Insurance and the Three Pillars

Michael Morrissey, Special Advisor, International Insurance Society

I’ve been thinking about where the insurance industry fits, in the economy and in society. It’s a business, of course, but not an unfettered profit maximizing kind of business. It’s subject to regulation by governments, which reduces the odds of total failure but also puts some restraints on profitability, albeit not as much as a public utility. So what, exactly, is the position of the insurance industry?

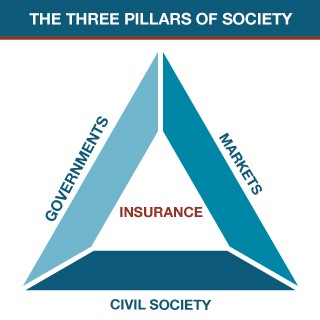

A recent book by Raghuram Rajan, a University of Chicago professor and former Chief Economist of the IMF, provided some useful insights. Although not focused on the insurance industry, The Third Pillar provided me with a new perspective. The premise of the book is that three forces – governments, markets, and civil society – interact in ways that affect our lives, and that when an imbalance in their interactions occurs it’s bad for society.

Governments, the First Pillar of any society, have certain responsibilities that no other sector can logically provide. These include national defense, assuring the safety of law and order, providing a transportation infrastructure, protecting basic human rights, and they do so mostly through the collection of taxes and fees.

Markets, the Second Pillar of a society, complement the roles played by governments by raising and allocating capital and resources, and facilitating the trading of goods and services among populations both within and outside their borders.

The Third Pillar is Civil Society, distinct from Government and markets, can be understood as communities, families and non-governmental organizations (NGOs) that promote the interests and will of the people, from the bottom up. The phrase civil society goes back to Aristotle’s description of the “political community” of shared norms and values of free citizens. This Third Pillar of like-minded groups is regarded by economists and ethicists alike as a vital and equally important element of society, without which the other pillars cannot function effectively.

Insurance is an activity and an industry that helps the three pillars work harmoniously, by incorporating elements of all three. It is thus an underappreciated force for good in our economy and society. As a regulated industry, insurance works with governments more than most businesses. The industry’s policy forms, capital levels, premium rates, allowable investments and other operating elements are in varying degrees regulated by governmental entities. Insurers enhance public health and safety by the products and advice they provide, and increasingly provide risk reduction and mitigation directly to sovereign and sub-sovereign governments through insurance and reinsurance structures.

Insurers are vital drivers of the capital and financial markets as well. With over $30 trillion of invested assets, insurers are one of the world’s most important sources of funding for everything from massive government infrastructure projects to the latest consumer technology gadget. The products and risk management advice of the industry are essential to the functioning of all industrial and consumer businesses as well.

Additionally, insurers provide risk management products to families, communities and local businesses without which life as we know it in the 21st century could not function. People need insurance to drive a car or own a home; businesses need it to protect against fires and lawsuits; communities need it to protect against extreme weather events. Insurance touches every aspect of Civil Society each and every day.

Insurance may be unique in the way it is interwoven into the activities of all Three Pillars. In fact, our industry is now taking on even more meaningful activities to enhance the pillars’ individual and collaborative functioning. In an age when so many people have lost confidence in the integrity and effectiveness of both governments and markets, communities are more important than ever. Insurers have developed meaningful ways to work with various elements of Civil Society to link their efforts to Government and Markets to make the world function better.

An example is the Insurance Development Forum, a public/private partnership of the insurance industry, the United Nations development Program (UNDP) and the World Bank. The IDF seeks to leverage the risk management and investing capabilities of the insurance industry to help vulnerable governments, people and economies enhance resilience through better understanding and managing risk. It is currently active in more than 20 countries, combining its participants’ expertise to offer climate risk financing, risk pooling and transfer, and other services designed to promote the UN’s Sustainable Development Goals.

The IDF is a good example, but only one example, of how insurance is playing an increasingly critical role in linking the interests and filling in the stronger and weaker capabilities that each of the Three Pillar possesses. Without insurance, each of the Three Pillars tends to operate in its own silo, leaving major gaps between them. Through the ever increasing involvement of the insurance industry, they are moving toward partnerships that enable each to achieve their own objectives better, and to powerfully leverage their combined efforts. Insurance is the key ingredient of this promising collaboration.

10.2020