Will Human Advisors Survive the Age of AI?

Sulim Lee, Regional Business Development Director , AIA Group

Role of Human in Life Insurance Sales and Distribution

Introduction

There is an old adage that has shaped how life insurance has been sold for the last century: “insurance is sold, not bought.” This describes the traditional model of how life insurance policies have primarily been sold by agents and advisors, underscoring the belief that human salesmanship is essential to explain to customers the importance and complex features of a life insurance product.

Yet the world has evolved dramatically over the last century — and especially more so in the past decade. As a millennial, I have witnessed the dawn of personal computers, the rise of the internet and prevalence of mobile that has changed our daily lives and disrupted entire industries. Physical video rental stores and traditional brick-and-motor travel agencies have suddenly lost relevance, displaced by video streaming platforms and online travel aggregators. Tech unicorns have become one of the coolest places to work for my college classmates.

I entered the life insurance industry in Asia after years working in investment banking focused on financial institutions. Over nearly a decade in this space, what has interested me the most is how little the sales model has evolved: life insurance is still predominantly sold through human advisory and intermediation.

Whether through tied agents, third-party brokers, bancassurance, or worksite marketing, the process remains consistent—human advisors set appointments, explain products, advise customers, persuade them to buy, and assist throughout the application process.

So why aren’t life insurance products sold entirely online like many other products? What is it about our industry that has preserved this traditional sales model? Is disruption possible? Could technology—especially with the rapid advancement of generative AI and now agentic AI—change the traditional human-driven sales model?

This paper explores these questions, on whether life insurance distribution can—and will—change in the near-to-medium term based on consumer behavior and technological advances. While the focus is primarily on the life insurance industry in Asia, I will reference North American and European markets where relevant.

Digital Distribution is Nothing New

Capability and Channels Already Exist in the Market

Digital marketing and selling life insurance products directly to customers isn’t a new concept or capability. For established insurers with financial means and a competent technology department, it isn’t particularly difficult to set up a digital-only sales distribution channel.

At first glance, digital distribution seems like a natural evolution given how today’s customers manage most of their financial needs online. In China, companies such as Ant Financial and Tencent have made buying financial services products through smartphones the norm for average consumers. The investment sector has also seen a rapid growth in robo-advisory, with global assets under management soaring from mere US$5 billion in 2018 to $1.8 trillion by the close of 20241. Closer to the insurance space, China's Zhongan P&C (online-only P&C insurer in China) wrote US$4.6 billion in premiums in 20242, while American companies like Lemonade have achieved notable scale in distributing insurance digitally.

A number of established life insurers in Asia have also launched or enhanced their digital fulfilment channels in recent years, especially spurred by the Covid-19 pandemic. The region has also witnessed a surge in insurtech startups in the last decade, including in Hong Kong, Singapore, India and Thailand, all promising disruption through digital-first channels.

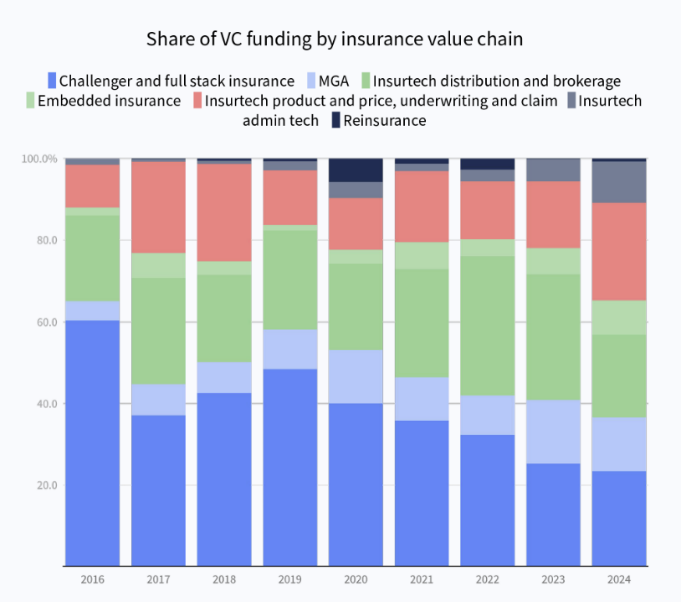

Yet, despite this flurry of activities and real consumer trends toward online transactions, life insurance sales through digital channels remain very low. This isn’t just an Asian phenomenon: North America and Europe see similar patterns. Global venture capital funding for “full stack” or digital-first challengers has also dropped sharply in recent years3, suggesting the capital market is not anticipating such transformation in the near term either.

Source: Dealroom, Mundi Ventures, and MAPFRE. The State of Global Insurtech 2024.

Why Digital Channels Haven’t Taken Off in Life Insurance

Why haven’t online sales become mainstream for life insurance, unlike other financial services products?

There are several reasons that can explain this phenomenon:

Behavioral Barriers. Life insurance is not an everyday necessity – like payments – nor is it mandated by the government as is often the case with motor insurance. It is also rarely a fun or impulsive purchasebecause it involves confronting mortality, planning for uncertainty, and managing long-term financial risks. Similar to retirement planning, although many people recognize life insurance is important, procrastination is common.

Financial Literacy & Awareness. Many potential buyers lack basic financial knowledge and understanding of insurance needs or products. Without this foundation, they’re unlikely to seek digital advice proactively. Supporting this, research by Abdul Qadoos on robo-advisory adoption showed that individuals with higher financial competence are far more likely to use digital advisory services.4

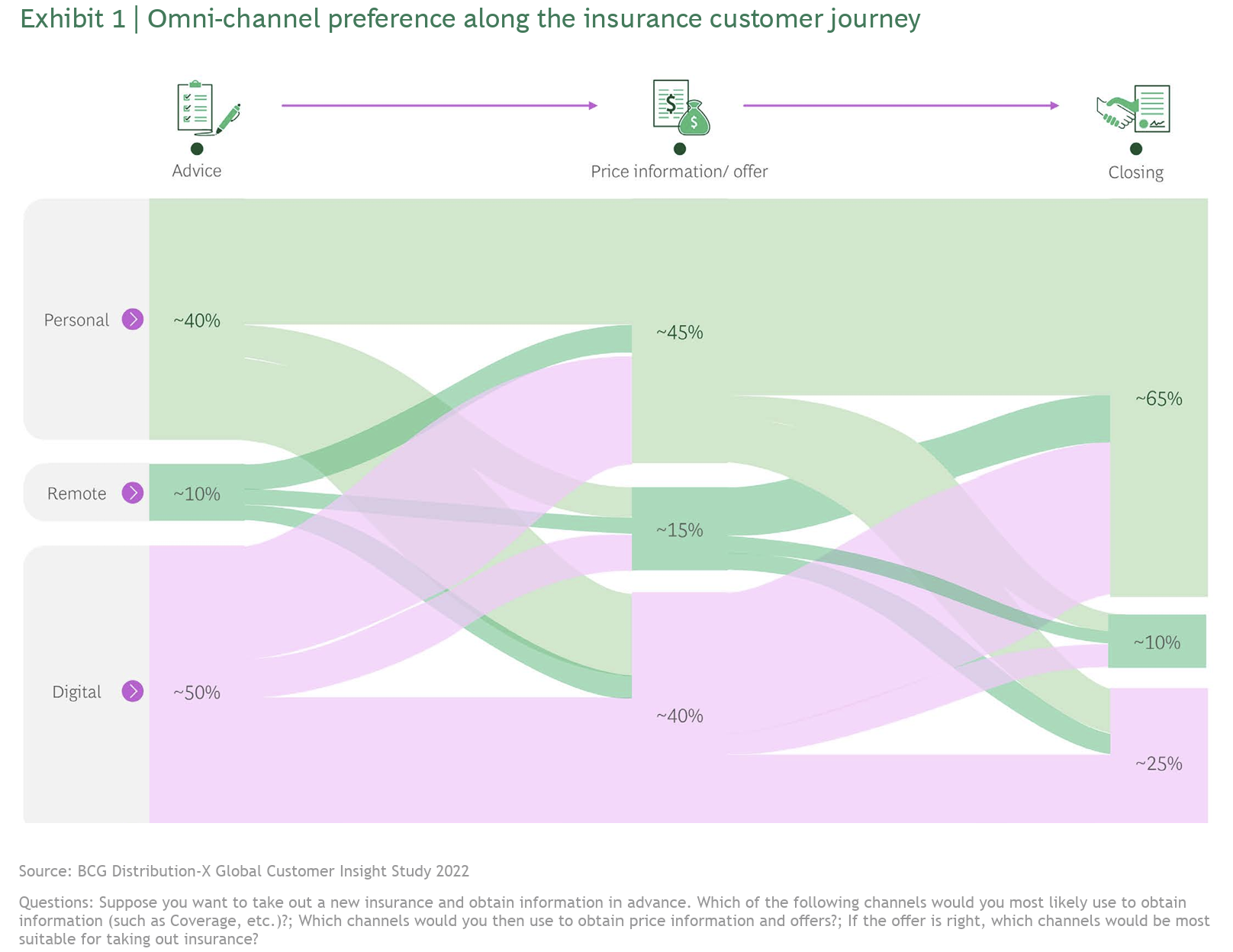

Complexity & Long-term Commitment. Even when consumers start their journey with intent and awareness online, the complex nature of life insurance — coupled with the requirement for long-term commitment — often drives them back to seeking human guidance. A Boston Consulting Group study found that only one in eight people prefers a completely digital purchase experience for insurance, and fewer for life insurance specifically5. This aligns with LIMRA's findings, which suggest that while consumers appreciate online purchase options, most ultimately want to consult an expert to confirm they are making the right decision6.

Infrastructure and Customer Acquisition Cost. Finally, while digital channel inherently has higher potential for scalability with lower marginal costs, it can incur substantial fixed and semi-fixed costs to develop and operate. It can also incur high marketing costs (digital ads, social media, paid search) to acquire a customer depending on the effectiveness of its marketing strategy. Given the low number of customers who will complete the sales journey entirely online for reasons outlined above, it is understandable that the ROI hasn’t been great in the past.

Why the “Human Touch” has been so Essential in Life Insurance Sales, Although with Costs

In the world of life insurance, human-intermediated sales process continues to be the prime method on how the product is sold. And rightly so, as humans play pivotal roles in educating customers, assisting with sales applications, and providing post-sales support that machines currently haven’t found an easy way to replicate in terms of effectiveness.

Value of Human Touch

- There are various key reasons why human advice has been so critical in life insurance sales:

- Prompting Awareness to Action: Skilled advisors help move customers from passive awareness and latent need to proactive decisions. Social psychology supports this: personal calls or face-to-face meetings generate engagement rates above 40%, while automated reminders often fall below 7%7.

- Providing Trust: Buying life insurance requires confronting anxiety about the future, making empathy and trust critical. Eye contact and body language of a human inspires trust in ways digital tools inexplicably cannot replicate. According to the Freeman Trust Report, 77% of consumers trust financial brands more after live, in-person interactions.8

- Education & Personalized Guidance: Terms like “increasing sums assured,” “deductibles,” and “waiver of premium rider” can confuse even experienced financial professionals. Simplifying these complex life insurance jargons, and tailoring guidance to individual circumstances can be done with intuitive ease by a human.

- Behavioral Interventions: The sales process often leads to drop-offs and objections due to its complexity. Advisors provide behavioral interventions by proactively following up, addressing concerns in real time, and motivating clients to act.

- Navigating Complex Insurance Processes: Insurance processes, such as underwriting or claims, can often be opaque. I’ve often heard from customers that one of the reasons why they want a human advisor is that they think agents can help navigate these with the insurers on their behalf.

I’ve heard and seen some amazing stories of professional advisors in action that truly showcases the power of humans: in Hong Kong, a senior agency director shared how he archives every single policy review for each of his customers, year after year, that cultivates long-term sales relationships. In Philippines, agents talked about the higher purpose they find when making a difference in someone’s life and the genuine trust that their clients place in them.

Associated Costs and Challenges

While there’s no denying the vital role humans play in life insurance sales, this does come with its own set of real challenges and costs.

High Acquisition Costs. Insurers must pay substantial commissions to human advisors for their time and effort. The sales process is grueling, often requiring about ten leads to close one sale, with multiple appointments and follow-ups.

Scalability Issues. Tied agencies often rely on their advisors' personal networks and referrals that tend to limit lead sources. Bancassurance channels face challenges from fewer physical footfalls. Recruiting new advisors is difficult, and they often take over a year to become productive.

Inconsistency in Quality. Advice quality varies widely; Some advisors even use aggressive or misleading tactics. For example, an advisor can sell an investment-linked policy to a client, positioning it as a pure investment vehicle, without fully explaining the increasing cost of insurance with age and its impact on account value.

Bias Toward Wealthier Clients and Larger Policies. Given the economics, there can be a favor for wealthier clients and large policies (often savings) due to higher commissions, while lower-commission products or those aimed at younger clients lag in sales. For example, an affordable standalone cancer protection product may not gain traction; The distributor reward just isn’t there for the effort involved, especially when it’s difficult to explain complex medical eligibility rules with confidence while the commission can only cover the price of coffee and transport.

Potential Implications

Not all factors are responsible for these trends — changing demographics also play a role — but I believe several of the previously discussed challenges may have contributed to the plateau in tied agency forces observed in multiple Asian markets. In some of these markets, the average age of agents is also rising, signaling potential future gaps in sales capacity as fewer younger entrants join the sales force.

Meanwhile, product penetration has stagnated, despite the “protection gap” in Asia continuing to widen. According to a Swiss Re study published July 2025, strong interest in insurance remains, particularly in emerging Asian countries, yet multiple barriers prevent purchase, including perceived high premiums and limited consumer understanding9.

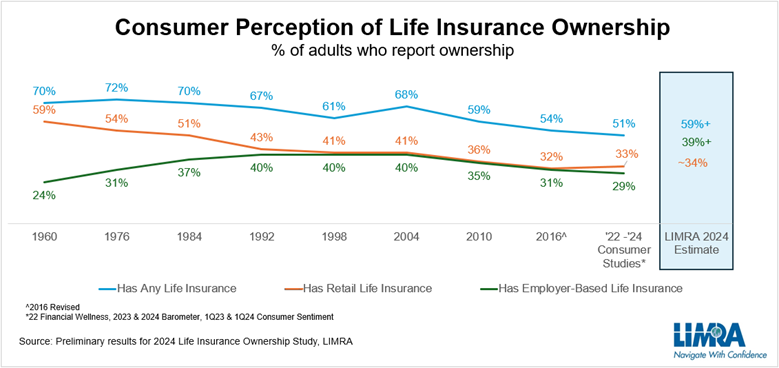

The situation is even more pronounced in North America. In Canada, the number of life insurance policies owned is declining, pointing to a shrinking customer base10. The U.S. has experienced a dramatic drop in retail life insurance ownership over the past six decades; LIMRA estimates ownership now stands at approximately 34%, down from nearly 59% in the 1960s6.

This suggests that while the life insurance industry itself has grown, it has increasingly concentrated on wealthier segments or shifted toward savings-type products rather than broad protection coverage. Such a dynamic raises a long-term question about the relevance of life insurance for future generations: if these trends persist, will the wider public lose confidence in its value and importance as a financial safety net?

Can AI Replicate Human Advisors? And Will Consumers Want It?

Current State of AI in Advice

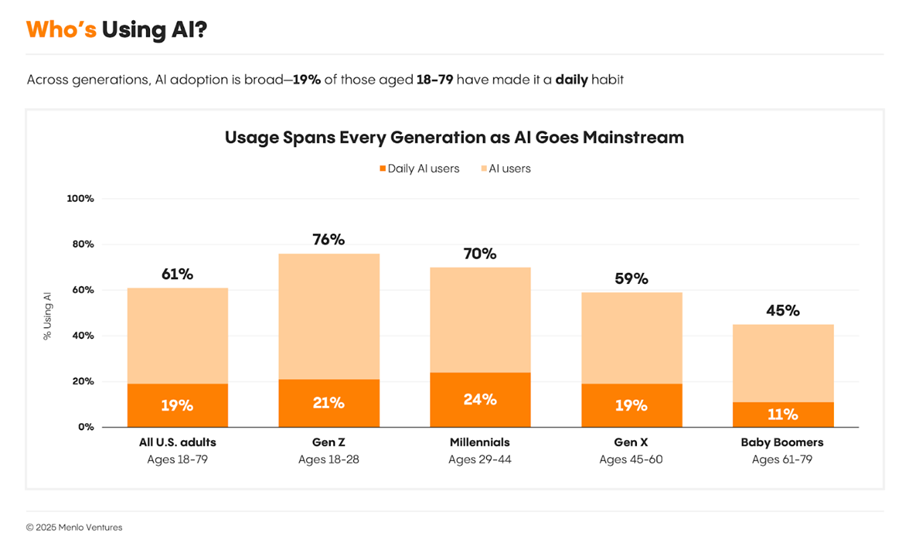

So, generative AI has arrived at our doorsteps, with the accompanying media noise that it will bring either a utopian or dystopian future. While tempting to dismiss as an “AI bubble,” the rapid adoption of generative AI has been astonishing — already, a growing share of people in developed countries use these tools regularly. For example, 61% of U.S. adults have used AI in the past six months, and 19% engage with it daily across multiple age groups11. Even my mom, who is in her 60s and has been a housewife in Korea for decades, has started relying on AI for everyday tasks like fact-checking and translating.

Source: Menlo Ventures. 2025: The State of Consumer AI.

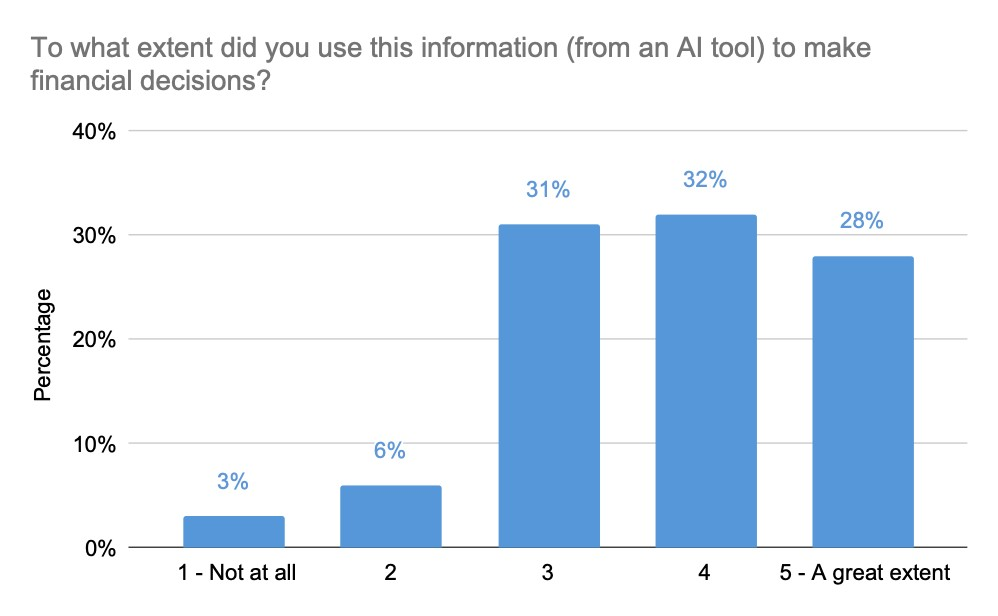

What’s more, many are using AI for financial planning and advice. A study by the Ontario Securities Commission found that among AI users, 29% sought financial or investment guidance, and over 90% used AI-generated outputs to shape financial decisions to at least a moderate extent12.

Source: Ontario Securities Commission. Artificial Intelligence and Retail Investing: Use Cases and Experimental Research.

Source: Ontario Securities Commission. Artificial Intelligence and Retail Investing: Use Cases and Experimental Research.

Curious about how AI might perform in the realm of life insurance advice, I decided to test ChatGPT, DeepSeek, and Grok by having them adopt the persona of a professional, MDRT insurance sales agent based in Hong Kong with over 20 years of experience. I asked them to explain complex insurance concepts in everyday language while probing my personal and financial circumstances through follow-up questions. I was quite surprised by how well these AI agents asked thoughtful questions; And based on what they learned from our conversation, they encouraged me to purchase a high sum assured critical illness policy, which felt quite relevant.

The “Science Fiction” Scenario

If so, can AI fully replicate the role of human advisors in life insurance sales? To explore this, I would first imagine an extreme “science fiction” scenario where sales operate entirely without human interventions, then step back to consider the practical constraints.

In this scenario:

- Insurers deploy autonomous “prospecting AI agent” that crawl through social media, partner and own customer databases to pick up on cues (such as posts about a new baby) that signify potential insurance needs.

- “Marketing campaign AI agents” identify optimal strategies, generate micro-targeted ads, run segmentation experiments and optimize channel mixes.

- Interested customers initiate interactions with “AI insurance sales agents” via websites, apps or messaging platforms.

- Alternatively, AI sales agents can be “embedded” in other transaction journeys – such as the bank’s website when applying for home loans – where there may be a natural affinity for life insurance.

- Customers can choose how they want to engage; For example, a recent college grad might prefer a Zoom call with a video avatar with warm, easy-going personality.

Source: AI-generated by Imagen-4 based on above descriptions

- The AI sales agents will ask probing questions to understand personal and financial contexts and explain complex insurance features interactively with analogies, charts, and animations.

- They can also sense emotional hesitations and respond accordingly, shepherding the customer successfully through the sales process.

- On the other hand, if the customer already knows what they want and prefer to just get the purchase done, the AI can streamline the entire process.

- Behind the scenes, various AI agents collaborate for proactive reach out, manage drop-offs with targeted nudges, and coordinate with digital or human counterparts.

- There can also be a “relationship manager AI agent” enabling long-term nurturing at scale, answering questions with personal context and adapting to evolving life stages.

- Finally, these AI systems will self-learn and refine over time, with human supervisors overseeing overall strategy, regulatory adherence and system enhancements.

What Needs to be True for AI to Replace Humans

Assuming the detailed scenario is technologically feasible and permitted by regulators —especially regarding data privacy and evolving AI governance frameworks such as the EU AI Act — what will it take for consumers to start buying insurance from these “AI sales agents”? For this kind of shift to succeed, several critical factors must align; Conversely, if they are addressed, we might see a real change.

High Financial Literacy and Wide Societal Awareness of Insurance. I won’t elaborate on this since it’s covered earlier. Even the best technology can’t help much if people don’t understand why insurance matters in the first place.

Consumer Trust in AI-Generated Advice. There needs to be widespread consumer trust in AI-generated advice, which will hinge upon (1) minimizing “hallucinations” and (2) high degree of explainability of such advice. Much like the human mind, gen-AI is still a relative black box – even Anthropic, the company behind the large language model (LLM) Claude, admits that they “don’t understand how models do most of the things they do[i]” - although researchers are spending immense efforts to combat the two issues.

Products with Immediate Perceived Need and Low Commitment. Products that feel urgent or offer more instant benefits may be more predisposed to being sold online — especially if there’s a government incentive attached. If commitment is low (annually renewable, relatively low price, or minimal surrender penalties), adoption can further go up. In Australia, the community-rated yearly renewable health insurance products are widely sold online due in part to significant government incentives.

Seamless User Experience that Feels Natural. The entire user experience must also feel natural, with seamless customer handoffs across different platforms and preservation & smooth transfer of contexts between AI agents. The “uncanny valley” effect – AI interaction feeling almost-but-not-quite-human – can also lead to consumer discomfort and therefore drop-off.

Capabilities of AI Technology. While gen-AI and agentic AI are no doubt incredibly powerful technological tools, we must be clearsighted about their strengths and limitations. Gen-AI excels at summarization and content creation, but it still struggles to truly understand context beyond user inputs and is dependent on its training dataset. Agentic AI can execute complicated multi-step workflows with minimal human input, but the goal must be clearly defined and can have complexity challenges. Referencing the detailed scenario, I believe AI can do very well at personalized customer education and most backend coordination, but may struggle in final sales closing and complex client scenarios.

Robust Infrastructure. We also have to acknowledge real-world infrastructure differences. While Jakarta in Indonesia enjoys reliable and fast internet & mobile connectivity, remote areas like West Papua suffer from patchy networks that may not be conducive to such journey.

What Will – and Won’t Change – in the Future From AI

Humans will Remain Crucial in Moments that Matter

Looking ahead, human advisors will continue to be the key driver in life insurance sales, especially at key moments that require empathy and trust. It is hard to imagine that human advisors will be fully replaced in the near-to-medium term by autonomous AI sales agents.

While AI advice can become a trusted “first opinion,” I believe many will still seek a human’s nuanced advice and assurance before acting. In fact, as routine transactions become increasingly AI-driven, human interactions may become even more prized.

Life Insurance Sales Will Encounter New AI-Driven Challenges

However, AI is set to introduce its own unique set of challenges to the industry. In addition to challenges arising from new regulations related to AI technology, we may see the following new developments:

Rising Consumer Demand on Advisor Expertise. The democratization of information through gen-AI will increasingly pressure advisors to uplift their professionalism and product knowledge. Advisors will need to not only intimately articulate their tied insurer’s products, but also provide informed comparisons with competitors and other financial options like mutual funds or ETFs. As such, mass recruitment of untrained or disengaged salespeople will become an increasingly ineffective strategy.

Search Engine Optimization (SEO) for Gen-AI Research. As the public increasingly relies on a few select Gen-AI platforms for personal finance and insurance advice, companies will face a new challenge in how to optimize for AI-driven consumer journeys. Insurers may need a deeper understanding of LLM training processes and publish clearer, structured, machine-readable content online so that their products can be “placed” in AI conversations.

But it Can Also Supercharge the Industry Forward

While AI can bring new challenges, I am cautiously optimistic that it can bring positive disruption to our industry by addressing many of its persistent pain points. If we can find the right intersection of what AI can do and what is valuable for our business through thorough technical and business due diligence, it can unlock tremendous value, according to Andrew Ng, founder of DeepLearning.AI[i].

I am especially excited about the prospect of leveraging capabilities of AI to significantly enhance the productivity of human advisors – an evolution that can fundamentally improve the economics of life insurance sales and help reduce the sector’s historically high acquisition costs.

Enabling Cost-effective Lead Generation with High Purchase Intent.

If we can utilize AI’s content generation, rapid reasoning, and automation abilities to create cost-effective leads with high purchase intent, I believe it can be a potential game-changer.

For example, an insurer launching family-themed campaign during Chinese New Year can start off by triggering a “target customer identification AI agent.” This agent would analyze large datasets – including internal CRM, social media, other transaction databases - using deep learning propensity models to micro-segment potential customers by demographics, life stage, family details, and inferred openness to insurance.

Next, a “campaign manager AI agent” would devise the best ways to engage these microsegments, generating hundreds of tailored family- and holiday-themed content pieces. Meanwhile, a “marketing strategy AI agent,” aware of pre-defined budget, costs per media, and funnel effectiveness, would optimize the campaign tactics recommended by the campaign manager.

All agents can employ a “human-in-the-loop” approach, letting marketing staff refine and validate key steps.

When customers show warm intent - like requesting an appointment - a “leads allocation AI agent” can instantly schedule with an existing or new advisor, minimizing lead loss from delayed follow-up calls.

Source: AI-generated by Imagen-4 based on above descriptions

Increasing Sales Conversion via Industrial Personalization and Quality Standards.

Another promising approach is improving conversion rates through industrial personalization and instituting minimum standard in quality of advice.

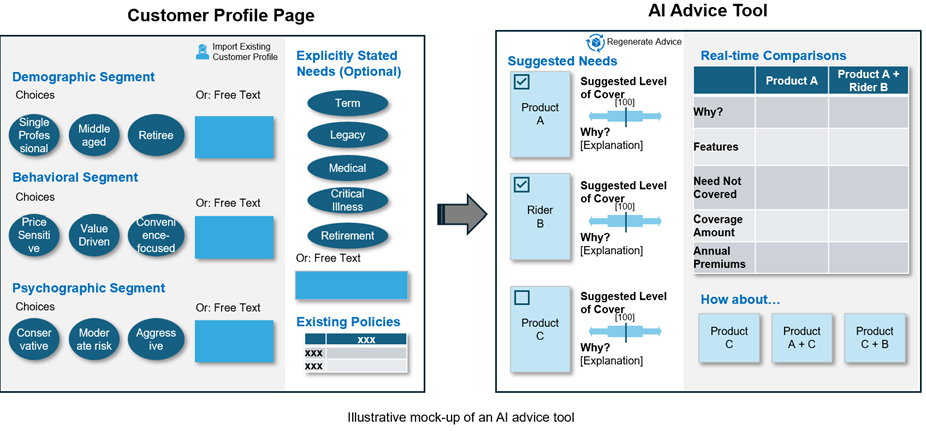

An “AI advice tool” can provide preliminary recommendations using pre-filled or inferred customer profile. Advisors will still retain full control and can override suggestions, but widespread use can raise the baseline quality of advice. This tool can also generate side-by-side sales illustrations for collaborative reviews with clients, allowing iterative comparisons of insurance products and rider combinations.

Combining AI-driven advice with human expertise can be powerful—experiments at a European bank show that when advisors validate AI recommendations, customers follow advice more and achieve better risk-adjusted outcomes15.

At the same time, a “AI sales collateral tool” can create tailored scripts, product brochures, videos, and interactive materials that can be either pre-delivered or used live during the sales process. For example, brochures for high-net-worth clients can be technical and polished, while those for family buyers during festival seasons can be vivid and visually engaging.

The effectiveness of the sales collaterals generated can be further improved by incorporating behavioral science—by simplifying language and making information more visually engaging and interactive. According to research by RGA, using simplified language, interactive tools, and videos noticeably enhances client understanding of life insurance products, supporting higher conversion rates and better customer comprehension16.

Automating Routine, Non-Value Added Yet Time-Consuming Tasks.

A key area of value is automating routine, low-value tasks that consume much of advisors’ time. I was surprised to find out many advisors still spend hours preparing sales illustrations, managing disclosure requirements, chasing client payments, coordinating with underwriting departments, and handling post-sales servicing and claims inquiries.

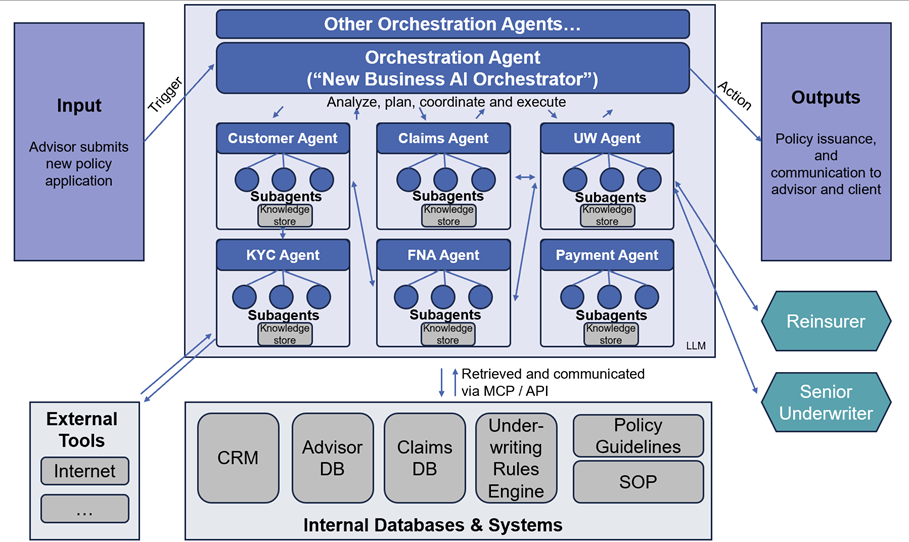

A multi-agent AI system can offer a powerful solution – a master orchestrator directing specialized “domain-expert” AI agents to manage workflows autonomously.

Illustrative example of a Multi-Agent System.

For instance, when an advisor submits an application for an existing client with slightly elevated cholesterol, a “new business AI orchestrator” could triage and coordinate with each specialized agents to: check client records, validate claims history, flag KYC/AML risks, review suitability and recommend bundles, assess underwriting risk and potential loadings or exclusions, and even liaise with reinsurers for approval.

This can dramatically improve operational turn-around time, reduce administrative burdens and free up advisors to focus on when the “human touch” truly matters.

Potential New Model of Mass Customer Acquisition for Long-term Nurturing.

In the medium term, a hybrid model might even emerge where companies focus on large-scale acquisition of customers for simpler, lower-value products through digital channels. These customers would then be nurtured—through ongoing engagement and transactions, potentially over several years—before higher-value, more complex sales are flagged and then handled by human advisors.

Companies will need careful consideration about this approach though, as will need to balance scale, investment and cross-sell effectiveness to make this economically viable. Nevertheless, it can be a potential strategy for companies playing the long-term game.

Closing Remarks

I believe that human advice remains the most powerful and effective method in life insurance sales. Personal relationships matter and continue to form the foundation of life insurance’s long-term commitments.

However, change is inevitable. The arrival of generative and agentic AI is beginning to reshape our industry, bringing both excitement and understandable unease. As an industry, we must thoughtfully establish clear guardrails to ensure the responsible use of these technologies within the regulatory boundaries.

AI is also merely a tool—it requires human creativity and deliberate management directions to be deployed and used effectively. We also all recognize that user adoption will be the toughest challenge in any transformation effort.

Despite this, I am genuinely excited about AI’s potential. It unlocks new opportunities for outreach, education, and access, enabling us to engage with consumers on an unprecedented scale. It is also lowering technological barriers—empowering those with less technical expertise to innovate rapidly.

I truly believe that when AI effectively complements and deeply integrates with human advisors, it has the power to supercharge our industry forward and expand access to trusted advice – ultimately providing genuine security and peace of mind for all.

References

1 Shane Garahy, Rosalind Norton, Pierce Tyther. The Race for Robo Advice: Building Trust and Accelerating Growth. August 2024. KPMG. https://assets.kpmg.com/content/dam/kpmg/ie/pdf/2024/08/ie-the-race-for-robo-advice.pdf

2 ZhongAn Online P&C Insurance Co., Ltd. 2025. Annual Results Announcement for the Year Ended December 31, 2024. Hong Kong Stock Exchange, March 19, 2025. https://www1.hkexnews.hk/listedco/listconews/sehk/2025/0319/2025031900450.pdf.

3 Dealroom, Mundi Ventures, and MAPFRE. The State of Global Insurtech 2024. Madrid: Mundi Ventures, 2024. https://www.mapfre.com/media/The-State-of-Global-Insurtech_-By-Dealroom-Mundi-Ventures-and-MAPFRE.pdf.

4 Qadoos, Abdul & Abougrad, Hisham & Wall, Julie & Sharif, Saeed. (2025). AI Investment Advisory: Examining Robo-Advisor Adoption Using Financial Literacy and Investment Experience Variables. Applied and Computational Engineering. March 2025.

5 Boston Consulting Group. July 2023. Omni-channel in insurance: Successfully turning digital leads into high-value sales. Boston Consulting Group. https://web-assets.bcg.com/c1/56/7bc9f3d74619ad4fea36d029f310/omni-channel-in-insurance-successfully-turning-digital-leads-into-high-value-sales.pdf.

6 LIMRA. 2024. New Life Insurance Ownership Data Suggests a Need for New Strategies to Engage Consumers. LIMRA. https://www.limra.com/en/newsroom/industry-trends/2024/limra-new-life-insurance-ownership-data-suggests-a-need-for-new-strategies-to-engage-consumers/.

7 Alamuddin, Rayane, Daniel Rossman, and Martin Kurzweil. 2019. MAAPS Advising Experiment: Interim Findings Report. Ithaka S+R, June 27. https://pdfs.semanticscholar.org/1a43/95fad1d278eaf62a2de650302560f48cbce4.pdf

8 Freeman. 2023. Freeman Trust Report 2023 Demonstrates Face-to-Face Interaction Is Key to Building Brand Trust. Dallas, TX: Freeman. March 27, 2023. https://www.freeman.com/about/press/freeman-trust-report-2023/

9 Swiss Re. 2024. "Asia Protection Gap Consumer Survey." Swiss Re. https://www.swissre.com/reinsurance/insights/asia-protection-gap-consumer-survey.html

10 Munich Re. 2023. "Understanding Distribution to Unlock Growth." Munich Re Canada Life. https://www.munichre.com/ca-life/en/insights/sales-product/understanding-distribution-to-unlock-growth.html.

11 Menlo Ventures, 2025: The State of Consumer AI, Menlo Ventures, 2025. https://menlovc.com/perspective/2025-the-state-of-consumer-ai/.

12 Ontario Securities Commission, Artificial Intelligence and Retail Investing: Use Cases and Experimental Research, Toronto, 2024. https://www.osc.ca/en/investors/investor-research-and-reports/artificial-intelligence-and-retail-investing#!tabContent529866.

13 Anthropic. “Tracing the Thoughts of a Large Language Model.” Anthropic. https://www.anthropic.com/research/tracing-thoughts-language-model.

14 AI For Everyone. "How to Choose an AI Project (Part 1)." Lecture video, taught by Andrew Ng, Coursera. https://www.coursera.org/learn/ai-for-everyone/lecture/XkLrV/how-to-choose-an-ai-project-part-1.

15 Yang, Cathy L. and Bauer, Kevin and Li, Xitong and Hinz, Oliver, My Advisor, Her AI and Me: Evidence from a Field Experiment on Human-AI Collaboration and Investment Decisions. June 2025. HEC Paris Research Paper No. MOSI-2025-1570. https://ssrn.com/abstract=5281742

16 Cruz, Rosmery, Peter Hovard, Shilei Chen, and Matthew Battersby. RGA. 2024. Searching for Simplicity: Using Behavioral Science to Make Life Insurance Product Information Simple and Effective. Schaumburg, IL: Society of Actuaries Research Institute. https://www.soa.org/4a2820/globalassets/assets/files/resources/research-report/2024/behavioral-science-rga.pdf.