The Missing Middle

The Potential for Life Insurance Expansion in Middle-Income Population

by Deep Banerjee, Senior Vice President & Treasurer, Protective Life Corporation

There is an untapped opportunity in the middle-income population in the U.S. for expansion of life insurance.

The 2022 LIMRA insurance barometer study indicated that 45% of respondents earning between $35,000 to $99,000 per year said that they need life insurance. According to the study, “The high level of need combined with the large number of households suggest interest from 48 million middle-class consumers.” There is do doubt that a large market awaits the industry. But it has also proven to be a complicated task. How to incentive distribution? How to find the right product? How do avoid lapses? These are just a few of the questions that insures need to answer before being able to tap this market.

However, being able to successfully expand into this segment does come with clear advantages. The obvious ones being scale and profitability (assuming, of course an appropriately priced product). But perhps not so obvious advantages could be improved ESG and better credit quality.

A Look at the Middle Market Demographics

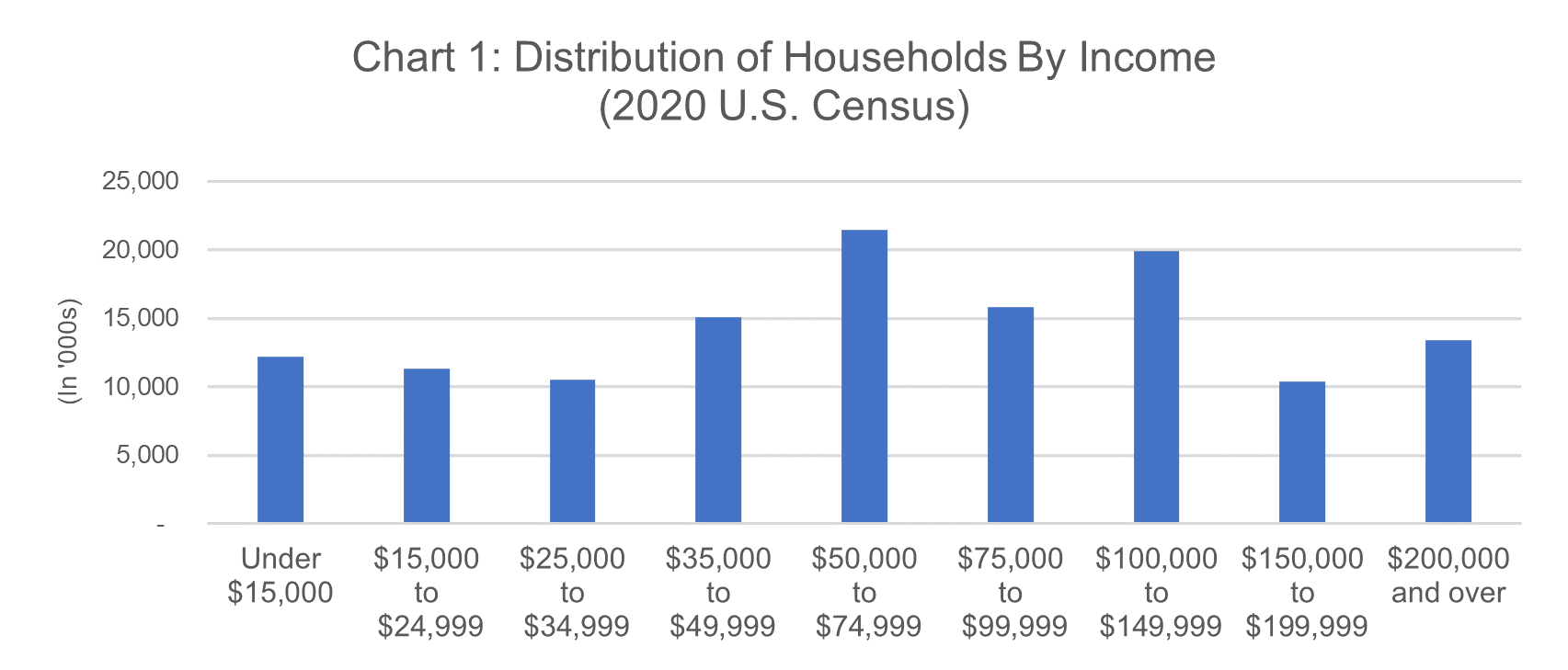

This article analyzes U.S. census data to gauge the middle-market consumer base. Based on the 2020 U.S. Census Data, there are about 130 million households in the U.S. with a median household income of $67,521. Households with an annual income of $35,000 to $99,000 comprise about 40% of total U.S. households, or 52 million households (see chart 1).

Key characteristics of these households, which would be the target for insurers interested in the middle market, are:

- They're relatively younger and educated. As a group, 38% of households are headed by individuals between 25 and 44 years of age. The middle market is also relatively well educated, with about 34% having at least a bachelor's degree, and only 7% haven't earned at least a high school diploma

- They live mostly in metropolitan areas. In all, 80% of these households are in metropolitan areas, and a majority are outside of what are considered principal cities.

- Their household size is close to the national average. The mean size of middle-market households is about 2.8 members, which is above the national mean of 2.5.

- They're largely homeowners, and half have multiple earners. More than 70% of the middle-market households live in owner-occupied residences and half have two or more earning members.

Declining Trend in Life Insurance Coverage Overall

Despite the favorable demographics of the middle market consumers, most insurers have gradually shifted away from this segment. Currently, about 59% of U.S. households have any form of life insurance compared to over 70% a few decades ago. At the same time the median face value of the policies has increased, indicating the focus on higher face value policies that may not fit the needs of the middle market population.

| Table 1: Households with Life Insurance Coverage | ||

| Year | Percentage with Coverage | Median Face Value |

| 1998 | 69.2% | $61,000 |

| 2004 | 65.4% | $100,000 |

| 2007 | 64.9% | $100,000 |

| 2010 | 62.6% | $100,000 |

| 2016 | 61.1% | $100,000 |

| 2019 | 59.4% | $100,000 |

Souce: ACLI fact book

Providing the Right Incentives and the Right Point of Sale Will Be Key For Distribution

Multiple, and somewhat interlinked, reasons account for the underpenetration and underinsurance of the middle market. These include lack of incentives for agents to focus on the middle market, limited middle-market-focused products, slow progress historically in investing in the direct-to-consumer channel, fewer dollars available to the consumer to put toward traditional life insurance policies, increased demand by high-net-worth consumers for estate planning or tax savings products, and lack of readily available education for the consumer on insurance products.

Unless insurers provide incentives to their distribution workforce to sell to the middle market, they'll naturally continue to gravitate toward higher-net-worth customers. Getting a higher commission for a higher value sale is clearly attractive.

The lack of products tailored to the middle market has also hurt sales. Term life insurance and final expense (mostly for seniors) have been the most common products insurers offered to this segment. However, there is a lack of permanent life insurance or cash value products in this market. The ability to build a life insurance product that is cost effective, while also providing some cash value or retirement benefits is challenging to say the least. But, building in additional value on top of mortalitty coverage will be important for this market segment.

Simplified underwriting, whereby the insurer waives medical examination, is being used to speed up the sales process but many consumers are not willing to pay the higher premiums that may be attributed to a policy sold without a medical examination. Looking at it from an agent’s view point, if insurers are mainly providing a basic term life policy for the middle market, they will likely prefer to focus their attention on the higher-net-worth clients, where they have a wider insurance and retirement product portfolio available to sell.

In order to succeed, insurers will have to provide better incentives to ensure that agents (independent or captive) find benefit from increasing efforts in the middle market. This will probably require a combination of monetary incentives as well as tools that speed the sales process. Additionally, a wider product portfolio, whether underwritten by the insurer or sourced from other financial institutions, will provide an additional edge to the sales force.

The point of sale is also critical of course. Online and digital may be easy, but it is unclear how effective it is to sell meaningful amount of life insurance. Embedding life products into platforms of other products may be a good solution. An article in the LifeAnnuity Specialist (“A New Model That Flips How to Sell Life Insurance Upside Down”, July 20, 2022) discusses this very idea. Whether it is embedding appropriate life insurane products during a mortgage or auto loan process, or connecting with communities or clubs that may be engaged in sports, there are innovative point of sale areas that can increase access to the middle market consumer.

Technology And Speed Will Remain Important to Consumers

Affordability will of course remain an important part of the puzzle. But the price point is not the end-all and be-all. But, multiple access points and knowledge of insurance needs are important as well. Traditional distribution channels, whether they be through captive or independent agents, will remain important for insurers as they try to penetrate this segment. However, more direct, nontraditional retail-focused channels will probably be a differentiating factor among insurers. For example, combining forces with a retail outlet or using online marketplaces may be helpful. Perhaps in the future, insurers may sell their products in a brick-and-mortar store right next to the latest smart phone and data plan or at a checkout counter at the local pharmacy or even on an online marketplace like amazon.com.

Can The Worksite Be the Path Forward For the Middle Market?

The worksite provides a significant opportunity for group benefits insurers to increase volume and cross-sell to the same group, at a relatively low cost.

Traditional group life or disability policies are common for the workplace, where the employer through an insurance carrier provides a fixed benefit while paying for the premiums. Traditionally, these have been small face-value life or limited benefit supplement insurance products.

However, in recent years, an increasing number of employers are providing additional voluntary benefits to their employees. Participating rate is around 57% was worksite life insurance where employee pays part of the cost (LIMRA workplace benefits employer benchmarking). Voluntary worksite sales provide individuals with easy access and affordable options to buy insurance. Unlike the traditional group insurance product, where the employer dictates the benefits, voluntary products allow the employees to choose different products and benefit levels based on their need and willingness to pay for the benefit. So, for example, an individual may be receiving group life insurance of $50,000 from his employer. He or she can then add protection through the voluntary channel by paying a few dollars extra per pay period. Moreover, the voluntary worksite channel has increased the product portfolio now available to consumers. In addition to group life and disability insurance products, insurers can offer additional products such as critical illness, cancer/specified disease, critical care and recovery, dental care, hospital indemnity, and child endowment. The process is usually very quick (just a few clicks of the mouse), and in most cases does not require a medical examination. Also, the premiums on the voluntary products are usually deducted from the employees' pay, making it a seamless process.

ESG and Ratings Are Possible Benefits from Middle Market Expansion

Insurers have of late made significant strides in improving their ESG (environment, social, governance) factors. It is worth noting the issue of diversity, which is part of the “S” in ESG, is not just limited to insurers’ employee base or community efforts. Having a diversified customer base is also positive for ESG. Finding a product and distribution that will work for the middle-income population could be seen as a positive diversifier for the customer base.

And, in terms of credit ratings, rating agencies often include brand and risk diversity in their analysis. The ability of an insurer to expand successfully in the middle market will definitely have a poisitive impact on its brand recognition, which can then add value to its business profile. Similarly, expanding the customer base could provide positive consequences for risk diversification that is also considered in the evaluation of credit ratings.

A Retail-Focused Insurer Could Succeed In the Middle Market

The changing demographics of the middle market require new and innovative products and distribution. Generation X and Y (those born roughly between the 1960s and early 2000s) consumers are interested in accessing most of their financial information online and are comfortable making most purchasing decisions on their smart phones. A growing portion of the target group is Hispanic, Asian, and African-American households, which may require a different distribution focus than insurers have used in the past due to cultural and, sometimes, language differences. Some insurers have already started to make in-roads into the middle market by making the necessary investments to adapt to the changing dynamics of this space. But, there is still plenty of undiscovered potential in the middle market for a retail-oriented insurer to increase its market presence, or a new entrant to succeed, through a focused distribution and product strategy.