Leveraging Emerging Trends to Drive Life Insurance Penetration in Africa

Kehinde Ariyibi, Head of the Retail Enterprise & Chief Compliance Officer, Custodian Life Assurance

Abstract

Our world is changing: every day, there are discoveries, new inventions, technologies, and new ways of living and doing things. These changes and trends affect every sphere of human life.

The financial service sector, including the insurance industry, is also affected by and will be significantly impacted and changed by these trends. A number of these trends are global and cut across every continent. In contrast, others are dynamic and peculiar to the African continent only.

This study captures and highlights the current life insurance landscape in Africa and emerging trends within the continent. It further identifies some of the steps the African market can take to successfully position itself to use these growth opportunities and to drive sustainable life insurance take-up and penetration across the African continent.

The strategies to drive life insurance penetration from a similar market were also reviewed and learnings were identified for the African market.

Introduction

Life insurance is a critical tool used for risk management and financial planning. It also provides safety nets for individuals, families, and businesses/entities and contributes to the economy of the country and the world at large.

The various life insurance offerings are usually streamlined to the retail or corporate market segment. This segmentation determines how life insurance is accessed and distributed, and in some instances, the cost and pricing for the product and offering.

The insurance industry plays a critical role by providing risk management solutions that facilitate and support business operations and economic activities. Insurance also stimulates investments in other sectors and creates employment opportunities and economic growth.

Economic growth is the sustained increase in the output of goods and services in an economy, typically measured as the rate of increase in real gross domestic product (GDP).¹ It reflects an economy's ability to produce more goods and services over time and is an important indicator of economic health and development.

The Insurance sector's contribution to GDP indicates the level of Insurance growth and overall economic growth. A country’s GDP indicates the economic growth level. 2

Insurance penetration rate and insurance density are some indicators used to gauge the adoption and level of Insurance growth, development, and maturity in a country or region.

Insurance penetration is measured as the total Insurance premiums to the GDP, while insurance density is calculated as the total Insurance premiums divided by the population; i.e., the average Insurance per person.

Overview of the Life Insurance Landscape in Africa

The African life insurance industry and the market has evolved and witnessed several changes over the last decade. Global trends have shown that life insurance is bigger than non-life Insurance; however, in Africa, the trend indicates that non-life Insurance is bigger than life insurance. The life insurance penetration in Africa therefore remains low compared to global averages.

The life insurance penetration rate in Africa is currently at an average of 3 percent of the continent's GDP compared to the global average of 7 percent.

According to the African Insurance Organization Annual report issued in 2023, the global life Insurance premium was $2.8 trillion in 2022, whilst Africa as a continent contributed $46.9 billion, which was barely 2 percent of the global life insurance premium for the year 2022.3

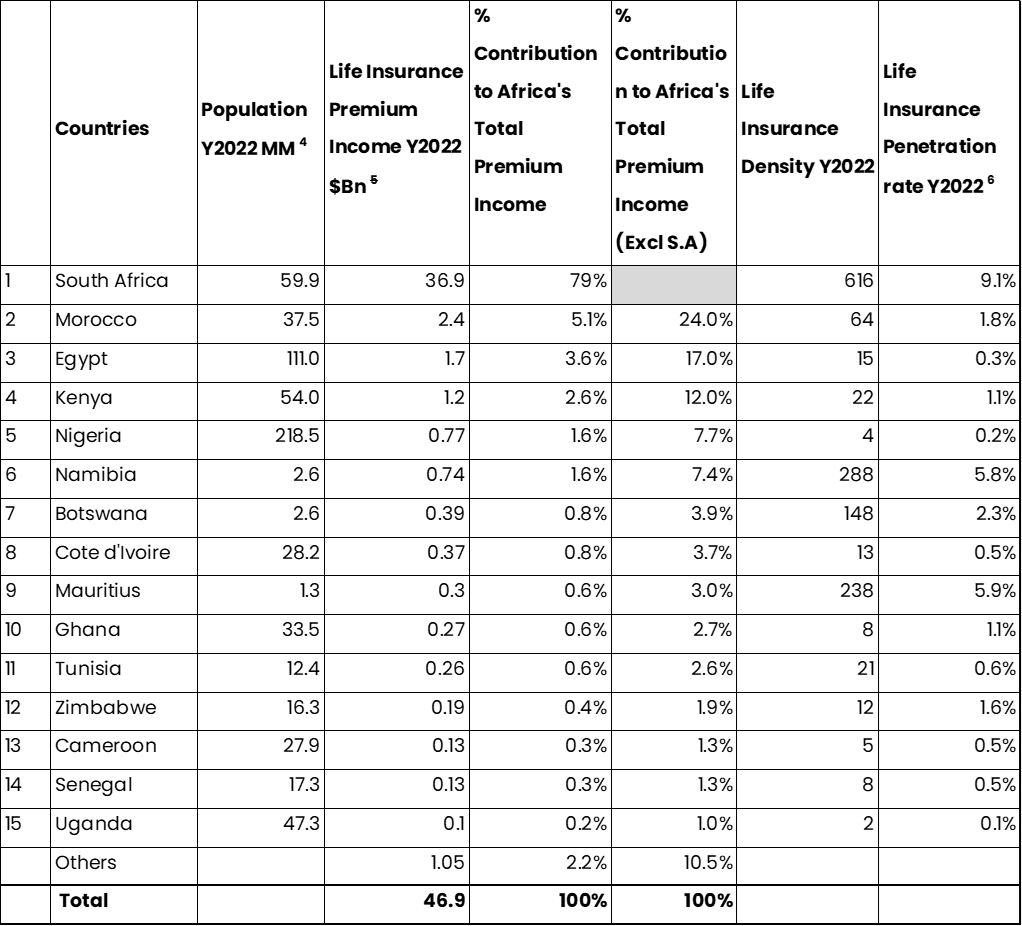

The top 15 countries contributing to the life insurance premium in Africa with their corresponding life insurance density and penetration rates as obtained respectively in 2022 are shown below.

Overview of African Life Insurance Performance

-South Africa accounted for 79% of the life insurance premium generated in Africa.

-The average life insurance penetration rate in Africa for the period was 1.6%.

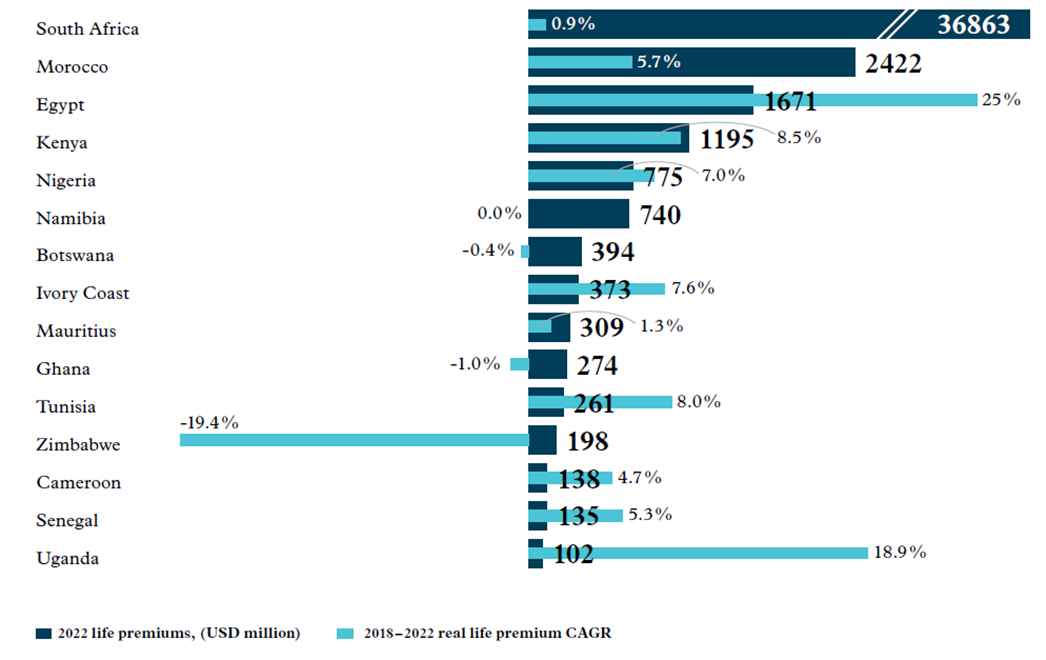

Life Insurance Premiums 2022 (in USD million) and Life Premium Compound Annual Growth Rate 2018–2022 (in %), Top 15 Markets 7

Source: Faber Consulting AG, based on data from Swiss Re Institute, Sigma explorer

Global View of the Life Insurance Market

According to a report issued by Statista.com, the biggest life insurance market globally is the United States. In 2022, the U.S., with an estimated population of 333 million people, was the leading life insurance premium-writing country, with a total value of life direct premiums written exceeding $600 billion. The second and third largest life insurance markets were China and the United Kingdom, respectively.8

An overview of the performance of some selected countries and continents is also highlighted below.

Selected Countries Overview 9

Global / Continental Overview 9

Challenges and Constraints of the African Market

The factors and obstacles currently limiting the African market from maximizing its potential to meet the global average life insurance penetration rate are multifaceted. These barriers and factors are also largely responsible for the inability to meet its potential.

Some of these barriers and factors are as follows:

Economic constraints: Barriers and constraints due to the economic situation of most countries in Africa have largely slowed down the growth rate of life insurance. Some of the specific issues revolve around rising inflation, low-income individuals and households, unemployment, poverty, etc.

Political instability: This has also led to uncertainties within the affected countries and regions. Political instability impedes economic growth and investments in these countries and sectors. Enabling regulations that will support the Insurance sector to grow is also largely unstable in these regions.

Technological barriers: Limitations and constraints due to investments and deployments of workable technology have also slowed down the penetration rate in Africa. Some of these barriers in technology could be due to deficits in the infrastructure, skilled resources, and investments in technology itself.

Inadequate product offerings and distribution channels: Suitable distribution models and products are also lacking in some of the African markets. Product offerings and distribution channels are usually adopted from the "developed world" without adapting and tailoring the same to the peculiar needs of the African consumer.

Low insurance awareness and perception of insurance and illiteracy: Awareness of insurance is very low in Africa. The perception of life insurance is largely poor due to the cultural, socio, and various religious faiths/doctrines.

Understanding Emerging Trends

Despite the challenges and barriers highlighted above which have inhibited the growth and uptake of life insurance across the continent, there are several emerging trends and factors globally and within the continent that are now opening tremendous opportunities for the continent to leverage significantly and have made life insurance products and services easily accessible, affordable, and available to more people in Africa.

The paramount trends identified for this research are below:

Technology advancements and automation: Advancements in technology deployments, usage, and automation would significantly shape the life insurance business, which would also lead to more innovations across the entire customer journey, including client prospecting, onboarding, underwriting, claims, etc. There would also be more efficient processes and improved customer experiences.

Digitization/digital offerings: As we all know, digitization is a transformative trend that will continue to evolve. This trend is already setting the standards for the life insurance market of the future. Digitization and digital offerings affect the entire life insurance value chain, thereby making insurance simple, responsive, and more accessible. An example is the widespread success of the adoption of mobile money in parts of Africa.

Artificial intelligence (AI): The use of AI to transform traditional life insurance models, from customer onboarding to claims payment, is a major disruptive technology that would also create the opportunities that would drive the volumes and numbers the African market is desirous of. Access to data, analytics, etc. would also enhance the ability to provide personalized life Insurance product offerings rather than generic products. Real-time health/medical assessments, etc., would also improve the client experience, process efficiency, and service delivery.Big data and analytics: The availability of data has skyrocketed, and insurers have made progress in advanced analytics. This has provided the underwriter with more insights into the client's behaviors, needs, lifestyle, and patterns. Life insurance providers who maximize this would have better insights into the market and position themselves to capture the opportunities available in the market.

Regulations and regulatory changes: The importance and impact of the regulatory environment and changes to the growth of Insurance cannot be emphasized enough. Regulations set the framework for the sector. They also create an enabling environment and opportunities for the growth of life insurance in the region. These regulations also change and evolve from time to time. An example of a regulation that stimulates growth would be mandatory life insurance coverage for employees in the formal sector as part of their employment benefits.

Demographic shifts: The growing middle class and young population, urbanization, and changes in consumer behavior are also some of the emerging trends that would also have a significant impact on the African market.

Leveraging the Trends (Opportunities)

Driving life insurance penetration in Africa by leveraging these emerging trends therefore requires strategic approaches that are poised to address the unique regional challenges across the various countries and jurisdictions, by capitalizing and leveraging on these opportunities.

Effective strategies that can be adopted to drive life insurance penetration and growth have been highlighted as follows:

1. Driving and Leveraging Distribution Channels

Partnerships: Partnerships are making life insurance more accessible, affordable, and integrated into everyday life by leveraging existing relationships, groups, and business models. This would also go a long way in covering the uninsured populace across the continent. Some synergies and partnerships in this regard are already working well with mobile network operators, where life insurance companies partner with telecommunication operators to offer micro life insurance products. Similarly, life insurance products can be bundled/embedded into products and services.

Bancassurance: Leveraging a bank's network, clientele base, and existing relationships to deliver insurance solutions digitally is also an effective distribution strategy that would drive growth and numbers.

Agency model: The existing traditional agency models across Africa can also be fully digitized. Life insurance agents should be enabled with the right resources, tools, and technology to reach the market and uninsured population.

Brokers: Similar to the agency models, brokers can start deploying technologies and tools that would have them reach the uninsured market segments.

2. Driving and Leveraging on Technology

Digitalization: The world is now digital, and technology is transforming the life insurance industry and easing the use of data. Life insurance products, offerings, and solutions must therefore meet the expectations and needs of the consumers to drive the growth and uptake of policies.

AI: The use of AI is already setting the life insurance players apart. It is already a major competitive differentiator. The use of AI would increase life insurance adoption and growth by driving and enhancing automation, increasing operational efficiencies and processes across the value chain by providing personalized Insurance covers.

Automation: Automation is the application of technology, programs, robotics, or processes to achieve outcomes with minimal human input.10 Automation of the entire life insurance process from marketing, sales, onboarding, policy/ customer servicing, and claims would streamline the business operations and ensure underwriters are more responsive and aligned with the ever-evolving developments and changes in technology.

Insurtech: Insurance technology (insurtech) is one of the strategies that will help life insurance bridge the financial inclusion gaps in the continent. This has also been noted to be the future of life insurance.

Mobile technology: Life insurance products will also be driven by mobile technology. This will be riding on the successes already recorded in Africa with mobile money.

3. Driving and Leveraging Innovation

Products and services: Developing innovative products, services, and solutions by leveraging innovative technologies and innovative business models will also drive financial/insurance inclusion, whilst deepening the penetration and contribution to GDP. The products and services should also meet the needs of the teeming young population in Africa. It is also paramount that the insurance solutions be flexible and appropriate for each market’s need and based on its insurance maturity level.

Microinsurance: Developing and providing simple, affordable, and easily accessible life insurance products and services for low-income households and individuals would also significantly drive the uptake and growth rate. These microinsurance products and services, for example, can be driven with mobile technology to drive further inclusion.

Customer centricity and smart processes: This involves focusing on the customer and customer experience before developing operational and service models. Implementing smart onboarding, underwriting, processes, and operations would also improve the customer perception and experience.

4. Driving and Leveraging Regulatory Frameworks

Regulations and policies: Each country and region must put in place supportive regulations and policies that would enable the Insurance sector to thrive. There must also be strategic collaboration between the market operators and regulators to stimulate and drive the intended growth and uptake in the African market.

- Financial strength: The acceptable financial strength and capacity for the sector in each region should also be defined and monitored to ensure adequate capital and reserves that would drive sustainable growth.

Consumer protection: Protecting life insurance consumers whilst ensuring fair practices must also be very intentional. This would strategically build trust and improve the perception and image of the Insurance Industry at large, whilst also leading to life insurance growth and uptake.

Learnings from Similar Markets: Asian Markets

Having identified the potentials and opportunities in the African market, this research is also extended to other markets and regions to gain some insights into the strategies and opportunities that have enhanced the life insurance growth in the jurisdiction.

For this research, we have examined life insurance in the Asian market and the learnings from Asia that can be co-opted by the African market.

The Asian life insurance market has been a key driver of the global Industry growth with an average life insurance penetration rate of 3 percent. The trends and opportunities in the market also varied according to the different countries in the region.11

The noted strategies from the research that have been adopted and implemented successfully in Asia, which have worked well for the region and can also be adopted in Africa are as follows:12

Leveraging technology and digital transformation

Leveraging AI and data analytics

Targeted life insurance products

Customized and flexible life insurance products

Financial literacy drive and campaigns to drive insurance adoption

Enhancing customer experience and streamlining operations

Affordable and flexible premium options

Strategic partnerships and insurance distribution via banks and Bancassurance

Some of the companies in the Asian region that have implemented these strategies successfully are AIA Group, Manulife, Ping AI Insurance, etc.

Conclusion

According to estimates by the Swiss Re Institute, advanced markets will generate about 61 percent, or $900 billion, of additional premiums in absolute terms in the next decade, and emerging markets an additional 39 percent, or $578 billion. 13

There is so much headroom for growth, development, and penetration of life insurance in Africa as an emerging market. The potential is also great and indeed massive for the continent.

Entities, countries, and jurisdictions that are desirous of this growth, expansion, and penetration should start taking the necessary steps and actions as highlighted, which would position them to effectively capture these opportunities. All players and operators within the life insurance ecosystem in Africa must therefore prepare for this next decade of opportunities.

References

Books

- Mankiw, N. G., Principles of Economics (9th ed.), Cengage Learning, 2021.

Reports

- African Insurance Organization Annual Report 2023

- McKinsey & Company, “Global Insurance Report 2023: A paradigm shift in Asia life insurance.”

- Global Insurance Report 2023: Navigating Asia’s evolving market

Websites

https://databankfiles.worldbank.org/public/ddpext_download/POP.pdf

https://www.atlas-mag.net/en/category/tags/pays/africa-insurance-penetration-rate

https://www.swissre.com/press-release/Life-insurance-set-to-boom-as-interest-rates-surge-says-Swiss-Re-Institute/f99547cc-0e74-4620-b2ba-8f79f391df00

https://www.statista.com/outlook/fmo/insurances/lifeinsurance/asia

- https://www.atlas-mag.net/en/category/regions-geographiques/monde/life-insurance-premiums-set-to-soar

____________________________________________________________

¹ Mankiw, N. G. , Principles of Economics (9th ed.). Cengage Learning, 2021.

2 https://www.investopedia.com/terms/g/gdp.asp

3 African Insurance Organization Annual Report 2023

4 https://databankfiles.worldbank.org/public/ddpext_download/POP.pdf

5 African Insurance Organization Annual Report 2023

6 https://www.atlas-mag.net/en/category/tags/pays/africa-insurance-penetration-rate

7 African Insurance Organization Annual Report 2023

8 https://www.statista.com/topics/1411/life-insurance/

9 https://www.atlas-mag.net/en/taxonomy/term/15%2C12

10 https://www.ibm.com/topics/automation

11 McKinsey & Company. Global Insurance Report 2023: A paradigm shift in Asia life insurance

12 Global Insurance Report 2023: Navigating Asia’s evolving market

13 https://www.swissre.com/press-release/Life-insurance-set-to-boom-as-interest-rates-surge-says-Swiss-Re-Institute/f99547cc-0e74-4620-b2ba-8f79f391df00