Millennials and the Life Insurance Protection Gap - Whether or Not Insurers Should Focus on Millennials

IIS Executive Insights Life & Health Expert: Ronald Klein, Executive Director, BILTIR

Introduction

Ever since the term “Millennials” was coined by William Strauss and Neil Howe in their book entitled Generations: A History of Americas Future 1584 – 2069, this cohort born from 1982 – 2004 (Strauss and Howe’s definition) has taken on perceived importance like no other before it[1]. Strauss and Howe used this term since the oldest in this group would become adults at about the turn of the Millennial. There have been many other catchy designations for cohorts such as the GI generation (sometimes called the World War II or Greatest generation), the Silent generation, Baby Boomers and Generation X, but Millennials receive the most attention by far.

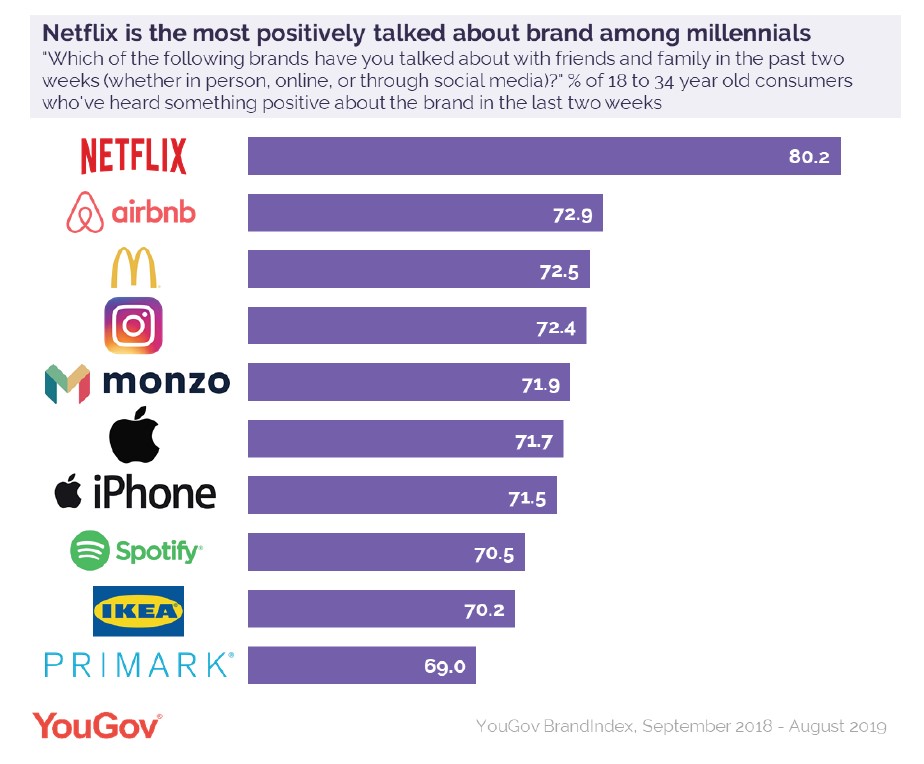

And, as holidays became a marketing tool for retailers, Millennials have become the most widely sought-after cohort for companies from Netflix to airbnb to McDonald’s. For many companies, the strategy is working. Netflix, for example, once again scored highest in a survey by YouGov, with over 80% of Millennials saying that they have discussed this entertainment streaming company in the past two weeks with friends or family in a positive way[2]. airbnb placed second with a score of nearly 73% while McDonald’s came in third with over 72% (see Table 1 below). This study was completed in 2019, before the pandemic hit. While it would be interesting to see the results currently, it is easy to imagine those companies that would have an increased score and those that might have trailed off.

Table 1: Millennial Survey for Most-Liked Brands

A quick look into the marketing plans of any company and you will soon find a strategy geared directly to Millennials with the hope of breaking into YouGov’s top ten list. Financial institutions are no different including life insurance companies around the world. Just enter the word “Millennial” into any major insurance company’s website, and you will see a list of articles and products designed for this “chosen” group. Not on websites are the marketing strategies that the sales forces will be keenly aware of.

This paper will explore if a cohort of individuals defined by an arbitrary set of birth years is really worth pursuing with a dedicated strategy by life insurers. Will Millennials really purchase more insurance than their richer Baby Boomer parents? Can this strategy help close the ever-increasing life insurance protection gap? If so, what are the best ways to reach Millennials? While the paper has a US “slant” to it, the data and ideas presented apply worldwide.

Definition of a Millennial

Looking at the demographics of the largest combined life and non-life insurance market in the world, the United States, will quickly show the reason for all of the attention paid to Millennials (see Table 2 below). Millennials comprise over 30% of the US population as of June, 2020 and is the single largest cohort, according to Strauss and Howe’s definitions. A look at the next 4 largest insurance markets, China, Japan, the UK and France, respectively, will yield similar results. Millennials account for approximately 27.3% of the population in China, 20.0% for Japan, 25.2% in the UK and 23.4% in France.

Table 2: US Population by Age for 2019[3]

|

Cohort Name |

Birth Years |

Number in Millions |

Percent of Total Population |

|

Homeland |

2005 - ? |

60.6 |

18.5 % |

|

Millennial |

1982-2004 |

101.7 |

31.0 % |

|

Gen X |

1961-1981 |

86.9 |

26.5 % |

|

Baby Boomer |

1943-1960 |

60.9 |

18.6 % |

|

Silent |

1925-1942 |

17.4 |

5.3 % |

|

GI |

1901-1924 |

0.7 |

0.2 % |

|

Total |

1901 - Present |

328.2 |

100.0 % |

Source: US Census Bureau, Population Division

A recent Newsweek magazine article estimates that Millennials have amassed just over USD 5 trillion of wealth in the US which is far below the nearly USD 60 trillion of wealth that the Baby Boomers hold[4]. Looking back at the Baby Boomers when they were the same age as Millennials, shows that the former age group held four times the assets as Millennials do now. This cohort certainly does not currently hold the purchasing power of the Baby Boomers, but it is certainly an importance source of current and future sales of all products, including life insurance.

Understanding Millennials

It is important to take a step back and understand Millennials. Each one of the people in a cohort is defined by outside influences during their formative years. The GIs grew up and may have fought in major world wars and lived through the Great Depression. The Silent Generation grew up during World War II and experienced the allied victory, a burgeoning middle class and strong patriotism. The Baby Boomers grew up thinking about themselves, measuring success in terms of money, thus taking risks, and witnessing a decline in the middle class. Gen Xers grew up learning to be even more individualized than the Boomers and began the mistrust in social norms.

So, what do we know about Millennials that makes this cohort so special? Millennials were mostly born to Baby Boomers and, in a large part, are products of their parents. They grew up being overly protected and being made to feel “special.” One look at the protection policies enacted since 1982 (see Table 3 below) and it is easy to begin to understand why Millennials are so risk averse.

Table 3: Certain US Child Protection Policies Enacted since 1982

|

Baby Seats |

Bicycle Helmets |

|

School Vaccinations |

Child Labor Laws |

|

V Chips |

No Drug Zone Laws Near Schools |

|

Grading in of Full Auto Licenses |

Video Game Ratings |

As toddlers, playdates were arranged in a safe environment for this cohort. Millennials participated in organized sports whereas their parents simply met friends and played. Millennials were dropped off to and picked up from school whereas their parents walked or rode bicycles (without helmets). Millennials moved back in with their parents whereas their parents could not move out of their parents’ houses fast enough. According to a 2019 study, more Millennials are living with their parents that at any time since 2000[5]. The study cites high housing costs, but it seems that Millennials are more apt to move in with their parents (or a parent) than other generations. With the massive unemployment caused by the pandemic, it is safe to assume that this trend has only continued.

Will Millennials Purchase Insurance

Millennials by their nature are risk averse, which should make life insurance seem more palatable to them than their risk-taking parents. The expected benefits of life insurance are less than expected premium payments by definition (insurers pay expenses and make a profit). Therefore, an ideal purchaser would have a utility curve that weighs large losses more heavily than small losses. These people would be willing to part with periodic small premiums so that a potential large loss is protected. But this is only one piece of the puzzle.

According to a study by Provision Living, Millennials spend an average of 5.7 hours per day on their phones[6]. This is more than any other cohort and marketers have attempted to reach Millennials via online ads. While this could be very effective for certain products, complicated financial tools such as life insurance and annuities present a far greater challenge. Maybe that is why a 2017 LIMRA survey found that 70% of Millennials would like to “talk to someone” about their life insurance needs[7]. There are many surveys that show Millennials are much more comfortable purchasing insurance online than other generations before them, however a large percentage still would like to speak with someone. This seeming contradiction has baffled sales attempts of insurers.

A strategy to sell insurance to Millennials purely based upon digital sales may not be the answer. The same survey showed that 80% of Millennials are looking for simpler products with relaxed underwriting standards. This result matches well to typical online purchasing habits – do some research and click a button to buy. Perhaps a strategy of providing very simple products that are relatively easy to purchase online focused toward Millennials as a “starter policy,” followed up by agent-driven sales for more complex products, could be effective. It is an even more important strategy during a pandemic where “face-to-face” sales become more difficult.

Trust also plays an important role for all age groups and a lack of trust in financial institutions could be a major impeding factor to insurance sales worldwide. Edelman conducts an annual survey of approximately 34,000 people in selected countries called the Trust Barometer. The 2019 survey found that “my employer is the most trusted institution[8].” Study results like these could be why major insurers such as Voya Financial have changed strategies to focus on worksite marketing. More and more life insurers are realizing that approaching employees through their employers is much more cost effective than individual sales by agents. The sales results also improve due to employees trusting their employers to provide benefits from medical insurance to wellness programs to social events.

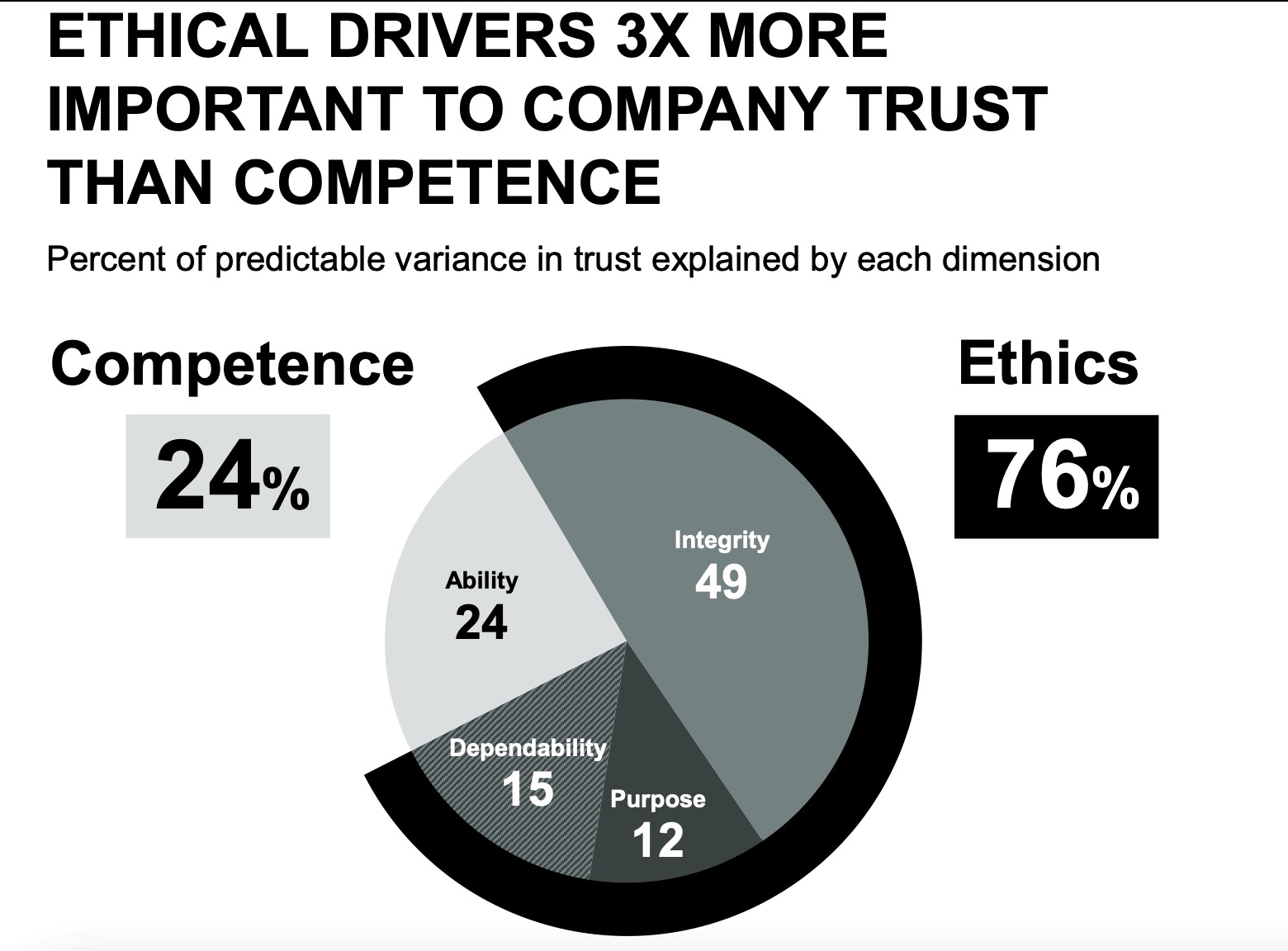

The 2019 Edelman Trust Barometer also revealed that people are now much more interested in how ethical a company is than how competent it is (see table 3 below)[9]. Piecing this together yields a strategy to sell insurance via worksite marketing at companies that are known to be ethical. ESG (environmental, social and governance) is the new corporate buzzword and there are multiple indices tracking a company’s progress toward these goals. For example, the S&P ESG Index family offers investors exposure to companies according to their ESG profile in the context of country-specific and regional indices[10]. Investors and employees are keenly aware that society is holding companies to higher standards than simply expecting a superior return on investment.

Table 3: Ethics are more important that competency

Source: 2019 Edelman Trust Barometer

Potential Solution for Gig Workers

But a large percentage of Millennials work in the gig economy. In fact, a recent study by Quartz at Work estimates that the US will see 42 million people in the gig economy by 2020[11]. Of course, this study was completed prior to the pandemic which will most likely slow the trend, but the trajectory is expected to continue regardless. And, the study goes on to say that Millennials will make up over 40% of this group.

What can be the strategy for life insurance companies to reach Millennials through their trusted employers if a trusted employer does not actually exist? Mistrust in financial institutions does not have to be the downfall of reaching Millennials that are in the gig economy. Is it possible to set up an association of Millennials in the gig economy where the association could have an ESG affiliation?

In France, if an employee was part of a small company prior to the mid-1970s, he or she did not have the same accessibility to insurance and pension benefits as those who worked for larger organizations. Because of this, the Association Française d’épargne & de retraite or AFER was established in 1976. “Members” joined AFER by paying annual dues and then had access to very favorable insurance products designed for the sole purpose of covering members. The risk is transferred to a third-party insurance company, although the products are sold using the AFER brand. Members have trust in the organization and assets have grown steadily where they now exceed EUR 55 billion. Please note that life insurance in France, similar to most European countries, has a very large savings element. The return on this savings is of prime importance to members and this rate has performed relatively well during the past decade of low interest rates. This increased the strength of the AFER brand considerably.

AFER is not the only association with this model in France, but it is the most well-known and holds tremendous brand loyalty. This model may not work under some country regulations. For example, in the US, an association cannot be formed with insurance as its primary purpose. Realizing that Millennials are increasingly concerned with ESG, perhaps forming a similar organization that concentrates on ESG concerns could attract members. The association could do research, write letters, encourage members to vote for certain candidates and even rank companies on ESG commitments. And, it could offer life insurance and annuity products to its members. This could be a way to use a trusted “employer” to provide benefits that Millennials will purchase. The products could be relatively simple (preferred by Millennials in studies), with online access and have agents ready, if needed. This could cover the seemingly complex set of criteria that Millennials in the gig economy currently maintain. Assuming that the insurance products offered perform well, Millennials will encourage friends and family members to join the association using their preferred social media channels. Millennials are more accustomed to trusting reviews from peers than any generation before them.

Conclusion

By their nature, Millennials are definitely a unique cohort of individuals that are worthy of their chosen status. In addition, marketers know that there will be a tremendous transfer of wealth in the coming decades from Baby Boomers to Millennials. The combination of being raised to be risk averse and the potential of a large transfer of wealth makes Millennials a true target market for life insurance and annuities. Reaching them is an entirely different story.

We know that Millennials grew up in the digital era and rely heavily on social media for support in purchasing. Forming associations with real socially responsible goals and activities could attract Millennials. Offering simple-to-understand life insurance products with fair returns could also encourage members to attract other members via social media. But most importantly, life insurers will be able to reach Millennials in the gig economy and offer badly needed insurance and annuities.

Life insurers protect families against the financial impact of premature death of a breadwinner, early disability and outliving one’s retirement assets. It is a laudable profession, but only if it reaches the people most in need of these products. Millennials are due to inherit vast sums of money from their Baby Boomer parents. Saving for the future via life insurance and annuities will not only give peace of mind to the policyholders, but takes a large burden off of government and society to care for those who cannot care for themselves. It is clearly worth the effort to reach this chosen group of Millennials.

12.2020

[1] Strauss and Howe, William Morrow & Co, 1991; ISBN-13: 978-0688081331

[2] https://yougov.co.uk/topics/consumer/articles-reports/2019/10/10/netflix-remains-most-positively-talked-about-brand, 11/19/20

[3] US Census Bureau, Population Division, June 2020

[4] https://www.newsweek.com/millennials-control-just-42-percent-us-wealth-4-times-poorer-baby-boomers-were-age-34-1537638, November 18, 2020

[5] https://www.zillow.com/research/millennials-living-with-mom-2019-24068/, 11/16/2020

[6] https://www.provisionliving.com/news/smartphone-screen-time-baby-boomers-and-millennials?action, 11/16/2020

[7] https://lifehappens.org/blog/heres-why-millennials-arent-buying-life-insurance-and-why-they-are-wrong/, 11/18/2020

[8] https://www.edelman.com/news-awards/2019-edelman-trust-barometer-reveals-my-employer-most-trusted-institution, 11/18/2020

[9] https://cdn2.hubspot.net/hubfs/440941/Trust%20Barometer%202020/2020%20Edelman%20Trust%20Barometer%20Global%20Report.pdf?utm_campaign=Global:%20Trust%20Barometer%202020&utm_source=Website, 11/18/20

[10] https://www.spglobal.com/esg/csa/indices/, 11/20/20

[11] https://qz.com/work/1211533/the-number-of-americans-working-for-themselves-could-triple-by-2020/, 11/18/20

About the Author:

Ronnie has over 40 years of insurance and reinsurance experience having worked and lived in 3 countries. In his current role, Ronnie serves as Executive Director to the Bermuda International Long-Term Insurers and Reinsurers (BILTIR) association. He also is a Collaborating Expert of Health and Ageing for The Geneva Association located in Zürich. Ronnie is Co-Chair of the Programming Committee for the ReFocus Conference and served on the Board of Directors of the Society of Actuaries. Before this, Ronnie worked as the Head of Life Reinsurance for Zurich Insurance Group in Zürich, Head of Life Reinsurance for AIG in New York and Global Head of Life Pricing for Swiss Re in London. Ronnie began his career at Mutual of New York. A little-known fact is that Ronnie holds a patent (US20060026092A1) for the first Mortality Bond issued called Vita when he was with Swiss Re.