Apple Pay are predominant and incremental, not transformative.

Furthermore, the proliferation of fintech through government-backed QR payment standards, Buy Now Pay Later instant credit and affiliate loyalty schemes are providing the foundation for digital ecosystems… and SuperApps!

SuperApps

A SuperApp is a mobile or web application that provides users with a wide range of services within a single platform, effectively acting as an all-in-one digital ecosystem. Instead of switching between multiple apps for different tasks, users can access various services like messaging, e-commerce, transportation, and financial transactions all within the SuperApp.

Notable Examples of Asia’s largest SuperApps [4]:

- WeChat (China): 1.3bn Monthly Active Users

Originally a messaging app, WeChat has expanded to include a vast array of services, including payments, e-commerce, and social media. - Paytm (India): 300m Monthly Active Users

Paytm started as a digital payments platform and has expanded to offer services like e-commerce, financial services, and entertainment. - Gojek (Indonesia, Southeast Asia): 170m Monthly Active Users

Gojek began with ride-hailing and has expanded to offer a wide range of services, including food delivery, payments, and logistics. - GCash (Philippines): 94m Monthly Active Users

The top finance app and largest cashless ecosystem in the Philippines. Users can easily purchase prepaid airtime; pay bills, send and receive money anywhere in the Philippines, purchase from over 6 million partner merchants and social sellers; and get access to savings, credit, loans, insurance and invest money. - Grab (Singapore, Southeast Asia): 46m Monthly Active Users

Similar to GoJek, Grab started as a ride-hailing service and has grown into a SuperApp with services like food delivery, payments, and financial services.

Most notably, these digital ecosystems and SuperApps have been offering traditional banking and investment services to their customers... without being included in traditional banking penetration statistics.

The Protection Gap miscorrelation

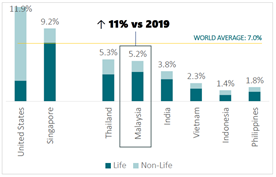

Beyond the disruption of traditional financial services, one statistic is both undeniable and alarming, Southeast Asia’s insurance penetration rate is a meager 3.4% [5].

This translates into a significant US$23bn General Insurance gap [5], as adoption of both Life and Non-Life Insurance in the region (excluding Singapore) remains far behind compared to global averages.

Fig [6] 2023 Insurance penetration % GDP

Source: Swiss Re Institute Sigma No 4/2024

These two topics are clearly not mutually exclusive: the under penetration of traditional banking equal underinsured populations.

However, if you look at the inverse of populations with low traditional financial penetration, you will find a high adoption of modern-day financial services, such as e-wallets. Financial services industry propaganda suggests a lack of financial inclusion, but only if measured by traditional definitions. Bankers and Financial advisors may have lost out on commissions and fees to the fintech’s ad and platform revenues, but this doesn’t mean the mass populations don’t have access to financial services - just not traditional ones. However, digital insurance models are not yet highly prevalent in these new ecosystems and therefore, we’re simply left with ‘the gap’.

Like digital banking services provided by fintech platforms, insurers need to diversify and reduce reliance on traditional distribution and take their products to where the consumers prefer to transact, through new distribution partnerships; e-wallets, e-commerce platforms, buy now pay later providers, mobile network operators, online travel operators, ride hailing and last-mile delivery platforms - the SuperApps.

This is where those in ‘the gap’ perform billions of micro-finance transactions every day through smart phones – topping up their network data, tapping to pay for bus and train fares, sending money to friends and family and much more. Where financial advice is replaced with social trust, recommendations, ratings and most importantly, convenience.

The Opportunity

Digital deposit, payment services and SuperApps have built a new multi-billion-dollar banking economy in emerging markets in Southeast Asia and yet the same opportunity is still untapped for insurance. If we can get it right, then we can help protect hundreds of millions of people, enhance SuperApp ecosystems by including these services and create sustainable profits for insurance companies.

A Case Study from Southeast Asia: Grab SuperApp

Background

Ride-hailing in Southeast Asia began gaining traction in the early 2010s, driven by rapid smartphone adoption, urban congestion, and a growing middle-class seeking more convenient transport options. The sector’s growth was turbocharged by the entry of global and regional players like Uber, Grab, and Gojek.

By 2018, Grab had acquired Uber’s Southeast Asia operations in a landmark deal that gave Uber a 27.5% stake in Grab, effectively ending the ride-hailing war and leaving Grab with near-monopoly status in many of the region’s markets [7].

Grab now operates in eight countries: Singapore, Malaysia, Cambodia, Indonesia, Myanmar, the Philippines, Thailand, and Vietnam and has evolved into one of the region’s biggest SuperApps, offering not just ride-hailing but also fast-food delivery, groceries, digital payments and notably financial services, including insurance.

Led by a small group of innovators, the Grab Insure team were seeking for more than a compilation of traditional insurance products in their shiny new SuperApp – despite the classic umbrella icon leading to a mini-insurance marketplace, they strived for something new, something innovative - and they wanted this from those not synonymous with innovation - the insurers.

Grab sought to offer insurance products tailored to their customers, driver partners, and merchants – leading to a barrage of product requests where they sought lower premiums to compete with the local banking goliath, DBS. Underwriting and premiums informed by marketing headlines striving to hit the utopian “…for just S$1 a day” premium price point. This swiftly moved on to requests for new products, and unique Grab Insure propositions that required a different approach.

The Customer Need and Proposition Design Process

When tasked with Innovation, using Design Thinking methods can often help you to take a step back and look at things from a new perspective – surfacing your customers pain points through deep research, observation, or strategic questioning. Go deeper and you’ll find latent pain points – those problems or challenges that your customers experience, but may not yet be fully aware of, articulate, or actively seek to solve.

At the heart of these latent pain points is often a perception of imbalance, or ‘fairness’ - a basic human expectation often unspoken but deeply felt. When systems, processes, or experiences feel biased, inconsistent, or opaque, users may not immediately voice their discomfort. Yet, this latent pain point can erode trust, reduce engagement, and trigger silent churn. Addressing fairness isn’t just ethical—it’s strategic.

Grab had an abundance of insights from customer feedback, complaints and a backlog of experience-based issues to resolve – so best start with those.

One particular customer insight stood out.

When a customer books a Grab ride and is not present at the designated pick-up location, a notification appears prompting urgency, and a $5 surcharge is automatically applied if the five-minute countdown expires. Additionally, cancellations made beyond a certain time threshold incur automatic charges. At first glance, these policies may appear reasonable.

However, customers highlighted a perceived imbalance: if the driver is late or cancels the ride, no equivalent penalty or compensation is applied. This asymmetry in accountability has led to widespread feedback that the system feels biased in favour of Grab and its drivers.

The Hypothesis

Would a Grab customer be willing to pay a small premium for the convenience of receiving compensation if the driver is late, or if the driver cancels? Spoiler alert, it turns out - YES!

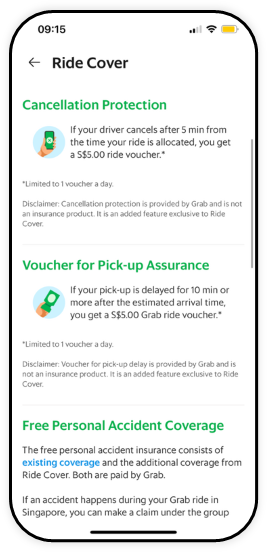

The Solution

And so ‘Ride Cover’ was born. An embedded insurance episodic subscription, allowing a Grab customer to subscribe once for every future ride for just S$0.30 added to each fare. A S$5 voucher is automatically paid to your Grab account if the driver is late, or if the driver cancels. No claim forms, phone calls or adjudication… a simple parametric claim, that is automatically triggered and paid to the customer when certain conditions, validated using data, are met.

For any traditional insurance company using traditional methods of product pricing and design – Ride Cover is not easy to create because it is not a common product chassis that is modified for the next potential customer segment. At inception, any actuary or underwriter would be stumped to decide how to charge for this new proposition.

Digital platforms and SuperApps hold the key to solving this problem and enabling a solution to be designed and priced – Data.

Exporting data of the last 1 million Grab rides gifts an actuary with everything they need to know to price the product; cancellations, late arrivals, pick-ups, average fares etc – effectively a pricing loss ratio assumption can be generated with only a pivot table and a few Excel functions (I’m sure it wasn’t that simple, but you get my point!).

Ride Cover is now live in all 8 Grab markets, millions of rides protected, millions of dollars in premiums and millions of claims paid back into the Grab ecosystem.

It remains one of very few case studies of scalable and profitable insurance innovation that drives shared value across the ecosystem between an insurance provider and SuperApp platform. This successful example demonstrates the critical importance of partnerships, two entities coming together with a common goal and succeeding through ideation and experimentation based on customer insight.

This case study of Ride Cover—and more broadly, GrabInsure, the insurance arm of the Grab group—offers valuable insights into structuring a successful new venture. It highlights the power of multi-disciplinary teams united by a shared vision and a customer-first mindset, where the experience itself is the product. Success is executed by dedicated capacity to deliver, optimize, and iterate toward both short and long-term goals, with a culture that embraces failure as a pathway to learning.

More recently, Grab became a member of the General Insurance Association (GIA) in May 2025, following its acquisition of a general insurance license from the Monetary Authority of Singapore (MAS) in December 2024. These milestones signal its readiness to launch proprietary motor insurance products [10]. Industry observers view Grab’s entry into this segment as a strategic move, leveraging its data capabilities, cost efficiencies, and a built-in base of private-hire drivers.

So, what have we learned from Ride Cover that we can apply in our insurance companies to tap into this multi-billion dollar opportunity?

The following sections will cover the important lessons that can be applied globally from this case study, which can provide a roadmap for how the “traditional” insurance industry can access this tremendous market opportunity.

It will enable the global insurance industry to reach hundreds of millions of new customers and create shared value with the SuperApps and digital ecosystems already operating in these emerging high-growth markets.

- Target Operating Model: Dispelling the Digital Transformation Myths

- Identifying Customer Needs and Developing Insurance Propositions

- Selective Growth Strategy: Embedded Insurance & SuperApps

Lesson 1: Dispelling Digital Transformation Myths

Insurance carriers have responded to the advance of Digital technology in various ways - some through efficiency-based transformation and tech rationalization projects and in few cases establishing digital business teams – focused on developing new distribution models, proposition design and innovation.

The latter required outside expertise to bring customer-first thinking unhampered by a legacy insurance mindset yet challenged with the same goal of selling traditional insurance products online. New shadow P&Ls were formed with top-down growth targets aimed at substituting declining telemarketing and bank branch distribution and grand ambitions to find incremental profitable growth stories to tell the shareholder - all whilst proving that online is a lower cost-to-serve channel.

It all sounds great, but the reality? None of it worked.

These Digital teams were hamstrung from day one with several major challenges:

- Monolithic insurance technology not fit for purpose – led by IT teams championing the use of legacy policy administration systems and incumbent vendors claiming to now be ‘digital’ despite the fact new products took at least 3-6 months to hardcode and test.

- Traditional leadership styles, waterfall-based project governance and endless steering committees inexperienced on Digital topics, understandably uncomfortable with these unfamiliar risks leading to indecision and investment delays.

- A portfolio of traditional, inflexible insurance products built for intermediated distribution, peppered with conditional underwriting questions and small print only discernible by the underwriter who wrote them.

- Traditional P&Ls constructs with rigid fixed expense allocations that don’t allow for the unique qualities of each channel and product, where it takes years to update actuarial insight with experience. Therefore, for the most part, all channels, policies and claims cost the same to serve, which makes it cost prohibitive to run a high-volume digital business - at least according to finance.

- An industry regulated by those not incentivized with change.

A bit like Captain Edward Smith of the Titanic, everything he [they] knew was wrong.

The idea to put a digital front door on a traditional insurance company and take the same insurance products and put them on a digital shelf generally doesn’t work, aside for simple mandatory products like Travel and Motor.

So, what is needed? Well, it requires a complete overhaul.

Digital Team Composition & Unconditional Sponsorship

- A vertical cut-through of the organization comprising a multi-disciplinary team of employees covering the full policy lifecycle.

- There should be no key dependencies sitting outside of the team – this is where conflict and inefficient working occurs, especially in large matrix-style organisations.

- One team aligned with the same vision and goal. After all, your goals drive your behaviour.

- Unwavering Sponsorship: The digitalisation of insurance distribution and servicing is inevitable, but that doesn’t mean it will happen overnight. The C-Suite needs to be patient, supportive and get comfortable with the long journey ahead. The adage of ‘build it and they will come’ is never truer.

Digital Technology

Technology is no longer a barrier to entry. Insurers today need just enough of it to remain agile—able to adapt quickly to the evolving needs of technology-advanced distribution partners and stakeholders. A one-size-fits-all Insurtech platform, if misapplied, can become a source of rigidity rather than empowerment.

Instead, consider a modular approach built on:

- Guardrails and Standards: These ensure high quality, consistency, and availability—without enforcing rigid standardisation that stifles market differentiation.

- Microservice Architecture: This enables you to build the services you know you need today, while remaining flexible enough to accommodate those you haven’t yet imagined.

- APIs as Enablers: APIs are the conduit through which distributers connect with the insurer to embed insurance natively into their ecosystems. But don’t expect them to share customer data in return—design your architecture with privacy and autonomy in mind.

- AI as an Accelerator: The advancement of AI offers the opportunity to enhance decision-making, automate processes, and accelerate time-to-market for new products and partners.

Lesson 2: Designing Insurance Propositions

Proposition Design & Underwriting

Insurers need to create an environment where these teams can reimagine, innovate and truly address the needs of today’s consumer.

- Develop ‘Assurance Propositions’ that contextualise risk and resonate with customers vs ‘Insurance Products’

- Start with the claim - ensure every condition and clause has a matching straight-through claims process or parametric data source to reduce the need of manual claims and the associated processing costs and time

- Co-Create propositions with partners to address consumers latent pain points (eg. Grab Ride Cover) leveraging their first-party customer data and native payments to collect premiums

Targeted, Pre-Underwritten Proposition Libraries:

To successfully partner with SuperApps operating across specialized verticals—such as e-commerce, mobile networks, and ride-hailing—insurers must be equipped with a curated library of embedded insurance offerings and distribution strategies. These solutions should proactively address the core needs of each vertical’s customer base and be seamlessly integrated into the natural flow of mobile transactions.

Illustrative Opportunities for Embedded Insurance:

- Mobile Network Operators

- Data and airtime top-ups

- Prepaid roaming packages

- Bill payments

- New postpaid subscriptions

- Contract renewals and device upgrades

- Fibre broadband plan applications

- E-Commerce Platforms

- Account registration

- Purchase of electronics and cosmetic products

- Delivery services

Buy Now Pay Later (BNPL) transactions

- Ride-Hailing Services

- Passenger rides

- On-demand deliveries (Packages, Fast-Food, Groceries)

- Gig-Economy workers (Drivers & Merchants MSMEs)

Embedded propositions can be built on existing underwriting coverages, repackaged and scaled to match the value of everyday transactions. By pricing them low enough to be perceived as sensible add-ons, they become intuitive choices for customers—effectively turning insurance into a seamless part of the digital experience.

Collaboration with the partners User Experience teams to seamlessly integrate these propositions in-path of existing transactions, leveraging their brand and tone-of-voice and providing plain English coverages – a clever mix of marketing and empathy for the risks we face every day.

In cases where benefits are tied to death or disability, distributors can leverage digital communications to notify named beneficiaries. These messages can highlight the proactive steps taken by the policyholder to secure protection for their loved ones and provide clear, actionable guidance on how to initiate a claim in the event of the policyholder’s passing.

Lesson 3: Selective Growth Verticals - Embedded Insurance

& SuperApps

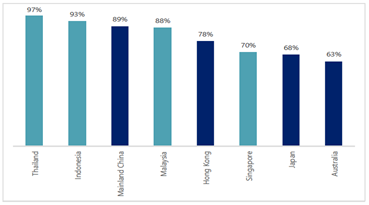

Consumers are increasingly open to purchasing insurance from new players and non-traditional providers—a promising trend that signals broader distribution opportunities and rising attachment rates.

Fig [8]. Percentage of Customers Open to Purchasing Insurance from New Entrants (Including Non-insurance Companies)

Source: "Making the most of Asia-Pacific's Insurance Boom", Bain & Company, 2019

Distribution Models

Major insurers are increasingly focusing on establishing high-performance Direct to Consumer (D2C) online sales channels and forming innovative Digital partnerships (B2B2C) as part of their strategic approach.

- D2C: Companies compete to acquire customers directly while maintaining a low Customer Acquisition Cost (CAC), seeking to maximise Lifetime Value (LTV) through robust retention strategies and cross-selling initiatives.

- B2B2C: This model enables non-insurance businesses to generate new sources of recurring, high-margin revenue without assuming underwriting risk. Utilising a distribution partners first-party data and integrated payment systems ensures a seamless and efficient user experience.

Both are valid distribution options, yet B2B2C provides insurers scalable access to mass-market populations who are typically disengaged from traditional insurance marketing and unlikely to purchase directly from insurers. Through contextual convenience—where protection is offered at the point of relevance—these customers are far more likely to engage and convert via trusted platforms.

Selective Growth Partnerships

Not all digital platforms or ecosystems present equal opportunities. Insurers must focus on those that offer the critical conditions for successful insurance distribution:

- High Monthly Active User (MAU) volumes to ensure scale

- Access to first-party customer data for pre-populating underwriting fields and minimising friction

- Native payment infrastructure and agency distribution licenses to enable seamless premium collection

- Insurance as a strategic priority, backed by dedicated delivery capacity—without this, delays and de-prioritisation are likely

- A culture of experimentation and iterative learning, where go-to-market (GTM) is seen as the starting line, not the finish line—true insights emerge only after launch

GCash and the Sachet Economy: Ripe for Embedded Insurance

Whilst the Philippines has the lowest insurance penetration rate of all Southeast Asia, they also have GCash - the region’s largest mobile payment platform with over 90 million registered users and accepted by more than 6 million restaurants, convenience stores and other businesses, according to Globe.

Filipinos typically buy small quantities of goods, known as ‘tingi’. This practice has led to the rise of the ‘sachet economy’, where products like shampoo, toothpaste, coffee, and condiments are sold in single-use packages. It permeates through various market segments, making it a significant aspect of the nation’s economic landscape.

Tingi culture not only addresses the immediate needs of consumers but also offers businesses a unique opportunity to expand their customer base. By capitalizing on this consumer behaviour through distribution partnerships like GCash, insurance companies can penetrate a vast market, boost sales, and foster brand loyalty.

These principles can guide insurers to design new propositions:

- Affordability: Micro-insurance propositions with low premiums and sums insured that accumulate over time – not a single, high-consideration purchase.

- Accessibility and Availability: Highly contextual assurance propositions conveniently placed in-path of high volume, low value transactions – like mobile top-ups, transport fares and bill payments, etc.

- Bundles: Subsidised or free insurance coverages integral to value propositions services to encourage usage, adoption and loyalty eg. “Free online shopping protection when you use your GCash Visa Card”

- Sampling: No commitment subscriptions that can be cancelled anytime within the app - no arduous cancellation process.

The Global Embedded Insurance Market

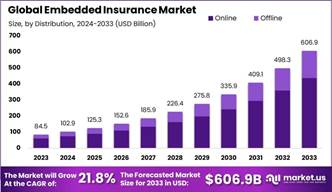

By embedding insurance propositions directly into transactions performed using a mobile app, whether it is a flight booking, an e-commerce checkout, a ride-hailing app, or a SaaS subscription. Embedded insurance integrates coverage directly into the purchase journey - making protection distribution contextual, and frictionless.

The global embedded insurance market is projected to grow from $84.5B in 2023 to $606.9B by 2033, with a CAGR of 21.8%. Asia-Pacific leads adoption, driven by mobile-first economies and SuperApps, capturing 35.7% of global revenue in 2023. Whilst in the U.S., embedded channels are expected to account for 30% of all insurance transactions by 2028, with $70B in General Insurance premiums by 2030. [9]

Fig [9] Global Embedded Insurance Market

Source: Market.us Embedded Insurance Market report

As we enter the era of Embedded Insurance 2.0, the model is maturing into deeper partnerships, smarter pricing, and broader reach into underserved segments. Success now hinges on infrastructure, data, and design—not just distribution. For insurers and platforms alike, this is more than a monetization strategy; it’s a chance to reimagine protection as a native layer of digital life.

In Southeast Asia, where SuperApps thrive and traditional insurance lags, this convergence offers a blueprint for truly bridging the protection gap.

Conclusion

Southeast Asia’s underinsured populations and booming digital ecosystems present a generational opportunity for insurers to rethink distribution, product design, and customer engagement. It is a tremendous testing ground for solutions and lessons that can be applied in emerging high-growth markets globally. This paper demonstrates that the protection gap in these global markets is not a result of financial exclusion, but of outdated models that fail to meet consumers where they transact—within SuperApps and mobile-first platforms.

The Grab “Ride Cover” case study exemplifies how latent customer pain points, like perceived unfairness, can be transformed into scalable, embedded insurance propositions. By leveraging partner data, native payments, and parametric automation, insurers can deliver frictionless protection that feels intuitive and valuable to the end user.

Key Learnings

- Digital transformation must go beyond tech upgrades—it requires multidisciplinary teams with aligned goals, empowered to innovate across the full policy lifecycle.

- Proposition design must start with the experience and claim, ensuring simplicity, transparency, and automation.

- Strategic, but selective growth partnerships with platforms like Grab and GCash unlock access to high-volume, low-cost distribution tailored to local behaviours like the sachet economy.

- Technology should be modular and enabling, not monolithic and restrictive—APIs, microservices, and AI are essential accelerators.

Ultimately, bridging the protection gap demands more than digitizing traditional insurance. It requires embedding assurance into the everyday lives of consumers—contextual, convenient, and customer-first. This is not just a Southeast Asian story; it is a blueprint for how insurers globally can lead the next wave of inclusive, profitable growth.

References

Underbanked and Informally Employed in Southeast Asia McKinsey Global Institute, World Bank, Malaysia Department of Statistics, Philippines Department of Labor Force Survey Outperformers: Maintaining ASEAN countries’ exceptional growth | |

Mobile Wallet Usage in Southeast Asia UnaFinancial via IBS Intelligence Philippines, Indonesia lead Mobile FinTech adoption in Southeast Asia | |

Global Mobile Wallet Adoption Boku & Juniper Research via Nasdaq Study: More than half of the world's population will use mobile wallets by 2025 | |

Notable SuperApps in Asia Zintego Exploring the Top 6 Super Apps in Asia and Their Impact on the Global Digital Revolution | |

Southeast Asia Insurance Penetration Peak Re | |

Graph: 2023 Insurance penetration % GDP Swiss Re | |

Grab had acquired Uber’s Southeast Asia operations Straits Times Grab confirms acquisition of Uber's South-east Asia business; Uber gets 27.5% stake in Grab | |

Graph: Percentage of Customers Open to Purchasing Insurance from New Entrants Bain & Company, 2019 | |

The Global Embedded Insurance Market Market US Global Embedded Insurance Market Size, Share, Upcoming Investments Report By Insurance Line | |

Grab Enters Motor Insurance Market in Singapore Straits Times Grab makes move to enter motor insurance market in Singapore |