Closing the Need Gap: Connecting with Underserved Population Segments

by Joseph Strathman, Director, Business Transformation, Transamerica Life Insurance Company

1. Executive Summary

Life insurance customers are increasingly segmented by gender, race, ethnicity, and other characteristics. Many of these groups are underserved and with unique needs, creating challenges for insurance carriers to reach them.

Carriers must be intentional about identifying their target customer populations and understanding the needs of each population segment. Carriers can successfully reach underserved customers by improving their own diversity, enabling them to attract distribution partners that represent and can reach the target customer populations. Diversity at the carrier also cultivates new ideas for products, marketing, customer education, and experience design. Optimizing the alignment between the carrier, distribution partner, and agent can enable greater access to insurance products by underserved populations, helping grow sales for insurers and agents while reducing the need gap across underserved populations.

This narrative will address macro population segments, needs, and carrier-agency relationships, including how diversity practices play a role in carrier and agent success. With multiple population segments having ample data sets available, this examination will use the United States market as a premise, taking note that the approach to closing the need gap is similar in other markets that also experience growing diversity and segmentation.

101 Million people in the U.S. have a coverage need gap

2. Life Insurance Need Gap

Although the COVID-19 pandemic triggered a spike in life insurance sales not seen by the industry since the early 1980s, reducing the number of people with a coverage need gap continues to be an allusive challenge to solve, particularly for younger and more diverse customers.

The need gap, often called the coverage gap, is a measure of the adult population aged 18-75 who need life insurance but do not currently own coverage or need more. With many population segments having a need gap, millions of individuals and families currently lack adequate life insurance coverage and are at risk of financial insecurity upon the untimely death of a loved one. Paying for a funeral, losing family income, not being able to pay off debts such as a mortgage, or not being able to leave a legacy to help pay for a child’s higher education tuition are common consequences of not having the proper life insurance coverage.

Today, only 52% of Americans own some amount of life insurance coverage,[1] a 17% decrease in ownership since 2011.[2] The population of people with a need gap has risen to 101 million adults,[3] encompassing a record-high 41% of the adult population.[1] With 60 million American households having an average coverage gap of $200,000 each, LIMRA estimates a US $12 trillion coverage gap exists.[4] Reducing the number of people with a need gap is not only financially lucrative for insurers to grow sales, but it helps meet the industry’s goal to expand financial protections to more customers. The latter is especially important since 40% of families would face financial hardship within six months if the primary wage earner died.[6]

“The more that we can actually have people get life insurance, one way or another, the better.”

- Andrea Caruso

“The more that we can actually have people get life insurance, one way or another, the better,” stated Andrea Caruso, Executive Vice-President, and Chief Operating Officer at MIB Group. “That’s the ultimate goal to figure out – how we actually provide greater coverage across the board.”[5] While insurers continue to innovate products, deliver new technology capabilities, and cultivate new sales channels, none of those things appear to be doing much to increase the number of people who have life insurance protection or reduce the number of people who have a coverage need gap.

Before insurers can take steps to increase coverage and reduce the need gap, it must be understood where the need gap exists.

3. Need Gap by Population Segment

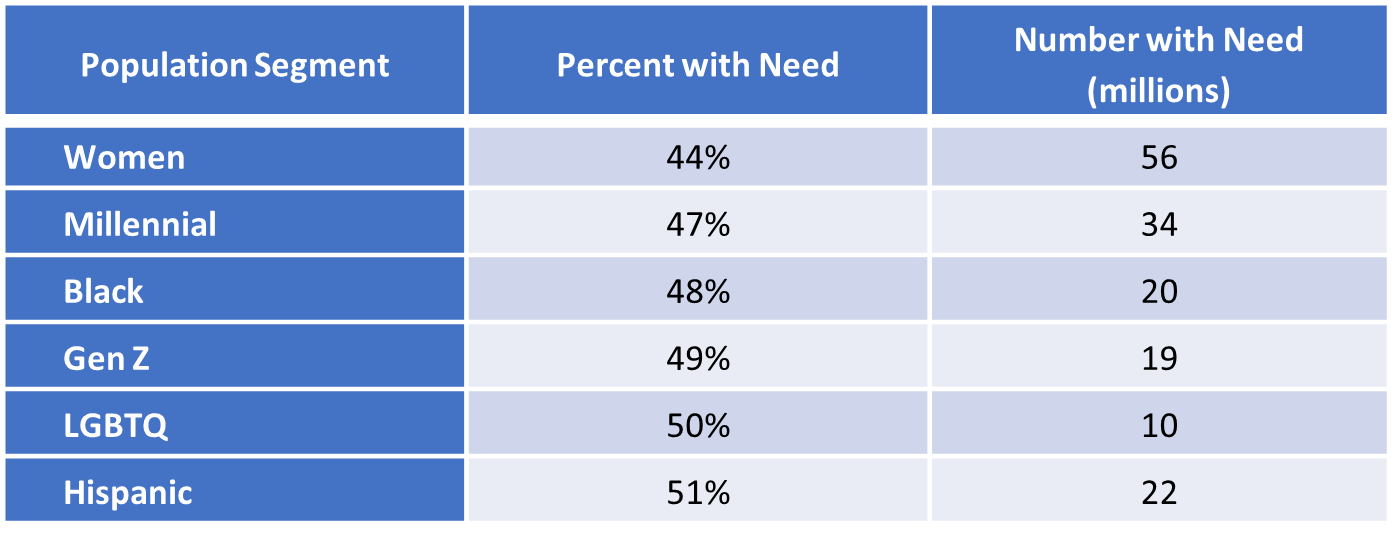

Like many countries, the population of the United States has many diverse population segments. The largest need gaps are experienced by historically underserved population segments including women and minority populations. When addressing the need gaps of these adversely impacted populations, insurers can approach a population segment by the size of the population with a coverage need, by the percent of the population segment with a need, or a combination of both factors.

Insurers choosing to only address populations with a large number of people in the need gap may be missing opportunities to reduce the need gap among underserved markets that might be smaller in size but have a greater percentage of population with a need gap. For example, the White American segment has a low percent of its population that has a need gap, but the number of people with a need in that segment is quite large.

Conversely, insurers could address the need gap of population segments that demonstrate a high percentage of the population with a need gap, but that population might be small in number. Gen Z, as an example, has a high percentage of its population with a need gap, but the number of people in that population is currently smaller than many other population segments that have a need gap. Insurers that fail to prepare for the needs of Gen Z could miss sales opportunities as Gen Z will have a growing number of people with a need gap as they age into adulthood. Meanwhile the percentage of its population with a need may shrink over time as more Gen Z people begin to buy life insurance as they experience milestone events such as marriage or having children. Thus, it is advantageous for insurers to consider both the percent of a population segment with a need and the number of people in that segment with a need to boost sales and reduce the cumulative need gap.

Table 1 shows macro population segments in the U.S. and the corresponding percent of that population segment with a need gap and the number of people in that segment with a need gap.

Table 1: Life Insurance Need Gap by Macro U.S. Population Segment

Sources: [1], [2], [3], [4], [5], [6]

A challenge when trying to group people is that every person belongs to more than one macro population segment, resulting in no segment being mutually exclusive from another segment. This creates a challenge for insurers when trying to understand why the need gap among Black American Millennial women, as an example, is similar in some ways, but different in others compared to Black American Millennial men.

Examining several notable population segments with a need gap will begin to shed light on why a one-size-fits-all solution to the need gap is impossible to implement.

Today, 58% of men in the U.S. report owning life insurance while only 47% of women have coverage.[12] Combining the population of women with no coverage with those who are underinsured, there are 56 million women in the U.S. with a need gap.[13]

Historically, men have been the breadwinner in most U.S. households, but that is changing. Although a gender pay gap continues to impact women negatively, women continue to surpass men in college enrollment[14] and are achieving higher participation rates in the workforce.[15] In nearly half of opposite-sex marriages in the U.S., women are now earning as much or more than their husbands.[16] Households will experience an increasing dependency on the incomes from women as more highly educated women enter the workforce and earn comparable or higher wages than men. As a population segment, this will increase the total insurance coverage need for women in the future.

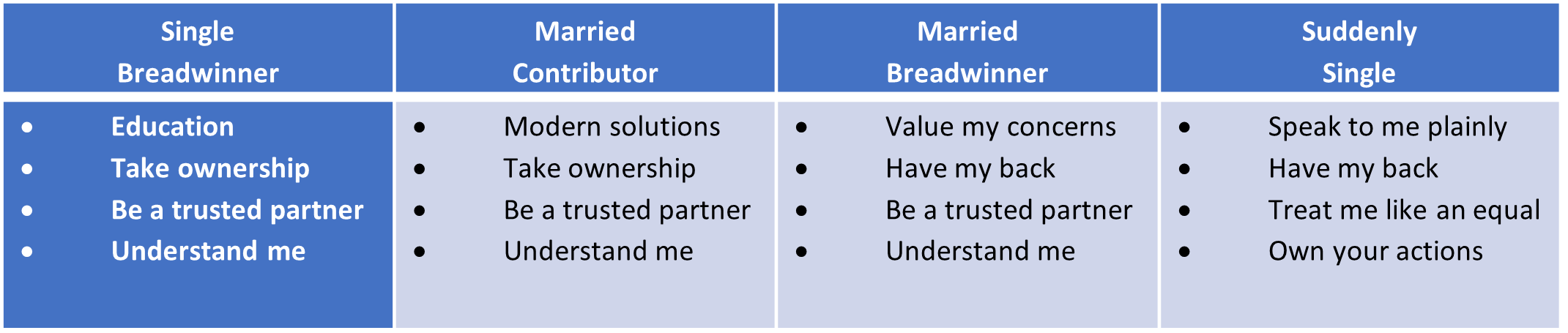

As women are increasingly taking on the role of decision makers when it comes to household financial decisions, many agents and advisors must take steps to improve their understanding of what women expect from their advisor and how to engage women during the sales process. New York Life is one example of a carrier that is providing their financial advisors with information about the needs and concerns that women have before, during, and after the sale of financial products, including life insurance. Table 2 shows the most common needs women identified while working with a financial advisor.

Table 2: Needs of Women Who Work with a Financial Advisor by Life Stage

Source: [17]

Understanding the needs of women is only part of what New York Life found in its research. When looking across single and married women, whether the woman was the breadwinner or a contributor to household income, 32- 42% of women felt patronized by their financial advisor, with 41% of married women who are the breadwinners and 51% of single women indicating they will probably not work with their financial advisor again.17 The work that New York Life is doing to raise awareness among its advisors, both men and women, about the financial and insurance needs of women is a positive step towards reaching this population segment and reducing the need gap.

Millennials, who are now aged 27 to 42, represent the largest population group ever recorded in the U.S. with just over 72 million people and growing due to immigration.[18] More than half of Millennials are married, have dependent children, own homes, and have household incomes more than $100,000.[19] Gen Z, the next generation following Millennials, includes a population of 69 million people born between 1997 and 2012. The Gen Z population is just starting to age into the target market for life insurance and will also likely increase in size due to immigration.[18]

53 Million Millennials combined with Gen Z adults have a coverage need gap

Only 48% of Millennials and 40% of Gen Z adults have some form of life insurance coverage, comparatively less than general U.S. population. Combined, 53 million Millennials and Gen Z adults believe they have insufficient life insurance coverage and comprise more than half the total population with a need gap in the United States. [20] Both population segments are expected to increase in ownership as both groups experience more life events that trigger the purchase of life insurance products.

The impact of the COVID-19 pandemic contributed to how Millennials and Gen Z viewed the need for life insurance. “Younger generations experienced a life-altering event just as they were starting their careers, getting married and having children,” said Alison Salka, Ph.D., Senior Vice President, Head of LIMRA research. “The realization of how precarious life can be may have made them more aware of the need to protect their loved ones.”[21] This increase in awareness is expected to activate sales, particularly among the Gen Z population, but it is too early to determine if this generation will purchase coverage at an adequate level or follow a pattern similar to Black Americans where ownership levels are high, but coverage amounts are inadequate. Millennials, so far, are following in the footsteps of Gen X by purchasing life insurance at milestone life events that trigger purchases, but the high percentage of the Millennial population with a need gap could be an early sign that Millennials are making purchases later and possibly purchasing at an inadequate level.

Like many population segments, Millennials and Gen Z are not purchasing life insurance because they believe it is too expensive. Among the younger generations, 27% of Millennials and 28% of Gen Z do not know how much or what type of life insurance to purchase. Education and using factual data to help younger generations understand the purpose and value of life insurance will be important, especially as it pertains to the types of insurance. With 17% of Millennials and 24% of Gen Z indicating they are not purchasing life insurance because they do not like thinking about death, educating people on the array of products with living benefits now offered by carriers is one approach to helping this generation close the need gap.[22]

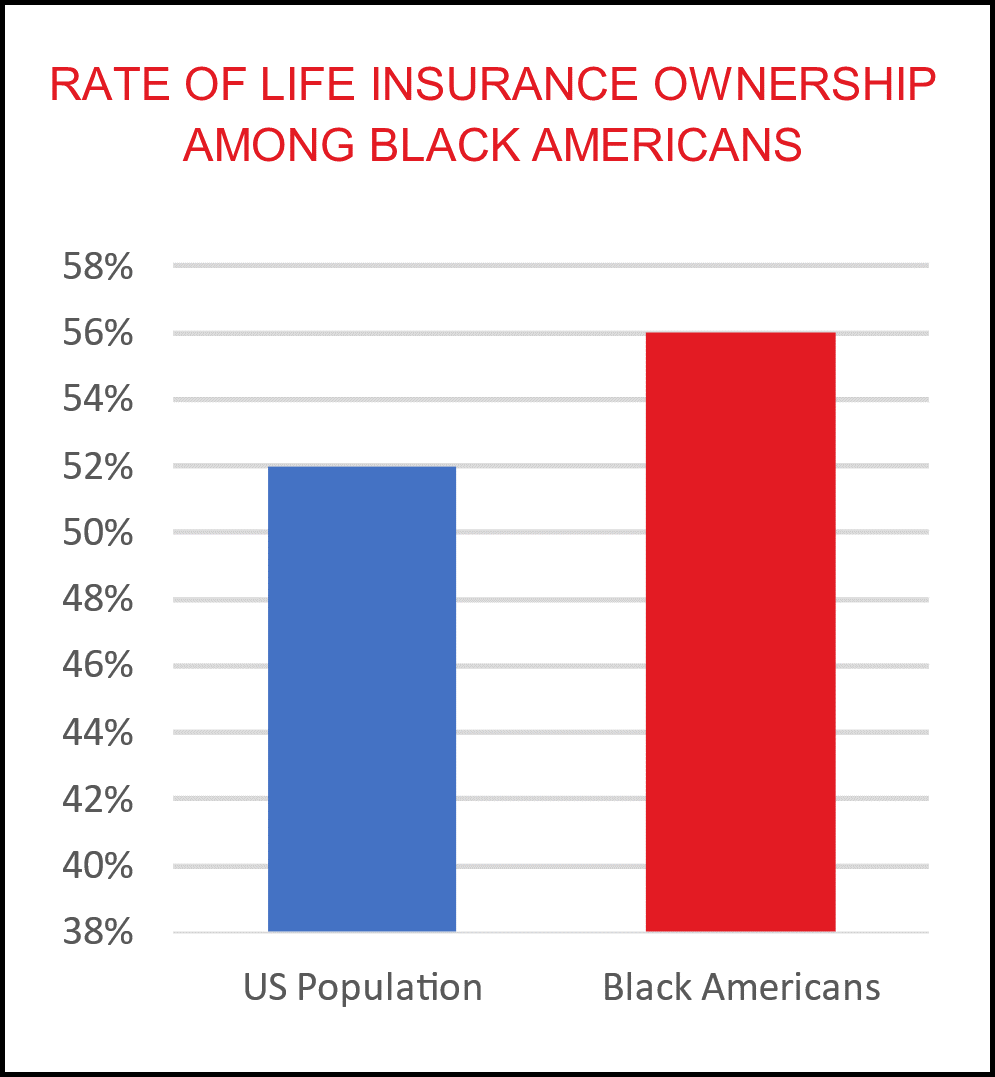

c. Black Population

Black Americans own life insurance at a higher rate than the general U.S. population. While the national average for life insurance ownership is 52% of the population, 56% of Black Americans own life insurance.[23]

The high percentage of Black Americans owning life insurance can be traced, in part, to the Black population being more concerned than other racial and ethnic groups about saving for an emergency, paying their monthly bills, and leaving their families in a difficult situation due to a premature death.[24] The COVID-19 pandemic brought these concerns to the forefront for the Black population. As the COVID-19 pandemic progressed, Black Americans were disproportionately burdened, not only in the rate of infection, hospitalization, and death, but also by financial strain.[25]

In 2021, one year into the pandemic, LIMRA reported 56% of Black Americans purchased some amount of life insurance coverage in the previous year.[26] However, the need gap has persisted largely because the coverage purchased by Black Americans has approximately one-third of the coverage amount compared to policies purchased by White Americans,[27] creating an ongoing need gap for 48% of the Black population or approximately 20 million Black Americans.[28]

Although the Black population has a higher ownership rate than other racial and ethnic groups, there are many myths about life insurance that are prevalent in the Black community that impact purchasing an adequate amount of coverage. Life Happens, a non-profit industry group, found that many Black Americans have misconceptions about life insurance. Some of these misconceptions include the belief that life insurance is only meant to cover final expenses, is too expensive, and that employers provide ample coverage.[29] These myths all contribute to the lower coverage amounts purchased by the Black population and contribute to Black Americans being underinsured, resulting in the high percentage of the population experiencing a need gap.

To combat some of the myths in the Black community, insurers and, especially, agents need to perform more outreach and education about products and the financial protections they provide for individuals and families. Life Happens suggests that having people from the Black community share real-life stories about the benefits of owning adequate life insurance will improve awareness and understanding of life insurance.[29] With an already high ownership level in the Black community, more awareness and education about adequate coverage amount is required to narrow the coverage gap in the Black community.

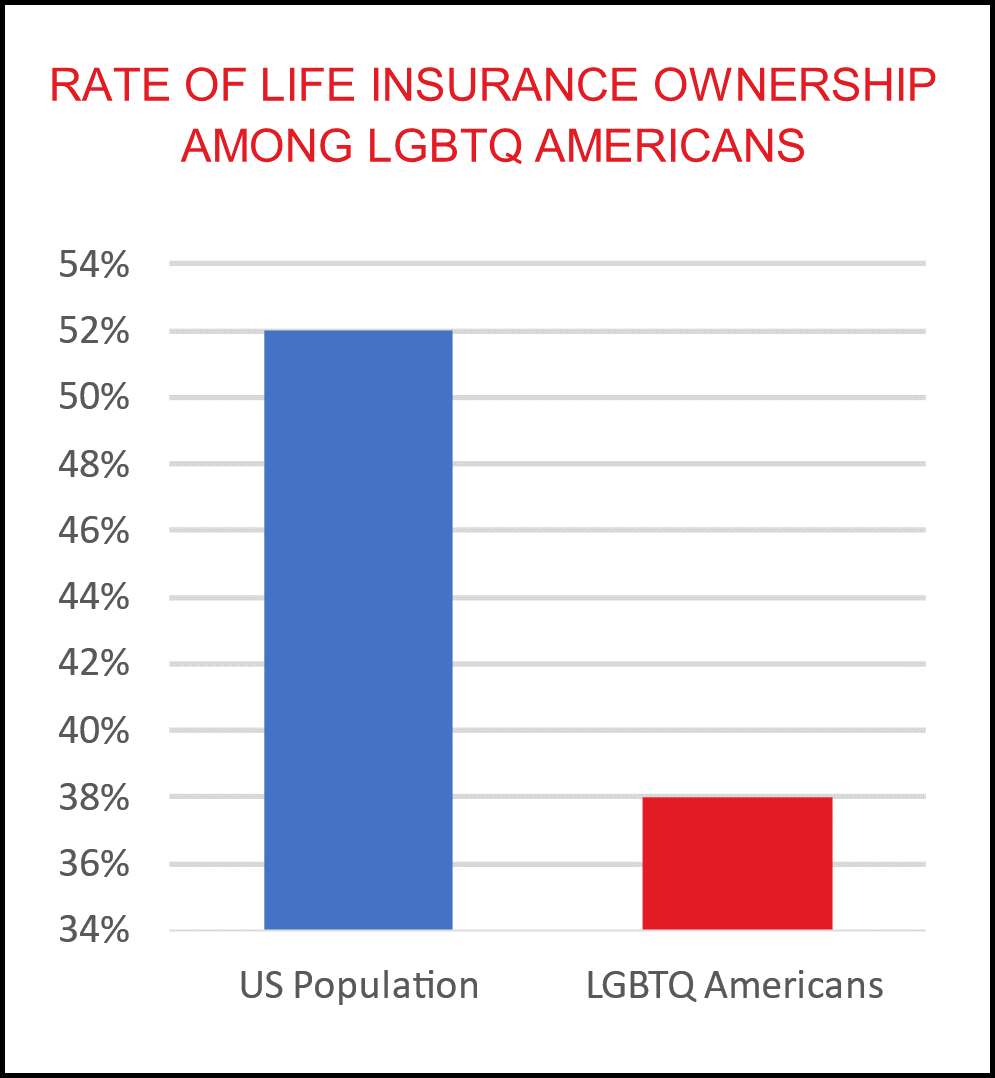

The LGBTQ population has only started having meaningful legal protections throughout the U.S. in the last 15 years. As gay couples find equality in the eyes of the law, Mindi Wernick, a MassMutal financial advisor, notes that, “They’re joining finances, and doing more traditional things, like buying life insurance.” [30]

However, there are still challenges to overcome with the LGBTQ population, especially when life insurance ownership rates hover at only 38% for the segment population, far below the general population, and 50% of the segment reports a need gap.[30] Although the LGBTQ population experiences some of the same barriers to life insurance as other underserved groups, such as overestimating the cost of life insurance, another major barrier exists – the lack of LGBTQ representation among insurance agents and advisors.

With so few agents from the LGBTQ community, many customers who are gay, particularly women, feel “no connection” to their insurance agent, according to Wernick.[30] According to Nationwide, an insurer that is helping educate advisors about the unique needs of the LGBTQ community, 70% of LGBTQ Americans would feel more comfortable with an advisor or financial professional who is a member of the LGBTQ community or a vocal ally.[31] The lack of access to and connection with an agent is likely a contributing factor to why 41% of LGBTQ Americans, the highest of any other market segment, prefer to buy life insurance online compared to 30% of the general population.[32] As a population that continues to face social obstacles and discrimination, sharing personal information about the composition of a family may also inhibit LGBTQ people from wanting to meet with a financial professional who is unknown.[33]

As LIMRA and others continue to collect data about the LGBTQ population, the need gap in this underserved population will become more evident and opportunities to reach customers will improve. This is notable as the number of U.S. adults who identify as LGBTQ living in the U.S. is estimated to be 20 million adults, almost double prior estimates, and is expected to grow with an increasing number of Millennials and Gen Z adults identifying as LGBTQ.[34]

Similar to the Black population, the Hispanic population was also disproportionately affected by the COVID-19 pandemic[35] and sees the purpose of life insurance primarily as a way to cover burial expenses.[36] Contrary to the Black population, Hispanic Americans have the lowest ownership rate of any racial or ethnic group with only 41% owning some form of life insurance[37] and 51% having a need gap, among the highest of any racial or ethnic group.[38]

23% Increase in Hispanic population over the past decade

The Hispanic population has rapidly grown to over 62 million people,[39] an increase of 23% over the past decade.[40] Although the Hispanic population growth is now slowing, Faisa Stafford, President and CEO of Life Happens, notes that, “The potential for serving the Hispanic market is huge,”[37] especially as 22 million Hispanic people are currently experiencing a need gap.[37]

Life Happens found that 75% of Hispanic Americans overestimate the cost of life insurance, prompting 38% of the population to report the cost and competing financial priorities as the primary reasons for not purchasing life insurance. Like the Black population, education about the need for life insurance and real-life stories are key components to engaging the Hispanic population. While many in Black communities rely on in-person engagement, social media acts as an important communication platform for the Hispanic population. 66% of Hispanic Americans use social media to obtain financial information, a rate that exceeds the general population where 53% use social media to obtain financial information.[38]

A major consideration for insurers and agencies when engaging the Hispanic population is ensuring marketing materials, forms, and other educational information are presented in the language most receptive to the audience. For many in the Hispanic community, language can be a deciding factor whether to engage with an agent or not. Likewise, agents serving the Hispanic population may prefer to work with carriers who can service customers in their preferred language, a benefit that extends not only to the Hispanic population but to other immigrant populations where English is not their preferred language.

4. Impact of the COVID-19 Pandemic

Starting in the second half of 2020 as the impact of the pandemic spread, applications for life insurance in the United States ramped up sharply with year-over-year sales increasing 4% by the end of 2020, the highest year-over-year growth rate since the early 1980s.[41] During the pandemic, more of the Gen Z population entered the workforce and more Millennials experienced life events that typically prompt interest in life insurance purchases. Insurers that offered online and direct-to-customer (DTC) sales aligned well with the tech-savvy younger populations. DTC channels offer customers the ability to immediately apply for life insurance, typically online, without the need to work with an insurance agent. This sales channel flourished during the pandemic when face-to-face sales opportunities were minimized. Americans 45-years old and younger had the highest growth in application activity in the first year of the pandemic with a 7.9% year-over-year increase.[41] Millennials, alone, purchased 52% of all life insurance policies between 2020 and 2022; 43% using a DTC sales channel or going online at some point during the buying process.[2]

“Our research shows that the pandemic raised consumer awareness and demand for life insurance protection.”

- David Levenson

“Our research shows that the pandemic raised consumer awareness and demand for life insurance protection. Three in 10 Americans tell us they are more likely to purchase coverage due to COVID-19,” said David Levenson, President, and CEO, LIMRA, LOMA and LL Global. “This interest has translated into record sales.”[43]

While interest in life insurance was boosted during the COVID-19 pandemic, application counts are showing signs of decreasing now that the pandemic is considered over. Following remarkable growth in 2020 and 2021, application counts in 2022 finished down 5.5% year-over-year. Application activity from all age groups, other than those aged 71 and above, decreased and are trending back to pre-pandemic application volumes.[44] The sales boost spurred by the COVID-19 pandemic does not appear to be lasting, but customer interest in life insurance remains strong, particularly among Millennials. The 2023 LIMRA Insurance Barometer Study found 39% of adult consumers in the U.S. intend to purchase life insurance coverage within the next year. Younger generations exceed the total population with 44% of Gen Z adults and 50% of millennials who intend on purchasing coverage in the next year.[45]

It is too early to determine if the sustained interest in purchasing life insurance is due the lasting effects of the COVID-19 pandemic or if it is due to more normalized employment and income among customers. Additionally, it is likely that some of the increase in interest from Gen Z and Millennials is due to those populations attaining ages and experiencing life events that historically trigger an increase in interest in financial protection products.

5. Holistic Multi-Channel Strategy

While online capabilities and DTC sales channels showed resilience throughout the COVID-19 pandemic, it was the financial uncertainty caused by the pandemic that drove the increased interest and sales of life insurance during the pandemic, not specific actions taken by insurers. As the DTC channel took hold during the pandemic and was once seen as the future for most life insurance sales, that view is no longer as dominant. Tom Scales, Head Practice Lead and Life Analyst at Celent, noted that, “We actually thought the pandemic would force a bigger push to DTC and, yes, there was a blip, but that’s gone now. Agent sales seem to be where things are going again.”[46] Although DTC sales continue in a post-pandemic world, the DTC sales channels now appear to simply be one more tool in the toolbox for insurers.

“Agent sales seem to be where things are going again.”

- Tom Scales

No single product, platform, marketplace, or sales channel will enable insurers to meet the needs of all their target population segments including those with a need gap. Therein lies the challenge for insurers. “Insurers have built their business models and make business decisions around products,” according to Denise Garth, Chief Strategy Officer at Majesco. “It’s not customer-oriented and it’s not a customer-first perspective taken by insurers.” Additionally, Garth notes that, “Insurers need to research more, be curious, and connect with their target customers to understand their needs more fully.” [47] Customer needs and buying preferences clearly vary by macro population segment and by population sub-segments.

Research from Majesco indicates that success in the market will depend on insurers’ abilities to develop multi-channel strategies that include support for traditional agent and broker sales along with establishing new strategic partnerships.[48] Doing so will allow insurers to grow sales, particularly among younger generations of customers who are seeking out multiple online and in-person sources of information and advice when buying life insurance. Some will choose an online-only buying experience from start to finish, while others will blend online sources of information, advice from friends and family, and then seek out a financial professional to complete their purchase.

Data from LIMRA shows only 25% of Millennials and 17% of Gen Z adults are willing to research insurance products online and complete a purchase entirely online. Instead, 46% of Millennials and 49% of Gen Z adults perform research about life insurance online, but ultimately seek out a financial professional to complete the purchase in-person.[49] While insurtechs and DTC sales channels provide opportunities to connect with customers, they will not fully replace the advisor, according to Caruso. Instead, “Advisors will need to be more holistic in their approach to serving customer needs,”[50] particularly with underserved customer populations. Enabling agents and advisors to embark on a holistic approach to serving customers requires alignment between carriers, agencies, and agents.

a. Role of the Insurance Carrier

Carriers must identify their target customer populations and ensure their products, underwriting, technology, and operational capabilities align with how the carrier expects to service the business. For example, if a carrier targets a high-volume customer population that has a Spanish language preference, then the carrier should be prepared to have a scalable business model using automation and employee service staff who are fluent in Spanish. To maximize success in reaching the target customer populations, carriers must avoid a mismatch between their target customers’ needs and what they are able to support. As Garth notes, it’s not just about products – carrier success will depend on how well they know the customer and how much they research and get to know the needs of their target customer populations. Not understanding the needs of the target customer populations will disrupt any sort of customer-centric approach by insurers attempting to build products and provide service experiences for the target populations. Ultimately, customers may be forced to shop elsewhere or choose to avoid making an insurance purchase altogether if their needs are not understood.

Carriers must identify the sales channels that are most likely to be used by their target customers. With a DTC model, the carrier must define how that interaction will function and on what platforms to offer a DTC sales channel. Knowing that most underserved customer population segments continue to use an insurance agent at some point in the sale process, carriers must engage agencies and agents who can make connections with target customer populations.

Carrier brands are often a place where customers start their purchase journey. Scott Campion, Vice-President Corporate Strategy for Prudential, notes that due to the complexity of many insurance products, “It’s often hard for a customer to learn about insurance on their own. Even going to a carrier website, a customer will bump up against the need to talk to an advisor pretty quickly.”[51] This is especially true for populations that are less savvy about insurance products, particularly younger generations and many underserved populations that may have misconceptions about the need for insurance and how much it costs. To help with this, insurance carriers must make it easy for customers to search for an agent that aligns with the customer’s desired criteria – finding an agent who is from the Black community, an LGBTQ ally, or finding an agent who is fluent in Spanish are examples of search criteria carriers can enable to make it easier for customers to connect with an agent.

b. Role of the Agency and Agent

Agencies and, especially, agents are the conduit between the carrier and the customer. Agents are the ones who make a connection and build relationships with customers to understand their needs and find the right products for their customers. Like carriers, successful agencies will have a target customer population that they service, such as focusing on a customer population with a particular language preference or minority group. Since agencies and agents are closer to the customer, they have stronger connections to the people in local communities and have a better understanding of customer needs. Having a close connection with its carriers, agents and agencies can be a vital feedback look for carriers to continually improve their understanding of customer needs. Ultimately, agents help activate the customer to make a purchase – building interest, connecting, educating, and securing customers are their key functions during the sales process.

It is important for agencies to attract and retain agents who can connect with their target customer population. Whether the agency is focused on serving the greater population or a segment, such as the Hispanic population, Black population, women, or other groups, agencies are vital to connecting carriers to customers. Simply having more agents is not advantageous to an agency; having more of the agents that reflect the diversity of the targeted customer population will lead to greater agency success and enable agents to reach more customers, particularly those who have a need gap.

6. Diversity, Equity, and Inclusion

While Garth advocates for insurers to do more to focus on the customer experience, what can insurers and agencies do to reach more customers? What can insurers do to close the need gap, particularly in the large Millennial and growing Gen Z adult populations – the largest macro population segments who are in the target market for insurers? One thing is clear, Millennials, Gen Z adults, and underserved population segments will not be satisfied with the way things have always been done.

a. Connecting Customers with Distribution

Both Millennial and Gen Z generations including segments who are women, Black, Hispanic, and LGBTQ, are more technically savvy than prior generations and demand multi-channel access to financial information and buying experiences. While this may appear to be a challenge in how insurers attract customers, it is also a challenge for recruiting sales distribution.

54% Lead-to-Opportunity conversion rate among sales groups with leading DEI practices

When carriers operated captive distribution groups, they had control over every aspect of the buying and servicing experience for a policy. As U.S. life insurers have slimmed the size of their costly captive sales distributions or eliminated them altogether, insurers are increasingly working with brokerages, independent marketing organizations (IMOs), and other independent agencies to attract customers and produce sales. However, just having more distribution groups and more agents does not mean insurers will connect with more customers and increase sales. Carriers must build relationships with the right partners to successfully reach their target customer populations. This is especially important when reaching underserved populations with a high percentage of people with a need gap. To reach the large and diverse Millennial and Gen Z populations, insurers need to secure diverse distribution channels and agents that can connect with customers.

As New York Life and Nationwide believe, when a salesforce reflects its target customers, whether they are women, LGBTQ, or other minority group, stronger connections are made between the brand and the salesperson when a salesforce reflects its target customer population. These connections translate to an increase in trust, expedited purchase decisions, and closure of more sales[52] – one measure of agent and carrier financial success. Sales distribution groups with leading diversity, equity, and inclusion (DEI) practices have an average lead-to-opportunity conversion rate of 54%, a significant difference above lagging DEI sales groups that have a sales conversion rate of only 26%.[53]

Reaching more customers from more population segments who have a need gap will require both carriers and their sales distributions to have leading DEI practices if they expect to grow sales among Millennials and the growing Gen Z customer population in the future. DEI practices may be precisely targeted in the recruitment of agents and sales distribution, or it may grow more organically through relationship networking and recruitment of agents who can help reach specific market segments.

b. Carriers and Agency Leadership

Within the next two decades, the combined population of racial and ethnic minority groups, notably Black, Asian, and Hispanic populations, will exceed the White population in the United States. Many industries and businesses in the U.S. are already starting to employ a workforce that reflects the country’s diverse population segments, but the insurance industry is lagging, particularly at the carrier and agency leadership level.

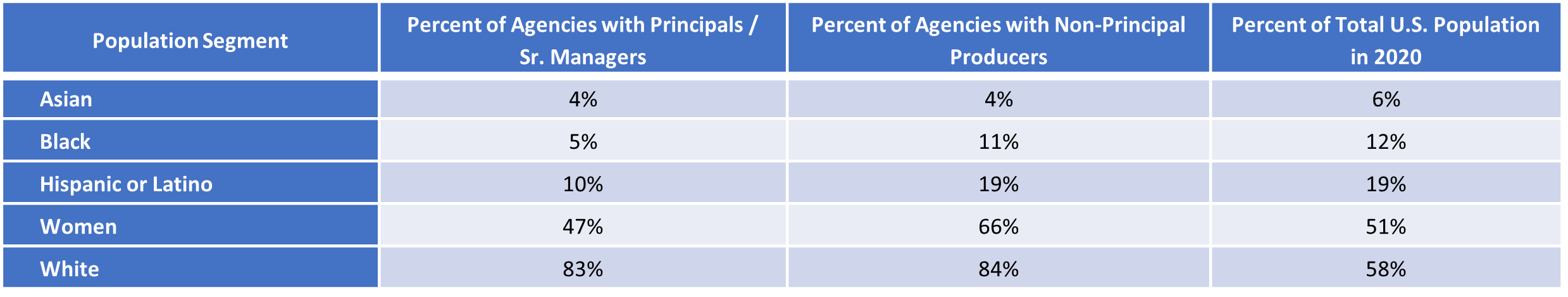

The 2022 Agency Universe Study found that 83% of all agency principals are White and 47% are women.[54] The disparity between population segments represented in leadership positions at agencies compared to the composition of the U.S. population is most notable among Hispanic or Latino, Black, and Asian population segments. Table 3 shows these underrepresented populations were represented half as frequently in agency leadership positions compared to the U.S. population.

Table 3: Percent of Agencies with Each Population Segment Compared to the U.S. Population

Sources: [55], [56], [57]

Diversity improves, albeit slightly, for newer agencies where 13% have at least one Black American principal compared to 2% of established agencies.[58] While women represent just over 49% of insurance sales agents, women, particularly minority women, are rarely found in agency leadership positions.[59]

“Black women are the number one entrepreneur group in the country. This is not a coincidence. This is because they cannot get anywhere in their current organization, and these are women who it takes them three times as long to raise capital and yet they do it; they’re more likely to never succeed and yet they do. Isn’t that someone you want on your leadership team?” states Nina Boone, North American Leader for Diversity & Inclusion at Korn Ferry. “That development and advancement need to happen, and we need to be really real about that.”[60]

“There are not enough people of color in executive leadership in the insurance industry.”

- Mike James

Insurance carriers are facing similar challenges. Despite years of talent recruitment, the insurance industry has not changed where it matters – in its leadership. Mike James, Executive Vice President, and Chief Sales Officer for NFP, notes, “There are not enough people of color in executive leadership in the insurance industry.” Only three of 168 senior executives, 1.8%, from the top 10 U.S. insurers and brokers by market value are Black.[61] But, there are signs of progress at some carriers.

Jackson Davis, Head of DEI at MassMutual, says, "MassMutual looks at diversity hiring both in terms of racial/ethnic and gender diversity as well as growth within the disability, LGBTQ, and veteran communities.” Lincoln Financial started the African American Financial Professional Network to connect Black financial professionals and partnered with CHIP, an organization that helps connect agents of color to customers in their communities.[62]

While there are many efforts focused on expanding diversity, equity, and inclusion at insurance carriers and agencies with the support of industry organizations, more can be done now than ever before to diversify carrier leadership and agency salesforce. More must be done to reach the younger generations that are increasingly diverse.

c. Discover and Sponsor Diverse Talent

Mernice Oliver is the founder of the National Association for Advancement of Women in Insurance (NAAWI) and sees the challenges recruiting women and minorities into the industry. "One of the biggest challenges I see right now, in terms of recruiting people in the insurance salesforce, is the recruiting sites have minorities, the brochures have minorities on there, they invite us to the events, then when we get there and the leadership represented at these events and organizations, they’re still White, they’re still male."[63]

A diverse workforce will not be created on its own – carriers and agencies need to be intentional about their efforts to recruit and develop a diverse leadership, workforce, and sales distribution. Although some mid-career leaders, workers, and sales producers are sure to be found, insurers and agencies need to educate people about opportunities in the insurance industry and develop a pipeline of younger talent – Millennials and Gen Z populations. Recruiting on college campuses, targeting early-career workers, and finding people looking for a new career opportunity are all talent pools that can be tapped. Once diverse talent is found, people must be cultivated for growth, opportunity, and leadership to maximize retention.

Establishing mentorship programs at carriers and agencies helps one person, the mentor, share their knowledge and experience with another person, the mentee. Mentorship can provide direct guidance, advice, feedback, and coaching to help develop the mentee’s knowledge and skills. While mentorship is focused on the direct support of an individual, sponsorship helps an individual gain access to others, particularly leaders, and helps establish an impression of that person. Sponsorship extends the mentorship relationship to create real opportunity and visibility in an organization.[64],[65] If insurers and agencies want to execute on their pledge to create opportunities for diverse populations, sponsorship is the “secret sauce” that can jumpstart upward career mobility for minority populations.[66]

7. Closing the Need Gap

Reaching the increasingly diverse Millennial and Gen Z populations, both comprised of underserved segments, will require sales channels comprised of diverse agents supported by agencies and carriers that prioritize diverse leadership and workforces. Insurance carriers and distribution partners that are aligned in their targeted customer populations and have aligned DEI practices will build stronger connections to underserved population segments and reduce the need gap.

Carriers that understand the needs of their target customers and are selecting sales channels and distribution partners that align to those needs will yield success. Carriers that embrace leading DEI practices in their leadership and align with diverse sales distributions will also benefit from having the feedback of a salesforce that brings varied perspectives leading to more efficient and productive ways to work.[67] This feedback can help the carrier improve products, technology, and service and ultimately deliver on the needs of the target customer populations.

75 Languages spoken among WFG independent agents

One example where DEI efforts are working is at World Financial Group (WFG), the third-largest agent force in the U.S.[68] Among its independent agents, more than 75 languages are spoken, enabling agents to connect with more customers in their native languages. Leaders and sales producers also reflect the diversity of their customers with 52% of its agents being women and 65% being non-White.[68] “WFG has built a diverse, equitable and inclusive platform that is conducive for everyone,” according to Lylian Apono, a leading sales producer for WFG.[69]

WFG is seeing results from their efforts, increasing its number of licensed agents from 43,000 in 2019 to 63,000 in 2022. The number of agents selling more than one policy for WFG increased from 25,000 agents in 2019 to 32,000 in 2022. Growth in the number of agents attracted to sell for WFG and the increase in productivity are two measures of success, so far. Transamerica, the parent company of WFG, is projecting earnings growth of 42% by 2025 because of efforts to recruit more diverse and younger agents while also increasing productivity in their chosen market segments.[68]

Victor Sanchez, Head of Distribution at WFG, indicates the focus for WFG is on diverse younger generations, often immigrant populations, and the middle-income market. “The challenge is, how do we access these people? We do it by speaking the languages of our customers. We do it by coming from the same communities as our customers and we can relate to them – they know us. There’s trust there, between the agent and the customer, that doesn’t exist with a lot of other carriers and their distribution groups.” Sanchez goes on to note that, “Customers want a product they can understand, but customers’ needs are often very different from one customer to the next. Talking to an agent takes the complexity out of the experience, so we see it as a partnership between the agent and the customer to get the customer what they need and solve their coverage gap.” [70]

8. Conclusion

The sizable life insurance need gap among many population segments in the United States will continue to be a challenge for the industry for years to come. With younger generations being more diverse than preceding generations, insurers and distribution partners need to embrace DEI practices to develop more diverse leaders and grow stronger sales agents who can connect with target customer populations.

With the current elevated interest in life insurance in a post-COVID-19 world, there are immediate opportunities to reduce the number of people and percent of underserved populations who have a life insurance coverage need gap. There are sales growth opportunities for insurers by reaching the Millennial and Gen Z populations through multi-channel access points. Aligning the diverse sales distributions to reflect the diversity of target populations will lead to stronger connections with customers. Reducing the need gap will not only provide greater financial protections for underserved customer populations, but it will result in financial success for insurers.

[1] LIMRA. (2023, April 24) New Study Shows Interest in Life Insurance at All-Time High in 2023. https://www.limra.com/en/newsroom/news-releases/2023/new-study-shows-interest-in-life-insurance-at-all-time-high-in-2023/

[2] LIMRA. (2021, February 1). Industry Associations Unite to Help Address the Life Insurance Coverage Gap in the United States. https://www.limra.com/en/newsroom/news-releases/2021/industry-associations-unite-to-help-address-the-life-insurance-coverage-gap-in-the-united-states/

[3] Life Happens. (n.d.). About Us. https://lifehappens.org/about-us/

[4] Kakar, Puneet. (2021, April 27). Deloitte. Financial inclusion and the underserved life insurance market, part one. https://www2.deloitte.com/us/en/insights/industry/financial-services/life-insurance-industry-trends-amid-the-global-pandemic.html

[5] Caruso, Andrea. (2023, June 20). Personal communication.

[6] LIMRA. (n.d.). Life Insurance Awareness Month (2022). https://www.limra.com/en/newsroom/liam/

[7] LIMRA. (2022, February 1). Significant Life Insurance Coverage Gap Remains in Black American Community. https://www.limra.com/en/newsroom/industry-trends/2022/limra-significant-life-insurance-coverage-gap-remains-in-black-american-community/

[8] Festa, Elizabeth. (2022, June 22). LGBTQ Consumers Trail in Life Insurance Coverage, Study Finds. https://www.investopedia.com/lgbtq-consumers-trail-in-life-insurance-5324954

[9] Life Happens. (2023, April). Millennials and Gen Z Lead Growing Need for Life Insurance in 2023. https://lifehappens.org/research/millennials-and-gen-z-lead-growing-need-for-life-insurance-in-2023/

[10] LIMRA. (2022). Millennials Represent Largest Market Opportunity for Life Insurers. https://www.limra.com/siteassets/newsroom/help-protect-our-families/2022/july/hpof-millennial-infographic_final.pdf

[11] LIMRA. (2022). Hispanic Americans: A Growing Population with an Increasing Need for Life Insurance. https://www.limra.com/siteassets/newsroom/help-protect-our-families/2022/october/hpof-hispanic-infographic_final.pdf

[12] Huddleston, Cameron. (2023, June 9). Forbes. 10 Things Women Need to Know About Life Insurance. https://www.forbes.com/advisor/life-insurance/what-women-should-know/

[13] LIMRA. (2022). Meeting the Opportunity - Women and Life Insurance. https://www.limra.com/siteassets/newsroom/help-protect-our-families/2022/march/feature/meeting-the-opportunity_women-and-life-insurance_infographic.pdf

[14] Parker, Kim. (2021, November 8). Pew Research Center. What’s behind the growing gap between men and women in college completion? https://www.pewresearch.org/short-reads/2021/11/08/whats-behind-the-growing-gap-between-men-and-women-in-college-completion/

[15] Fry, R. & and Stepler, R. (2017, January 31). Pew Research Center. Women may never make up half of the U.S. workforce. https://www.pewresearch.org/short-reads/2017/01/31/women-may-never-make-up-half-of-the-u-s-workforce/

[16] Fry, R., Aragao, C., & Parker, K. (2023, April 13). Pew Research Center. In a Growing Share of U.S. Marriages, Husbands and Wives Earn About the Same. https://www.pewresearch.org/social-trends/2023/04/13/in-a-growing-share-of-u-s-marriages-husbands-and-wives-earn-about-the-same/

[17] New York Life. (2019, April). 6 Lessons for Success: YOUR GUIDE TO STRENGTHENING RELATIONSHIPS & TRANSFORMING YOUR BUSINESS. https://www.newyorklifeinvestments.com/assets/documents/lit/women-and-investing/sixlessonsforsuccess.pdf

[18] Statista Research Department. (2023, March). Statista. Resident population in the United States in 2022, by generation. https://www.statista.com/statistics/797321/us-population-by-generation/

[19] LIMRA. (2022, July 6). It’s Time to Help Get More Millennials Insured. https://www.limra.com/en/newsroom/industry-trends/2022/millennials-its-time-to-get-insured/

[20] LIMRA. (2023). Securing the Future - Life Insurance Needs of Younger Adults. https://info.limra.com/gen-zy-barometer

[21] Advisor Magazine. (2023, April 25). New Study Shows Interest in Life Insurance at All-Time High in 2023. https://www.lifehealth.com/interest-in-life-insurance-at-all-time-high-in-2023/

[22] LIMRA. (2023). Securing the Future - Life Insurance Needs of Younger Adults. https://info.limra.com/gen-zy-barometer

[23] LIMRA. (2022, February 1). Significant Life Insurance Coverage Gap Remains in Black American Community. https://www.limra.com/en/newsroom/industry-trends/2022/limra-significant-life-insurance-coverage-gap-remains-in-black-american-community/

[24] LIMRA. (2021, July 6). Increased During the Pandemic but a Significant Need-gap Remains. https://www.limra.com/en/newsroom/news-releases/2021/new-study-finds-black-american-life-insurance-ownership-increased-during-the-pandemic-but-a-significant-coverage-gap-remains/

[25] Oladele, C.R., Tuckson, R., McKinney, T.L., Dawes, D., Tolliver, D., & Nunez-Smith, M. (2022, March). THE STATE OF BLACK AMERICA AND COVID-19 A TWO-YEAR ASSESSMENT. Black Coalition Against Covid. https://blackcoalitionagainstcovid.org/the-state-of-black-america-and-covid-19/

[26] Bunn, Curtis. (2021, July 20). NBC News. Black Americans are buying more life insurance. Here's why. https://www.nbcnews.com/news/nbcblk/black-americans-are-buying-life-insurance-rcna1458

[27] Medine, Taylor. (2020, September 24). Haven Life. Is there a life insurance race gap? https://havenlife.com/blog/life-insurance-racial-wealth-gap-statistics/

[28] LIMRA. (2022, February 1). Significant Life Insurance Coverage Gap Remains in Black American Community. https://www.limra.com/en/newsroom/industry-trends/2022/limra-significant-life-insurance-coverage-gap-remains-in-black-american-community/

[29] Life Happens. (2021). ENGAGING THE BLACK COMMUNITY WITH LIFE INSURANCE. https://issueins.com/wp-content/uploads/document_Marketing-Guide_DEI_EngagingBlackCommunity_2021_Producer.pdf

[30] Oh Nataren, Erica. (2021, June 23). Life Insurance: A Key Piece of Protection for LGBTQ Families. https://lifehappens.org/blog/life-insurance-a-key-piece-of-protection-for-lgbtq-families/

[31] Nationwide. (2022, June 1). LGBTQ+ Community Falling Behind on Financial Security. https://news.nationwide.com/lgbtq-community-falling-behind-on-financial-security/

[32] LIMRA. (2022, June). Winning the LGBTQ American Market.https://www.limra.com/siteassets/newsroom/help-protect-our-families/2022/june/feature/june---lgbtq_fact-sheet.pdf

[33] Schein, G.W. (2022, January). The same but different: Financial planning with LGBTQ clients. https://nationwidefinancial.com/media/pdf/NFM-21502AO.pdf

[34] Powell, Laural. (2021, December 9). We Are Here: LGBTQ+ Adult Population in United States Reaches At Least 20 Million, According to Human Rights Campaign Foundation Report. https://www.hrc.org/press-releases/we-are-here-lgbtq-adult-population-in-united-states-reaches-at-least-20-million-according-to-human-rights-campaign-foundation-report

[35] Zamarripa, R. & Roque, L. (2021, March 5). The Center for American Progress. Latinos Face Disproportionate Health and Economic Impacts From COVID-19. https://www.americanprogress.org/article/latinos-face-disproportionate-health-economic-impacts-covid-19/

[36] Life Happens. (2022, September). The Life Insurance “Need Gap” for Hispanic Americans. https://lifehappens.org/research/the-life-insurance-need-gap-for-hispanic-americans/

[37] Mseka, Ayo. (2022, September 1). Insurance Newsnet. Life insurance coverage among Hispanics lowest in U.S., study finds. https://insurancenewsnet.com/innarticle/life-insurance-coverage-among-hispanics-lowest-in-u-s-study-finds

[38] Life Happens. (2022, September). The Life Insurance “Need Gap” for Hispanic Americans. https://lifehappens.org/research/the-life-insurance-need-gap-for-hispanic-americans/

[39] Funk, G. & Hugo Lopez, M. (2022, June 14). A brief statistical portrait of U.S. Hispanics. https://www.pewresearch.org/science/2022/06/14/a-brief-statistical-portrait-of-u-s-hispanics/

[40] LIMRA. (2022). Addressing the Life Insurance Coverage Gap Among the Hispanic Community. https://www.limra.com/siteassets/events-learning-and-networking/webinars/2022/linkedin-live/addressing-the-coverage-gap-among-hispanic-americans.pdf

[41] MIB. (2021, January 13). U.S. Life Insurance Activity Hits Record Growth in 2020 Reports the MIB Life Index. https://www.mibgroup.com/resources/life-index-reports/us-life-insurance-activity-hits-record-growth-in-2020/

[42] LIMA. (n.d.). Millennials Are Serious About Life Insurance. https://interactive.limra.com/millennial-life-insurance

[43] LIMRA. (2022, March 16). LIMRA: 2021 Annual U.S. Life Insurance Sales Growth Highest Since 1983. https://www.limra.com/en/newsroom/news-releases/2022/limra-2021-annual-u.s.-life-insurance-sales-growth-highest-since-1983/

[44] MIB. (2023, January 10). U.S. Life Insurance Application Activity Finishes 2022 Down vs 2021 and 2020 and flat compared to 2019. https://www.mibgroup.com/resources/life-index-reports/dec-2022-us-life-index/

[45] LIMRA. (2023, April 24) New Study Shows Interest in Life Insurance at All-Time High in 2023. https://www.limra.com/en/newsroom/news-releases/2023/new-study-shows-interest-in-life-insurance-at-all-time-high-in-2023/

[46] Scales, Tom. (2023, May 25). Personal communication.

[47] Garth, Denise. (2023, June 16). Personal communication.

[48] Majesco. (2023, August). Bridging the Customer Expectation Gap for L&AH.

[49] Salka, A. & Carroll, J. (2023, July 12). LIMRA. Unlocking the Future: Empowering Gen Z & Millennials to Secure Their Future.

[50] Caruso, Andrea. (2023, June 20). Personal communication.

[51] Campion, Scott. (2023, June 22). Personal communication.

[52] Pipedrive. (n.d.). How to achieve salesforce diversity (and why it matters). https://www.pipedrive.com/en/blog/salesforce-diversity

[53] Forrester. (2021, November). Diversity Drives Sales Success. https://business.linkedin.com/sales-solutions/b2b-sales-strategy-guides/forrester-diversity-report-2021?trk=lss-blog-diversity-report

[54] Independent Insurance Agents & Brokers of America, Inc. (2022). Agency Universe Study Management Summary. https://www.independentagent.com/research/SiteAssets/AgencyUniverseStudy/agency-universe/2022-AUS-Summary-F100722-M-BPS.pdf

[55] Insurance Information Institute. (2023). Diversity and inclusion in the insurance industry. https://www.iii.org/article/diversity-and-inclusion-in-the-insurance-industry

[56] Independent Insurance Agents & Brokers of America, Inc. (2022). Agency Universe Study Management Summary. https://www.independentagent.com/research/SiteAssets/AgencyUniverseStudy/agency-universe/2022-AUS-Summary-F100722-M-BPS.pdf

[57] United States Census Bureau. (2022). Data and Tools. https://www.census.gov/data.html

[58] Dopazo, Alex. (2019, February). Workforce Diversity in the Independent Agency System: 3 Steps to Change. https://www.independentagent.com/diversity/Pages/Resources/IIABA-AUS-2019-Diversity-Paper.pdf

[59] Insurance Information Institute. (2023). Facts + Statistics: Careers and employment. https://www.iii.org/fact-statistic/facts-statistics-careers-and-employment

[60] Oliver, M., Boone, N. & Whipple, T. (2021). How the Insurance Industry Can Be an Active Ally to the Black Community. https://www.insurancejournal.com/research/research/how-the-insurance-industry-can-be-an-active-ally-to-the-black-community/

[61] Scott, Alwyn. (2020, November 18). U.S. insurance executives seek to fix industry's diversity problem.

[62] Roby, L & Ayers, A. (2023, March 28). Insider. Diversity has been a big problem for life insurance, but companies say they're trying to address the problem head-on. https://www.businessinsider.com/personal-finance/diversity-equity-inclusion-life-insurance-changing-2023-3

[63] Oliver, M., Boone, N. & Whipple, T. (2021). How the Insurance Industry Can Be an Active Ally to the Black Community. https://www.insurancejournal.com/research/research/how-the-insurance-industry-can-be-an-active-ally-to-the-black-community/

[64] Chow, Rosalind. (2021, June 30). Don’t Just Mentor Women and People of Color. Sponsor Them. https://hbr.org/2021/06/dont-just-mentor-women-and-people-of-color-sponsor-them

[65] Coons, Matthew. (2022, May 5). Mentorship vs Sponsorship: Understanding the difference in DE&I. https://www.ragan.com/mentorship-vs-sponsorship-understanding-the-difference-in-dei/

[66] Bradly Smith, Stephanie. (2021, March 5). How a Lack of Sponsorship Keeps Black Women Out of the C-Suite. https://hbr.org/2021/03/how-a-lack-of-sponsorship-keeps-black-women-out-of-the-c-suite

[67] Pipedrive. (n.d.). How to achieve salesforce diversity (and why it matters). https://www.pipedrive.com/en/blog/salesforce-diversity

[68] Fuller, Will. (2023, June 22). Transamerica - Building America’s leading middle market Life Insurance and Retirement company. https://www.aegon.com/system/files/file/2023-06/presentations-cmd23.pdf

[69] WFG. (2023). In an industry defined by a lack of diversity, WFG stands apart. We Stand For Everyone. https://www.worldfinancialgroup.com/dei

[70] Sanchez, Victor. (2023, July 18). Personal communication.