Customer Wellness Agenda in the Health Insurance Industry

Sandeep Kedia, Chief Financial Officer, Aditya Birla Health Insurance

Introduction

Spreading risk among many is termed as Insurance1a Spreading risk can be as simple as multi-member group in hunting to spread risk of being the one to be insured or killed by animals, or shipping cargo in batches so that entire shipment is not lost.

Insurance has a long history, and its starting point can be traced back to different times depending on the type of insurance. In ancient world, the first forms of insurance were recorded by the Babylonian and Chinese traders.

As the ancient world evolved, maritime loans with rates based on favorable seasons for travelng surfaced. Around 600 B.C., the Greeks and Romans formed the first types of life and health insurance with their benevolent societies, which provided care for families of deceased citizens. In the 12th century in Anatolia, a type of state insurance was introduced. If traders were robbed in the area, the state treasury would reimburse them for their losses.

Standalone insurance policies that were not tied to contracts or loans surfaced in Genoa in the 14th century. In the following century, standalone maritime insurance was formed. With this type of insurance, premiums varied based on unique risks.

History of Insurance2

- 1750 B.C.: Early loss limitation in trade loans

- 600 B.C.: Early life &

- 12th Century: State reimbursed traders for losses

- 1347: First insurance policy issued

- 1666: Fire Insurance concept developed

- 1980s: Mandatory car accident introduced Accident & life insurance Introduced

Until the late 17th century, many areas were still dominated by friendly societies that collected money to pay for medical expenses and funerals. However, by the end of the 17th century, London became a hub for companies or people willing to underwrite the ventures of cargo ships and merchant traders.

Modern insurance can be traced back to the city’s Great Fire of London, which occurred in 1666. A man named Nicholas Barbon started a building insurance business, which later introduced the city’s first fire insurance company. Accident insurance was made available in the late 19th century, and it was very similar to modern disability coverage.

In United States history, the first insurance company was based in South Carolina and opened in 1735 to offer fire coverage. As the 1800s arrived and passed, insurance companies evolved to include life insurance and several other forms of coverage. In the 1940s, general insurance surfaced. It wasn’t until the 1970s that the need for car insurance grew enough that steps were taken to make it mandatory in most states.

Health Insurance

Health insurance as we understand it is a relatively new concept and has coincided with the emergence of institutionalized healthcare. As the healthcare industry evolved, the need for health insurance has evolved simultaneously; thus, it is imperative to understand that the basis of foundation of the health insurance industry is that of being a funder of health costs.

Need for change

(A) Friction in health care industry vs Insurance

Year PPP (USD)

2000 594

2010 1,031

2021 1,638

Source 2: World Health Organization – Global health expenditure database

Healthcare costs include hospitalization costs and other costs associated with medical treatment like pharmacy, diagnostics, alternative medical treatments, etc. Healthcare cost have experienced significant increases over the past decades due to:

- Population Increases

- Newer medical treatments

- Higher customer awareness and ability to spend

- Fraud, Waste and Abuse in Health care costs

- Industry profit motive leading to fraud waste and abuse

- Hospitality + Hospitals = Emergence of 5star hospitals

Source: PWC report: Next in health services 2024: Healthcare’s big squeeze and the way out

Demand for Affordability from Health Insurers

Health insurers have been traditionally viewed through the lens of funders of healthcare services consumed by the customers. There has been a constant demand for affordability in health insurance premiums versus increasing healthcare costs, which creates a challenging situation for all the stakeholders. The key reasons for customers demanding affordability include:

Customer financial constraints: Consumers facing financial pressures seek health insurance options that are affordable.

Higher life expectancy: With higher life expectancy, the cost of insurance is increasing. Customers are looking for plans that offer essential benefits without excessive costs.

Value proposition: Consumers want plans that provide comprehensive coverage without compromising on quality or accessibility. They are increasingly seeking transparency in pricing and value for their money.

Insurance Products as a Push Product

Health insurance continues to be a “push” product where regulatory (government) interventions, employer benefits, or subsidised government schemes drive market penetration. This has led to a scenario where insurers need to spend significant amounts on building distribution. This has led to insurers spending significant amounts for:

- Marketing and sales expenses

- Employee costs

The combination of rising healthcare costs, increasing demand for affordable health insurance, and escalating distribution costs for insurers has created a challenging landscape leading to friction between health insurance companies and the providers of health care.

Measures to Reduce Health Insurance Costs

As healthcare costs continued to rise, health insurance companies faced increasing pressures for affordable premiums.

Reduce product benefits / cost sharing

To manage their costs insurers used options like negotiating providers’ costs, networks of preferred providers, cost-sharing mechanisms like co-payments, deductibles etc. These measures, aimed at controlling costs, often lead to dissatisfaction among healthcare providers.

Management of the Risk Pool (Limit Lives in the Risk Pool)

Insurers started managing the risk pool (i.e., effectively keeping out select cohorts of customers as not eligible for insurance). Data-based experiences and medical underwriting are being used to reduce premiums for healthier groups and thereby attract their business. Purists argue that this goes against the basic philosophy of pooling of risks to be termed as insurance.

Tariff negotiations/steerage to preferred providers

To manage their costs more effectively, insurers started negotiating with hospitals on the pricing and in defining the standard protocols to be followed in case of treatments. The increasing ability of the insurer to steer a large pool of customers (treatment seekers) to providers of insurer choice led to superior bargaining powers in the hands of the insurers in certain markets.

The cost-saving measures by insurers aimed at reducing usage of health treatments. This led to friction between health providers and health insurers as insurers started dictating health provider tariffs or, started steering customers to their preferred providers, irrespective of ease of customer.

There is an inherent conflict between the provider and the funder. The friction is further compounded by constant evolution of newer expensive techniques; there exists elements of over usage and fraud waste and abuse by select providers; on the other hand, there is a significant push for all inclusive and affordable health insurance services. The insurer services are customer facing and they experience the maximum customer interactions.

Means and Method to Resolve the Conflict

There is an age-old axiom, “An ounce of prevention is better than a pound of cure.” The main reason for conflict to date is the economics of the businesses of both healthcare providers and healthcare funders. There is an ever-increasing need for healthcare providers and newer and newer treatments as the world ages and we are getting susceptible to more and more diseases. The higher utilization of services is leading to funders making the product unaffordable. Thus, the solution lies in a way whereby the demand for services from citizens can be reduced and thereby limiting the usage of funders and making their services affordable to all

Now let’s ask: “When did Noah build the Ark—when it started raining or long before it began to rain?” The existing approach to insurance is how to get dry after it starts raining4.

The Concept of Wellness

According to the World Health Organization (WHO), health is defined as being "a state of complete physical, mental and social well-being," and not merely the absence of diseases or infirmity.

Wellness initiatives promote a healthy lifestyle which may be defined as “a way of living that lowers the risk of being seriously ill or dying early. A way of living that helps us to enjoy more aspects of life5.”

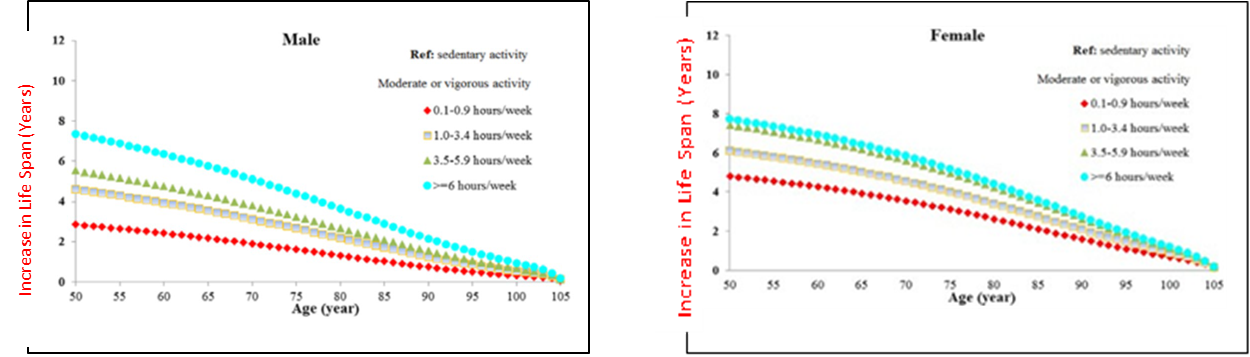

Proof of Concept: Impact of Wellness in Individual Health6

Maintaining good health can help in sustaining good health, and various studies and statistics support this concept. Research shows that healthy behaviors significantly reduce the risk of chronic diseases. For example:

Diabetes: According to the American Diabetes Association, engaging in regular physical activity and maintaining a healthy weight can reduce the risk of Type 2 diabetes by up to 58 percent.

Longevity: Maintaining good health contributes to increased lifespan. The American Journal of Public Health published a study showing that individuals who adopted healthy lifestyle practices could add up to 10 years to their life expectancy.

Quality of life: Research in the Journal of Aging and Health highlights that healthy lifestyle habits are associated with higher levels of functional independence and quality of life in older adults.

Source: Impact of Healthy Lifestyle Factors on Life Expectancies in the US. Population - Yanping Li, MD, PhD* An Pan Dong D. Wang, MD, ScD Xiaoran Liu, PhD Klodian Dhana, MD, PhD Oscar H. Franco, MD, PhD Stephen Kaptoge, PhD Emanuele Di Angelantonio, MD, PhD Meir Stampfer, MD, DrPH Walter C. Willett, MD, DrPH Frank B. Hu, MD, PhD

Overall, the evidence supports that maintaining good health not only helps in continuing to stay healthy but also fosters behaviors and conditions that reinforce this positive state.

We all realise eating right can help us avoid illness, but health insurance companies won’t pay a doctor who tells a patient what to eat and what not to eat or to change the way he eats. Similarly, a health insurance company will not pay a doctor who helps monitor a condition (say, blood glucose levels) of a customer which enables prevention of Type 2 diabetes. There are many examples where the insurance company is ready to pay for the illness of the customer (“how to get dry”) but not for expenses which can build the ark (“long before it begins to rain”).

These traits reduce the impact of diseases and improve life expectancy. As life expectancy increases, the incidence of chronic diseases is reduced and consequently the need for medical treatments. The lower need of medical treatments is what the health insurers are desiring, and they are employing methods which are more like how to get dry and not build the ark before it rains.

Proof of Concept of Wellness Programs

In an environment of rising health care costs, employers experienced higher employee welfare costs. This led to employers approaching insurers with methods to reduce costs without reducing employee benefits. This led to the emergence of interests of employers and insurers in methods of improving the health of the employees and at the same time lowering costs of expenses being incurred.

Workplace Wellness Programs

Wellness programs commonly are a well-known and common phenomenon in places of employment across the globe.

In the 1970s, Johnson & Johnson became one of the most first employers to systematically engage in a workplace wellness program. Over time, the company promoted its wellness program as a significant cost-saver, likely spurring interest among other companies.

of large corporates offer wellness program to their employees

Common Activities of Wellness Programs

Workplace wellness programs often include three common activities: risk identification, behavior modification, and educational programs. Some of these activities, like risk identification, are designed for primary prevention where the goal is to encourage healthy behaviors and reduce health risks. Other wellness programs, such as those using educational programs or behavior modification, focus on secondary or tertiary prevention. For example, these programs provide employees with information or assistance with disease management of their chronic illnesses.

Impact Wellness Programs

The economic rationale behind wellness programs is the idea that healthier employees are less likely to require extensive medical care, reducing healthcare costs for both employers and insurers. Additionally, healthier employees are more productive, experience fewer sick days, and contribute more effectively to their organizations.

A landmark meta-analysis conducted by Harvard University7, often cited as one of the most comprehensive studies on this topic, provides compelling evidence of the economic benefits of wellness programs. The study, which reviewed over 30 peer-reviewed articles on the costs and savings associated with wellness programs, found that, on average, for every dollar invested in these programs, medical costs fell by approximately $3.27.

For $1 investment in wellness programs, medical cost fell by $3.27

There is conclusive evidence that wellness programs have a positive impact on individual health. It has been proved without doubt that the wellness program can be scaled for many customers with the right incentivization and data insights. Then the mute question is why the Wellness programmes have not become mainstream offerings in all health insurance schemes.

HAS Insurance sector given Retail Wellness a complete miss

Insurers have always viewed customers pools more as risk pools and the entire stratification of the customers is based on spreading risks. But there is also a concept of reducing the risk. Example - In motor policies, customers who drive their cars more safely are charged lower premiums. Similarly, when it comes to health insurance, customers who look after their health can be given incentives or charged lower premium. Is there a way to nudge customers to adopt a healthy lifestyle?

Most insurers have mostly ignored the entire concept of wellness in the life of their customers. Insurers continue to pursue the traditional means and methods of acquiring, engaging and managing the expectations of their customers.

Key Challenges in Wellness Models

Health and wellness are personal choices and one size fits for all is not expected to gain traction with the customers. Insurers traditionally have considered only inpatient department (IPD) and more recently outpatient department (OPD) hospitalization as medical expenses. The concept of prevention has not yet been accepted as the core of health insurance offerings by the insurers.

The following may be identified as major reasons for wellness not becoming mainstream in insurance:

- Government funding of insurance schemes:

The healthcare schemes funded by the government invariably do not allow for wellness expenses. These expenses are perceived more of a discretionary expense and do not fall within the gambit of allowable medical expenses that are to be funded by the government, Example, preventive medical checkup without prescriptions, etc. A large part of healthcare needs is funded by schemes approved by the governments. This has led to general empathy toward wellness offerings.

- Regulations

The implementation of wellness models by health insurance companies experiences regulatory challenges that impact their development and effectiveness. In many countries regulators define wellness expenses as outside the scope of health insurance companies and hence not a permitted activity. Many regulators place limits on the financial incentives or penalties that can be associated with wellness programs. These caps reduce the effectiveness of wellness programs. Some regulators are concerned that wellness programs could lead to higher premiums for those who choose not to participate, as they are perceived to favour healthier individuals.

- Discretionary versus beneficial

There continues to be a constant debate around what nature of expense is discretionary and what is beneficial in improving customer health. There is also vagueness as to what should constitute healthy behavior, for example, eating healthy food versus the need to be the slimmest in the house. Preventive care in all cases would not be wellness and should not be funded by the insurance companies but basic individual needs should be funded by the insurance companies.

- Technological investments

If an insurer wants to experiment with the wellness program, it needs to create a network of wellness services across the length and breadth of the geography. It must also create a mechanism to gauge program benefits and limit fraud waste and abuse of these services. To do all this the insurer needs to invest in technological capabilities on a scale. Some of these tech investments may not bear fruit. Finally, it must answer the question of why a new customer would buy a wellness offering from a health insurer. Given these challenges, insurers have continued the traditional approach.

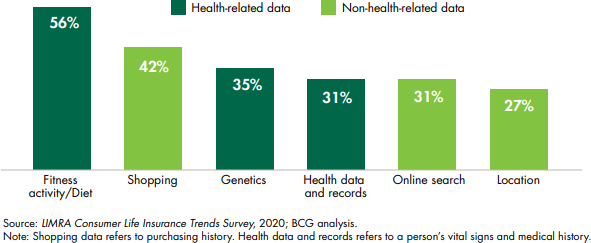

- Data and privacy

Wellness programs lead to large amounts of customer data being collected by the insurers. Participants are generally wary of potential privacy breaches. It is generally unclear what insurers are doing with this data. This raise concerns around how the insurer will use the information. Given the concerns around privacy, customers tend to be skeptical of sharing health information.

Historically there have been challenges in offering retail wellness at scale. The insurers in general have not been innovative enough in looking for solutions to these issues. There exists a compelling opportunity for insurers to offer these products. Unless the insurers remain proactive, it will not be long before the industry is disrupted by technology or new incumbents.

New Trends in Wellness in Insurance

There has been a growing interest in personal health post COVID -19. Health and wellness are top of mind as future “health consumers” are becoming more proactive in managing their healthcare needs. Gen Z is more proactive and involved as healthcare consumers with a focus on preventative products and services and more amenable to digital solutions.

This health push provides an opportunity for insurers to promote customers’ good and at the same time improve customer health.

The following are the emerging trends:

- Compelling business opportunity in wellness

According to the Global Wellness Institute (GWI), the global wellness economy was valued at approximately $3.3 trilion in 2021. This includes various sectors such as personal care, beauty, and anti-aging; nutrition; and fitness. In the U.S. alone, a McKinsey report8 suggests that the wellness market has reached $480 billion per year and further growing at 5 percent to 10 percent annually. Further, 82 percent of U.S. consumers now consider wellness a top or important priority in their everyday lives, which is like what consumers in the United Kingdom and China report (73 percent8 and 87 percent8, respectively).

- Availability of personal health data (wearables)

The rise of the smart phone and advent of wearables has made it possible for collection of personalized health data at scale. It enables access to real-time, reliable customer health data on a regular basis. The process is easy, reliable, relatively cheap and does not require significant effort from the customer. Even in developing countries the access to wearables has democratized data availability.

- Consumer willingness to share wearables data:

Given adequate data privacy, two out of three Americans would be willing to accept health insurance wellness programs based on wearable devices, particularly if they have benefits related to health promotion and primary prevention. These programs could potentially be key for health insurers to appeal to the younger and healthier segments of the population9

- Tech evolution and the arrival of Gen AI:

There have been significant strides in technology over the years. It has now become possible to continuously source, store and create meaningful insights on such large pools of customer data on a real time basis. The advent of tech has enabled:

- Seamless data integration and aggregation:

Integration of data from various sources such as wearables, mobile apps, health records, and fitness devices is helping to create a unified view of the customer.

- Hyper-personalized recommendations:

By analysing large datasets, tech can provide hyper personalized recommendations such as diet plans, mental health tips, etc.

- Predictive analytics:

We can now predict potential health issues or wellness trends based on historical and real-time data. We can identify emerging trends and patterns in wellness data, which can help in forecasting future needs.

- Improved customer understanding and engagement:

Traditionally insurers’ engagement with the customers has been limited to premiums and claims conversations. The entire transactional relationship led to a scenario where there is no affinity of the customer with the insurer. Relatively healthy customers found limited value proposition in the product, thus reducing their “stickiness” with the insurer. In addition, the ability of the insurer to understand the emerging health of its risk pool was also very limited.

In comes the concept of wellness, which creates additional value to the customer by engaging with the customer on a day-to-day basis, enhances the value proposition and provides improved data on existing customer health.

There have been significant changes in customer behavior, this along with advent of newer technologies and a compelling business opportunity is enticing insurers to up the quotient of wellness offerings.

Global Examples of the Wellness Model

Several health insurance players have been working on integrating wellness into their offerings. These programs are designed with a holistic approach to incentivize healthier behaviors among their members, ultimately aiming to improve overall health overcomes. Each organization utilizes a combination of advanced technology, data analytics, and behavioral insights to deliver personalized care, foster long-term healthy habits, and reduce healthcare costs. By integrating these innovative strategies, these programs not only enhance the quality of care provided but also promote preventive measures that lead to healthier and longer lives for their members.

Examples of wellness models:

Discovery’s Health program![]()

Vitality is a behaviour change platform, which guides and incentivizes people toward better health. Vitality combines insights from behavioural economics with insights from clinical science to reward members for taking steps to understand and improve their health

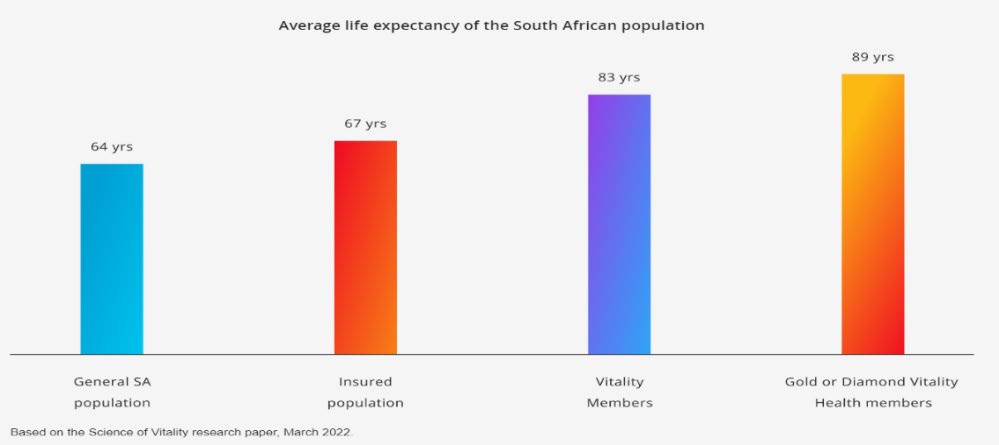

With over 25 years of experience, research has shown that Vitality members live longer, healthier lives. Across all ages, their most engaged members have experienced lower health risk than non- Vitality members because of the healthy behaviours they adopt through the program. This leads to a significant increase in their life expectancies. A typical 40-year-old member with a Gold or Diamond Vitality Health status has a life expectancy of 89 years, compared with 67 years for the insured population in South Africa.

Source: Vitality Research

Like Discovery, there are multiple other health insurance players that have introduced wellness programs like United Healthcare, Kaizen, Optum, Pulse, etc.

Wellness as a proposition can be delivered for retail customers at scale. It is up to the incumbents to decide which player will take the lead. It is expected that the wellness model can create differentiation amongst health insurers in particular driving significantly different valuations for the successful insurer.

Case Study

We now analyze a leading health insurer in India which has embedded the wellness model as an integral part of its offerings. The impact the model has had on the various stakeholders (i.e., the company, customers, shareholders, competition and even the regulators). This can be a template that may be followed by other insurance companies to up their wellness offerings.

- Company Name: Aditya Birla Heath Insurance Company Limited (ABHI)

- Market: India, Asia

- Business Commencement: 2016

- Shareholders: Aditya Birla Capital | Momentum Metropolitan | Abu Dhabi Investment Authority (ADIA)

Why I selected this company and market: India is the most populous country in the world. It’s the 4th largest country in the world in terms of land mass and is the fastest-growing country in the world with people famed for their focus on affordability. The country boasts large tech capabilities and has one of the highest number of users of smartphones in the world.

Health insurance is characterized with low penetration. The landscapre consists of 30+ companies eligible for offering health insurance spread across private and public ownership. The company is the latest entrant into the health insurance space in the country of India.

Thus, it has all the building blocks in place for testing the wellness model and abundant complexities for proof of concept.

Company Background ABHI:

Company Vision: “Empowering People to Lead Healthier Lives”11

Operating Model: The company, being a late entrant in the market, had to adopt an operating strategy that will define whether it’s another “me too” insurer or has a model/offering which is different from other players. The company decided that wellness would be the cornerstone of its operating model, and it would not be a “me too” insurer. This model on a scale has been attempted by a few health insurers and hence the entire proposition had to be rethought. The below were the key aspects of their differentiated health-first model.

Wellness Model Design

The operating model aims to address the issues with wellness model implementation as enumerated in the earlier parts of the report. The key areas being addressed by the operating model at ABHI has led to acceptance of the model according to me are as follows:

- Identify whom to sell: Sharpened customer profile in addition to the normal customers

- Design products which have Wellness Benefits

- Model to acquire customers at scale

- Operating model around knowing and intervening to improve customer health

- Investments in digital capabilities to support data first health model

- An ecosystem to manage the end-to-end needs of customers around health and wellness

Problems that the model seems to have solved:

- Identify whom to sell - target customer segment11

The wellness model targets nontraditional customer segments. Companies having belief in the model would ideally target customers who tend to exhibit healthy behavior in addition to the existing pool of customers thereby expanding the market. The company presentations claim that their average customer pool is younger by five years.

- Product offerings with health benefits11

The company has developed a product suite which encompasses regular and wellness offerings. All the retail health indemnity products have built-in wellness offerings. Wellness benefits amongst others have been termed as “health returns.” Customers who exhibit healthy behavior get up to 100 percent of the premium back. The 100 percent health returns demonstrate the conviction in wellness offerings. Product benefits include wellness benefits of gym access, physical fitness sessions, health checkups, discounts on pharmacy, diagnostics, etc.

ABHI has also defined senior citizens as target customer segments for which product benefits include health coaching, disease risk management access, etc. as built-in product benefits. The wellness benefits have been termed as “promise of good health” and the benefits of claims is being referred to as “promise of insurance.”

- Customer acquisition at scale: – attract distributors

The efficacy of any operating model lies in its ability to acquire customers at scale. All existing distribution models referred to the wellness led model as “niche” model and not susceptible to scale. Distribution models have overcome the initial resistance; the company initially launched its products through Bancassurance. Bancassurance at that time was not a preferred model of distribution for health insurance policies. Subsequently the offerings were launched across all channels of distribution. The model has enabled ABHI to acquire one of the most diverse distributions as the model is appealing to the distributors who are eager to distribute products which not only delivers the promise of insurance, but as the company states, the promise of good health.

Operating model of knowing and improving customer health11

The company has digital capabilities which enable the company to track individual customer health data on a real time basis. Model pillars are:

- Know your health

- Improve your health

- Get rewarded

- Better understanding of customer health:

The model enables health insurers to acquire customer health data through company-funded health assessments. In addition, it has developed the capability to track individualized health data using wearables. Basic customer data and hyper-personalized customer risk stratification score (well-being score) are being created for its customers at a scale.

“2.6L+ Health Assessment + 15L+ Risk stratification score

- Ability to intervene basis risk stratification

Basis health data customers are segregated into high, low and medium risks (risk stratification) This enables the insurer to take corrective interventions basis hyper personalized customer needs. These personalized interventions enable the insurer to manage the health of its customers and overall reduce the cost of health expenditure.

- Customers Rewarded for exhibiting healthy behaviour:

The model aims to develop a structure of rewarding health-conscious behaviour. They have been able to define and track what can be termed healthy behaviour.

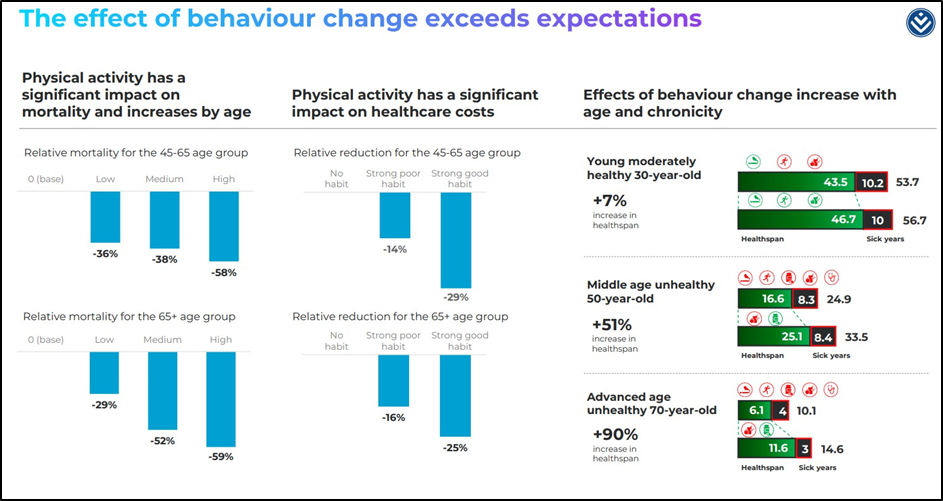

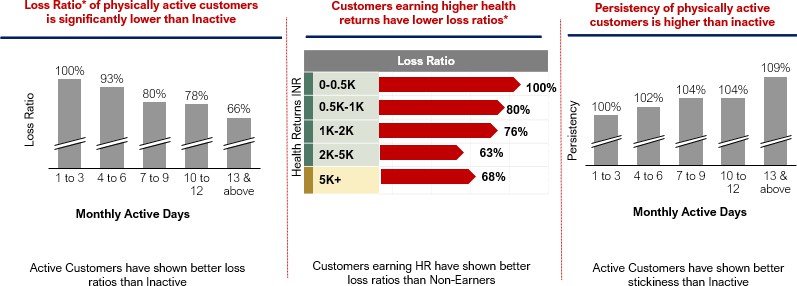

- Model Impact on Intervened cohorts11:

The result of the study indicates a direct correlation between higher interventions and lower costs in terms of claims and higher persistency in the cohort.

Source: Aditya Birla Investor deck

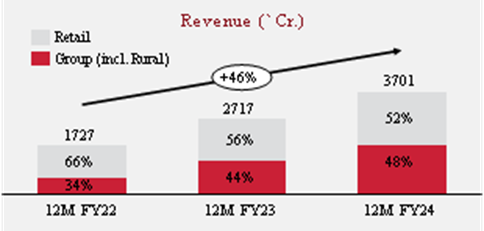

- Impact of Model on Company Growth and Valuation

The company is one of the fastest-growing health insurance companies in a hypercompetitive market. As per reports, the company enjoys the highest valuation amongst its peers and the same has been validated by the investment multiple it has received from strategic investors.

(Source: ABHI Data Source: Public Disclosures on their website, Annual Reports of multiple years including Management Discussion and Analysis)

- Impact of Model on Competition

Most of the insurers in India have started wellness offerings. The focus on these products may be limited but a beginning of the same has been made. In addition, players have started investing in wellness capabilities. Another leading insurer has launched the digital Health assessment capabilities on its digital app. The same has also been offered as a “freemium” capability (i.e., available to even noncustomers as a strategy to attract new customers).

- Impact of Model on Regulation

The regulator has also warmed up to the idea of wellness offerings. In fact, the new regulations propose full-fledged access to wellness offerings that can be made available by insurers as part of its product suite.

Conclusion

The ABHI model proves that the wellness proposition can be attained for retail customers at scale. Increasing customer health awareness and the need for holistic health and wellness solutions would make wellness as the pull in selecting insurers.

It is demonstrated that the wellness proposition is attractive for both customers and distributors. Advancements in tech and AI would enable commercially viable hyper-personalized engagements which I believe would be the key to future customer retention.

As regulators push for higher affordability and access to health insurance for all customers, I believe that in the future, insurers will have no option but to rely on wellness techniques to mitigate the risk of their customer pool.

The economics of the model is proven given the results achieved by them. Investors have also attributed value to the model even when model is in its scale up stage.

Acknowledgements

While completing this paper I have relied on research down through various websites on the internet, my understanding on the life insurance and general insurance business. Have gone through a large number of data points to arrive at my conclusions and are in general based on my research and hypothesis that wellness as a concept in health insurance is a phenomenon whose time has come. The findings are supported by data and similar concepts applied at various parts in the health insurance industry.

1(a)Concept of Insurance – Investopedia | 1(b) History of Insurance – Investopedia | WSR Insurance – How insurance began | History of US Insurance- Swiss Re | History of Insurance – Insurance Information Institute | History of Insurance – The Health Insurance Association of America | 2 Increase in Health Costs –World Health Organization - Research of inflation in health care of various countries | 3 Increase in life expectancy – World Health Organization life expectancy data bases | 4 Concept of Noah influenced by the book Outlive by Bill Gifford and Peter Attia. The concept of Noah and the Ark has been stated in the book in some other context the same have been used by me post my reading of the book | 5 Wellness as a concept is generally understood in common parlance. Have used the definition as defined by World Health Organization (WHO)| 6 Impact of Wellness – Studies by World Health Organization, JAMA – Open Access Medical Research Reports - Healthy Lifestyle and the Likelihood of Becoming a Centenarian Yaqi Li, PhD; Kaiyue Wang, MSc; Guliyeerke Jigeer, MD; Gordon Jensen, MD, PhD; Katherine L. Tucker, PhD; Yuebin Lv, PhD; Xiaoming Shi, MD, PhD; Xiang Gao, MD, PhD | American Diabetes Organisation | American Journal of Public Health | Journal of Aeging and Health | Impact of Healthy Lifestyle Factors on Life Expectancies in the US Population - Yanping Li, MD, PhD* An Pan, PhD* Dong D. Wang, MD, ScD Xiaoran Liu, PhD Klodian Dhana, MD, PhD Oscar H. Franco, MD, PhD Stephen Kaptoge, PhD Emanuele Di Angelantonio, MD, PhD Meir Stampfer, MD, DrPH Walter C. Willett, MD, DrPH Frank B. Hu, MD, PhD | 7 Harvard University Study - Workplace Wellness Programs Can Generate Savings by Katherine Baicker, David Cutler, and Zirui Song | 8 Compelling business opportunity in wellness - McKinsey Report - The trends defining the $1.8 trillion global wellness market in 2024 | Research Global Wellness Institute | 9 Consumerwillingness to share wearable data - (Source: BMC Public Health -Willingness to adopt wearable devices with behavioral and economic incentives by health insurance wellness programs: results of a US cross- sectional survey with multiple consumer health vignettes) | 10 – Wellness Competitors – Vitality Website | 11 Aditya Birla Health – Various Industry reports, Company Annual Report, Public Disclosures and Investor Presentations as available on their website.