From Youthful Image to Aging Reality: Rethinking Korea’s Pensions for a Super-Aged Society

Jaeyoon Lee, Assistant Manager, Corporate Pension Division Investment Consulting Team, Kyobo Life Insurance Company, Ltd.

Executive Summary

This paper, titled "From Youthful Image to Aging Reality: Rethinking Korea's Pensions for a Super-Aged Society," explores the stark contrast between South Korea's youthful global image and the rapidly aging reality it faces.

Despite being one of the most rapidly aging countries globally, South Korea is also grappling with an alarmingly low birth rate, leading to a significant increase in the dependent population. The elderly population is growing, yet their retirement savings and pension preparedness lag considerably behind other Organisation for Economic Cooperation and Development (OECD) nations, with the elderly poverty rate in South Korea standing at a staggering 40.4 percent.

This paper identifies a critical gap in the country's pension system, particularly in the preparation for old age. South Korea's so-called "three-tier" pension structure—comprising the National Pension Service (NPS; refer to "Appendix" for the basic understanding of NPS) corporate pensions (such as defined contribution [DC] plans), and private pensions—is insufficiently developed to address the looming challenges. The NPS alone cannot meet the needs of the aging population, necessitating an expansion of corporate and private pensions.

Key obstacles to this expansion include a cultural reluctance to actively invest in retirement plans, even with governmental support and policy reforms, particularly prevalent in East Asian societies. Moreover, many individuals opt to receive their corporate retirement benefits as lump-sum payments rather than securing them for long-term retirement needs, exacerbating the issue.

To address these challenges, this paper advocates for stronger governmental policies and, critically, the need for a shift in public perception regarding retirement planning. Enhancing financial literacy and broadening the understanding of retirement preparedness are essential.

This study also explores how insurance companies can play a pivotal role in this process. It examines opportunities for insurers to contribute to increasing financial literacy and retirement savings, particularly in a rapidly digitalizing world. By leveraging digital tools and strategies, insurers can help expand the reach of retirement planning and pension utilization among the Korean population.

In conclusion, the paper suggests that by capitalizing on these opportunities, insurance companies can not only expand their business but also contribute significantly to addressing pressing social issues like elderly poverty in rapidly aging societies like South Korea.

Introduction

When people think of South Korea nowadays, K-pop, K-drama, or K-cosmetics often come to mind—trends that are capturing the attention of young people worldwide. This vibrant image may give outsiders the impression that South Korea is a young and dynamic country.

However, many may not be aware that South Korea is actually aging faster than any other country in the world. In 2022, Elon Musk, CEO of Tesla, tweeted about South Korea, saying, “Korea is facing the fastest population collapse.” Indeed, this is more dangerous than any other issue Korea is facing.

South Korea has already been experiencing a rapid decline in its working-age population, which means the number of dependents is increasing. This trend is certainly not welcome news for the insurance industry. However, every crisis also presents opportunities. I will explore the challenges faced by rapidly aging societies like South Korea and identify potential opportunities for insurance companies in such contexts.

A Rapidly Aging Society: South Korea

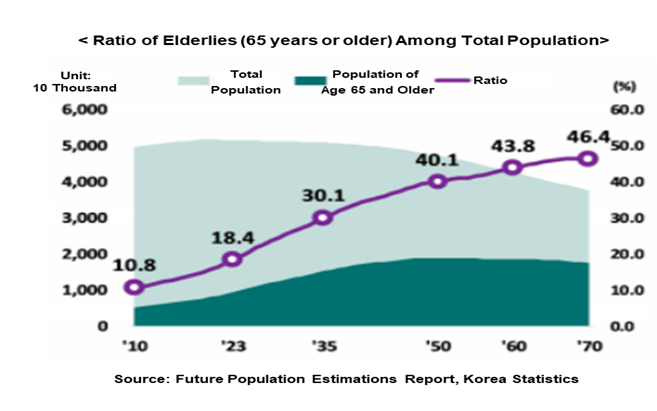

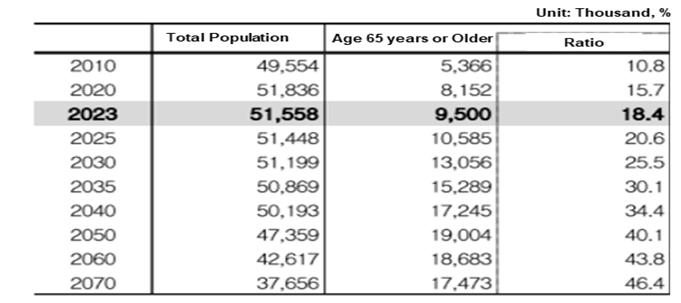

According to Statistics Korea, as of 2024, individuals aged 65 and older make up about 19 percent of the total population, and this percentage is expected to reach 20.6 percent next year, marking South Korea's entry into a super-aged society. It is already reported that in 2023, the population in their 70s surpassed the population in their 20s.[i]

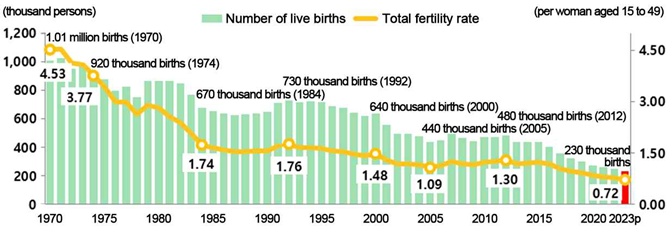

Considering the current fertility rate (at an all-time low of 0.72), the speed of increase in the elderly population is expected to accelerate. This means that the number of people retiring will also increase. The mainstream demographic will soon consist of those who are retired or nearing retirement.

As the aging population grows and the younger population declines, various economic problems can arise.

The increasing dependency ratio will impose a significant burden on future generations. Moreover, a larger elderly population means more people will have to rely on their own assets for a longer period due to increased life expectancy.

This begs the question: Is the so called “mainstream demographic” financially prepared for their post-retirement life?

Retirement Readiness in South Korea

Unfortunately, the current statistics show that South Korea's elderly are not. According to the "Global Protection Gap Study Report," which was prepared by McKinsey at the request of the Global Federation of Insurance Associations (GFIA), Korea's income replacement rate was about 47 percent. This means that the retirement pension income is only 47 percent of the average income earned before retirement. This is almost 25 percentage points lower than the OECD recommended rate and 11 percentage points lower than the OECD average (58.0 percent).[ii]

Usually the rule of thumb is that if you want to maintain the same quality of life after retirement, you should plan to need roughly 80 percent of your pre-retirement income. So, if you earn $50,000, you'll need $40,000 to keep up the same standard of living you enjoy now. But for Korea’s case, the average retirees will only have less than $25,000.

Some might argue that South Korea's well-established healthcare system makes it manageable to have a lower income after retirement. However, it is concerning that healthcare costs in South Korea are continuously rising.

The report classified Korea as a country with high medical expenditure, noting that "the proportion of out-of-pocket medical expenses is 34.3 percent, which is significantly higher than the OECD average of 20 percent."

Moreover, in 2021, the per capita medical expenses for those aged 65 and older were 4,974,000 KRW(around $3,800), increasing by 215,000 KRW($165) each year[iii]. These costs are rising by about 4 percent annually, adding a considerable financial burden.

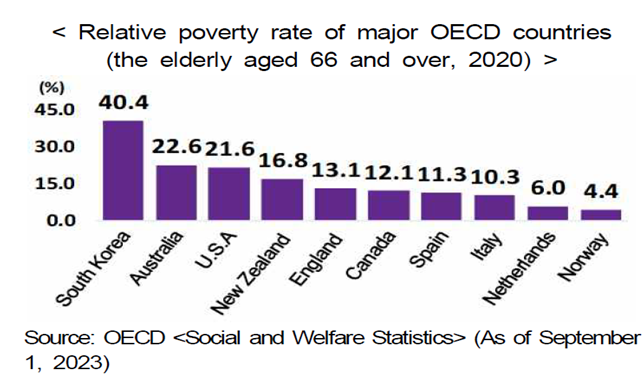

As a result, South Korea's elderly poverty rate is 40.4 percent, one of the highest among OECD countries and nearly double that of the United States[iv].

In light of these circumstances, how can South Korea reduce its elderly poverty rate and improve its income replacement rate? Additionally, what opportunities might these challenges present for insurance companies?

In the subsequent section, we will first examine the pension system, which is crucial for ensuring a stable post-retirement life. This analysis will seek to uncover potential solutions to the rising elderly poverty rate.

The Three-Tier Pension in Korea and Advanced Markets: The Difference?

The high elderly poverty rate in Korea cannot be solely addressed by the NPS. Although the NPS provides a basic level of support, it is not sufficient to ensure a comfortable retirement for all.

Let's compare the current state of Korea's three-tier pension system with those of the U.S. and Australia, focusing on the inadequacies of the second tier, the corporate pension system, and the need to expand the third tier, personal pensions.

By examining the experiences of advanced countries, including the challenges they faced and the solutions they implemented, we can identify effective strategies for rapidly developing markets and countries like South Korea that are quickly entering an aging society.

The Pensions in the U.S. and Australia

The U.S. strengthened its first-tier pension system by creating and operating Social Security after the Great Depression. However, starting in 2021, the baby boomer generation, which accounts for 30 percent of the U.S. population, began to retire in large numbers. With the increase in average life expectancy, the funding became insufficient, and eventually, the retirement age had to be extended, reducing the benefits.

Australia also has a social system called the Age Pension, but it is far from sufficient to ensure a comfortable life. Due to insufficient funding, the retirement age was raised to 67.

How, then, were these two countries able to successfully navigate and overcome these challenges?

Promoting Second-Tier Corporate Pension

In the U.S., the focus was on the 401(k) plan. The Pension Protection Act of 2006 allowed for automatic enrollment and default investment options in 401(k) plans, along with tax benefits. Additionally, employer matching options encouraged employees to contribute voluntarily by adding a certain percentage to the amount the employees saved.

As a result, the 401(k) has become a significant part of retirement savings in the U.S. At year‑end 2023, 401(k) plan assets totaled $7.4 trillion[v].Consistent stable returns were achieved, particularly because a large portion of investments were made in stock funds within mutual funds, facilitated by long-term investments. These investments have significantly benefited the U.S. stock market.

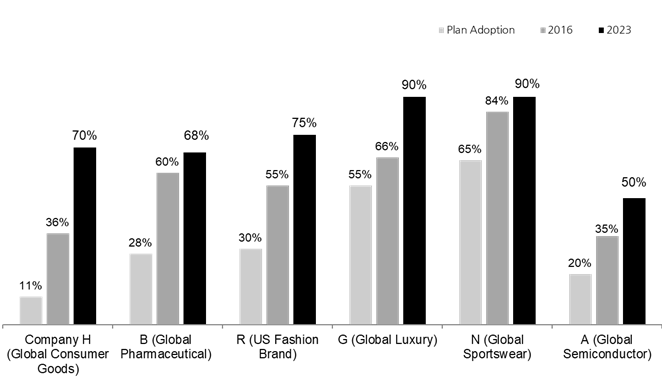

In Australia, to complement public pensions, they introduced the superannuation system, a type of DC plan. By gradually increasing the mandatory employer contribution rates, participation rates have surpassed 90 percent, and the expected income replacement rate for retirees has exceeded 60 percent when combined with the Age Pension.

Such efforts to strengthen second-tier pension systems in advanced markets have helped ensure that citizens can secure a certain level of funding and maintain a stable life after retirement.

Lessons from the U.S. and Australia’s Case

As evidenced by the examples of the two mentioned countries, relying solely on the first-tier pension system is insufficient to maintain a basic standard of living, just like the case of Korea.

The key to these countries' success in preparing for retirees lies in the strengthening of their second-tier pension systems (such as DC plans) and the creation of appropriate portfolios aimed at generating stable long-term returns.

This was achieved through a variety of mandatory and incentivizing policies implemented at the government level, which significantly increased participation rates.

Furthermore, once the second- and third-tier pension systems are established, adopting proactive investment strategies and constructing appropriate portfolios are crucial for achieving stable long-term returns. This, in turn, contributes to more prosperous pensions for the beneficiaries.

For instance, approximately 65 percent of 401(k) assets are invested in mutual funds, with a significant portion concentrated in equity mutual funds[vi].

As a result of this investment strategy, numerous reports indicate that the average annual return for 401(k) plans ranges between 5 percent and 8 percent[vii].

Nearly half of the Australia's superannuation assets are invested in equities.[viii] Within the default investment options (MySuper) chosen by many employees, equity investments account for 40 percent to 60 percent.[ix]

This portfolio allocation has enabled Australia’s superannuation system to achieve average returns similar to those of the U.S.

These successful models provide valuable benchmarks for South Korea. By adopting similar portfolio and investment strategies, South Korea can enhance the effectiveness of its retirement pension system, thereby ensuring better post-retirement income security for its workers.

Recognizing this advantage, Korea has recently endeavored to implement the aforementioned practices from advanced markets."

The South Korean government has been actively promoting the adoption of the DC pension system through various incentive policies. In 2022, the government introduced the default option system, aiming to improve the overall returns for DC plan participants. However, despite these efforts, several shortcomings remain evident.

The Challenges and Shortcomings

Delay in Mandatory Adoption

Although the government has been pushing for the mandatory adoption of retirement pensions across all workplaces, implementation has been repeatedly postponed. This delay hinders the widespread establishment of a robust retirement savings culture.

The participation rate in Korea's retirement pension system remains below 60 percent, according to Statistics Korea. Furthermore, the growth of the retirement pension market in Korea has been slow, with the rate of increase in accumulated funds lagging behind other countries.

Limited Effectiveness of Default Options

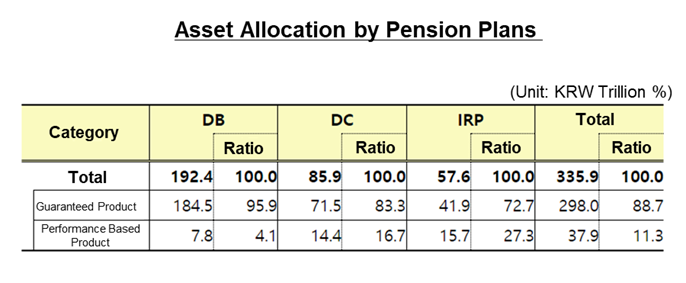

Since 2022, the South Korean government has made efforts to introduce mandatory “default option” schemes and encourage investments in target date funds (TDFs). These initiatives aim to promote more balanced and diversified investment strategies for retirement savings. However, a large amount of capital is still concentrated in ultra-low-risk default options such as time deposits, ELBs and guaranteed investment contracts (GICs).

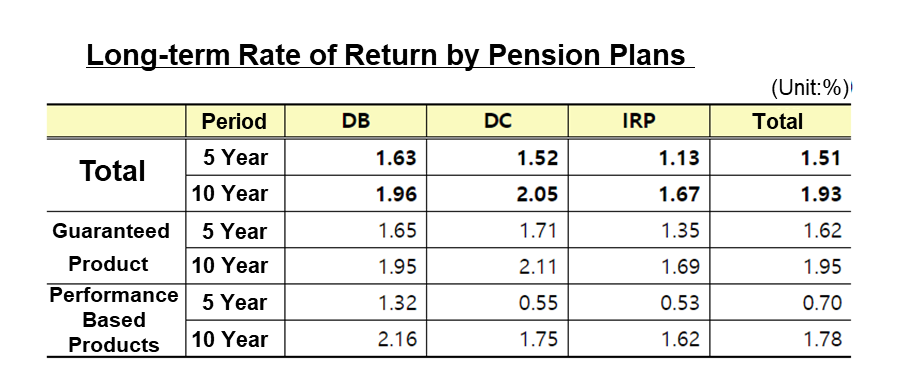

As of the end of 2023, the reported data indicates that the 5-year and 10-year average returns for South Korea's DC plans remain stuck in the mid-2 percent range.[x] (2.56 percent and 2.26 percent)

Despite the government's efforts, South Korea's DC system has not yet achieved the expected outcomes similar to those seen in more developed markets.

Next, we will delve into the reasons behind the slow growth of the pension plan funds.

Conservative Investment Behavior

In South Korea, the rapid economic growth following the Korean War was characterized by a strong emphasis on frugality, hard work, and education. Campaigns such as the Saemaul Undong (New Village Movement) and the Anabada (Save, Share, Reuse, Recycle) campaign during the 1997 financial crisis encouraged people to save diligently and avoid unnecessary expenditures (for details, please refer to "Appendix").

During South Korea's rapid economic development, saving money was considered a virtue among the population. High interest rates further encouraged this habit, and it became common practice to save and economize every penny.

Given this backdrop, the idea of "earning and saving money" was deeply ingrained in South Korean society, which made the swift adoption of investment concepts and understanding more challenging. This mindset naturally extended to retirement pensions, where the concept of gradually accumulating savings took precedence.

This historical and cultural context explains why South Koreans, even young employees, prefer safe and low-risk investment options for their DC plans. While recent global financial events have sparked some interest in riskier investments, changing the longstanding conservative mindset remains a gradual process.

Backing data: DC investment performance of Korea,

asset allocation of Korea’s pension plans (below table)

A country that exhibits similar characteristics to South Korea in terms of pension investments is Japan. Japan, having entered an aging society earlier than South Korea and being geographically close, shows comparable trends in its retirement pension market. Japanese people, like Koreans, tend to have a conservative investment approach and are slow to adapt to changes. Prolonged deflation and economic stagnation have led to a preference for safe assets over stock-based products. Despite introducing default option systems, a significant portion of investments remains in principal-protected assets.

According to 2021 statistics, only 11 percent of Japan's default investment assets are in investment trust assets, with approximately 87 percent in cash equivalent or principal-guaranteed assets.[xi]

The cultural similarities between the two countries, coupled with their shared experiences of economic difficulties—such as Korea's 1997 Asian Financial Crisis and Japan's “Lost Decades”' following the economic bubble—along with their similar challenges in facing an aging society, seem to have contributed to the conservative investment mindset and the enduring perception of saving as a virtue.

Errors in Financial Planning

Another critical issue is the lack of deep consideration for retirement planning among many individuals, especially during their 30s and 40s when they are most active in the workforce. Many people assume that their current income will continue indefinitely and therefore do not plan adequately for retirement.

The tendency to inadequately plan for long-term financial needs contributes to the conservative investment strategies observed. Many individuals focus on short-term stability rather than optimizing long-term growth through diversified investment portfolios.

Statistics from 2021 show that approximately 95.7 percent of individuals chose to receive their retirement benefits as a lump sum[xii]. This indicates that many have not deeply considered the importance of annuities, or they find the amounts insufficient to convert into annuities after partial withdrawals, which are most common among individuals in their 30s and 40s[xiii] (100-Year Research Institute, NHQV).

This lack of planning often leads to financial strain in later years, as many people start to worry about their retirement finances only a few years before retiring. Unexpected medical expenses are also often not factored into their planning.

In this paper, we have explored the issue of insufficient retirement income in rapidly aging societies like Korea and examined how advanced markets have addressed these challenges. Through substantial government intervention, countries such as the U.S. and Australia have been able to largely mitigate the problems associated with retirement income.

However, in countries like Korea and Japan, where the aging population is more pronounced, we find that despite significant governmental efforts, these challenges remain difficult to resolve.

While governmental initiatives are crucial, the potential role of insurance companies in addressing these issues cannot be overlooked. By leveraging their unique strengths, insurance companies can contribute significantly to alleviating the retirement income gap. This presents numerous opportunities that could not only enhance the business prospects of insurance companies but also address broader social issues, such as elderly poverty, which remains a significant challenge for the nation.

In the subsequent section, we will explore in detail how insurance companies can effectively contribute to solving these pressing issues.

The Solutions

Government Policies

Ultimately, to grow the scale of retirement pensions over the long term and ensure that subscribers' future retirement assets reach an adequate level, it is essential to encourage individuals to actively manage their retirement savings with a long-term perspective from the beginning of their careers. This can be achieved by improving the existing policies of the Korean government and, more importantly, by enhancing the understanding of retirement planning and investment literacy among Koreans to better prepare them for asset growth.

For instance, as previously mentioned with the default options, a significant portion of funds in Korea are currently allocated to principal-protected products, often excessively so. In Korea, participants have the ability to choose their default option, but they tend to select the least risky products. Instead of offering ultra-low-risk principal-protected options, if the default options were restructured to offering low-risk, moderate-risk, and high-risk categories with the aim of generating reasonable returns despite some level of risk, long-term returns could potentially improve. However, for participants to make these more informed choices, it is essential to enhance their financial literacy. This is where opportunities for insurance companies arise.

Financial Literacy

The key difference between the second- and third-tier pension systems in Korea and Japan and those in more successful countries lies in how participants perceive their pensions and retirement income, which ultimately stems from varying levels of financial literacy.

According to an OECD study[xiv], individuals with higher financial literacy are more likely to understand a variety of financial products and invest in diverse asset classes such as stocks, bonds, and mutual funds. They also manage risks better and maximize returns.

However, relying solely on government efforts to raise financial literacy is insufficient. The active involvement of financial institutions is crucial. In this context, I argue that insurance companies are particularly well-positioned to make a meaningful impact and hold significant potential for further development in this area.

The Opportunities for Insurers

Active Engagement in Financial Education

Insurance companies have a unique opportunity to play a significant role in enhancing financial literacy. By actively participating in financial education through their advisors, insurers can help clients better understand retirement planning and investment strategies. Improved financial literacy will lead to better financial attitudes, which in turn will result in more proactive and rational investment behaviors. Over time, this could contribute to the growth of retirement fund accumulations similar to the U.S., ultimately increasing individual retirement savings.

Leveraging Face-to-Face Interactions

Compared to banks or brokerage firms, insurance companies often have more direct, face-to-face interactions with clients. This provides an excellent opportunity to offer personalized financial planning advice while introducing insurance products. By utilizing this advantage, insurers can help clients improve their financial literacy and prepare more effectively for retirement.

Insurance companies employ a large network of agents who not only assist with life planning and recommend necessary insurance coverage but also have the potential to offer more comprehensive advice on retirement assets. For example, alongside helping clients manage their DC plan investments, these agents could not only provide information to enhance the participants’ financial literacy but also provide portfolio management consultations to actively enhance the growth of their clients' retirement savings.

Some might suggest that such services could just as easily be offered by banks or securities firms. However, the distinct advantage of insurance companies lies in their mobility. Unlike other financial institutions, where clients typically need to seek out services, insurance agents can visit clients directly, offering personalized consultations. This proactive approach can make a significant difference, as it removes the barrier of requiring clients to initiate contact and seek out advice on their own, such as visiting the branch office.

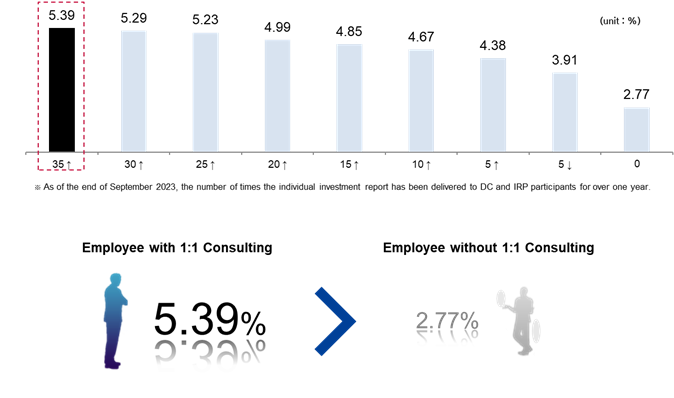

Insurance companies can regularly review and manage their clients' retirement pension assets through these direct consultations. For instance, Kyobo Life Insurance employs specialized retirement pension consultants who are dedicated to providing ongoing DC investment advice and retirement planning support to their clients. Data indicates that employees who receive such tailored services tend to make more informed investment decisions, resulting in better returns with each consultation.

Furthermore, in cases where companies offer multiple retirement plan providers, many clients have chosen to switch to Kyobo Life after experiencing the superior consulting services provided by the insurer. By effectively leveraging their network of agents, insurance companies can establish a competitive edge over other financial institutions.

Digital Engagement

The growing trend of digital engagement also presents new opportunities. Today, individuals can input their information online and directly purchase insurance products. This digital touchpoint can serve as an opportunity to provide basic financial planning guidance and assist clients in preparing for retirement more thoroughly by linking these services with insurance products.

Particularly in Korea, where the MyData industry is becoming increasingly active, insurers can analyze the gaps between public pensions, current private pensions, and existing income and assets, offering tailored financial planning products or strategies to address these needs.

In a similar vein, expanding open banking services—much like Korea's MyData initiative—could enable a more comprehensive analysis of individuals' retirement assets, leading to tailored recommendations for pension and insurance products. This digital transformation presents a significant opportunity for insurance companies to enhance their offerings and better meet the needs of their clients.

Educational initiatives should also include digital activities, such as proactive outbound calls and exposure through various content formats like YouTube shorts. Kyobo Life Insurance, for instance, has the highest number of subscribers in the retirement pension sector and a higher proportion of performance-based investments compared to other insurers in Korea. This success is directly tied to their efforts in educating their customers. By encouraging investments and showcasing performance data, insurers can significantly expand the market for annuity conversion programs.

Conclusion

While aging populations and declining birth rates have often been viewed as challenges for the insurance industry, they also present significant opportunities. If we view the aging population as a growing customer base, we can see it as a promising market with long-term potential. This trend is not limited to East Asian countries with advanced aging populations; as the global population's average life expectancy increases, more countries will face similar demographic shifts.

Particularly, even countries that currently enjoy stable retirement incomes and low elderly poverty rates may eventually face the challenges of an aging population. As these nations gradually experience demographic shifts, there is a possibility that their citizens' retirement funds could diminish over time, leading to situations similar to those currently observed in Korea.

By effectively addressing these challenges in the Korean market, where these trends are already evident, insurance companies can not only benchmark their success but also seize more opportunities globally. In doing so, they can contribute to making retirement more secure and prosperous for people around the world.

[i]“Future Population Estimations Report”, Korea Statistics

[ii] Global Protection Gap Study Report" McKinsey and GFIA

[iii]“2023 Elderly Report”, Korea Statistics

[iv] Poverty Rate Aged 66 and older, OECD

[v] 401(k) Resource Center | Investment Company Institute

[vi]https://www.ici.org/system/files/2023-10/ten-facts-401k.pdf. Investment Company Institute

[vii] 401(k) Resource Center | Investment Company Institute

[viii] https://www.superannuation.asn.au/wp-content/uploads/2024/06/2406-Super-stats.pdf

[ix] Annual Superannuation Bulletin. APRA

[x] Retirement Pension Disclosure Data, Ministry of Employment and Labor

[xi] Recommendations to Enhance Japan’s Defined Contribution Pension System and the Nippon Individual Savings Account Program Feb 2024, Investment Company Institute

[xii]2021 Pension Asset Management Statistics, Ministry of Employment and Labor, Financial Supervisory Service, NHQV 100 Year Research Center

[xiii]https://download.nhqv.com/CommFile/3000000000/152/8/20220603145827138.pdf, NHQV

[xiv] OECD/INFE International Survey of Adult Financial Literacy Competencies", OECD