Can Life/Health Insurance Help Alleviate Social Inequalities?

by Nagib Amara, Head of Inforce Management, Group Risk Management, AXA Group

Why a topic about life insurance and social inequality?

A few months ago, I came across the advertisement shown below. It was printed by the New England Mutual Life Insurance Company in 1861[1]. The advertisement highlights the positive role that the life insurance industry has in mitigating some important social issues. 162 years later, not only have these social inequalities increased in many countries but at the same time, the adoption of life insurance products has continuously declined. In a time when all industries are keen to show their positive impact on environmental and social issues why aren’t insurers yet seen by the public as contributing positively to the well being of society. Is it realistic to expect life insurance companies to take out the role of reducing social inequalities while being profit makers? If so, what are the main barriers to them playing this role?

Executive Summary

In many countries we see a decline in demand for life insurance policies since the beginning of the century. Yet societal challenges related to the ageing of these societies or to the increase of life-style related diseases make life insurance even more relevant today than before. The decrease in demand for life insurance should be a worrying phenomenon for public authorities as it puts more pressure on them to face these growing challenges without strong support from private actors.

In this report, we develop the idea that sustainable growth for the life insurance industry is possible if emphasis is placed on reducing social inequalities by increasing protection, thanks to a wider adoption of life, health or income insurance protections. This strategy would not only support growth for the industry, but it would truly demonstrate its social and responsible impact.

To achieve this purpose, many barriers to a wider adoption of life insurance protection need to be addressed. The insurance industry needs to tackle the challenges of i) lack of awareness of a large part of society around life insurance products, ii) the affordability and complexity of the current product range, as well as iii) the relatively slower digitalization of the industry. Finally, a continuous effort should be done to overcome the trust deficit with customers.

While some insurance companies have already started this journey, I believe the 4-point action plan below is key to making life insurance more popular, having a greater impact on society and building trust.

Build simple and affordable products. Given the low penetration rate of the insurance products, it is important to design simpler and more affordable products. Addressing structural cost issues in terms of operation, distribution and product development as well as reaching the desired scale (point 2 and 3 below) are necessary to reach this objective.

Increase the customer awareness and reach. This can be done through i) Education – by increasing literacy via basic courses on insurance as early as school years ii) Media – in line with new customers purchasing habits, it is important to increase our presence on social media platforms, and finally iii) Distribution – Distributors are important to reach this objective, but we need to rethink the incentive mechanism in order to incentivize them to target a wider range of customers.

Proactively engage with public authorities. A low adoption of insurance will leave the burden to the public authorities who will have issues facing consequences alone. It is therefore in the interest of both parties to promote more win-win private/public partnerships which could increase the adoption of life insurance products. For insurers, this would not only support growth but also address anti-selection risk and ensure cross subsidization.

Address the trust issue in all dimensions – The insurance industry, as part of the wider financial services industry, ranks poorly in trust surveys compared to other industries. From streamlining claim processes to increasing costs transparency as well as partnering with trusted brands, life insurance companies should actively seek ways to address the trust issue.

How can the life insurance industry alleviate some social inequalities?

Social inequality is the condition where people have unequal access to valued resources, services and positions in a society. In this report the focus will be on income and wealth inequalities.

Income and Wealth inequalities and their drivers

Many studies on social inequality and its impacts have been conducted over the past years. One of the most debated is from the french economist Thomas Piketty conducted in 2013 - “Capital in the Twenty First century” which studies wealth concentration and distribution over the past 250 years. He argues that the rate of capital return in developed countries is persistently greater than the rate of economic growth, and this trend will continue to be responsible for more and more wealth inequality in the future.

The top 10% wealth shares have massively increased in the US, China and Russia over the past years

Source: “The role of insurance in mitigating social inequality” – The Geneva Association

In its 2020 report - “The role of insurance in mitigating social inequalities”, the Geneva association – a global association of insurance companies conducting research with academic institutions and multilateral organizations – stressed that income inequality is not a universal phenomenon and needs to be examined at the country level with domestic policies able to make a huge impact. The report highlights that the rises in inequality were higher in the countries with high population density such as as China, India, the US and Indonesia. It elaborates on some of the main drivers such as technological advances and globalization of trade which penalize low skilled people and education, with the lower chances for children with poorly educated parents to continue in post secondary education.

Only 1/10 children with poorly educated parents continue to tertiary education compared to 2/3 of children with highly educated parents

Source: "The role of insurance in mitigating social inequality” – The Geneva Association

The report also explains the impact of social inequalities on the economies and how life insurance products can help mitigating its impacts. Some of these ideas are summarized in the following section.

Impacts of social inequality on economies and on the life insurance industry

Social inequality can adversely impact individuals and the economy at large. Its persistency in society can trigger important social, political, and financial disruptions. On the social front, it can lead to unrest that eventually undermines investor sentiment. On the political side, it can be instrumentalized for more populism or a protectionist agenda. Finally, it can also lead to financial crises over the long run as was the case for the global financial crisis in 2008, triggered partly by the loosening of mortgage requirements to accommodate people with precarious situations.

Life insurance companies, as major institutional actors in the economy, are impacted by all these consequences. Social unrest as well as violence are not only detrimental to business sentiment but also trigger more claims payment. A slowdown of economic growth means lower purchasing power and lower sales of life insurance products. Finally, financial and market volatility can lead to more surrenders and a lower capacity to offer attractive yields to customers.

Social inequality has also shaped societies and created noticeable patterns due to inequal access to insurance protection notably health insurance. In the US for example, the life expectancy difference between the wealthiest and the poorest is today in a range of 10 to 15 years. This gap is attributed to the high number of uninsured people which still exists despite the adoption of the Affordable Care Act. More recently, the coronavirus pandemic highlighted that in many countries, lower income people bear more of the effects of health pandemics through income losses as well as having more limited healthcare accessibility.

While life insurance cannot address all of these issues, it can play an indirect role in mitigating some of the consequences. The two examples below show the importance that life insurance products can have in mitigating income and wealth inequality:

Premature death/disability of the main breadwinner (SeeTable 1 for some indicative statistics) – It can leave families in a precarious situation if there is no adequate protection mechanism at the country level or from the deceased’s employer. Therefore, there is a clear value for products that pay a specific amount upon the death or disability of the main breadwinner to cover for short to mid term expenses or secure tuition for kids’ education in the long-term. These products called Term Life and Disability coverage, are usually more affordable than most people think (see LIMRA survey in the next section). However, the penetration rates for these types of products remain low. For emerging countries, the need for this type of protection to be provided by the private sector would be even higher than in mature countries, as the challenge for the public authorities to protect the whole population is even bigger, given the size of the informal sector and part time workers.

Increased longevity and old age poverty – The role of pensions and financial security during the retirement phase of life is very important to protect retirees from falling into poverty (See Table 2 for some indicative statistics about poverty at retirement). Life insurance companies offer annuities that could complement the other sources of income during retirement and further mitigate the risk of outliving one’s savings during old age. These products offer monthly income in exchange for a premium. However, despite their guarantee to ensure a lifetime income, these products remain unpopular among individuals. The value proposition of annuities becomes more relevant as the population is ageing but also as many employers are shifting toward defined contribution pension schemes which transfer investment and longevity risks to the pensioners.

Reasons behind the lower demand and how can these be addressed

Life insurance penetration, measured as the share of premiums in the GDP, has been declining in many economies over the past years. Using the Swiss Re Sigma database, we can see that the ratio in advanced markets has fallen from 5.7% to 3.7% from 2000 to 2022. This indicates a lower relevance of life insurance despite the ageing of the populations as well as the growing impact of lifestyle related diseases.

Life insurance penetration has been declining since the beginning of the century in major economies

To analyse the reasons behind the lower demand for life Insurance, two studies will be used i) the LIMRA & Life Happens “2023 Insurance Barometer Study” which analyzes the results of a US survey conducted among more than 8000 people aged 18-75, about what matters most to them when thinking about life insurance, and ii) a survey from the the Geneva association “Addressing Obstacles to Life Insurance demand” conducted in seven mature market (US, UK, France, Germany, Italy, Japan and Switzerland).

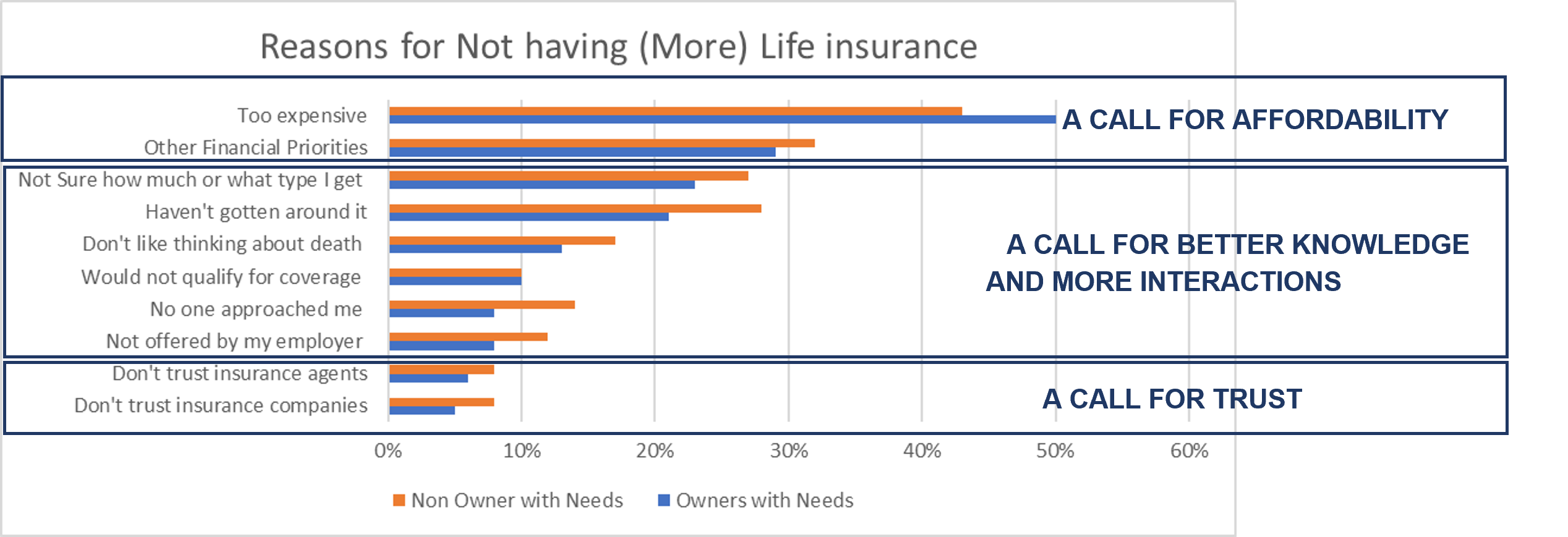

Both studies identify common reasons for lower insurance demand such as the affordability of the products and people having “other financial priorities”, or the lack of knowledge about insurance products.

Although not cited among the first reasons not to own an insurance policy, the trust factor is also an important element. An increased level of trust in insurance companies as well as intermediaries would also encourage additional purchase of insurance products.

Source: LIMRA & Life Happens “2023 Insurance Barometer Study”

Insurance knowledge gap

Lack of awareness about life insurance products is one of the main causes for underinsurance in the life sector. The Geneva association study (2020) highlighted that, apart from Term Life insurance, a vast majority of the respondents were not aware of the range of life insurance products available and consequently very few currently own one of these insurance policies (see Table 3 for more statistics).

The LIMRA survey shows that 42% of respondents say they are somewhat or not at all knowledgeable about life insurance whereas only 27% indicate they are very or extremely knowledgeable.

It also highlights that this trend is even more noticeable among the younger generations. Indeed, more than a quarter of the Gen Z, Millenial and Gen X members are not sure about how much or what type of coverage to get. Besides, many of them are intimidated by the education and purchase process. Insurance knowledge among baby boomers on the other hand is much higher.

How to address the lack of knowledge issue?

First, it is up to life insurers to proactively address the low level of insurance awareness and education. Public authorities might also be willing to facilitate awareness of the importance of being insured (especially after the COVID-19 pandemic). This awareness should start as early as school age with the introduction of basic courses about insurance and the merit of being insured for health, protection or retirement purpose.

For the learning process to be easier, life insurers also need to tackle the complexity of their product range. Some customers might be intimidated to buy a life insurance product because there are many features and the explanation process is lengthy.

Moreover, the younger generation is utilizing social media for financial product education and discussion. They are more enclined to shop online for convenience and financial considerations (i.e. they believe products are cheaper when bought online). It is important that life insurers are present in these platforms to connect with customers, educate them, and build trust.

While increasing the literacy is important, it is also important to review the distribution strategy to reach the desired scale. Indeed, insurance products are said to be often “sold” rather than “bought”. A wider adoption of life insurance products requires a review of the incentives mechanisms to encourage selling more lower ticket size policies and therefore targeting a wider range of the population.

Only a quarter of the respondents were able to correctly estimate the price of a Term Life insurance with the majority believing it was 3 times more expensive

Source: LIMRA & Life Happens “2023 Insurance Barometer Study”

Insurance affordability

According to the LIMRA survey, the top barrier to purchasing a Life insurance product in the USA is the cost of the products. Indeed, 63% of US adults (aged 18-75 years old), say they did not buy life insurance products because it was too expensive.

To some extent, the higher cost of insurance products is a perception from people who don’t own a life insurance policy. Indeed, only a quarter of the respondents of the LIMRA survey were able to correctly estimate the price of a term life insurance product, with the vast majority believing it was 3 times more expensive than it is.

Distribution commissions/support as well as administrative costs drive most of the life insurance costs. A survey from Bain&Company (2018) – How to breathe new Life into Life insurance - shows that the insurance industry is falling behind other industries in terms of optimizing operational expenses despite recents efforts to reduce expenses. In 2016, insurers spent 3.2% of their annual revenue on IT, less than half the 6.8% spent by banks. 70% of the executives surveyed believe they lag other financial services sectors in the adoption of digital technologies. Thepredominance of legacy IT systems, their costly associated processes as well as the difficulty to improve the agent’s productivity (due to lower sales) contribute to a rise of the costs of life insurance products.

How to address the affordability issue?

A study from McKinsey (2021) - “The Productivity Imperative for US Life and Annuities Carriers” –highlights a difference of 30% between top and bottom quartile companies in terms of overall expenses. This suggests that more cost improvements could be made across the industry. The study points to potential areas for costs improvement on the Operational side –via redesigning end to end processes, usage of automated tools, improvement of customer-facing activities with the use of more self services options to improve first call resolution rates. On the Distribution side, by far the most expensive part of the value chain, optimizations are recommended in terms of digital and self services capabilities to reduce sales support costs, improvement on the leads generation to better engage with the customers and eventually improve the overall productivity. Finally, on the Product development side, complexity leads to higher costs of maintenance as well as higher costs to onboard and train distributors. It is important to promote simpler concepts for lower ongoing maintenance costs.

For private insurance to make sense, it is also important that the costs of insurance remain affordable for all. On the other hand, it is also important that the composition of the “risk pool” allows for cross-subsidization for the private insurance companies to manufacture viable and profitable products. Therefore, the role of the public authorities to allow for the creation of larger risk pools is important. This could be achieved with more Private Public Partnerships (PPPs) in a win-win approach.

The trust gap

Because life insurers promise to pay claims at a distant and unspecified point in the future in exchange for a premium payment today, trust is paramount.

The annual report from the Edelman Trust barometer (2022) – an online survey involving more than 32,000 respondants across 28 countries – shows that the financial services industry rank among the least trusted industry (with only social medias ranking behind). Within the financial services industry, insurance companies rank below banks and credit card companies.

The 2 studies from LIMRA and the Geneva association suggest that an increased level of trust vis a vis insurance companies, and their intermediaries would encourage additional insurance products purchases.

How to address the trust issue?

First and foremost, the insurance companies need to be irreproachable during the claims settlement process. Delayed claims settlement (when these are not fraudulent) and long procedures cause people to lose trust in the industry in a moment where customers can be vulnerable.

Simplicity and product transparency are also important to clearly state the price and the value for customers in each product.

Because our industry suffers from a lack of trust since the global financial crisis in 2008, partnering with other non-financial companies with trusted brands with a view to access new customers could also be a winning strategy.

Conclusion

Going back to our original question on whether life and health insurance companies can and should alleviate income and wealth inequalities, the answer is yes they should because it is in their best interest and yes they can if they really address the customers concerns highlighted in the various surveys. This was after all the industry’s original mission as illustrated in the 1862 advertisement shown in the beginning of this report.

The fact that the industry is in a slump and trust indicators are low show that we have not managed to convince the public about our capacity to fulfill this role in a time where inequalities are higher than ever in many countries.

It is therefore up to the leadership of the industry to assert themselves to the public with this original image and relentlessly address the root causes of the low adoption of life and health insurance.

Targeting this goal is not only good for the society in general, but also key for the industry’s growth and would certainly increase employee’s engagement and talent acquisition in a time when employees increasingly seek purpose at work.

Author Notes

This paper was prepared by Nagib Amara in his personal capacity as part of the Leadership of tomorrow program. The opinions and thoughts expressed only reflect the authors views. Any errors or omissions remain solely the responsibility of the author

The author would like to warmly thank Tim Rozar for his comments on previous drafts of this paper, his availability as well as the various fruitful exchanges and insights during the past 5 months.

1 Boyd’s Washington and Georgetown Directory: Containing Also a Business Directory, Congressional and Department Directory, and an Appendix of Much Useful Information. New York. Thomas Hutchinson. 1862.