Ensuring Lifetime Income

Brittainy Rivers, COO & VP, Client Delivery, TAI, an RGA Company

The Insurance Industry: Leading Innovation to Solve Lifetime Income Challenges

Overview

America is facing a multi-dimensional challenge: ensuring aging Americans have adequate income throughout retirement. The 65+ demographic has exceeded 61 million people in 2025.1 This generation of retirees, and those approaching retirement, are navigating a shift in financial responsibility, moving from defined benefit plans in the past to defined contribution plans today. This shifts the retirement savings obligation from the employer to the employee and transfers the market risk portion of that savings to the individual. Having witnessed the worst 10 years of stock market performance in history, from 1999 to 2008,2 this generation carries lasting psychological effects that influence their financial decision making. This uncertainty is compounded by concerns over Social Security, as its Trust Fund is expected to reach insolvency in or before 2034.3 Additionally, many Americans lack education around retirement savings and financial planning, leaving individuals stuck and unsure about where to turn for solutions.

The majority of the current American workforce is almost certain to face a retirement shortfall. According to a recent New York Wealth Watch survey conducted by New York Life,4 fewer than 20% of adults report having a retirement strategy and only 36% report having any form of retirement savings. As factors such as race and socioeconomics further complicate access to financial information and retirement product offerings; we stand on the brink of a serious social issue that impacts everyone.

The National Institute on Retirement Security conducted a study examining how American households are performing in relation to retirement savings goals and best practices. The study found that the retirement savings gap in the US for ages 25-64 ranges between $6.8 and $14 trillion dollars.5

As insurers and reinsurers seek opportunities to support individuals in their pursuit of financial protection, a key question arises: “How can the insurance industry lead in education and product innovation to address lifetime income challenges and help individuals accumulate the wealth and savings they need over the duration of their lives?”

This paper begins by detailing the current state of America’s retirement challenges with a focus on lifetime income. It discusses the shifts individuals must make to prepare for life after retirement and the financial risks retirees face. It emphasizes the urgent need for the insurance industry to drive product innovation and education that can provide Americans with guaranteed lifetime income.

Lifetime Income Challenges

Lifetime income refers to a consistent stream of income received throughout retirement, helping ensure financial stability and the ability to maintain one’s standard of living and cover essential expenses.

Income earned during working years plays a critical role in shaping retirement strategies for many. Lower income earners must generally prioritize covering day-to-day necessities, making building a robust retirement portfolio an out-of-reach luxury. For high-income earners or those with inherited assets and substantial investment portfolios or savings, conventional investment guidance often does not apply. Since the top 10% of Americans hold over 67% of wealth, their account values and assets often skew data and discussions around retirement planning.6

For the purposes of this discussion, we will focus on the middle-income earners, whose retirement strategies typically include Social Security, annuities, defined benefit and defined contribution plans, real estate, private investments, savings, and other assets.

As Americans enter the largest wealth transfer in history, middle-income earners who inherit assets have an opportunity to implement investment strategies and product selections to achieve retirement goals and minimize tax implications. With the number of individuals turning 65 increasing each year and life expectancy at an all-time high, now is an opportune time to develop advanced solutions that target lifetime income inadequacy.

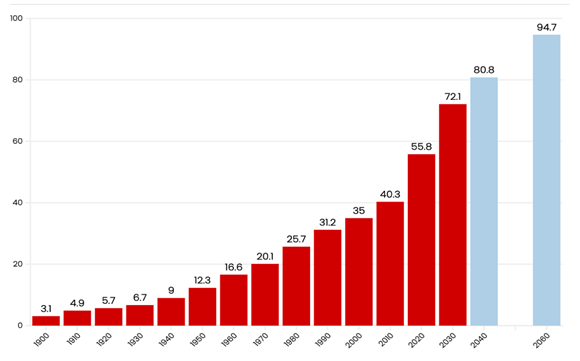

FIGURE 1: Number of Persons Age 65 and Older

1900–2060 (numbers in millions)

Note: Lighter bars (2040 and 2060) indicate projections.

Source: U.S. Census Bureau, Population Estimates and Projections. Public domain content accessed via census.gov.

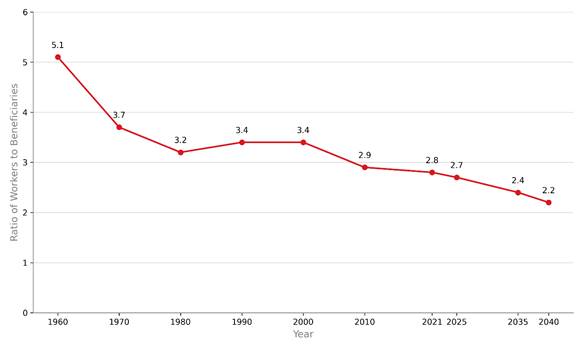

The rapid growth of the aging population is significantly impacting the funding and future solvency of Social Security, as the ratio of workers to beneficiaries continues to decline.

FIGURE 2: Ratio of Workers to Social Security Beneficiaries

Source: Social Security Administration, 2021

Over the years, the government has implemented various reforms to maintain Social Security’s solvency during times of financial strain. However, with the aging population exploding from 35 million to 61 million since 2000, outlays now outpace income and rising life expectancy has made the challenge ever more daunting and difficult to solve. Retirees and pre-retirees may soon face benefit reductions, further widening the gap in their lifetime incomes. Recent legislative changes could further accelerate the insolvency of the Social Security Trust Fund.

Another challenge workers face is accurately estimating how much money they will need to fund their retirement and meet their savings targets. Only half of Americans have calculated how much money they will need to fund retirement, yet on average, survey respondents believe $1.26 million in savings per household is necessary to retire comfortably.7 However, US households only have an estimated median retirement savings of $64,000,8 illustrating the need for greater financial education and awareness of retirement savings shortfalls. While retirement savings vary by age, there remains an alarming shortage among retirees and those nearing retirement within the next decade.

TABLE 1: Retirement Account Balances by Age Group

| Age Group | Average (Mean) Retirement Account Balance | Median Retirement Account Balance |

|---|---|---|

| Under 35 | $49,130 | $18,880 |

| 35–44 | $141,520 | $45,000 |

| 45–54 | $313,220 | $115,000 |

| 55–64 | $537,560 | $185,000 |

| 65–74 | $609,230 | $200,000 |

| 75 + | $462,410 | $130,000 |

Source: Analysis of Board of Governors of the Federal Reserve System https://www.investopedia.com/average-retirement-savings-by-age-8740967

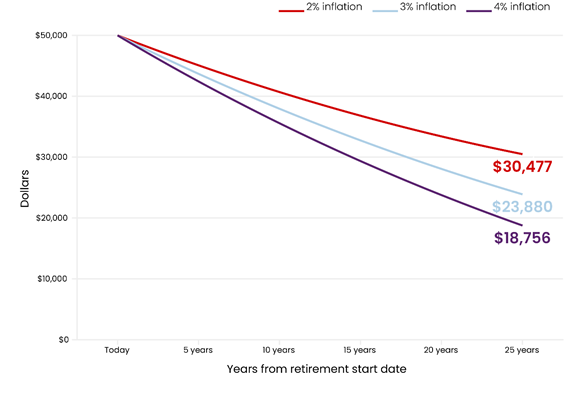

As workers plan for their post-retirement needs, the unpredictable nature of inflation presents a significant challenge to ensuring portfolios can keep pace with rising living costs over time. Inflation, which is the long-term decline in purchasing power, affects retirement planning by increasing the cost of goods and services and reducing the real value of portfolio assets.

FIGURE 3: The effect of inflation on purchasing power

Even at a low inflation rate of 2%, in 25 years $50,000 will buy as much as $37,477 buys today

Source: America’s Lifetime Income Challenge, Pinnacle Financial Partners. Used with reference to publicly available inflation data from the U.S. Bureau of Labor Statistics.

Many Americans struggle with managing their stock portfolios and other financial assets. In fact, 57% of Americans with workplace retirement accounts are unaware of the various types of investments they hold,9 illustrating a gap between financial knowledge and actual investment behavior.

Another important factor is the evolving nature of tax laws and regulations. Recent legislation is expected to provide relief to retirees by lowering their taxable incomes. This may help reduce retirees’ tax burden and, in turn, lower the amount of income needed during retirement. Since these changes are currently effective through 2028, individuals must continue to devise long-term strategies to support their retirement needs.

Given the complex challenges individuals face in planning for life in retirement, the guidance and product innovation that insurers and reinsurers, working in partnership with asset managers and recordkeepers, can provide are both timely and essential to the market.

Solving the Challenges: The Role of the Insurance Industry

Closing the Education Gap Through Innovation

Although there is an abundance of information available through literature, media, financial services, and advisory platforms, an education gap persists among Americans regarding retirement strategies. Many remain largely underinformed about tax and investment strategies aligned with their long-term financial goals. This gap continues to widen due to disparities in financial literacy, inconsistent access to retirement plans, limited exposure to advisory resources, and the sheer complexity of retirement planning.

Although retirement planning and investment information is readily accessible, there remains an opportunity to better empower individuals to engage with and apply this knowledge to their long-term financial wellbeing. The rise in popularity of social media influencers and artificial intelligence (AI) has introduced new vehicles to promote financial literacy and education.

Social platforms like TikTok, Instagram, and YouTube are revolutionizing how individuals – especially younger and lower-income groups – access financial education. Influencers use short-term, engaging content to demystify complex topics, cultivate community, and encourage open conversations about money. Their transparent and relatable storytelling often builds more trust than that of traditional financial institutions.

This presents a powerful opportunity for insurers to partner with influencers and position their own employees as trustworthy and credible voices in the retirement and lifetime income space. By combining interactive, gamified learning experiences with accurate, transparent content, insurers can boost financial literacy, build trust and inclusivity, and create lasting consumer relationships.

Artificial intelligence is transforming financial literacy education by providing personalized learning experiences, simplifying complex concepts, offering interactive simulations, and providing real-time feedback. One standout example is Alinea, a Securities and Exchange Commission (SEC)-registered investment advisory app tailored for beginner investors. Alinea uses AI to analyze user behavior and preferences, delivering personalized, best-interest investment recommendations. Its virtual assistant simplifies the investing journey by teaching foundational concepts, automating decisions, and crafting personalized investment strategies.

A recent comparative study found that AI-powered financial literacy platforms significantly enhance knowledge retention among young adults compared to traditional methods, especially when content is personalized and interactive.10 This underscores the potential for insurers and financial institutions to adopt or partner with platforms to reach underserved or digitally native audiences.

Leading organizations are embracing education as a core pillar of their outreach and growth strategies. While digital tools and AI platforms are transforming how individuals learn about investing, there remains a critical need for human-centered, community-based education – especially for those who prefer instructor-led learning. One model is Fidelity’s FinEd Champions Program, which equips employee volunteers with enhanced financial education training and curated resources to deliver instruction in classrooms and in their communities. Fidelity has also launched its In-School Learning initiative, partnering with public school systems to deliver financial education programs to students, teachers, and families through coordinated classroom visits with Fidelity associates. Fidelity hosts family nights to provide supplemental education opportunities and through a collaboration with EVERFI, Fidelity will place virtual financial education curriculums in the hands of teachers at 500 high schools across the country.11

By empowering employees as financial education ambassadors, insurers can build trust, foster inclusivity, and create meaningful community impact. These programs not only simplify financial topics but also strengthen industry connections, positioning insurers as partners in financial wellbeing instead of product providers.

Expanding Access to Lifetime Income Through Product Innovation

As the retirement landscape shifts, the need for transformative solutions that ensure financial security later in life has never been more urgent. Insurance companies play a critical role in expanding access to retirement strategies and lifetime income. By evolving beyond traditional risk pooling, insurers can innovate and partner to become architects of long-term financial wellbeing, delivering inclusive products that offer flexible income streams, guaranteed lifetime income, tax efficiency, and protection against market volatility.

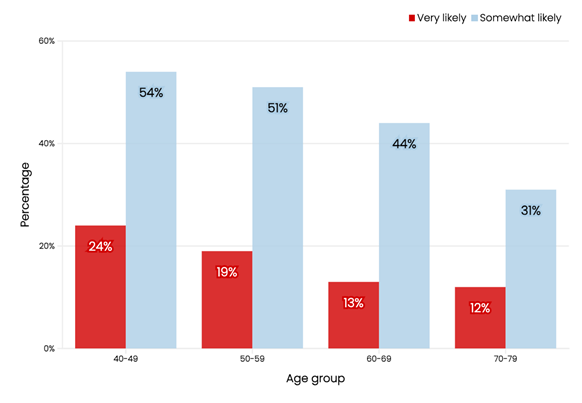

Workers with access to defined contribution plans often benefit from structured savings, employer contributions, and integrated annuitization options. The “Setting Every Community Up for Retirement Enhancement” (SECURE) Act, enacted on January 1, 2020, is a law designed to help more Americans save for retirement. The act has sparked renewed interest among employers in offering lifetime annuity products within 401(k) plans creating pension-like income streams in the retirement plans they offer. While the inclusion of guaranteed income products in defined contribution plans is nothing new, plan sponsors have historically been reluctant to incorporate annuities into 401(k) plans. With regulatory barriers now removed, momentum is building. Four in ten plan sponsors are actively considering or have decided to add in-plan annuities and nearly seven in ten non-retired workers say they would be “very” or “somewhat” likely to select an in-plan annuity option if available.12

FIGURE 4: Likelihood to Invest in Guaranteed Option by Age

Source: LIMRA, 2023 Retirement Investors Survey. Reprinted with permission.

Even though a majority of plan participants express interest around in-plan annuity options, plan sponsors often cite concerns around product cost, complexity, and administration as key barriers to adoption. These obstacles are increasingly being addressed through technology with middleware companies helping to resolve issues related to portability, liquidity, and seamless movement between the plans and recordkeepers.

Contribution Limits and Delayed Retirement Saving

Another important consideration in the accumulation phase of retirement planning for workers with employer-sponsored plans is the impact of contribution limits. While these plans offer tax-advantaged growth and employer matching, their rigid contribution caps, currently set at $23,500 for individuals under 50 and $31,000 for those eligible for catch-up contributions,13 can hinder savings potential for those who begin saving later in life. Individuals unable to contribute during their early working years due to lower income, caregiving responsibilities, high burden student loan payments, or lack of access to employer-sponsored plans often find themselves constrained by these limits just as they gain financial capacity to save more aggressively.

To address structural limitations, policymakers and industry leaders should consider not only increasing catch-up contribution limits, but also introducing age-based flexibility, such as tiered contribution thresholds or a lifetime cap. These approaches would allow individuals greater flexibility in managing their 401(k) contributions over time, better aligning with the realities of delayed income and enabling more effective retirement preparation.

While revising contribution limits and catch-up provisions is critical to helping late savers build sufficient retirement assets, these solutions primarily benefit individuals who already have access to employer-sponsored retirement plans. A significant portion of the workforce, however, lacks access to retirement saving plans altogether. For these individuals, the challenge is not how much they can contribute, but how to begin saving at all. This gap highlights the need for inclusive retirement solutions that extend beyond the workplace and address the inherent inequities in the current retirement system.

Before diving into product innovation, it’s essential to begin with policy innovation. States across the US have implemented, or are piloting, automatic enrollment in IRA programs for workers without access to employer-sponsored retirement plans. These programs provide options to opt-out and are designed to be low-cost, portable, and inclusive. However, they fall short of fully addressing the retirement savings gap, highlighting the need for broader, more comprehensive solutions.

Federal legislation, specifically the SECURE Act and SECURE Act 2.0, introduced key measures to expand retirement access. These policies allow long-term, part-time workers to participate in 401(k) plans, provide tax credits to small businesses that establish retirement plans, and enable pooled employer plans (PEPs). PEPs allow unrelated employers to join a single retirement plan, helping reduce administrative costs and broaden access to workplace retirement savings.14

Policy innovations have made meaningful strides in expanding retirement access, but they represent only part of the solution. To fully address the retirement savings gap, product innovation must work in tandem with policy. Financial institutions and insurers play a critical role in designing solutions that meet individuals where they are. These innovations must offer tools that help translate policy into action and empower underserved populations to build sustainable retirement income.

Key product developments are reshaping and expanding the retirement solutions landscape, aiming to provide more holistic solutions for individuals navigating their financial futures independently. Insurers and their partners are working to remove barriers to purchase and to entice workers with products that meet not only their financial goals, but also long-term legacy aspirations.

Fee-based and non-commission annuities have emerged in response to growing demand for transparency and cost efficiency. By eliminating traditional sales commissions, these products reduce overall fees for investors, making annuities more accessible and affordable. Aligned with the fiduciary model, fee-based annuities require financial advisors to act in their clients’ best interests, fostering greater trust and clarity in the advisor-client relationship.

Digital platforms and Insurtech companies are significantly reshaping the annuity landscape. These innovations have streamlined the purchasing process, improved client experience, and enabled more personalized solutions. Online platforms now allow individuals to compare, purchase, and manage annuities entirely online, empowering them to make informed decisions using real-time data. Additionally, robo-advisors integrated into Insurtech platforms provide automated, algorithm-driven financial planning services. Personalized annuity recommendations are generated based on an individual’s financial situation, risk tolerance, and retirement goals.

A notable trend in product innovation is the rise of environmental, social and governance (ESG)-focused annuities. These products enable investors to align their financial goals with personal values by investing in companies that meet specific ESG criteria. In addition to offering the potential for competitive returns, ESG annuities support positive social and environmental outcomes. This appeals to ethically minded investors who want their retirement strategies to reflect broader commitments to social responsibility and sustainability.

From Accumulation to Decumulation: A New Set of Challenges

While product innovation has heavily focused on the accumulation phase of retirement planning, the transition to decumulation of retirement assets introduces a new set of complexities. As individuals approach retirement, the emphasis shifts from building assets to strategically converting those assets into sustainable income. Many retirees face uncertainty around how to draw down savings efficiently, balance longevity risk, and navigate tax implications. A lack of clear guidance, combined with limited access to lifetime income education and products, can lead to suboptimal decisions, such as underspending due to fear of outliving savings or overspending without a structured plan. This presents an opportunity for innovative decumulation strategies and tools that can help retirees convert savings into predictable, lasting income.

A range of financial products has emerged to support retirees in converting their savings into reliable lifetime income. Immediate and deferred income annuities offer guaranteed payments for life, with deferred options allowing individuals to plan for future income needs later in retirement. Target date funds (TDFs) offer professionally managed solutions that distribute regular income while gradually drawing down assets. Bucket strategies, segment assets by time horizon, allowing alignment of investment risk with income needs over time.

As lifetime income solutions evolve to meet the diverse needs of today’s workforce, the method of delivery is becoming just as critical as the products themselves. Historically, traditional distribution channels, such as employer-sponsored plans and advisor-led sales, have primarily served individuals with institutional support or higher incomes. To broaden reach and improve equity, insurers, asset managers and Insurtech firms are reimagining both product design and distribution models. Innovations such as embedded annuities in target date funds, digital marketplaces, and managed account integrations are redefining how individuals discover, evaluate, and adopt lifetime income solutions.

Discussion

To address the widening retirement savings gap and promote lifetime income security for aging Americans, the insurance industry must lead with proactive solutions. Expanding access to financial education is an essential first step. By developing targeted campaigns that close persistent knowledge gaps in retirement planning, tax strategies, and investment options, insurers can influence and guide individuals to solutions that not only address shortfalls but create confidence and stability in retirement.

To become trusted voices in the lifetime income space, insurers should activate internal subject matter experts and collaborate with external influencers across all media platforms. Equipping employees to share insights and promote financial literacy, through micro-learnings, gamified content, and social platforms, can demystify complex concepts and foster community engagement.

Product innovation is a critical component in addressing the lifetime income gap. Solutions like buffered and structured annuities offer a compelling combination of growth potential and protection against market volatility. Innovative fee structures for annuities are also removing barriers to entry by significantly reducing fees for prospective annuity buyers. Innovation in decumulation-focused products is essential to helping individuals manage longevity risk and appropriately control the spending of their savings. Deferred annuities, for example, can mitigate this risk by initiating payments at later life stages, such as age 80, allowing retirees to spend their retirement savings more freely knowing additional guaranteed income will be available at a later date. Technology presents a powerful opportunity to personalize engagement through AI-driven tools. The tools can assess retirement readiness, deliver tailored guidance, support financial education, and encourage proactive planning. Additionally, technology streamlines onboarding and administration, enhancing the user experience while fostering trust and transparency between financial institutions and customers.

A critical lever in closing the lifetime income gap is strategic collaboration, both within the industry and with policymakers, to advocate for reforms that incentivize retirement savings and expand access to retirement plans. By working closely with regulators and aligned organizations, stakeholders can help shape inclusive, tax-advantaged legislation that promotes long-term financial security. A key factor in this effort is leveraging the expertise of insurers, asset managers, and other industry leaders to inform policy that empowers individuals to secure their financial futures.

Addressing structural barriers is essential to expanding access to lifetime income solutions. Effective strategies must be inclusive and tailored to the unique needs of middle-income earners, part-time workers, and individuals without employer-sponsored retirement plans. Equally important is recognizing and addressing the psychological challenges faced by pre-retirees and retirees. Insurers should design products and messaging that reinforces stability, transparency, and long-term value, building trust and confidence throughout the retirement journey.

For this paper, several challenges surfaced, underscoring the complexity of the lifetime income gap and the many factors that influence it. While this paper focuses on middle-income earners, a significant portion of the population continues to face more immediate financial concerns, such as managing daily expenses and debt, which must be addressed before meaningful retirement income planning can begin.

Obtaining comprehensive insights about large populations and their sentiments and choices around retirement can be challenging. The complexity of individual financial situations makes large-scale analysis difficult, as income needs and circumstances are best understood when segmented into smaller, more targeted groups. This approach allows for more accurate and reflective discussions tailored to specific needs. Another barrier to holistic analysis is the limited availability of data, which when available, is often centered around individuals with workplace plans. Data and metrics around other workers are often times extrapolated or estimated from smaller or older data sets. Additionally, data around in-plan annuities inclusion into employer-sponsored plans and the adoption rates of said plans are not readily available. Many alternative strategies and products are so new that meaningful observation or analysis has yet to occur.

Conclusion

As America confronts a widening retirement savings gap, the insurance industry stands at a pivotal crossroads. The challenges resulting from a demographic shift toward an aging population, coupled with the decline of traditional retirement structures and the looming insolvency of Social Security, require bold leadership and cutting-edge solutions.

To meet the moment, insurers and reinsurers must embrace their role, not only as financial protectors but as educators, innovators and change agents.

My challenge to insurers and reinsurers:

- Design for the Full Financial Journey

Retirement is not a point in time event. Insurers and reinsurers can design for the full arc of an individual’s financial life. From the first paycheck to the last withdrawal, products must reflect the evolving needs, behaviors and realities of the individuals. This requires the industry to build solutions that flex and bend with an individual’s life – not just the market.

- Accelerate Product Innovation

If we want adoption, we must meet individuals where they are. Creating automatic solutions like embedded guaranteed income as a default in target-date funds and managed accounts removes a challenge many individuals face – taking the first step. Developing strategic relationships by collaborating across industries to drive scalable solutions that provide diverse product offerings for non-401(k) assets, should be accelerated to increase access and options for individuals seeking personalized solutions.

- Educate and Empower

Bridge the knowledge gap by investing in financial literacy and educational initiatives. Leverage collaboration between marketing teams, behavioral scientists, financial influencers and community leaders to develop engaging programs and content that awaken the power individuals have in owning the success of their financial futures. - Advocate for Policy Reform

Partner with and lobby alongside organizations that push for legislation that expands access to workplace retirement plans, personalized plans and preserves favorable tax treatment for savings. We are entering the largest intergenerational wealth transfer in history. This is the moment to advocate for policy and develop tax-friendly legislation that incentivizes individuals to manage that wealth across their lifetime, not only to preserve it but to convert it into lasting financial security.

Ultimately, solving the lifetime income challenge is not just a financial one, it’s a societal one. The insurance industry must lead with intention and purpose to ensure that Americans, regardless of income and background have access, tools and opportunity to retire with dignity and security.

References

- United States Census Bureau. Older Adults Outnumber Children in 11 States and Nearly Half of U.S. Counties. United States Census Bureau. June 26, 2025. Updated July 15, 2025. Accessed July 24, 2025

https://www.census.gov/newsroom/press-releases/2025/older-adults-outnumber-children.html

- S&P 500 Historical Index, measured from 1926 to 2024

- Social Security Administration, Agency Financial Report Fiscal Year 2024. Publication No. 31-231. Social Security Administration. November 2024. Accessed July 1, 2025

https://www.ssa.gov/finance/2024/Full%20FY%202024%20AFR.pdf

- New York Life Wealth Watch 2025 Outlook: Americans’ financial confidence holds despite continued debt and inflation challenges. New York Life Newsroom, January 7, 2025. Accessed June 18, 2025.

https://www.newyorklife.com/newsroom/2025/wealth-watch-2025-outlook

- Rhee N The Retirement Savings Crisis: Is it Worse than we think? National Institute on Retirement Security. June 2013. Accessed July 1, 2025

https://www.nirsonline.org/wpcontent/uploads/2017/06/retirementsavingscrisis_final.pdf

- Board of Governors of the Federal Reserve System. DFA: Distributional Financial Accounts – Distribution of Household Wealth in the U.S. since 1989 – Q1 2025. Federal Reserve. 1989. Updated June 20, 2025. Accessed July 22, 2025

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#quarter:142;series:Net%20worth;demographic:networth;population:1,3,5;units:shares;range:2010.1,2025.1

- Northwestern Mutual 2025 Planning and Progress Survey. Northwestern Mutual. June 19, 2025. Accessed July 24, 2025

https://news.northwesternmutual.com/2025-04-14-Americans-Believe-They-Will-Need-1-26-Million-to-Retire-Comfortably-According-to-Northwestern-Mutual-2025-Planning-Progress-Study

- Collinson C, Cho H. Transamerica Center for Retirement Studies. “The Multigenerational Workforce: Life, Work & Retirement: 24th Annual Transamerica Retirement Survey of Workers. June 2024. Accessed July 24, 2025

https://www.transamericainstitute.org/docs/research/generations-age/multigenerational-workforce-life-work-retirement-survey-report-2024.pdf?sfvrsn=ef00c973_9 - El Issa E. Do You Know What Your Investments Are? Most Americans Don’t. NerdWallet Survey conducted February 9-11, 2021. Nerd Wallet. March 22,2021. Accessed July 24, 2025.

https://www.nerdwallet.com/article/investing/do-you-know-what-your-investments-are-most-americans-dont?msockid=2adef50af59f6cf70f3ee0bef40c6d96

- M. Ponuselvi; Dr. N. Rajathilagam (2025) A Comparative Analysis of AI-Powered Financial Literacy Platforms vs. Traditional Methods in Improving Financial Knowledge Retention among Young Adults. International Journal of Innovative Science and Research Technology, 10(2), 2166-2172.

https://doi.org/10.38124/ijisrt/25feb1498

- Fidelity Investments Renews Commitment to Financial Education. Fidelity Newsroom. April 1, 2024. Accessed July 27, 2025.

https://newsroom.fidelity.com/pressreleases/fidelity-investments-renews-commitment-to-financial-education/s/f97db607-a3a7-4543-a282-a8e0bd7b6686 - In-Plan Annuities Are Gaining Momentum in the Workplace, Are They Poised to Be the Next Big Thing? Maybe. LIMRA. May 30, 2024. Accessed July 22, 2025

https://www.limra.com/en/newsroom/industry-trends/2024/in-plan-annuities-are-gaining-momentum-in-the-workplace-are-they-poised-to-be-the-next-big-thing-maybe/

- 401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000. IRS. IR-2024-285. November 1, 2024. Accessed July 22, 2025.

https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-700017

- Myers E; Donovan S; Li Z. Congressional Research Service. Nontraditional Workers and Retirement Saving: An Overview and Discussion of Policy Issues. April 7, 2025. Access July 29, 2025.

https://www.congress.gov/crs_external_products/R/PDF/R48484/R48484.1.pdf

This document was prepared by human authors and reviewed by RGA’s editorial and legal teams. While AI tools may have been used to assist with research and formatting, no generative AI was used to write or compose the submission. RGA confirms that all content is original and compliant with the competition’s guidelines. For verification or questions regarding authorship, please contact RGA Corporate Communications.