Seniors and Health insurance in France, an unsolvable equation?

Virginie Guinée, Group Head of Pricing - Life & Health Group Benefits, AXA GIE

Health risks are undoubtedly increasing with age, therefore, how to propose an inclusive and sustainable healthcare coverage for the eldest?

Introduction

According to Les Echos [1] on July 31st, 2025, with the decline in fertility and birth rates on one side, and the increase in the elderly population on the other side, the combination is explosive. Especially in a country like France, where the social protection system is based on solidarity between generations.

In France, the number of births in the first half of 2025 has continued to decline, following a steady decrease (except after COVID) since 2011, as announced by INSEE. At the same time, the population is ageing, which has implications for the development of healthcare services and care facilities. Thus, it raises questions about the financing of social protection.

I firmly believe that Insurance has a key role to play.

Purpose

Have you ever tried to book a dentist appointment for your grandfather of 95 years old? Or have you already advised a friend reaching retirement age, what would be the best health insurance product tailored to her needs as she’s about to lose her Employee Benefits health coverage?

Echoing my own convictions, as I took care of my grandfather, looking at all new developments (advance in medicine, AI, robots, etc…), and at fairness too, what person, what company, what society would we be if we did not take care of the health coverage/care for our elderly?

So how Insurance could protect and propose an inclusive and sustainable health coverage for the eldest?

Definition, determinants and principles

Ageing

I found the following answer within a recent press article [2]. Ageing encompasses several dimensions: physiological, psychological, and social. While age is calendar-based, the experience of ageing varies depending on the context.

In practice, the generally accepted threshold for being considered "elderly" is 75 years old, according to the French National Authority for Health (Haute Autorité de Santé). This is an age from which health begins to decline more permanently, with vulnerabilities that may be more or less pronounced and social life becoming less active.

On a societal level, various terms are used for different ages: "senior" from 55 years (workforce), from 70 years (medical field), "elderly" from 75 years, "third age" between 75 and 85 years, and "old age" from 85 years onward.

Demography

As of January 1st, 2024, as noted by INSEE [3], 14.7 million of people living in France are 65 years old and more, representing 22% of the population. This proportion is placing France at the average level of the European Union. This proportion increased by +5pts in 20 years. The share of women in this senior population is increasing with age, given their higher longevity, 53% at 65 years old, 61% at 85 years old and 76% at 95 years old.

Beyond the effect of mortality increasing with age, there is also the effect of the generations’ size to consider. Born between 1946 and 1955, French seniors of the baby-boom generation represent more than half of the senior population aged 65 years and more. With the ageing of these generations, persons of 85 years old and more could represent 24% of the senior population in 2050.

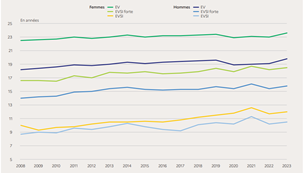

Additionally, in France, even though life expectancy (EV) (DREES [4]) is increasing regularly, it has been recently affected by the COVID-19 pandemic. And, unfortunately, these additional years of life are not necessarly lived in good health.

Epidemiology

According to DREES [4] between 2008 and 2023, the life expectancy without incapacity at age 65 (EVI) increased by 1 year and 11 months for women and by 1 year and 10 months for men, at an average of 1.6 months and 1.4 months per year respectively. The life expectancy without strong incapacity (EVSI) at age 65 y.o. is also increasing between 2008 and 2023.

Source: DREES [4]

These trends reflect the decline in the age at which chronic diseases linked to ageing appear, limiting therefore these persons in their daily life. These evolutions could also indicate that, when these health issues appear, they could affect the seniors temporarly or for shorter periods thanks to the improvement of their coverage (DREES, 2024).

This echoes a concept called "compression of morbidity." Formulated in the 1980s by Dr. James Fries, an American epidemiologist, it refers to the idea that the longer one person remains healthy, the shorter the period of illness at the end of life.

Nevertheless, there is no certainty regarding the future evolution of morbidity [5].

According to the World Health Organization (WHO), chronic diseases are the leading cause of global mortality. In Europe, they account for nearly 86% of deaths. (Ameli, 2025).

When we talk about chronic diseases, we refer to long-term, often progressive illnesses that require regular medical monitoring and can have a lasting impact on quality of life. They do not fully heal but can be stabilized and managed. Hypertension, type 2 diabetes, cardiovascular diseases (such as heart attacks and strokes), cancers, respiratory diseases (like asthma), kidney diseases, or neurodegenerative conditions (such as Alzheimer's and Parkinson's) are all included. As highlighted by a recent press article [6], these pathologies, often accompanied by signs such as sarcopenia, mild cognitive disturbances, or geriatric syndromes, tend to develop insidiously around the age of sixty y.o. and can profoundly influence the course of ageing.

Other determinants of individual health expenditure

As reminded by M. Tenand [7], we do not have to forget that, in addition of demography and epidemiology, medical practices as well as medical technological progress, have also contributed to the increase in healthcare budgets.

To complement, health-seeking behaviors (that is, the tendency to consult healthcare professionals to varying degrees) will influence the type of care provided and its intensity. In France, for example, it is possible to consult a community pharmacist, see a private healthcare professional or visit a hospital, or go through the emergency services; this choice—partially constrained—determines the diagnosis made and, subsequently, the treatments received.

In addition, public health policies, like the recent “100% Santé” reform in France, could also play a role [8].

France’s Health system principles

Indeed, as explained by DREES [8], the social protection system is of Bismarckian inspiration like in Germany. These systems are characterized by the existence of a public health insurance that broadly covers the population; enrollment is mandatory, and basic health services are provided by Social Security funds to insured individuals and their dependents in exchange for contributions.

The range of goods and services covered is defined by public authorities, as is the level of reimbursed benefits, within a limit set by the authorities known as the "reference tariff."

In addition, to protect the more vulnerable, the public health insurance, for a given list of long-term illness/chronic condition (ALD, affection de longue durée), provides a full cover for this kind of pathology.

Thus, private insurance in France complements public health insurance.

These private insurances may be mandatory; for example, private employers and now public employers are required to provide supplementary health insurance to their employees (company contracts). Students, non-salaried people, retirees are therefore covered mostly thanks to supplementary retail health insurance.

Generally, private insurance, developed alongside basic coverage, mainly finances benefits not included in the core package of care: health needs not considered essential (such as optical or dental care), procedures at the periphery of healthcare (such as chiropractor or dietetician), or comfort services (such as choosing a private room in the hospital).

In France, according to DREES [8], private insurances primarily finance outpatient care (17%), other medical goods (15%), and dental (13%).

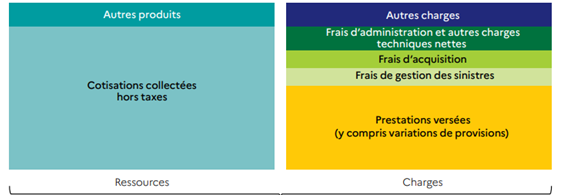

Premiums are the main resource for private health organizations. In 2022, on average, about 81% of tax-excluded premiums are paid back to insured individuals in the form of benefits [8].

To complement, for a contract to be classified as "solidarity-based" and to benefit from tax and social incentives, it must not apply rates directly linked to the insured’s health status (for example, it cannot use medical questionnaires to set premiums).

In France therefore, private health insurance is mostly founded on the principle of mutualization.

Nevertheless, as noted by DREES [8], it must be stressed that Group contracts, are on average more comprehensive than individual contracts. They offer a better quality/price ratio, cover more than 80% of private sector employees. Conversely, more than 90% of retirees are covered by an individual contract.

Article 4 of the law of December 31, 1989, known as the "Évin Law," requires insurance organizations to organize the arrangements for maintaining supplementary health coverage, to allow former employees benefiting from collective guarantees to retain their supplementary coverage at a regulated rate.

This regulated rate is planned as follows: in the first year after leaving the group insurance contract, the rates remain the same as the overall rates applicable to active employees; in the second year, these rates cannot be more than 25% higher than those; and in the third year, they cannot be more than 50% higher.

But you cannot adapt your benefits, you need to keep the ones selected by your company for the active employees. And the employer’s participation to the coverage is terminated.

Insurance requirements

Main actuarial pricing principle

Source: DREES [8], Ma complémentaire santé

The net premium is calculated by a private insurance company such that (A)=(B):

• With (A): present value of the expected claims over the insurance period.

• And (B): present value of the risk premiums paid over the insurance period.

But what does it mean?

A. From an insurer’s standpoint:

In the case of individual retail health contracts, generally, the premium can be adjusted based on the insured’s age. Indeed, the likelihood of healthcare consumption and the amount of expenses in case of care increase with age, leading to a higher risk of costs for the insurer.

Thus, according to DREES [8], for a "reference" insured person aged 85, the average monthly premium for an individual contract is €146, compared to €33 at age 20. Furthermore, the variability of premiums between contracts increases with age.

Premiums for individual contracts for retirees can also depend on the insured’s residence, or length of the contract. Pricing based on residence accounts for variability in healthcare offering as number of/access to hospitals, doctors, medical facilities may vary by city/department.

Offering a decreasing premium with the length of the contract helps organizations retain customers and, for those promoting age-based solidarity, protects against opportunistic subscriptions at older ages.

Additionally, age limits for subscribing to a contract can be imposed. This practice can be used to help maintain the financial balance of solidarity-based contracts across age groups.

In fact, for this type of contract, there could be a "threshold" age beyond which, on average, the insured moves from being a net contributor to a net beneficiary of this solidarity. Setting an age limit below this "threshold" avoids opportunistic subscriptions by indirectly reserving access for those who have previously contributed to the solidarity, encouraging them to keep their contract.

Last, since 2012, gender-based pricing has been prohibited for all supplementary health organizations; in 2011, as mentioned by DREES [8], it affected one-third of individual contracts from insurance companies, and women paid on average 27% more than men.

B. From a customer’s standpoint:

The senior person wants to be treated fairly, but with a personalized approach to ensure a healthy ageing, with benefits tailored to his or her needs at the lowest cost possible.

Risks and opportunities

Nevertheless, to maintain the actuarial equation presented above, there are risks.

Risks

Maintaining social cohesion is a key parameter, we are seeing currently that social security withdraws from certain risks, thereby automatically increasing the reliance on supplementary insurance; and this will certainly be amplified by the recent discussions on the 2026 French budget.

And one cannot indefinitely raise premiums or reduce benefits to offset the growing risks. Would that not amount to "abandoning" these clients at the very moment they need the coverage the most?

But there are also opportunities, to go beyond the maths and to become a true partner for the health of our senior clients.

Opportunities

Prevention

Prevention assessment – Health check-up

As already recommended by World Health Organization via its ICOPE ((Integrated Care for Older People) program, or by the national Health social security in France, prevention is essential.

A significant portion of chronic diseases is related to preventable or modifiable risk factors.

Thanks to French public health insurance, my prevention assessment [9] aims to promote the identification of these risk factors and to encourage patients to take an active role in their health by adjusting their behavior accordingly.

Data for Prevention

Some insurance companies are already investing in this prevention field, such as MGEN the historical French mutual for National Education civil servants who recently plan to use its insured members' health data for prevention purposes [10].

The mutual's corporate foundation, an independent research organization, received authorization from CNIL to create a health data warehouse.

Product design for Prevention

The new insurance company Alan is, on its side, focusing on young retirees. "Indeed, up to 60% of the most common health issues among seniors can be reduced through precise and personalized preventive actions," explains CEO Fabrice Staad in a recent press article [11]. "These targeted health measures can thus extend life expectancy by 10 years." Alan offers five levels of coverage, including medical consultations via chat and video, personalized and innovative prevention programs, quick medical responses (less than 5 minutes per chat), personalized service."

Partner, Services, Assistance

Most of Health insurers and mutuals already propose digital services as explained for Alan above, such as teleconsultation, second medical advice in case of a diagnosis of a health complex condition, chat in case of questions, etc to assist the client in his or her patient journey.

Other European countries’ perspectives

Germany

The German Healthcare system is a dual system with a Statutory Health Insurance [SHI] and a private health insurance [PHI]. While SHI is accessible to everyone, certain conditions apply to PHI. Both differ in the financing of medical services: the public is a pay-as you go system whereas the private one is financed considering aging provision.

Most of the population is covered by the public scheme, the other is insured by the private scheme which is open to civil servants, high-income employees, self-employed and free-lancers. The total number of private insureds has been declining, in line with the increasing income limit.

Full Private Health Insurance (PHI) products are Life-like type, with levelled premiums and ageing reserves with a guaranteed renewal provided to the client by the insurer.

Premiums’ increase is strictly regulated. These products comprise both inpatient and outpatient benefits.

As for France, the main challenges are demographic change and increasing medical costs.

In terms of actuarial answers, the current ones are ageing reserves, with ageing reserves (due to levelled premiums), legal surcharge of 10% and additional ageing reserves, the Safety (security) loading added to the premium (up to a maximum of 10%), the RfB (Surplus; RfB is a cumulative and mutualized provision that enables to limit the increase of premiums due to the premium adjustment and so it has a key role), and the regulated premium adjustment mechanism (BAP).

In terms of products’ design, regulation imposed the following changes.

Some examples below highlight the important concern of regulator with the sustainability and affordability of private health insurance covers, moreover when ageing.

1994: A standardized cheap alternative to the existing full private health insurance was introduced in the case of the customer having trouble paying his premiums in higher ages. It came with very strict terms of admission.

2000: In the full private medical insurance, a supplement of 10 percent of the annual gross premium must be imposed for every insured person between the age of 21 and 60. This premium supplement is fed directly into the ageing reserves and used for premium reduction when the customer reaches the age of 65.

2011: Tariff changers law. Starting from this date, the possibility was given to policyholders within a given insurance company, to switch from one product to another-product in the insurance company (e.g. from one comfort-product to a product covering only basic needs). The tariff change is possible without penalties, but with a new medical selection if better benefits.

The consequences in terms of benefits’ decrease: the accumulated amount of reserves of the previous product will be used to reduce the premiums of the new products.

It is quite common therefore to propose a high benefit when working, and at contract’s inception with possibility to reduce them later, at retirement age for example, when employer’s participation disappears.

In addition of the German legal framework, the EU directive with respect to gender’s discrimination was introduced in 2012 and modified the German Health market, as for France, as highlighted above.

2012: The introduction of unisex products meant that from 21.12.2012 only products that could be sold were calculated in a way that men and women have the same premiums at a given age. It is possible to switch from a bi-sex product to a unisex product, but not the other way round. The calculation of unisex products included the risk that many women will switch to the unisex products which were usually cheaper for them. Switches in the unisex products have mostly occurred in the first couple of years after their introduction and the number has strongly dissipated since then.

Ireland

In Ireland, the state provides a national healthcare system, as noted by DREES [8]. In this type of healthcare system, known as a "Beveridge" system, central, regional, and local authorities are responsible for funding the healthcare system. Residents of these countries are automatically covered by the healthcare system, whether or not they contribute to its funding via tax or other means.

However, generally, the care pathway is highly regulated, often linked to the geographical area of residence within the country, and primary care is mostly provided in public centers where doctors are generally salaried or paid on a capitation basis.

A private healthcare offer can develop alongside the public system, in a duplicative mode, to get a faster access to medical facilities.

Health private insurance in Ireland is community rated with corporate groups allowed to have a discount applied of up to 10% on health products. All products are also subject to open enrolment meaning that they must be made available to any customers would it be individuals or companies for their employees and offer lifetime cover.

Irish products cover both inpatient and outpatient and dental.

In Ireland, it is also not permitted to price health private insurance by age or age-bands. There is therefore a large mutualization and a high solidarity between generations.

But, as mentioned by the IrishTimes in 2022 [12], Ireland is ageing faster than anywhere else in Europe, placing growing pressure on the health service and posing challenges for planning its future, according to a report published by the Department of Health in 2022.

Complemented by a recent publication of the Irish government [13], the impact of an ageing population on the public finances will be significant.

It is in this context, and to promote intergenerational equity, that the government is preparing for the establishment of two long-term funds. These funds will save a portion of ‘windfall’ corporation tax receipts to help offset some of the costs associated with long-term structural challenges, including an ageing population.

Proposed recommendations

Being agile and proactive, and sticking to clients’ needs.

Some proposals in terms of product’s design & pricing:

- Propose systematically a complete health check-up at contract’s inception and at key ages/key periods at 60/65 y.o. or retirement age whichever comes first and then at 75 y.o.

Some might say that it could be expensive, but we could expect that prevention will be effective to avoid some more important health issues/costs afterwards, as generally, average contract’s duration for a retail health insurance corresponds to a 7-to-8-year period. In France moreover, it could come in complement of National social security benefits.

It is a first-year investment, like the one some insurers and mutuals could do in providing an additional commission for the salesperson/agent or broker for the 1st year of contract.

But it is a true investment, for the health of our clients and I am convinced that it would serve as a complementary argument for sales.

- Propose an adaptive Table of benefits as some benefits do not have the same importance at age 60 and at age 85, and as many seniors in France are women.

This is key, as, at the same time, by sticking to clients’ needs, we also have the opportunity to maintain the risk premium as flat as possible.

Some insurers and mutuals already propose an evolving or a progressive table of benefits depending on clients’ loyalty, but here, the purpose is more to adapt each benefit to the retirement life period, to construct a risk premium as flat as possible for a 7-to-8-year period or even more.

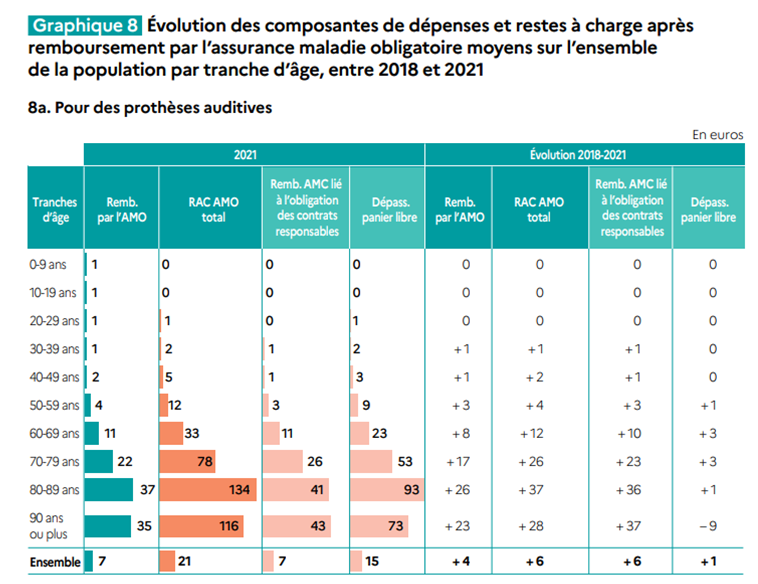

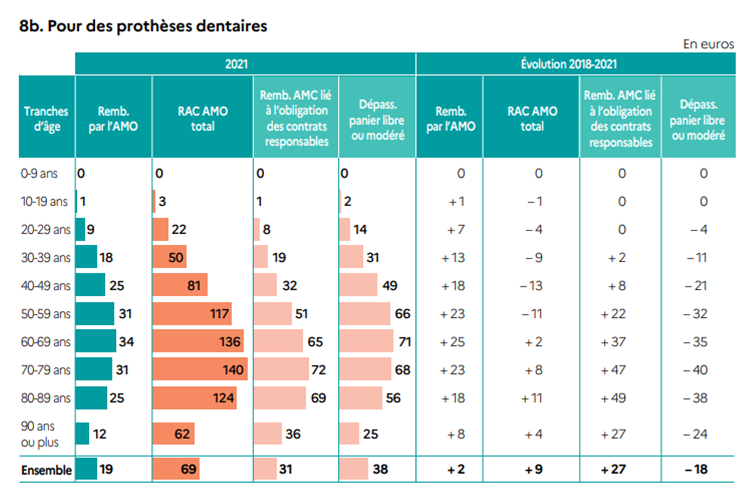

Example of Optical, Dental & Hearing aids

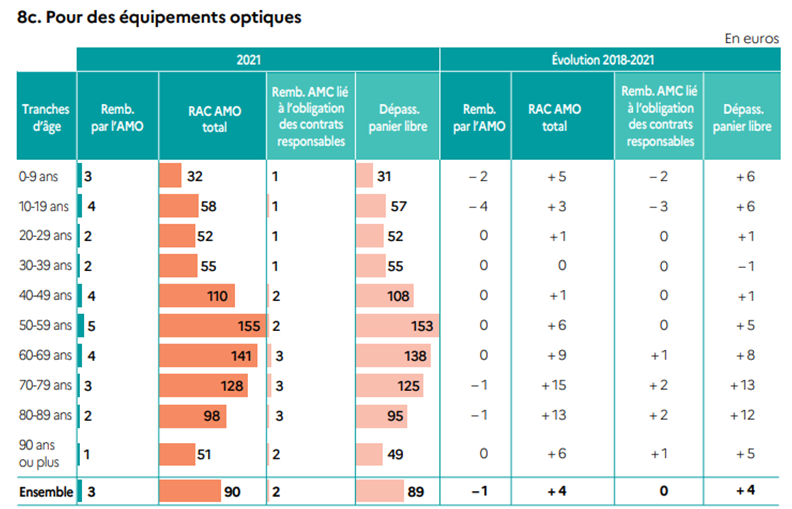

Looking at the 3 charts below published by DREES [8], we clearly see that the moment of need for these 3 benefits is not the same between age-bands, and that, after the peak, in average the expenses are decreasing. This means that for a specific age, we could compensate from one year to another between different families of benefits and that we would be able to price several ages, several age-bands with the same risk premium.

Source: DREES [8]

For dental prosthesis, the most critical period is 70 to 79 years old.

Source: DREES [8]

For optical benefits, the most critical period is 50 to 59 years old. Looking at senior population only, it is from 60 to 69 years old then decreasing.

Source: DREES [8]

Example of Hospitalization and Out-patient (GP & Drugs)

According to DREES [14], compared to those under 75, the individuals aged 75 or older have higher healthcare needs. Almost all of them consulted a general practitioner at least once during the year, and one-third were hospitalized.

Beyond the age of 75, poly-pathology is a common phenomenon: it is estimated that between 40% and 70% of people aged 75 or older are treated for multiple conditions.

The most frequent pathologies include heart diseases, diabetes, asthma, and Alzheimer's disease. Nearly one-third (29%) of people aged 75 and older are treated for a cardiovascular condition. Some diseases are highly correlated with each other.

For individuals aged 75 and over, the highest expenditure category is medications, followed by medical fees (expenses for consultations with general practitioners and specialists), then nursing acts. The latter expense almost quintuples between the 60-74 age group and those 75 and over.

Expenses for physiotherapy are also multiplied by 2.5 between the two age groups. Transportation and medical equipment costs are increased by a factor of 1.7. These expense categories are characteristic of dependency.

Here again, we see a difference between age-bands and a higher proportion of this type of expenses compared to optical & dental and hearing aids.

Some proposals in terms of services:

These proposals came from recent discussions I had with my parents, my parents in law and some of their friends, all aged between 73 and 82, as they know I am working in the Life & Health Insurance field.

A human in the loop

Looking at different French insurers and mutuals’ websites, and other players in the health field, lots of services are proposed via a digital way, chat, etc but currently all seniors are not at ease with digital platforms like e.g. Doctolib for booking an appointment with a doctor or a medical facility or even using teleconsultations, chat etc.

Having a human in the loop will help to facilitate medical appointment’s booking or face to face visits, it will ease the patient’s journey, increase its loyalty, avoid waste & abuse by directing insureds in Insurance medical facilities or within Insurers’ medical providers preferred networks.

Propose a holitisc support when noticing important issues

In France, it is true that insurers do not know the pathologies of their clients, they just know if they reimburse a GP visit, a hospitalization, or a Lab test.

But I think there is a possibility to be more proactive. When e.g., a client is calling for having access to a health support benefit, a housekeeper as they just went out from the hospital, asking “how can I help you further”, would be the adequate question. And if the client is answering, giving additional details on his or her health status, we must try to propose services enabling the patient to get the best healthcare journey as possible, moving from a pure payer approach to a partner’s one.

As an example, if a person is answering that he or she left hospital after a surgery to extract a tumor and then has a reconstruction of a part of the body, services could be e.g. to propose names of medical practitioners for his or her reeducation close to his or her home, propose a psychological support to face the challenges of the reconstruction.

Conclusion

Is there an inevitability to the ageing peril? Should we resign ourselves?

On the contrary, to propose an inclusive and sustainable healthcare coverage, we must dare to take care. Prevention is always better than cure.

References

1. Les Echos, https://www.lesechos.fr/idees-debats/editos-analyses/demographie-peril-vieux-2179658

2. Le Journal des femmes, https://sante.journaldesfemmes.fr/fiches-sante-du-quotidien/3221026-age-personne-agee/

3. INSEE France, Portrait social, Edition 2024, Novembre 2024, Perte d’autonomie https://www.insee.fr/fr/statistiques/8242365?sommaire=8242421#consulter

INSEE (Institut national de la statistique et des études économiques) Première, France, n°2040, Février 2025, Statistiques et Etudes, Plus de la moitié des personnes de 65 ans ou plus sont des baby-boomers https://www.insee.fr/fr/statistiques/8349408

4. DREES, France, (Direction de la recherche, des études, de l’évaluation et des statistiques), Etudes et résultats n°1323, Décembre 2024

5. BEH, n°5/6, 2006, le vieillissement de la population va-t-il submerger le système de santé ? Caisse nationale d’assurance maladie des travailleurs salariés, (CNAMTS), Institut de recherche et de documentation en économie de la santé, (IRDES)

6. Le Journal des femmes https://sante.journaldesfemmes.fr/quotidien/3231830-signes-bien-vieillir-apres-70-ans/

7. Hausse des dépenses de santé. Quel rôle joue le vieillissement démographique ? Marianne Tenand, Médecine et Sciences, Paris-Jourdan Sciences Économiques (UMR 8545), École d’économie de Paris et École normale supérieure

8. France, Panoramas de la DREES, Santé, Edition 2024, La complémentaire santé, acteurs, bénéficiaires, garanties

9. France, Assurance maladie en ligne, https://www.ameli.fr/medecin/sante-prevention/bilan-prevention-ages-cles

12. IrishTimes (2022), https://www.irishtimes.com/ireland/social-affairs/2022/12/02/ireland-ageing-faster-than-anywhere-else-in-europe-as-births-fall/

13. Irish Government (2024), https://www.gov.ie/en/department-of-finance/press-releases/minister-mcgrath-publishes-reports-on-population-ageing-and-the-public-finances-in-ireland/

14. Comptes nationaux de la santé 2012, Dépenses de santé, hospitalisations et pathologies des personnes âgées de 75 ans ou plus