Improving Retirement Outcomes: Opportunities to treat the symptoms and underlying causes

by Steve Cramer, Senior Vice President & Chief Product Officer, Retirement Division, Protective Life Insurance Company

Abstract

The are many challenges faced by American retirees and those who will eventually retire. The challenges are only outpaced by the uniqueness of the individuals themselves. Relying on public data and existing published research, this paper highlights a small portion of the demographic, structural, and societal realities of the system used to achieve their retirement objectives. Recommendations are then made to improve the short, medium, and long-term individual retirement outcomes of the American population:

Short Term:

- Increase Public Awareness of Existing Resources

- Solidify the Old-Age and Survivors Insurance (OASI) Trust to Avoid Benefit Reductions

Medium Term:

- Further Investment in Public/Private Partnerships Democratizing Financial Products

Long Term:

- Increase Compulsory Financial Literacy Education in Public Schools

The Retirement Landscape in the U.S.A

America is Aging

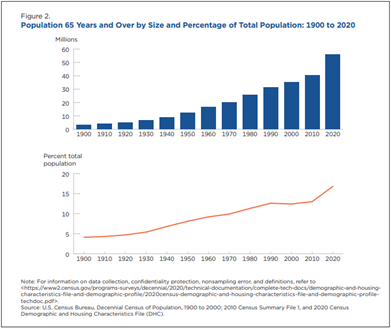

We are not just getting older. We are already old(er). According to the U.S. Census Bureau1, the median age increased from 37.2 to 38.8 between the 2010 to 2020 surveys. While this may not seem material, it is the continuation of the Baby Boomer’s impact on the country’s aging. In 1970, the median age was 28.1, and the portion of the population 65 or older has grown by over 70% since then.

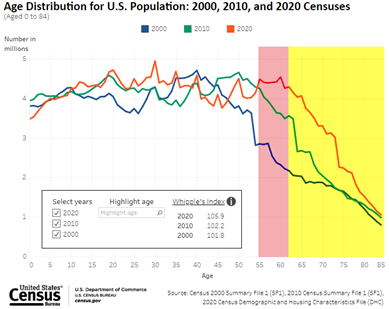

This shift in age will continue. The chart below demonstrates historical and future progression2. Comparing the lines in the yellow section highlights the increases in 65 and older so far. Doing the same for the pink section shows the growth above that key age yet to come before the Baby Boomer wave rolls through.

Old Age Social Insurance

People get old and eventually stop being able to work. The need to provide for them once they can no longer earn a living through wages is not new. The first old-age social insurance program was established in Germany in 1889. Social Security, as we refer to the entitlement in the U.S., was created in 1935 and benefits began in 1940. While originally only a retirement program, survivor benefits were almost immediately added, and disability benefits were added two decades later3.

Today, Social Security payments to retirees vary greatly. At the current full retirement age of 67, the maximum monthly benefit is $3,627 or $43,524 per year. If early retirement is needed, maximum annual benefits at age 62 are $30,864. As of June 2023, the average Retirement Benefit payment was $1,788.894. Annualized this is only $21,467, which is under 150% of the individual federal poverty level.

For those married retirees, a spouse can elect to take half of the higher spouse’s benefit instead of their individually calculated amount. This is most beneficial for single income households, or those with imbalanced income. Spouses of deceased retirees may choose to maintain their own or their deceased spouse’ benefit level. The death will result in a reduced household income either way.

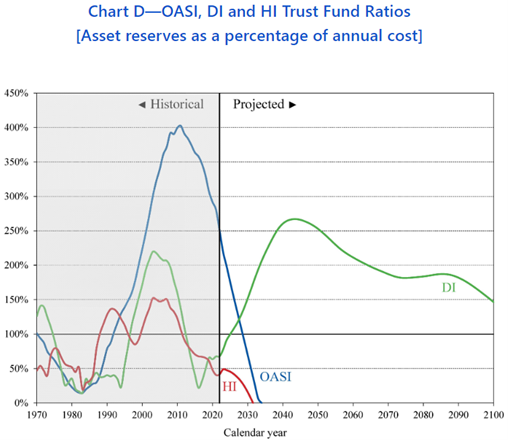

Social Security benefits are currently supported by the reserves held in the OASI trust fund and current withholdings. Without legislative action, the trust fund is projected to be depleted in 2033. Once this occurs, retiree benefits will be reduced to 77% of their current levels in order to be funded by the currently employed withholdings5.

Declining Defined Benefit Pension Participation

Americans aged 55-64 had an average tenure of 11.9 years at the same company in 19816. By 2022, tenure was reduced to 9.8 years7. This shortened commitment to a single employer is combined with a smaller investment in the lifetime income of the employee by the company. Only 15% of American private industry workers are covered by a traditional pension (defined benefit) plan8.

Employers are still supporting the retirement of their workforce, particularly in the white-collar careers, through 401K match contributions and other profit-sharing opportunities. The investment and longevity risks associated with those contributions, however, are born entirely by the employee when utilizing these plans.

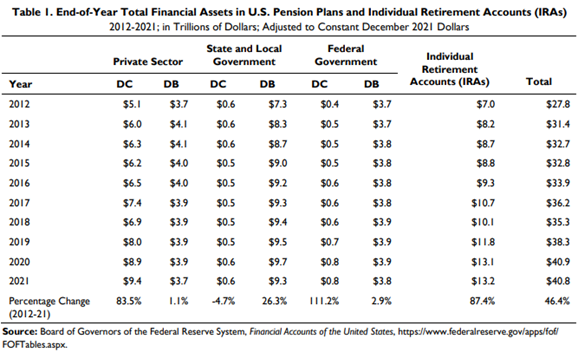

This trend can be seen in the table below9, showing that in 2012 over half of the retirement assets in the U.S. were in Defined Benefit plans. Ten years later, Defined Contribution plans make up nearly 60% of the total assets.

Personal Retirement Savings

There are $40.8T in U.S. retirement assets9. However, Vanguard’s “How America Saves Report 2023” 10, shows the average account balance is $112K. The median account balance is much lower, at just over $27K. According to a study by the Alliance for Lifetime Income11, just 48% of surveyed consumers believe their money will last for the rest of their lives. This is down from 55% in 2021, while almost half of those surveyed are saving less than 10% of their income for retirement. This is echoed in the Vanguard report, listing the average deferral rate at 7.4%. A skew can be seen in this statistic as well, with the median rate lowered to 6.4%.

Global Comparisons

Demographic Variations By Country

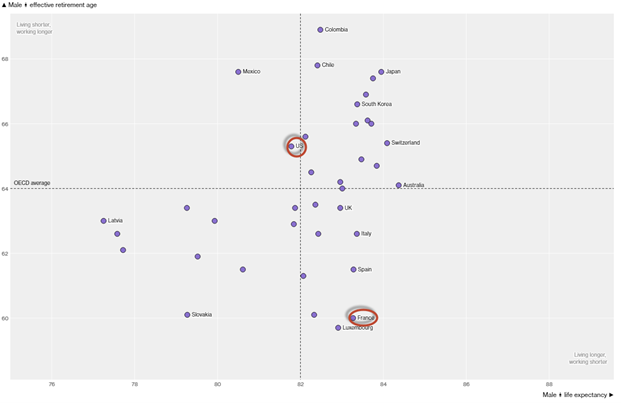

The United States of America is different than other countries in many ways. The governmental structure, the economic system, and the individual expectations of its workforce and retirees are all uniquely American. However, the economic uncertainty presented by an aging population’s longevity risk is not unique. According to the World Health Forum, people aged 65 and older now outnumber children aged 5 and younger for the first time in world history12. Using data aggregated from the OECD and WHO, Bloomberg reports13 that in terms of healthy retirement length, the United States ranks number 34 out of the 38 countries compared. The chart below, from the same study, demonstrates the varied retirement ages and life expectancies observed by different countries. The US and France are highlighted to draw focus to the different expectations in these two nations. The French life expectancy is significantly higher, and the retirement age (at the time of this study) is much younger. The retirement age in France was recently increased two years, which caused massive protests, strikes and unrest.

The State of Financial Literacy

A robust report on global financial literacy and its impacts was written by Leora Klapper, Annamaria Lusardi, and Peter van Oudheusden14. Financial literacy was measured by reviewing responses to questions testing the basic understanding of four concepts necessary for financial decision making. Those concepts were: interest rates; interest compounding, inflation, and risk diversification. While these may seem like advanced topics for the minimum threshold of “literacy”, the questions were asked using examples and easily understood language. A score of three out of four correct answers was defined as “financially literate”.

. . . . only 57% of adults in the U.S. are financially literate.

As one might expect, financial literacy varies widely between advanced and emerging economies, with an average 55% and 28% respectively. The ratesare quite different even within advanced economies, too. For example, 68% of adults in Canada are financially literate, while only 37% are in Italy. Landing in the middle of this range, only 57% of adults in the U.S. are financially literate.

Retirement Health Around the World

The American approach to retirement today is largely self-funding with a minimal yet vital social safety net provided through old age insurance. This is not the only approach to providing for the wellbeing of a country’s elderly. It is not the only system with challenges, either.

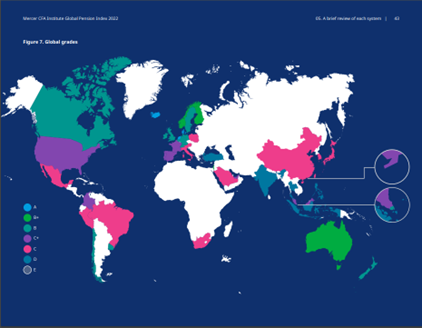

The Mercer CFA Institute Global Pension Index12 ranks individual nations’ retirement systems through scores in adequacy, sustainability, and integrity. Grades are assigned based upon the numeric index value. Although they use different approaches, the U.S.A and France both have a C+ grade. France’s gets an A in adequacy but has much lower marks (D) in sustainability. Iceland, The Netherlands, and Denmark are the only A graded countries.

Iceland scores high across the board and has many different components in their system. There is a basic state pension, income-tested supplemental pensions, mandatory private pensions with employer and employee contributions, and voluntary personal pension plans.

The map below shows the wide range of retirement grades across the world.

American Financial (un)Wellness

Financial Challenges Faced Today

According to the Federal Reserve’s research on the Economic Well-Being of U.S. Households in 202215, the 3rd ranking self-reported financial challenge is “Retirement and Savings.” This is only lower than “Inflation” and “GeneralNeeds.” More troubling, when comparing the 2016 responses to 2022, the number of respondents who responded “None” reduced from 53% to 28%. So, more people are facing challenges, and “Retirement and Savings” are near the top. Not surprisingly, this self-reported challenge differs by income level. The lowest income cohort escalates the importance of “Housing” and “Employment.” Meanwhile, those earning $100K or more place “Retirement and Saving” above even their “General Needs.”

According to the Federal Reserve’s research on the Economic Well-Being of U.S. Households in 202215, the 3rd ranking self-reported financial challenge is “Retirement and Savings.” This is only lower than “Inflation” and “GeneralNeeds.” More troubling, when comparing the 2016 responses to 2022, the number of respondents who responded “None” reduced from 53% to 28%. So, more people are facing challenges, and “Retirement and Savings” are near the top. Not surprisingly, this self-reported challenge differs by income level. The lowest income cohort escalates the importance of “Housing” and “Employment.” Meanwhile, those earning $100K or more place “Retirement and Saving” above even their “General Needs.”

The same study provides insight into the general wellness level felt by Americans today and its deterioration over the last four years (Figure 5). When asked, nearly three times as many people feel they are worse off than they were a year ago when compared to the same question asked in 2018.

Financial Planning Use

There are a variety of options available to financial advisors, and adoption is increasing. In fact, over three quarters of the advisors now use financial planning software, according to a survey performed by Joel Bruckenstein and Bob Veres16.

Only 27% of the consumers have a specific financial plan . . .7

Even with so many advisors utilizing planning software in their practice, only 27% of consumers have a specific financial plan that they are following11. This statistic may seem extremely low, until you consider that only 35% of Americans use a financial advisor17. Although financial technology companies have also begun to build out self-service planning solutions, the low overall plan usage indicates that individual adoption remains low. Addressing the financial literacy shortfalls will be a prerequisite for mass adoption of these tools.

Improving Financial Outcomes

Immediate Focus

In order to assist those nearing or in retirement, there are two immediate actions to be taken:

- Increase awareness of all entitlement and assistance programs available to individuals today.

- Increase funding of Social Security to avoid the reduction in benefits that is projected to occur in less than a decade.

For those without additional time or ability to save, public assistance programs can provide crucial support. However, the National Council on Aging estimates that $30 Billion in available financial assistance goes unclaimed each year18. Increased public and non-profit investments in simple and easy to understand awareness campaigns targeted at the populations likely to qualify can begin to address this lack of awareness. While knowledge of their eligibility may be only one barrier to access, it is the first step in receiving the help available.

The OASI trust fund is running out of money. The political landscape in America will make solving this problem a challenge, but a legislative solution is necessary. Without changes to our current laws most Americans will be less financially secure in their retirement. While everyone would see a reduction, for those relying only on Social Security payments, their entire income will be 23% lower. This could send them into poverty or drive them deeper into it. There are many solutions to this problem, but I recommend an increase in the earnings limit on withholding of Social Security tax without an equal increase in the maximum benefits. This would amplify the current progressive tax structure and face political resistance. However, this path is likely more preferrable than millions of Americans receiving a decrease in the benefits necessary to maintain their standard of living.

Mid-Term Focus

Employer-sponsored retirement plans are a public/private partnership. There are tax credits and deductions to subsidize start-up expenses and ongoing incentives to promote auto-enrollment. Increasing the employer incentives to contribute either independently or through matching programs will drive up fund balances and allow the employee to maintain control of their retirement assets. In addition to the more established options outside of plans, in-plan annuity options allow employees to offload at least a portion of their longevity risk. As we progress the financial education initiatives mentioned below and financial plan adoption increases, the self-directed longevity risk management will become more viable for many retirees.

For those without access to employer-sponsored plans, some states have initiated auto-enroll programs into IRAs. These appear to be similar to the Obama-era MyRA program at the federal level, which is no longer active. While administration costs and political gridlock will be difficult barriers, this could be an additional area of public/private partnerships. Acquisition costs, small retirement product balances, and processing ongoing flow payments into accounts drive up the unit costs at financial service companies. These costs are barriers to accessing products for those wishing to save and limit the potentially viable market segments for financial companies. If there are government programs to shepherd accounts to a size that the private sector can afford, simple and inexpensive (even commoditized) products could be made available. These products could also assist with the longevity risk of the retiree.

Long-Term Focus

Awareness, Social Security funding, and public/private partnership efforts will only go so far. Addressing the overwhelming financial unwellness in America will require an increased focus on education. Specifically, we need to increase investment in the financial literacy of the next generation of workers and retirees. Currently 23 states require a semester course in personal finance education to graduate from high school19. This is an increase from only 6 states in 2019. The progress is significant, and it should expand to all 50 states. However, the importance of financial literacy and the complexity of our financial systems requires more. Middle school programs, and multi-semester high school curriculums should be developed and then required. This broad range of topics is critically important for our students’ success in life. It requires as much attention as any other category taught in our schools today. If we start early, use engaging experiential learning techniques, and maintain our focus, then our financial literacy rates, our financial wellness levels, and even our retirement outcomes will improve.

References:

1https://www2.census.gov/library/publications/decennial/2020/census-briefs/c2020br-07.pdf

3https://www.ssa.gov/history/hfaq.html

4https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

5 https://www.ssa.gov/oact/trsum/

6Job tenure of workers in January 1981 (bls.gov)

9 https://crsreports.congress.gov/product/pdf/IF/IF12117/2

13 https://www.bloomberg.com/graphics/2023-global-retirement-age/

14 https://gflec.org/wp-content/uploads/2015/11/Finlit_paper_16_F2_singles.pdf

19https://www.ngpf.org/state-of-financial-education-report/

This research paper is not an Actuarial work product and is only intended for the expressed uses of the RGA/International Insurance Society Leaders of Tomorrow program. The opinions and recommendations do not reflect those of Protective Life Insurance Company or any other organization with which the author is affiliated.