Decreasing the Insurance Gap by Improving Financial Literacy

Beth Carter, Vice President – Head Of CX Operations, Protective Life Insurance Company

Ms. Carter is the 2024 RGA Leaders of Tomorrow Award recipient. The following is her winning research.

Overview

The life insurance industry’s mission remains significant: protecting individuals, families, and businesses from life and retirement risks. While life insurers worldwide have adapted to meet the evolving needs of consumers, one giant hurdle persists: Why are people not buying more insurance products?1

Educating consumers to make better financial and insurance decisions is a great opportunity for the industry. It can benefit both consumers and insurers, as well as create more resilient societies because of greater penetration of insurance coverage.

Insurance Need-Gap

Despite many around the world living with a protection coverage gap, insurance sales have remained flat since the turn of the 21st century. Life insurance carriers are seeking to understand why people are not buying more insurance products and examining ways the insurance industry can meet this need.

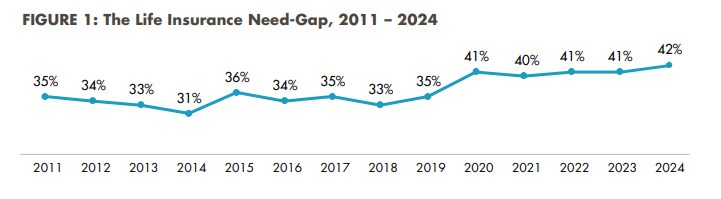

Consumers in the United States have a significant unmet need. The Life Insurance Marketing and Research Association (LIMRA)’s annual Insurance Barometer Study provides insights into U.S. consumers' perceptions, attitudes, and behaviors regarding life insurance. The life insurance need-gap is an important measure because it represents the total self-reported life insurance need among all American adults aged 18 to 75 annually. 2

Source: LIMRA 2024 Insurance Barometer Survey

Blending the estimated U.S. adult population data with the LIMRA survey results suggests the total life insurance need-gap now encompasses about 102 million adults. 2

Many Americans do not fully understand the cost, benefits, and importance of life insurance, and without adequate knowledge, people may not prioritize life insurance. Consumers state a need for life insurance but are intimidated by the education and purchase process. 2

Consumers experience pain points involving product complexity and lack of education or financial acumen. Many people in the U.S. may not fully understand the benefits and importance of life insurance, leading to lower uptake. The variety of life insurance products and the complexity of choosing the right one can be overwhelming, deterring some people from buying coverage. Economic challenges, such as income inequality and financial instability, can make it difficult for individuals to prioritize or afford life insurance.

Purpose of Paper

A lack of financial and insurance literacy makes it difficult for individuals to understand the role of life insurance and its value. If people don’t understand the risks they face, or how insurance can protect them and their loved ones, how can they be expected to purchase life insurance or the right coverage?

Low financial literacy can impede interest in life insurance, and insurers must take steps to increase consumer knowledge. This paper explores how increasing financial and insurance literacy can positively impact life insurance penetration and reduce the current need-gap. The focus will be on the U.S. but can be applied to other countries.

Financial Literacy

Financial Literacy Definition

Financial literacy is defined as the ability to understand basic principles of business and finance. It is measured using questions assessing basic knowledge of four fundamental concepts in financial decision-making: knowledge of interest rates, interest compounding, inflation, and risk diversification. A person is defined as financially literate when he or she correctly answers at least three out of the four financial concepts.

Worldwide, just one in three adults show an understanding of basic financial concepts. Although financial literacy is higher among the wealthy, educated, and those who use financial services, billions of people are unprepared to cope with financial changes.

Importance of Financial Literacy

The importance of financial literacy can be seen in almost every phase of life; important financial decisions must be made, from whether to go to college to when to retire. How well individuals navigate these decisions can be dependent on their financial literacy. Comprehensive financial literacy empowers individuals to make informed financial decisions.

Financial illiteracy represents an economic and social challenge with long-term consequences for individuals, families, and communities. The gap between complex consumer choices and financial literacy is believed to contribute to the growing trend of harmful and often unsustainable spending patterns. This has led to unprecedented levels of debt and historically low economic stability across the U.S. 3

Additionally, compared to individuals with a high level of financial literacy, those with a low level are twice as likely to be debt-constrained and three and one-half times more likely to be financially fragile. 4 Individuals with higher financial literacy show a higher number of insurance products owned. 5 Furthermore, research shows that consumers who have attended financial education programs are far more likely to purchase life insurance products.

Financial Literacy in the U.S.

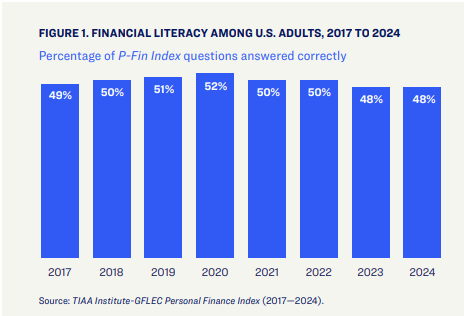

The Teachers Insurance and Annuity Association of America (TIAA) -Global Financial Literacy Excellence Center (GFLEC) Personal Finance Index (P-Fin Index) annually assesses financial literacy among U.S. adults and explores the relationship between financial literacy and financial well-being. The P-Fin Index gives Americans an alarming grade regarding understanding the concepts that anchor decisions about saving for retirement, managing debt, or insuring against risks. The number of people in the U.S. who understand basic financial principles remains nearly the same over the past eight years. 6

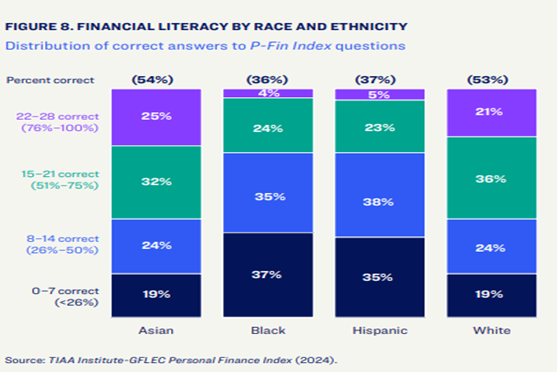

Financial literacy also varies substantially by sociodemographic characteristics. Financial literacy among women has consistently lagged behind men. There is a 10-point gender gap in the percentage of index questions correctly answered in 2024.4 The LIMRA study results indicate a similar gap exists with life insurance. Women (46 percent) are less likely than men (57 percent) to have life insurance. 2

Among those studied in the U.S., financial literacy levels among Asian and white Americans are nearly equal. Financial literacy levels among Black and Hispanic Americans are roughly equal but at lower levels compared to Asian and white Americans. 4 This also correlates with LIMRA study results, which cite Black and Hispanic Americans report higher need for life insurance protection than other groups. 2

Financial illiteracy is common among individuals with no postsecondary education and among low-income populations. Furthermore, financial literacy is lower across specific generations, especially Generation Z. 4 Similar to the gender and race correlation, nearly half of each of the younger three generations reports a life insurance need-gap. 2

Insurance Literacy

While there is a wealth of information available on financial literacy, little is available on insurance literacy. When insurance is considered part of financial literacy, insurance ranks among the least used, and least understood, of any common financial product.7

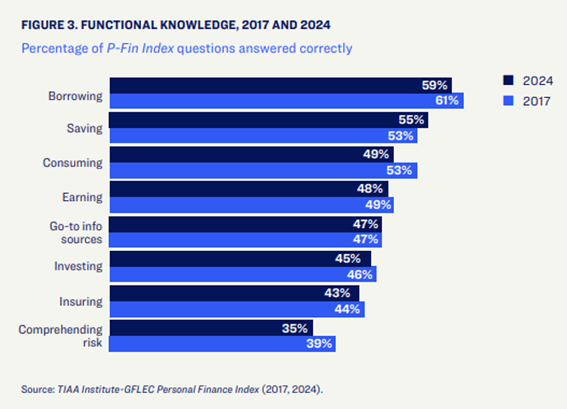

The P-Fin Index explores eight functional areas across finance, including insuring and comprehending risk. Data from the 2024 index reveals that Americans appear most comfortable with financial knowledge on borrowing, saving, and consuming, and the least confident around insuring and comprehending financial risk. Furthermore, both knowledge in insuring and comprehending risk has decreased since 2017. 4

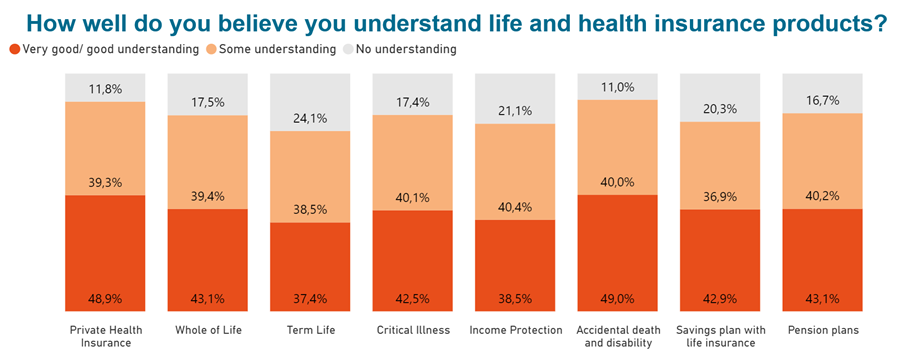

In 2021, ReMark surveyed nearly 13,000 people from 22 countries to measure insurance literacy on a global scale, asking a series of questions on the basic principles of insurance including underwriting, risks, and needs. Out of the products surveyed, term life stood out with the largest gap in understanding, which is concerning as it is often considered to be the simplest. 8

Life insurance is a unique and complex product. Along with age, marital status, education, employment status, and having children, insurance literacy can influence insurance purchase decisions. Insurance literacy positively correlates with life insurance products where individuals with higher basic and product insurance literacy show a higher number of insurance products owned. 5

Current Challenges in Insurance Literacy

Cultural and Behavioral Barriers

Even though death is one of the few events that all humans have in common, there is a general uneasiness or tendency to avoid thinking about death and planning for it, which can lead to procrastination in purchasing life insurance. However, the LIMRA study results suggest the topic is on the minds of Americans as concerns with burdening loved ones with funeral expenses (29 percent) and leaving dependents in a difficult financial situation due to premature death (29 percent) are called out. 2

Lack of Awareness

Insurance is critical for managing the financial uncertainty that most households face. It can also be an important source for building wealth, particularly across generations; yet there are no cohesive, effective strategies in place to educate all consumers. Historically, financial planning was primarily a privilege of the wealthy, and many current life insurance distribution models incentivize selling to more affluent markets. This creates a gap in access to educational support on financial products and services for all, regardless of their net worth.

Complexity of Insurance Products

Most consumers lack a fundamental understanding of the array of life insurance products. Financial literacy can empower consumers to evaluate the benefits of different insurance products and options to provide financial protection and flexibility. People will be hesitant to purchase complicated products they do not understand.

Misinformation

Many American consumers now turn to social media to obtain guidance about financial topics and insurance products. There is little to no governance on the accuracy of the content in social media platforms, which can cause misinformation and a negative impact on financial literacy. The LIMRA study suggests that 59 percent of Americans use social media when seeking information on financial or insurance products, citing YouTube and Facebook as the platforms most used.[2

Recommendations

The evidence is clear that opportunities exist to implement strategies that will have a significant impact on both financial and insurance literacy. It will take more than annual observations dedicated to financial literacy and life insurance awareness. Financial and insurance education is a lifelong journey and should be implemented throughout life’s stages—from schools to the workplace to retirement.

The life insurance industry must unite and be the voice to drive awareness and education. Holistically, steps should be taken to establish a baseline or benchmark to measure the current level of insurance literacy, understand people’s needs and the barriers they face, and raise awareness to comprehend the importance. Furthermore, emphasis should be placed on deploying targeted strategies that will be more effective in reaching underserved populations.

Mandate School Curriculum

Many states have integrated financial education in schools to promote financial literacy and equip younger generations with tools. However, there is no conclusive evidence of the success and effectiveness of those programs since our literacy rates do not seem to be improving.

Furthermore, if the adults teaching the courses are not certified to teach the specific curriculum, gaps likely exist. The quality and curriculum of current programs should be evaluated, and the core curriculum should be adopted and appropriately incorporated at various ages and grades, with the ability to measure success. Teachers need to be certified and properly trained to teach financial literacy.

We need to empower young people with knowledge before they make life-changing financial decisions so they can begin their adulthood on a stable foundation. According to the 2021 American Community Survey Report, school enrollment in the U.S. was made up of 17.3 million high schoolers, 16.6 million undergraduate students, and 4.6 million graduate students. 9 Mandating a personal finance course for high school graduates would ensure they are better positioned for a secure financial future. Colleges and universities should use their platform to implement meaningful, value-added financial education services and programs for students. Similarly to high school students, mandating a course as a graduation requirement would ensure a wider reach to young adults.

Invest in Adult Education

Providing access to financial education for adults can spread a positive ripple effect throughout society by ensuring more have access to resources and tools to increase their financial literacy. While adult education courses are already available through various channels, they are set up to be attended by adults proactively seeking the information. Digital and traditional marketing campaigns to attract more interest in increasing financial literacy and the benefits should target women, younger generations, and Black and Hispanic Americans. Opportunities exist to incorporate workshops and seminars on life insurance across broader ecosystems and new partnerships with existing access to target consumers.

Influence Corporate Responsibility

There is a growing demand for financial wellness programs in the workplace. The largest opportunity to reach the adult population is through the workplace, with Statista reporting over 135 million full-time employees in the U.S. in July 2024. 10 Additionally, according to research from GFLEC, there is a critical need to invest in employee financial health. 11 New programs and products should be developed to include offering financial literacy programs as a part of benefit packages or incorporated within existing offerings.

Effective workplace financial wellness programs should take a holistic approach to financial health. It will also benefit employers, as 60 percent of individuals are more likely to stay engaged with an employer that offers programs that help them understand their financial needs.12 Financial literacy is also linked to participation in employer-sponsored benefit plans. 3

Financial Institutions and Insurance Companies Lead the Way

Most insurers have invested in a plethora of educational content available on their websites; however, it is not reaching most individuals. While insurance companies need to tailor their products to satisfy customers’ needs, they also need to consider the best ways to enhance the financial knowledge of the public. Ensuring that consumers are better informed will result in higher levels of demand for insurance products. This transformation will not only promote insurers’ growth prospects but will elevate the perception of the industry and its role in protecting and enriching the ever-evolving world.

Across the life insurance industry, insurers should unite to orchestrate learning campaigns and platforms to educate the general population and increase financial and insurance literacy. While that might be perceived as self-serving, the industry could partner with a non-profit organization, such as lifehappens.org, to back a cohesive strategy for broader outreach. This could be expanded to include other industries that would have an interest in increasing financial literacy. The goal should be to increase public understanding of the importance and benefits of life insurance and its role in overall financial literacy.

Educational campaigns can clarify the different types of policies and their advantages, making the decision-making process easier for consumers. Partnering with community organizations not currently affiliated with insurance, such as local non-profits and religious institutions, to offer financial literacy workshops and resources can reach underserved populations.

Government Incentives

A substantial amount of legislation and initiatives have been introduced at the federal and state levels intended to encourage financial education and increase consumer financial literacy. For example, Congress approved legislation in 2003 creating a Financial Literacy and Education Commission, resulting in a central hub for financial education derived from over 20 different federal agencies (mymoney.gov). While federal and state lawmakers have recognized the trends and passed financial literacy legislation, financial literacy rates and the protection need-gap remain at consistent, concerning levels.

Researching to understand the most effective methods for improving financial literacy and regularly evaluating existing programs will help refine strategies and ensure they are meeting the needs of the population. State and federal scorecards should be created, with key performance indicators established to measure improvement in financial literacy rates across multiple demographic groups.

Incentives for individuals with life insurance should be introduced to promote greater adoption and encourage interest in learning more about the benefits of life insurance. Like Japan, the U.S. should implement federal tax deductions for life insurance premiums. 13 Government policies to incentivize participation in financial literacy programs for businesses, such as tax credits or grants for organizations, will encourage broader engagement.

Use Cases

Many countries acknowledge the importance of improving financial literacy among their populations and are investing in a variety of initiatives. Here are a few past and current examples of how countries are addressing the need for greater financial literacy.

Denmark: Money Week

In 2015, Denmark implemented mandatory financial education for students ages 13 to 15, covering budgeting, saving, banking, consumer rights, and more. Each year since, an educational initiative called Money Week takes place, targeting grades 7 to 9 to improve the financial literacy of young people. In 2024, the initiative reached 46,000 students directly and an additional 100,000 people indirectly. 14

Money Week includes educational visits and lectures from financial experts from financial institutions and the National Bank of Denmark; online teaching and a contest linked to an online quiz; and a main event summit about young people and their financial well-being arranged with the Union of Youth Organizations. 14

Denmark ranks first in financial literacy worldwide, according to the S&P Global FinLit Survey. 15 Additionally, Denmark’s life insurance penetration has increased from 2020 to 2023, while most countries have declined over the same period. 16

Taiwan: Financial Supervisory Commission

According to MasterCard's Financial Literacy Index results, Taiwan has the highest level of financial literacy in the Asia-Pacific region. This study indicates that financial literacy is an essential factor in the Taiwan life insurance industry, which has particularly high insurance density and is ranked high in insurance penetration globally. 17

The Financial Supervisory Commission (FSC) was established in July 2004 as the authority responsible for the development, supervision, regulation, and examination of financial markets and financial service enterprises in Taiwan. Promoting financial literacy is one of the most important policies of the FSC. Since 2006, the FSC has implemented the financial literacy promotion plan to construct a comprehensive financial knowledge framework, reshape basic financial education, and integrate related resources. The plan has tailor-made programs focusing on different groups such as women, senior citizens, indigenous people, and new immigrants. The FSC and financial institutions hold many financial literacy promotion activities annually. 18

Taiwan has also recently developed a scorecard to highlight key performance indicators with targets to measure the effectiveness of the government’s policy implementation efforts. In 2023 and 2024, targets include increasing the use of financial services and insurance products and measuring the number of life insurance policyholders per 1,000 adults, as an example. Additionally, the scorecard focuses on the quality of financial services, with targets aligning with financial literacy activities. 19

Japan: Financial Literacy and Education Corporation

In April 2024, Japan founded the Financial Literacy and Education Corporation (J-FLEC) in response to underperforming initiatives on financial education. J-FLEC’s vision is: “As a platform for improving financial literacy, we provide financial education tailored to the changing times and the diversity of individuals and support the use of financial services and the formation and use of assets to improve lives for now and the future.” 20 Key initiatives planned through J-FLEC include certifying advisors to be dispatched to lead classes, events, seminars, and free and discounted financial consultations. The success of the program will be measured through established key performance indicators, including a target to improve financial literacy and the percentage of people who are aware of life planning and actions. 20

In addition to financial literacy programs, Japan also offers tax incentives for life insurance premiums. Life insurance premiums paid to a Japanese agency in local currency are deductible to a limited extent in computing national and local inhabitant’s taxes. 13

South Africa: Investing in Financial Literacy

To improve financial literacy and access to financial services, the South African government adopted the Financial Sector Charter in 2004, which requires all financial services institutions to contribute a percent of their annual profits to financial education programs. 21 The South Africa Insurance Association (SAIA) represents the short-term insurance industry member interests at all levels and with all stakeholders. SAIA’s financial literacy initiatives are funded through a compulsory contribution by member companies in the short-term insurance industry. 22

In 2015, the International Labour Organization (ILO) commissioned a study to take stock of financial education initiatives in South Africa. This resulted in creating an initiative combining financial education with other interventions, such as the creation of an enabling environment for financial inclusion, responsible lending, and the development of on-demand, reasonably priced financial services to enhance the financial inclusion of vulnerable groups. 22

In 2020, South Africa came in at third overall globally in life insurance penetration. 23

Conclusion

Personal Learning Journey

As I conducted research for this paper, I was astounded by the number of opportunities that came my way highlighting financial and insurance illiteracy and life insurance need gaps among those closest to me. Surely this could not be the case, as I have been in the insurance industry for more than 20 years and would understand how critical it is to ensure my family is educated and informed. I was quickly humbled.

I have two sons I was preparing to send off to college: one entering their sophomore year and the other his freshman year. Both attended a class while in high school with a financial literacy curriculum included. When quizzed by me this summer, neither could pass the financial literacy questions I posed and had limited knowledge of life insurance products. Both were surprised to learn that we indeed had life insurance policies (for them and my spouse and I) and I took the opportunity to educate them on why it was important and how it allows us to protect our family.

Later in the summer, I accompanied my son to his freshman college orientation at a state college. As we met with his counselor to select his classes, nothing in the course catalog offered a class on financial literacy. When asking the counselor for a recommendation on a one-hour class, the counselor recommended a “wonderful class” geared toward financial literacy. I inquired why I could not find the class in the catalog, and the counselor said the title of the class was incorrectly labeled. While I jumped at the chance to register my son for the class, I was disheartened to think of the many students who miss out because the class is not required or properly endorsed and marketed by the college.

At the beginning of August, a close family member asked me where they could buy life insurance. I asked how much they were looking for and it was quite a large amount. Being very close to them and familiar with their lifestyle, I assumed this new policy would replace an existing one. I was disappointed to learn that they are significantly underinsured and that their current policy did not provide adequate coverage. Furthermore, they were not taking advantage of the employee benefits for life insurance.

Be the Change

Financial literacy is one of the key factors influencing people's attitudes toward life insurance. Individuals are more likely to invest in their financial security and save for retirement as they become more aware of the risks they are exposed to and gain a better understanding of the characteristics of available insurance products.

Financial and insurance literacy is a journey and as the world changes, so must our knowledge. Taking steps today can help billions of people worldwide improve their lives, including those most important to you.

The insurance experience will no longer be transactional; it will be an educational journey, a proactive partnership. As an industry, we must do better to educate consumers and protect them and their families. Investing in health, wellness, and customer education should not just be a corporate strategy; it should be part of a larger commitment to meet the evolving protection needs of our society.

This research paper is only intended for the expressed uses of the RGA/International Insurance Society Leaders of Tomorrow program. The author’s opinions and recommendations do not reflect those of Protective Life Insurance Company or any other organization with which the author is affiliated.

________________________________________________________________________________________

References

- “The Key to Growth in U.S. Life Insurance: Focus on the Customer.” McKinsey & Company, 23 Mar. 2016, https://www.mckinsey.com/industries/financial-services/our-insights/the-key-to-growth-in-us-life-insurance.

- Wood, Stephen, et. al., “2024 Insurance Barometer Study.” LIMRA, 15 July 2024, https://www.limra.com/en/research/research-abstracts-public/2024/2024-insurance-barometer-study/.

- Harnisch, Thomas L., “Boosting Financial Literacy in America: A Role for State Colleges and Universities.” American Association of State Colleges and Universities, 2010, https://aascu.org/resources/boosting-financial-literacy-in-america-a-role-for-state-colleges-and-universities/.

- Klapper, Leora, et. al., “Financial Literacy Around the World: Insights from the Standard & Poor’s Rating Services Global Financial Literacy Survey.” World Bank Development Research Group, 2014, https://gflec.org/wpcontent/uploads/2015/11/Finlit_paper _16_F2_singles.pdf.

- Bongini, Paola, et. al., “Insurance Holdings: Does Individual Insurance Literacy Matter?” Finance Research Letters Volume 58, Part C, December 2023, https://www.science direct.com/science/article/pii/S1544612323008838#:~:text=Insurance%20literacy%20has%20a%20positive,number%20of%20insurance%20products%20owned.

- Yakoboski, Paul, et. al., “Financial Literacy and Retirement Fluency: New Insights for Improving Financial Well-Being.” 2024 TIAA Institute-GFLEC Personal Finance Index, 2024, https://www.tiaa.org/public/institute/publication/2024/financial-literacy-and-retirement-fluency.

- “Why is Nobody Talking About Insurance Literacy?” Remark SCOR Digital Solutions, 24 Jan. 2022, https://www.remarkgroup.com/en/insights/why-is-nobody-talking-about-insurance-literacy.

- “The Growing Demand for Insurance Education.” SCOR – The Art & Science of Risk, 14 Jan. 2022, https://www.scor.com/en/expert-views/growing-demand-insurance-education.

- Fabina, Jacob, et. al., “School Enrollment in the United States: 2021.” United States Census Bureau American Community Survey Reports, June 2023, https://www.census.gov/ content/dam/Census/library/publications/2023/acs/acs-55.pdf.

- "Monthly Number of Full-Time Employees in the United States from July 2022 to July 2024.” Statista, Aug 2024, www.statista.com/statistics/ number-of-full-time-employees-us/2. Accessed 28 Aug. 2024.

- “Investing in Employee Financial Health.” Global Financial Literacy Excellence Center, Nov. 2019, https://gflec.org/wp-content/uploads/2019/11/Employee-Financial-Health-Nov2019.pdf.

- “Longevity Economy Principles: The Foundation for a Financially Resilient Future.” World Economic Forum, 15 Jan. 2024, https://www.weforum.org/publications/longevity-economy-principles-the-foundation-for-a-financially-resilient-future/.

- “Japan Individual – Deductions.” PWC Worldwide Tax Summaries, 9 July 2024, https://taxsummaries.pwc.com/japan/individual/deductions.

- “2024 Denmark Global Money Week”. Global Money Week, Aug. 2024, https://globalmoneyweek.org/countries/155-denmark.html.

- Meineke, Michelle, “Can You Answer These 3 Questions About Your Finances? The Majority of US Adults Cannot.” World Economic Forum, 24 Apr. 2024, https://www.weforum.org/agenda/2024/04/financial-literacy-money-education/.

- Casanova, Fernando, et al., “World Insurance: Strengthening Global Resilience with a New Lease on Life.” Swiss Re Institute, Mar. 2024, https://www.swissre.com/dam/jcr:2d26 776f-20e4-4228-8ee0-97cec2ddb3c4/sri-sigma3-2024-world-insurance.pdf.

- Goh, Daniel, “Financial Literacy Across Asia Declining; Mastercard.” Young Up Starts, 29 Apr. 2015, https://www.youngupstarts.com/2015/04/29/financial-literacy-across-asia-declining-mastercard/.

- “Promoting Financial Literacy.” Financial Supervisory Commission, 2024, https://www.fsc.gov.tw/en/home.jsp?id=396&parentpath=0,261.

- “2023 Results of Financial Inclusion Indicators for Taiwan.” Financial Supervisory Commission, 16 May 2024, https://www.fsc.gov.tw/en/home.jsp?id=54&parentpath =0,2&mcustomize=multimessage_view.jsp&dataserno=202406120001&dtable=News.

- “Overview of the J-FLEC.” Japan Financial Literacy and Education Corporation (J-FLEC), 2024, www.j-flec.go.jp.

- Cole, Shawn, et al., “Evaluating the Effectiveness of a Financial Literacy Program in South Africa.” Poverty Action Lab, 2014, https://www.povertyactionlab.org/evaluation/ evaluating-effectiveness-financial-literacy-program-south-africa#:~:text=To% 20improve%20financial%20literacy%20and,profits%20to%20financial%20education%20programs.

- Sibanda, Sibongile, and Tawanda Sibanda, “Financial Education in South Africa : Overview of Key Initiatives and Actors.” ILO, 2016.

- Staib, Daniel, et al., “World Insurance: Riding Out the 2020 Pandemic Storm.” Swiss Re Institute, 12 June 2020, https://www.swissre.com/dam/jcr:05ba8605-48d3-40b6-bb79-b891cbd11c36/sigma4_2020_en.pdf.