COVID-19 and the Economic Downturn’s Effect on P&C Insurance: An Opportunity for Technology?

Patrick Schmid, PhD, Economist and VP for The Institutes RiskStream Collaborative

– a blockchain insurance consortium. Oversees all departments: products, operations & technology

The outbreak of the novel coronavirus (COVID-19) and the shelter-in-place response has wounded the US economy. Business and consumer-oriented economic indicators show the extent of the damage thus far, but economic data released in spring/summer months are likely to demonstrate further deterioration. The P&C insurance industry has not been immune to the economic fallout. The downturn is likely to strain underwriting profits, and the decline in interest rates and financial markets will undoubtedly impact net investment yields, which will exacerbate the industry-wide profitability efforts. The P&C insurance industry should expect differing impacts dependent on the insurance line. The line by line policy and loss impacts are studied within this article. Going forward, it is anticipated the pandemic response and economic downturn may expedite technological change and adoption, as industry players seek to maximize operational efficiency in a new world.

The Economic Downturn

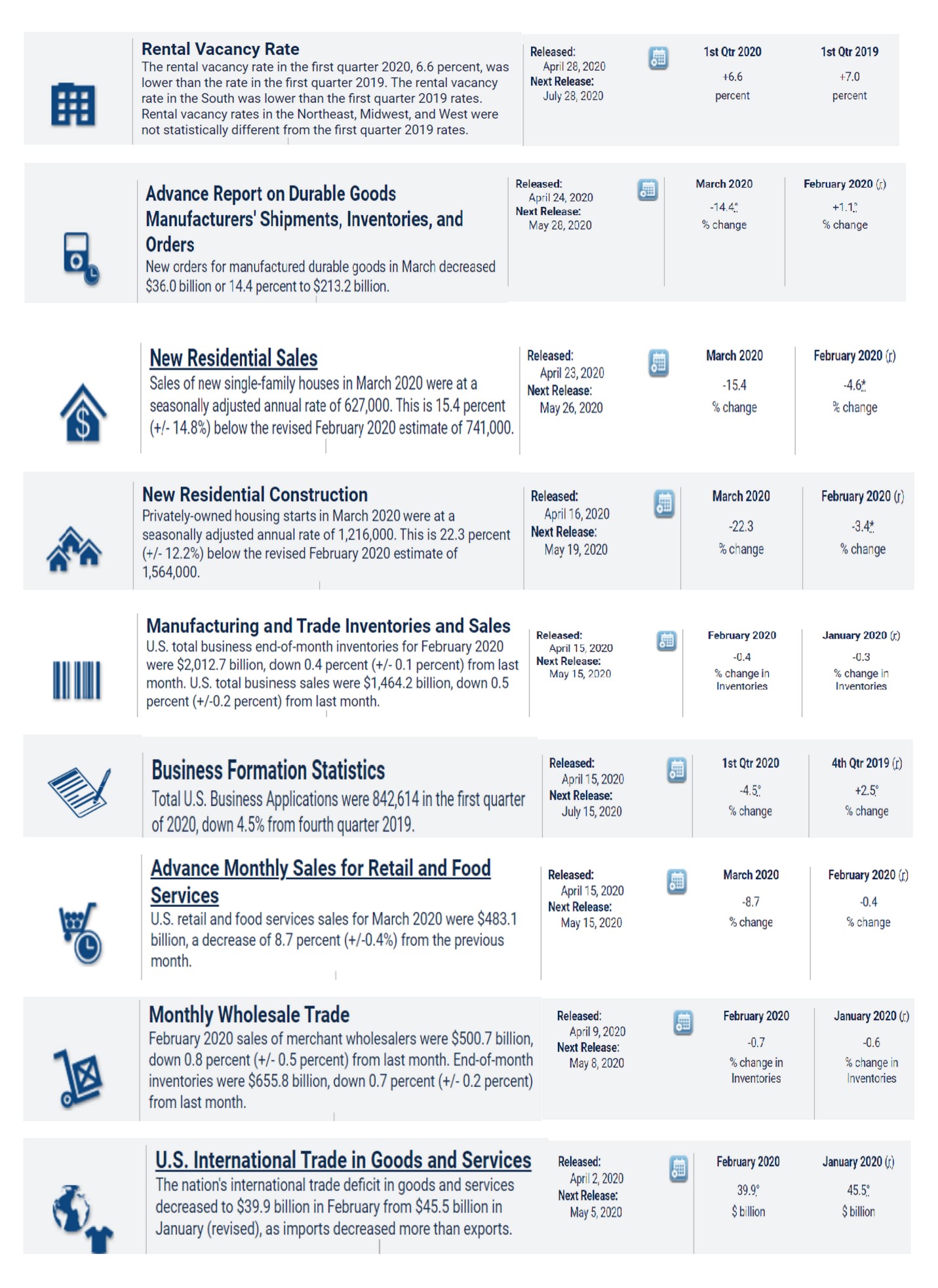

The emergence of the pandemic has wreaked havoc on consumer activity, business activity and governments. Declines in manufacturing, residential housing, trade, business formation, and retail/food sales have all shown up in April’s economic indicators. These numbers are likely to worsen with May releases.

Figure 1:

Economic Indicators released in April indicated a sharp decline in residential and business activity.

The decline in residential and business activity underscored by worsening economic indicators (shown above) forced businesses to reevaluate their operations. Many have cut costs, including staff. This process has resulted in an unprecedented spike in unemployment claims.

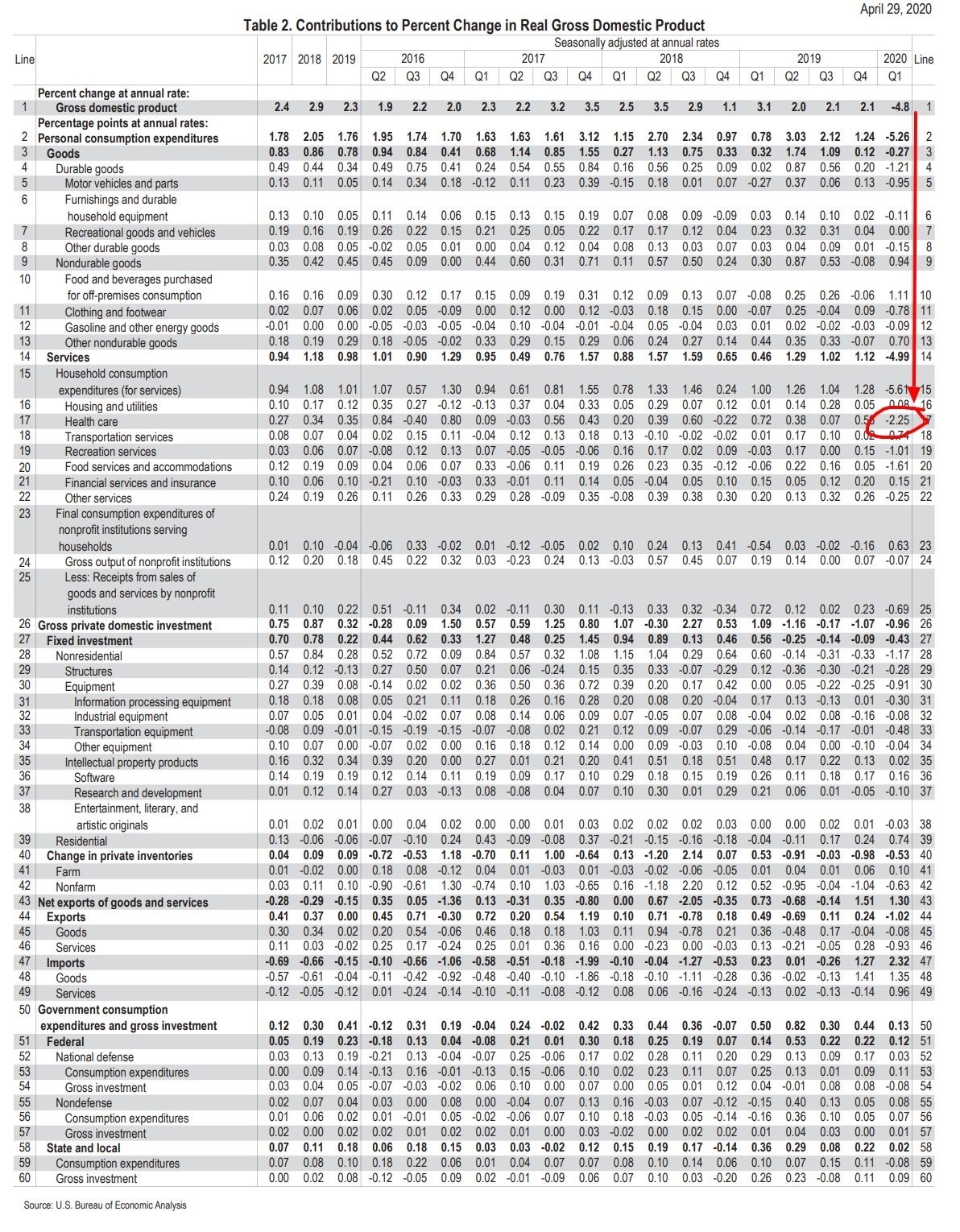

Figure 2:

Unemployment claims spiked in April 2020

The recent spike in unemployment is extremely alarming, and despite efforts by government and the Federal Reserve to provide temporary backstops, the impact is already showing up in lower frequency economic indicators, such as Gross Domestic Product (GDP). In the first quarter of 2020, GDP was estimated to have declined by 4.8%. Interestingly, a significant piece of this decline was a contraction in healthcare. The “flattening of the curve” was a mantra aimed at ensuring protection of the healthcare industry during the global pandemic, but an associated decline in elective procedures has resulted in significant losses for many hospitals.

Figure 3:

While the GDP decline was worse than initial estimates and undoubtedly indicates the start of a severe recession, it came in below the measure hit in Q4 2008 when GDP declined 8.4%. It is expected that the 2020 downturn will worsen significantly when 2nd quarter GDP is released in the summer. Some are estimating a 40% fall in GDP in Q2, hinting at an economic depression. Hopefully, that will be avoided.

Impact on the Overall P&C Insurance Industry

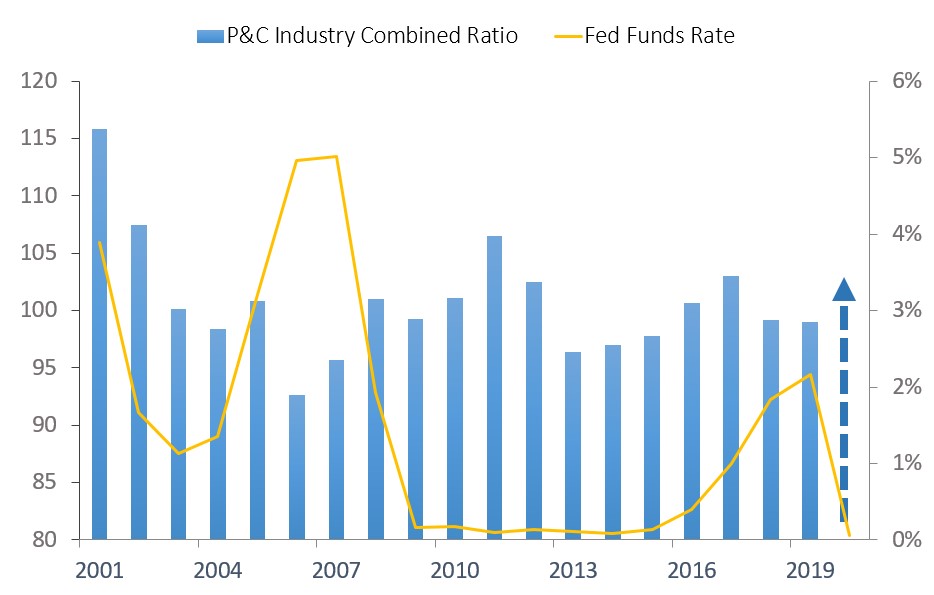

The P&C insurance industry is not insulated from the economic fallout. The impact on business activity is expected to be felt in commercial lines and the effects on residential activity and general consumer activity are expected to show up in personal lines. The effects are expected to impact the P&C combined ratio through changes to premiums, losses and expenses.

A combined ratio above 100 indicates the industry is paying out more money in claims then it is making from policies. Due to effects on policies and losses the industry should expect an increase in the combined ratio. Adding to industry stress, net investment yields are likely to decline as well. The industry typically invests very conservatively, so interest rates are a good measure to track as a proxy. Recently the Federal Reserve responded to the emerging economic crisis by expanding the money supply and reducing the federal funds’ interest rate to near zero (again). The decline in P&C investment yields related to lower interest rates will constrain P&C insurance profitability further. The duration of ZIRP (zero-interest rate policy) will specifically impact areas of insurance with longer time horizons.

Figure 4:

The industry-wide P&C combined ratio is expected to increase while interest rates (and investment yields) fall.

Which Areas (in P&C Insurance) are Expected to Be Most Severely Impacted?

While the magnitude of the impact on the P&C insurance industry combined ratio remains to be seen, the economic decline associated with sheltering in place from COVID-19 is bound to weigh on P&C insurance. There will undoubtedly be changes in the demand for insurance and the new environment will lead to alterations in insurance claims and losses. Down the road, this may also lead to changes in regulation and could even generate new business models.

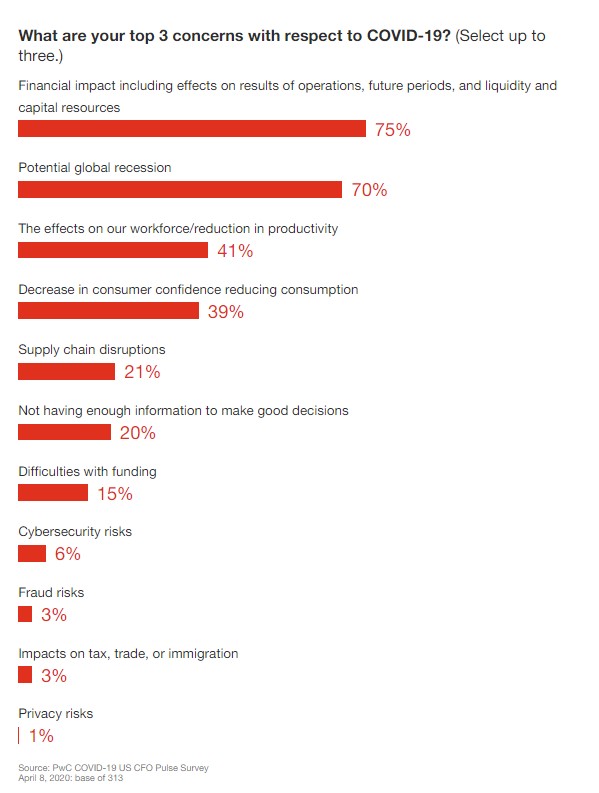

Given the nature of the pandemic, it is challenging to predict all implications for insurance. A recent survey from PwC, for example, explored some potential areas of concern with finance leaders related to COVID-19 and found the following concerns rose to the top.

Figure 5:

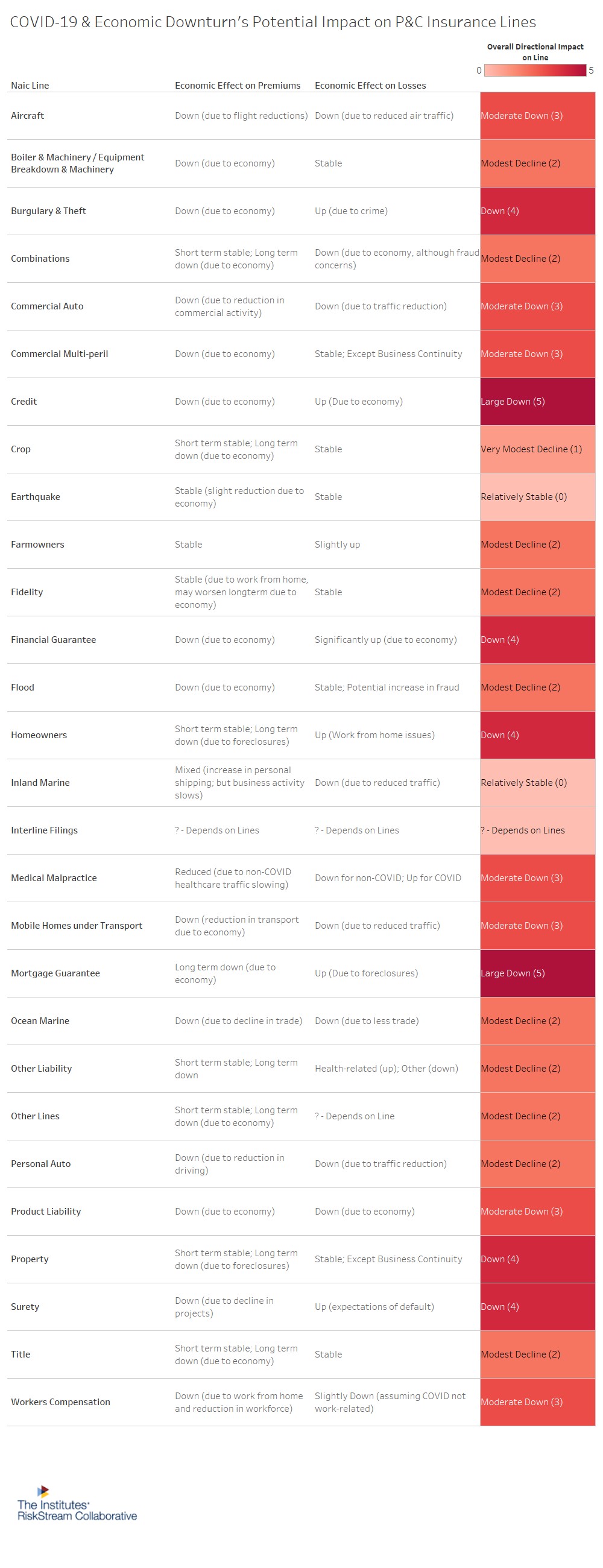

These themes are also relevant for leadership within the P&C insurance sector. The entire insurance value chain — from policies, pricing and distribution; to underwriting and risk management; to claims and servicing; to finance, payments and accounting — will be impacted in some manner. The industry will have to navigate operational pressures as more employees work-from-home, while simultaneously finding ways to optimize profit as general business activity pulls back and the economy contracts. If premiums decline or losses spike, insurers will need to find ways to cut costs. Yet, each line of insurance will experience policy and loss effects differently. Figure 6 analyzes the directional impact to each line of P&C insurance.

Figure 6:

Premiums are likely to contract across a variety of lines of insurance as the economy weighs on new exposures and causes early policy cancellations. General auto and air traffic will decline as more people stay home. The uptick in unemployment (shown in Figure 2) will undoubtedly show up in reduced premiums for personal auto, aircraft and commercial auto. The reduction in in workforce along with movement to new work-from-home environment may also result in businesses cutting workers compensation policies. COVID-19 and associated isolation policies impacted global trade (Figure 1) and business projects, which will reduce policies for various lines like ocean marine and surety. Areas related to housing, like homeowners or mortgage guarantee, may have some short-term stability, but long-term risk as foreclosures spike. Cost cutting, particularly within small business, is expected to constrain property premiums as many businesses consolidate. Finally, medical malpractice may see a reduction in policies particularly if the non-COVID healthcare slowdown (shown in Figure 3) continues and more hospitals cut back on elective procedures and associated expenses.

As shown in Figure 6, claim losses are also expected to vary by line. Reduced business and personal activity is expected to lower losses in a variety of lines, including auto, airlines and ocean marine. Credit, mortgage guarantee and surety losses are expected to increase as the economic downturn causes capital challenges and project cessations. Homeowners may see a slight uptick in losses as more residential activity takes place at home, due to school cancellations and work-from-home policies, thereby increasing risk.

Business interruption coverage, which can be included in property coverage (for example), is an area of question. This coverage indemnifies companies for lost profits for nonexcluded risks, yet outbreaks of disease are generally excluded. Certain policies include coverage for “interruption by communicable disease.” Even with this language included, some policies still exclude contamination due to a pathogenic organism, bacteria, virus or disease. There are a lot of elements to consider with this issue. Therefore, it is likely there will be challenges and litigation related to business interruption.

Why the Pandemic May Be a Catalyst for Tech-Adoption in Insurance

The P&C insurance industry was thrust into a new business environment due to the global pandemic. Within a week a relatively manual industry, which relies heavily on face-to-face interaction, showed an impressive ability to adjust and leverage technology to continue to provide products and services. While some firms within the insurance industry had already made strides in tech-related innovation and automation prior to the pandemic, the industry as a whole has been somewhat reluctant to adopt emerging technologies. On the surface, it may seem unlikely that the efforts over the past few months may have lasting impacts and change tech-adoption rates within the industry. Digging deeper, the pandemic and the associated economic fallout may windup being the key catalyst for widespread tech-adoption within insurance.

Prior to the pandemic the stage for large-scale technological adoption within insurance was already set. While the economic downturn will lower the quantity of available start-ups and InsurTechs, the quality and adoption rates associated with InsurTech may increase. In addition, the count of internal projects for brokers, carriers and reinsurers leveraging new technologies has been rising over the past few years. Industry organizations had already understood the importance of innovation, yet had less reason to trigger production usage. Some forward-looking credit agencies understood the industry-wide hesitancy and have created scores for innovation. AM Best released its innovation score methodology in March, 2020. They explain that these company-specific innovation efforts (or lack thereof) are likely to have a long-term impact on an insurer’s financial strength. Put differently, in order to profit maximize, insurers need to innovate. In this new world, they need to do so now.

While innovation can include elements outside of technology, much of it is directly related to technology. A notable constraint to technological adoption within insurance has been lack of customer adoption. Telematics, for example, has been around for an extended period of time, but never experienced robust demand. It’s possible the pandemic could change this. In an environment where miles driven has collapsed and more customers are now unemployed, Telematics and Usage-Based-Insurance (UBI) may provide angles for auto insurers to maximize retention of policyholders. The cost-benefit for consumers to exchange private information for a reduced rate is likely to be changing as well.

One major challenge with consumer and business-adoption of internet connected devices, like those proposed with UBI, has been data security risk. There are still some concerns, but security is slowly improving and the risk is becoming more manageable. It’s likely that there’s a methodical upturn in IoT usage over the next few years, but any increase in insurance usage will be deliberate focusing on areas where security is tight. Interestingly, the large scale public adoption of IoT-oriented devices and the data streams associated may also present new insurable opportunities, while simultaneously providing insurers with an ability to further improve operational efficiency through automation.

It was shown in Figure 6 that certain insurance lines are expected to experience an increase in losses as the economy flounders. Some of the increase may wind up being attributed to fraud. AI and machine learning systems may help reduce the cost of reviewing potentially fraudulent transactions identified by traditional rule-based systems. An additional benefit of cognitive fraud detection systems is that they can detect fraud patterns that humans may overlook. This can help save insurers money in a challenging economic environment.

In an era where insurers are aiming to maximize policies while reducing expenses, AI may also be able to help. Artificially intelligent systems have been developed to read contracts, assess which areas of potential risk, and even offer suggestions on how to improve the terms of the contract.

Blockchain may be another useful tool as it emerges through the ‘trough of disillusionment’ towards production usage. According to Gartner, Practical Blockchain is a Top 10 Strategic Technology Trend for 2020. Within insurance, The Institutes RiskStream Collaborative has been working with roughly 40 P&C and L&A insurance-related organizations to design use cases for life and annuities, personal lines, commercial lines and reinsurance over the past few years. RiskStream had expected a downturn in industry participation in our working groups and committees due to COVID, yet we have been surprised to witness more participation. This may be another signal that the pandemic and economic downturn is causing industry participants to re-evaluate the need for cost savings through technology.

RISKSTREAM DEMO VIDEO:

https://youtu.be/vRf2kuKlcH4

The timing of involvement in industry-wide initiatives may be also be ideal. RiskStream’s Proof of Insurance and First Notice of Loss solutions described in the video above, have moved through multiple path to adoption steps with members. Therefore, the associated ROI is within reach. Once adopted, it’s likely the path forged within these personal lines areas will allow for easier adoption of use cases being designed/built in other areas, such as commercial lines, reinsurance and life & annuities. RiskStream’s is not alone in demonstrating progress within blockchain. Other industries are also noticing advanced interest in their blockchain initiatives, such as MOBI (in mobility), BiTA (in logistics) and OCC (in energy). Each of these initiatives may also be of interest to insurers.

Whether insurers decide to leverage IoT, AI, blockchain or other forms of technology, there’s little doubt that firms that have made technological adoption progress have more room to withstand the economic downturn’s effects. This article demonstrated that the economic downturn will effect insurance, but also showed each insurance line will be impacted differently. The ROI of technological adoption is dependent on the underlying technology and the specific use case. While use cases for various tech have not necessarily grown since the onset of the pandemic, the overall economic environment has worsened, increasing the need for immediate operational efficiency. Insurers will be required to produce more with less resources. Optimization within the insurance industry, and business overall, will likely be more and more important in a world that is volatile and changing. Careful investment in technology is likely to be a useful resilience tool for insurers in this new, volatile environment.

***Special thanks to RiskStream’s Susan Kearney for offering your business insight and assistance with this project.

References:

https://www.census.gov/economic-indicators/

COVID-19 and the insurance industry

The coronavirus (COVID-19) outbreak is causing widespread concern and increasing economic hardship for consumers…www.pwc.com

Initial Claims

Units: Frequency: Suggested Citation: U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved…fred.stlouisfed.org

Gross Domestic Product, 1st Quarter 2020 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 4.8 percent in the first quarter of 2020 (table 1)…www.bea.gov

JPMorgan now sees economy contracting by 40% in second quarter, and unemployment reaching 20%

JPMorgan economists issued an even more dire forecast, now foreseeing a 40% decline in the nation's gross domestic…www.cnbc.com

Gartner Top 10 Strategic Technology Trends for 2020

Human augmentation conjures up visions of futuristic cyborgs, but humans have been augmenting parts of the body for…www.gartner.com