The Space Debris Dilemma

IIS Executive Insights Cyber Expert: David Piesse, CRO, Cymar

“Those who look only to the past or the present are certain to miss the future."— Address in the Assembly Hall at the Paulskirche in Frankfurt (266), June 25, 1963, Public Papers of the Presidents: John F. Kennedyi

in Frankfurt (266), June 25, 1963, Public Papers of the Presidents: John F. Kennedyii

“Humanity is likely past the stage where merely halting new debris is insufficient to curb orbital pollution. It is therefore expedient to not only prevent new debris but also actively remove existing threats through debris remediation.”— Theo Picardiii

“Cyberspace is the soft underbelly of global space networks.”— General Whitingiv

Synopsis

The space industry is vital to humankind for communication and that dependency is now threatened as the lower orbits of space are full of debris requiring urgent clean-up. Without governance, mitigation, and remediation, new satellite launches could become impracticable, lacking licensing, financing, and insurance.

Because third-party liability regulation in space is not well developed, root cause and attribution are difficult, with the operator taking all responsibility of collision risk. Solutions need to be found quickly. This paper looks at the emerging risk problem, the current situation, and what can be done.

The future of space is not guaranteed as space debris risk interacts with climate, cyber, pollution, and solar storm risks at an exponential rate. Space debris poses a significant threat to operational spacecraft, with potential catastrophic consequences. Space sustainability is paramount, with the need for collaboration, data sharing, regulatory standards, and public-private partnerships.

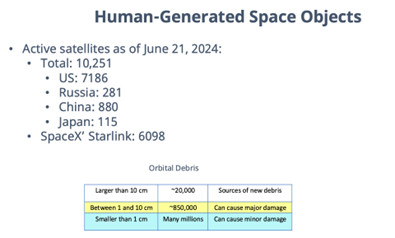

The statistics below show 20,000 large pieces of tracked debris, 850,000 of untracked dangerous debris, and billions of pieces of small debris, all capable of causing damage.

Source: Secure World Foundation (SWF)v

Events Involving Space Debris vi

| Date of Event | Space Debris Event | Information |

| January 2025 | Kenya Debris vii | Massive space object fragment crashes into Kenya village. |

| October 2024 | IntelSat IS 33-E total loss | Loss of power and service to customers. |

| March 2024 | Cargo pallet re-entry | Used batteries from ISS re-entry in sea. |

| September 2023 | Sentenel-1 (EU)—–Near miss | Collision alert—Avoidance and interfered with the Morocco earthquake trace. |

| August 2023 | ViaSat Inmarsat-6 F2 power failure | Post-launch power failure after activating satellite. |

| April 2023 | ViaSat-3 antenna failure | Post-launch failure of the large antenna to deploy. |

| December 2022 | Vega Rocket VV15 launch failure | Rocket explodes after launch, losing 2 Airbus payloads. |

| November 2022 | Long March rocket debris near miss | Chinese rocket broke up and scattered debris in LEO close to Starlink. |

| July 2022 | Space-X debris | Satellite re-entered Earth and landed in Australian farm. |

| February 2022 | Space-X solar storm | Catastrophic damage to 40 Starlink satellites; financial loss of $20 million. |

| November 2021 | Kosmos 1408 | Anti-sat test threatened ISS with debris cloud. |

| March 2021 | Yunhai-1 | Chinese satellite collision with debris. |

| March 2021 | Florida home eventviii | ISS debris survives burn and crashes through Florida home, giving rise to lawsuit against NASA. |

| 2018-2019 | Atlas V Centaur | 3 fragmentation events spreading debris from a rocket break-up. |

| February 2009 | Kosmos Iridium collision | Military satellite collided with communications satellite, spreading debris. |

| January 2007 | Fengyun-IC | Anti-sat test on weather satellite, largest fragmentation in history. |

| July 1979 | Skylab re-entry | Space station comes down in the sea. |

| January 1978 | Kosmos 954 re-entry | Failed satellite spread radioactivity in Canada, which wins a lawsuit against Russia. |

| June 1961 | Ablestar | Rocket explosion with 300 pieces of trackable debris. |

There have not been many collisions in space to date, as seen in the above event table, where most events are break-ups, explosions, and debris collisions.

Definitions

Active debris removal (ADR)— Methods for removal of space debris in orbit

Anti-satellite weapons (ASAT)—Counterspace military attacks on satellites

Atmospheric drag—Natural gravity forces that eventually pull space objects back to Earth

Causal AI—Application of causal reasoning, root cause analysis, and explanation

Constellations—Multiple satellite launches; with satellites flying in clusters.

Decommissioning security agreement (DSA)—Escrow agreement for space bonds

End of life (EOL)—The end of the lifespan of a spacecraft, labelling it as defunct

European Space Agency (ESA ix)—European space intergovernmental organization

Geostationary orbit (GEO)—Orbit in space for fixed telecommunication satellites

In-orbit servicing (IOS)—Ability to repair and refuel satellites in space

Insurance-linked securities (ILS)—Capital market insurance structures

International Space Station (ISS x) – research station in space 250km above Earth

International Telecommunication Union (ITU)—agency regulating satellite radio frequency

Japanese Aerospace Exploration Agency (JAXA)—agency supporting aerospace in Japan

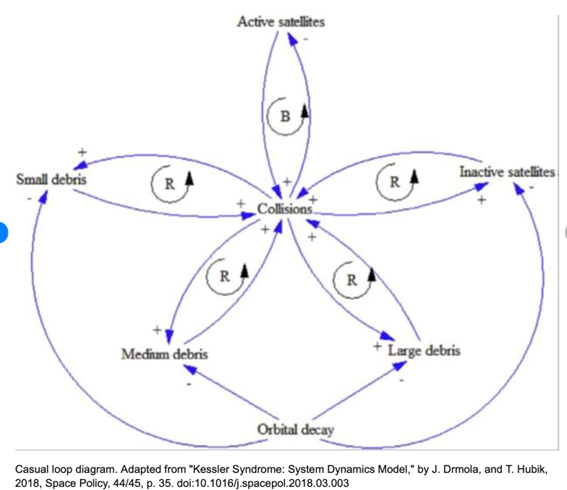

Kessler Syndrome – cascading chain reaction of collisions between orbiting objects in space

Low Earth orbit (LEO)—The orbit closest to Earth where many satellites are located

Micrometeoroid – a fragment of a meteoroid or asteroid colliding with debris in space

Mission extension vehicle (MEV xi)—Vehicles used for ADR and IOS

Middle Earth orbit (MEO)—Communication satellites for North and South Poles

National Aeronautics and Space Association (NASAxii)—USA space regulation agency

Post-mission disposal (PMD)—Mechanism on spacecraft disposal at EOL

Redundancy – many satellites are launched together, and operators can afford to lose some

Research and development (R&D)—Private industry investment in space

Remote proximity operation (RPO)—Close IOS space maneuver conducted by MEV

Secure World Foundation (SWF)—Organization that promotes space sustainability

Space debris reclamation bond (SDRB)—A proposed bond to help clean up space

Space situational awareness (SSA)—Awareness of spacecraft debris and tracking

Space sustainability rating (SSR)—A rating system for good space management

Space traffic management (STM)—The means and rules to navigate space

Spacecraft—Collective term for satellites, rocket bodies, and launch materials

Tragedy of the commons—A condition in which people who have access to a shared resource act in their own interests and eventually deplete the resource

World Space Sustainability Association (WSSA)—Organization that encourages public-private partnerships for space-related projects

Introduction

The space industry is currently valued at $570 billion and growing at around 8 percent annually.xiii Venture capital entering the space sector increases the number of satellites and correlates to overall debris. With a lack of remediation strategies, the probability of collisions in low Earth orbit (LEO) and geostationary orbit (GEO) rises dramatically. Space sustainability and collision risk is addressed by managing safe operation of spacecraft and removing existing debris, with prioritization based on risk factors. Internationally, space sustainability is overlooked (no UN Sustainable Development Goal focuses on space), so this must be integrated with Earth sustainability to educate decision-makers.

Risk and liability transfer mechanisms are needed to force operators to take responsibility and share overall economic risks. Countries must create regulations with international cooperation to create a fair playing field to support new market entrants, especially Africa. The European Space Agency (ESA)’s guideline reduction from 25 to 5 years that defunct satellites stay in orbit increases pressure for removal; but operators must ensure that all assets are removed at end of life (EOL).

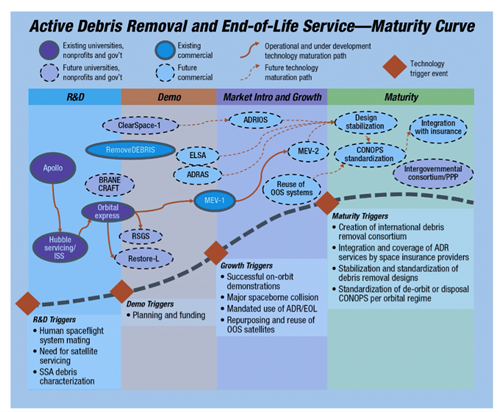

Waiting for global regulation will lead to a poor outcome for the space industry. Active debris removal (ADR) services need to be implemented post haste where satellites are unable to be removed as part of a normal post-mission disposal (PMD) procedure. ADR companies should focus on cost reduction.

Because the technology is expensive, exploring downstream funding to spread the financial burden draws a parallel with climate risk. This could be financed by governments or via a mechanism adhering to the “polluter pays” principle.xiv Insurance underwriters assess the risk, determine the loss probability, and set premiums to offset claims.

Insurance today plays a minor role for satellite operators due to the lack of financial incentives for debris removal. Claim payouts have significantly surpassed premiums, causing insurers to withdraw and rendering some missions uninsurable. (Re)insurance can be a powerful tool to spread the financial burden and raise funds for ADR as long as there are clear regulatory frameworks.

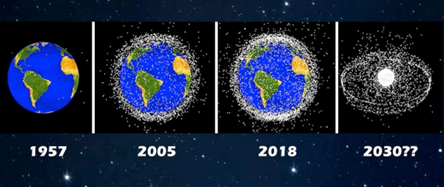

The escalating issue of space debris can be addressed by providing financial incentives such as reclamation bonds for operators to de-orbit their defunct satellites. The proposal emphasizes the need for international cooperation and regulatory buy-in as insurance alone does not fix the issue. This is how the UN addressed mining operation clean-up in the 1980s. This is serious and urgent attention is required now, as the following diagram shows.

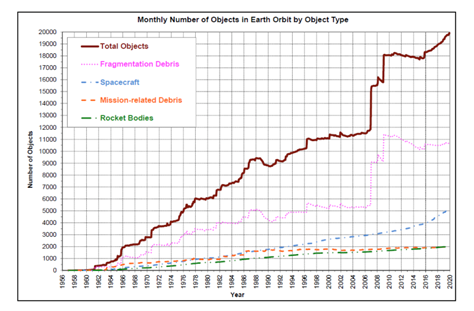

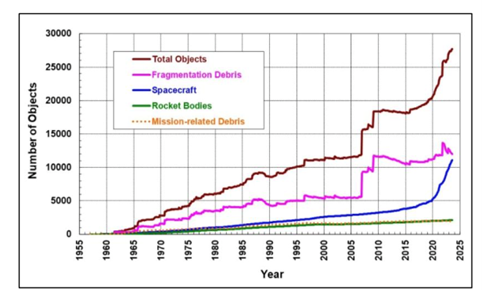

Source: NASA Total Number of Objects in Earth Orbit

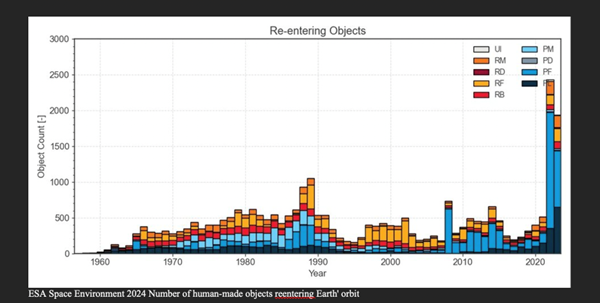

Since the launch of Sputnik in 1957xv, space debris has accumulated on Earth’s orbits. Larger objects are tracked by the U.S. Joint Space Operations Centre,xvi which makes orbital data available. However, there are larger number of smaller objects, not tracked or trackable.

The increasing amount of space debris represents a risk for satellite missions. Depending on the size and the relative impact velocity of objects, collisions could cause considerable damage to satellites. In some regions, the spatial debris density is already so high that a collision could result in a cascading effect, known as the “Kessler Syndrome,”xvii when two or more objects collide and set off a chain reaction. Around 20 percent of all LEO satellites could be rendered inoperable within 6 months of this syndrome being triggered.

Source: NASA

Sustainability Challenges

Attention needs to be drawn to the Space Protection Initiative proposed by Mike Mainelli in his tenure as Lord Mayor of London 2023/2024.xviii

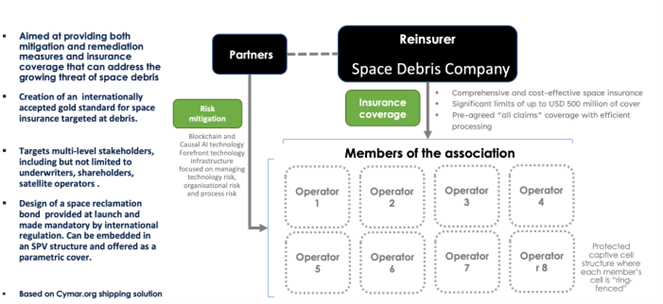

The objective needs government to make space reclamation bonds mandatory and requires proof of adequate financial means for retiring unused spacecraft materials before permitting launch, orbit, licence registration, or ground station use. The global insurance market has offered limits of up to $500 million per operator as long as a spacecraft company demonstrate de-orbiting of third-party space debris with mandatory governance in place to use the bonds.

The diagram below shows the extent of the debris problem: 38.5 percent of the UN sustainable development goals cannot be met without space for positioning, telemetry, and observation.

Source: Lord Mayor Space Protection Initiative

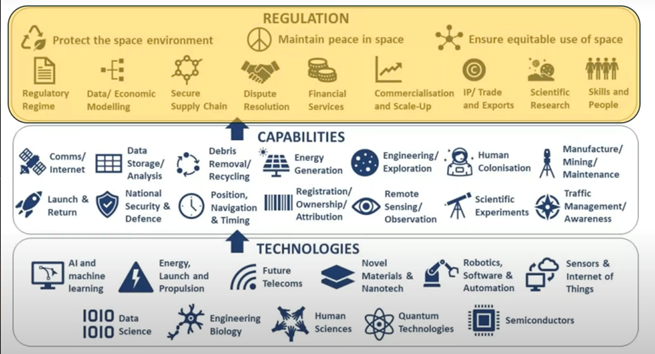

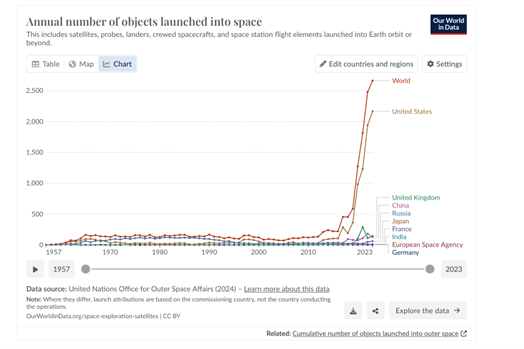

The chart below illustrates the steady increase and diversity of space actors and activities.

Source: United Nations Office for Outer Space Affairsxix

Negative third-party effects could have serious impact as few mandates or regulations exist, with much of the space governance network based on norms. There are four main treaties: the Outer Space Treaty of 1967,xx the Registration Convention,xxi the Liability Convention,xxii and the Rescue Agreement,xxiii and all focus on identifying responsible behavior.

Counterspace or anti-satellite weapons (ASAT) test activities add to space debris problems. These are attacks on satellites in orbit from weapons such as laser, microwave, or electronic radio frequency warfare. Counterspace capabilities are not new, but they grow in line with technology and should face a moratorium as they pose a direct threat to future economic activity in space (particularly LEO), raising the cost of operations and creating uncertainty/ risk to vital constellation satellites such as Starlink.xxiv The Secure World Foundation (SWF) coordinated an industry statement in support of an ASAT missile test moratorium.xxv

Source: Secure World Foundation (SWF)

Insurance Market Solutions

Space assets are capital intensive, so before financing, insurance is required. Insurers engage early to get detailed information from the manufacturer about technology and business plans. The insurance market offers space insurance policies for pre-launch, launch, in-orbit, and third-party liability. They cover risk to the spacecraft, not space debris clean-up, and are subscription based, covered by multiple insurers. Prelaunch covers material damage when transporting spacecraft from manufacturer to operator launch site; and launch cover follows, then in-orbit cover while the satellite is active. Although two-thirds of contracts cover launch plus one year of orbital activities, only 1 percent of LEO satellites and less than one-third of satellites in GEO and middle Earth orbit (MEO) satellites are insured.xxvi

Mandatory third-party liability is subject to regulatory jurisdiction, covering damage to other satellites, terrestrial property, bodily injury during (pre)launch, aircraft damage, or space debris falling to Earth. Most launches are insured but not all satellites in orbit, especially if operators have redundancy of loss via constellations without debt covenants. SpaceXxxvii self-insures and most insurance clients are communication satellite providers of TV video broadband in GEO or clients in LEO for imaging satellites/remote sensing. NASA outsources contracts to private companies which transfer the risk.

In-orbit servicing (IOS) can refuel and build spare parts in orbit. IOS maturity will add depth to the cover by being able to define whether the satellite can carry out its intended purpose, fully or partially, as in communication satellites operating the transponders to end of life (EOL).

Underwriters need to know brand track records and failure rate, to price accordingly. Once the satellite is activated in orbit, design faults can emerge where losses affect the rating. Insurers buy historical space data to model with no industry standard models. Fuel margins and redundancy to cover the risk are built into the policy for decommissioning at EOL.

In LEO, the collision risk from debris is higher as satellites are going faster in all directions. If there is a notable catastrophic collision, it will change the risk profile. Regulators are asking operators to make sure satellites are safe for deorbit. The satellite operator assumes all third-party liability risk and needs to buy it.

Lloyds of London has realistic disaster scenarios such as solar flares and applying counterfactuals on what happens if 5 percent of every satellite failed; or accumulation risk where several satellites made by the same manufacturer have a defect manifesting down the timeline, leading to product liability. About 50% of the premium goes into the reinsurance market as quota share alignment, but the risk is uncorrelated and diversifies portfolios.

Space is a volatile market, and a loss-making year can be due to one launch. Lloyds underwrites one-third of the global space market. Rates decrease every year as technology improves. War risk exclusions are similar in effect to shipping, and there are geopolitical issues around ASAT capabilities.

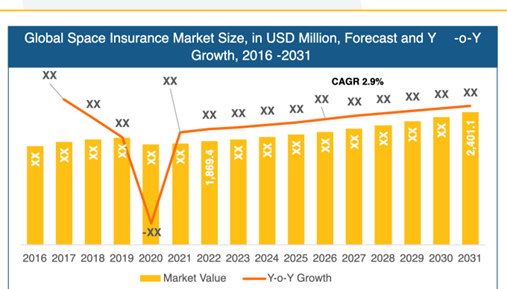

In terms of overall market share, space insurance currently makes up 0.02 percent of the entire insurance market.xxviii There are a small number of insureds and high severity of losses, with a volatile underwriting capacity reacting to recent loss events.

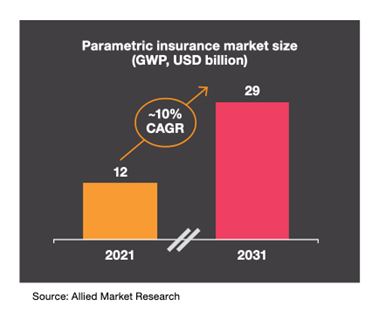

A key challenge is that spacecraft cannot be examined if something goes wrong. Parametric insurance when data is available would address an event and be more suitable to addressing the risk than indemnity.

Source: Growth Market Reports Analysis

The 2022 Vega C rocket explosionxxix is a poster child for the volatility involved in space sector insurance, with a single accident that year representing a major loss. The ViaSat-3 failures in 2023xxx represented $1 billion of potential liability, and the recent total loss of the Intelsat 33e in 2024xxxi has continued the trend.

Total premiums collected annually after 2016 did not cover the claims and in 2023/24, claims exceeded premiums, causing rates to rise. It is preferable to look at the capital market ILS vehicles so capacity is not impaired by recent losses.

Mitigation of risks plays a key role in the economic value of IOS. The insurance and the IOS markets have strong reason for collaboration. IOS operators face difficulties in obtaining insurance for their missions due to uncertainties in the operation of liability, jurisdiction, and governance. Insurers lack historical data and technical insight to evaluate IOS mission risk. Future IOS operations with space situational awareness (SSA) capabilities will generate data to improve insurance pricing.

Space Debris Modelling

NASA/ESA have material risk to their spaceflight programs from space debris derived from manmade objects and meteoroids traveling faster than orbital debris. Together, untracked and invisible, they are known as micrometeoroids and orbital debris (MMOD),xxxii posing the biggest risk to spacecraft.

NASA uses a risk mitigation and assessment tool, Bumper,xxxiii with historical datasets to determine probability of a spacecraft being damaged by MMOD during its operational lifetime. This runs alongside the orbital debris model, ORDEM 3.0,xxxiv which studies how each exposed component will behave when hit by a debris particle. Causal reasoningxxxv accurately improves this risk by magnitude and direction.

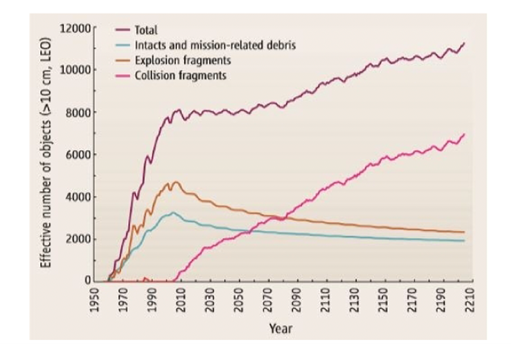

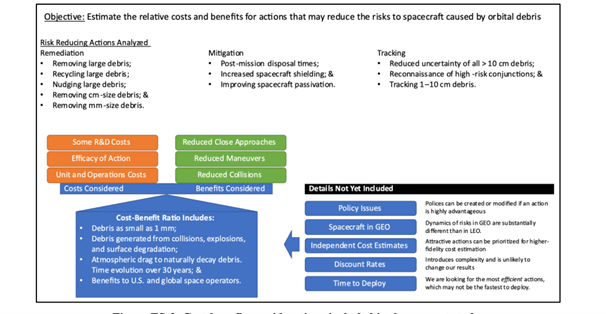

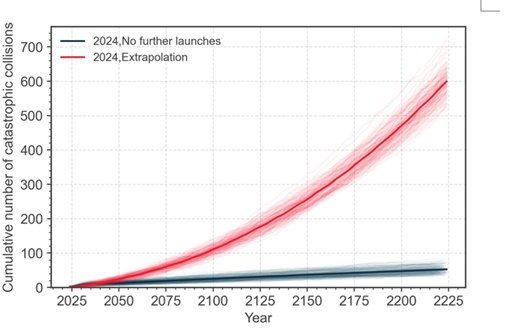

NASA’s aim is to assess the space debris environment and predict effects of future launch traffic and space operations on the near-Earth space environment, with efforts to reduce orbital debris accumulation by mitigation and remediation. The following diagram shows the long-term modelling growth of debris without remediation.

Source: Obrata Space Solutionsxxxvi Historical and Predictive Growth of Large Debris

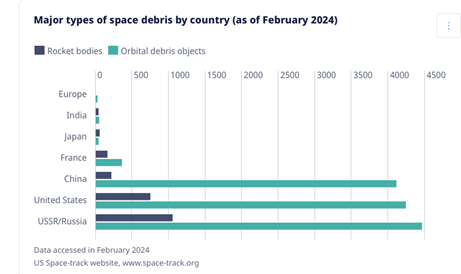

Focus is on the statistical modelling of space debris not visible from Earth. The orbits of larger objects (those >10 cm) are tracked using ground-based sensors and catalogued by U.S. agencies, as seen in the chart below. 25% of tracked objects are debris from nominal space operations and are intentionally released during missions. About 50% are created by fragmentation events, so 75% of tracked objects are debris.

Source: NASA Growth of Tracked Objects

High numbers of small untracked debris are estimated by models simulating verified, historical space debris fragmentation events and generating a forecasted debris cloud. Particles modelled are the result of fragments from spacecraft explosions or collisions, followed by particles from solid rocket motors, and then paint flakes.

Orbits facing the highest collision risk range are from altitude 800 to 900 km where Earth observation and sun-synchronous satellites reside, so avoidance manoeuvres must be performed. The spatial density of debris here is high and the Kessler Syndrome is plausible.

Catastrophic collisions have not contributed to debris generation to date and occur statistically 1 in 10 years; but with many satellites in orbit, that is a high return period. Debris Risk Assessment and Mitigation Analysis (DRAMA)xxxvii is used to assess the risk of a catastrophic impact for a specific mission. LEGENDxxxviii is a 3D orbital debris model that simulates historical/future debris populations in the near-Earth environment, using Monte Carlo deterministic simulation xxxix, to reproduce known historical populations. Previous launches of spacecraft are added as they occurred over time with influences of atmospheric drag.

The prediction of large tracked space objects re-entering in an uncontrolled manner and risk on the ground must be modelled and it is difficult to pinpoint a country or city. Using geographical datasets, superimposition of the expected ground tracks from a particular orbit estimates the probability of ground damage and requires the accurate understanding of a subject matter expert on what portions of a disintegrating spacecraft reach the ground. An effective mitigation measure is passivation (the removal of stored energy), including residual fuel, compressed fluids, and electrical storage device discharge from spacecraft at EOL, which causes explosive breakup.

Active In-Orbit Debris Removal (ADR)

ADR is the active removal of large debris from orbit as a means of reducing the debris hazard. The cost is high for the amount of debris that can be removed whatever the method used to deorbit large objects in LEO, especially for small debris.

Source: Clearspace

There are ADR schemes for small debris such as sweepers and ground/space-based laser evaporation of surface material to de-orbit small debris. The future debris hazard can be mitigated at less cost by reducing the number of breakups of spacecraft. De-orbiting or accelerating the orbital decay of spacecraft at EOL can reduce the debris, as can re-orbiting them into disposal (graveyard) orbits, but this is not sustainable as the debris remains in Earth orbit and is not viable for LEO.

Even if all launches stopped, larger pieces of debris will still continue to break up at four to five a year, so debris in orbit would continue to increase and orbital regions could become unusable due to the high density of space debris.

Other active space debris removal concepts—such as electrodynamic tethers, adhesive techniques, solar sails, orbital transfer vehicles, and drag augmentation devices—all necessitate international collaboration, financial support, and the relaxation of international laws to develop a cumulative removal solution that considers international space law responsibility and liability. Launches must include both effective PMD plans and collision avoidance mechanisms.

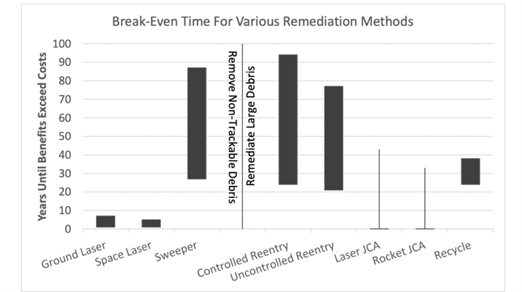

When tax laws and subsidies are linked to the commitment to remove debris of a particular satellite after the completion of the lifecycle, the debris generation problem can be mitigated at the ground level. The diagram below shows the cost effectiveness of the laser method over the sweeper method.

Source: NASA

The risk to people on Earth is low as debris burns up on re-entry; but risk is high on the International Space Station (ISS) and for astronauts. However there are recent events in Kenya (2025) and Florida (2024) where space debris has made landfall without burning up. There are no binding international rules governing the management and prevention of the growth of debris in space. Space-faring countries have established guidelines, but they are not sufficient to guarantee a sustainable space environment. ESA reduced duration of the disposal phase in LEO from 25 to 5 years.xl

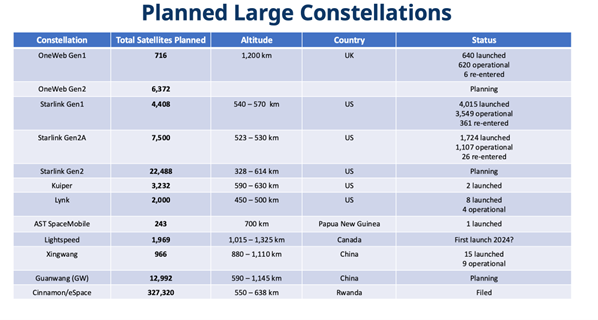

A catalyst for growth is the proliferation of commercial satellite constellations, particularly those designed to deliver broadband internet via LEO. Projects envisioning thousands of satellites promise to revolutionise connectivity and expand digital access globally, but also raise legitimate concerns about environmental impact. Tracked debris objects account for 4% xli of total activity, which could skew risk analysis among stakeholders by artificially lowering costs of operating safely in space when billions of pieces of untracked debris still exist.

A few operators are responsible for catalogued space debris objects. This highlights the need for co-ordinated international efforts to mitigate debris creation while imposing fines on non-compliant spacecraft operators to avoid a “tragedy of the commons” situation shutting out new entrants from emerging countries.

Source: US Space Track xlii

Debris objects stem from inadequate EOL strategies, such as the lack of passivation (PMD). Economic impacts are estimated at $191 billion at risk globally,xliii but disrupted services and environmental damage are harder to quantify. As objects move in LEO at 17,000 mph, the impact of even a paint flake can cause significant damage to existing infrastructure, generating more debris. There can be effective cost-benefit analysis of debris clean-up (remediation) methods as robust data on the number of objects in space exists. In summary, small debris should be removed, and large debris should be nudged to prevent collisions and achieve meaningful results.

Source: NASA

Mitigation includes reducing the time defunct spacecraft remain in PMD, increase shielding on spacecraft to protect against debris, and passivating the spacecraft to eliminate explosion. The smaller centimetre-sized debris must be tracked while reducing uncertainty of existing tracked debris. Remediation actions remove/recycle large debris, nudging them to eliminate collision risk and removing millimetre-sized debris.

Remediation capabilities can provide similar risk reduction per dollar as tracking/mitigation, especially just-in-time nudging, equate to collision avoidance. Nudges can be done by ground- or space-based lasers, sounding rockets that release dust to increase drag on the debris, and lasers to remove centimetre-sized debris. The ROI may return benefits that are 300 times the cost. The following illustrates a cost-benefit analysis.

Source: NASA

Regulation of Satellites in Earth Orbit

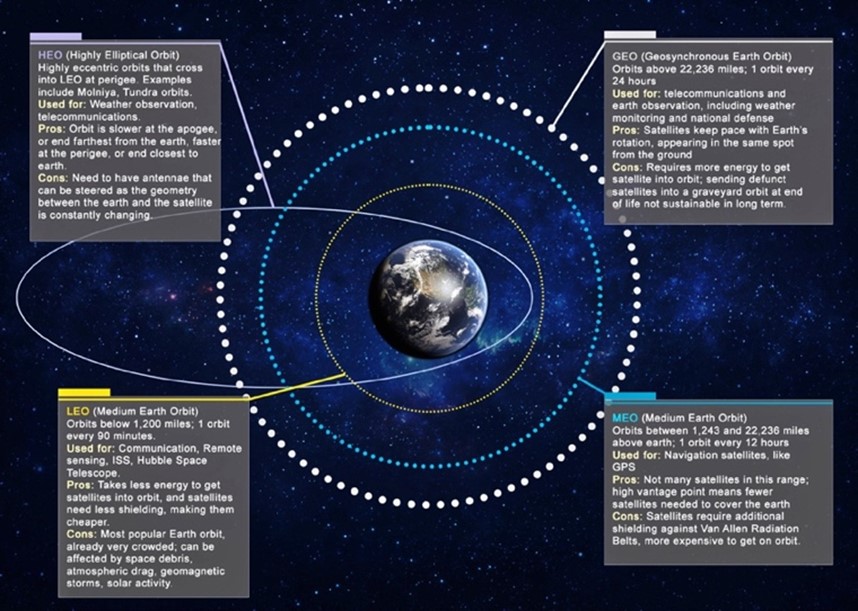

Orbits are classified into four types, based on their orbital characteristics:

Source: Space System Command xliv

- Low Earth orbit (LEO), between 200 and 2,000 km above the Earth’s surface

- Middle Earth orbit (MEO), located mainly between 8,000 and 20,000 km above the Earth’s surface

- Geostationary Earth orbit (GEO), fixed at 35,786 km above the equator

- Highly elliptical orbit (HEO), 40,000 km from Earth at the farthest point of the orbit

The International Telecommunications Union (ITU)xlv allocates frequencies and positions (GEO satellites) or orbital characteristics (LEO satellites) for every radio transmitting and/or receiving satellite in each orbit, recording all allocations in the Master International Frequency Registerxlvi (MIFR). Satellites positioned in orbit travel around the globe at the same speed the Earth rotates. Each GEO satellite always stays in the same fixed position and connects by pointing an antenna at the satellite. LEO satellites have faster communication and lower latency as they are smaller and cheaper to build and launch. Thousands of LEO satellites are active in orbit and new versions complement them for seamless connectivity.

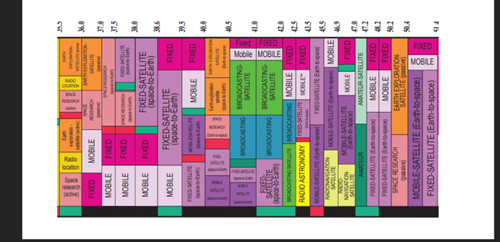

Regulation addressing liability around damage for small pieces of space debris will not precede those addressing a catastrophe event such as a destructive ASAT, massive collision, or several large collisions occurring close together. Whether the cause is hostile or accidental, any orbit becoming a dangerous passage would be a national security concern. ADR technologies are currently funded by organizational R&D, but the overall ADR industry needs government and regulatory support because of the impact on communications. Satellite constellations rely on the radio-frequency (RF) spectrum which is now congested. Radio regulations are maintained by the ITU to ensure reliable satellite operation by allocating RF to those services and coordinating the orbital positioning of different satellites.

Source: Secure World Foundation (SWF)

Both radio spectrum and orbits around the Earth are finite resources, necessitating international cooperation among governments and global regulation backed by structured coordination among radio and satellite operators. As the number and size of satellite constellations grows to meet demand, space must be well managed to ensure sustainability.

Governments need to create a regulatory framework around spectrum allocation. The global satellite communications market will reach $40 billion to $45 billion by 2030, up from $25 billion.xlvii LEOs are expected to contribute 40 percent of the market. Starlink and Eutelsat-OneWeb have more than 4,500 satellites in orbit, with speeds of 25 to 150 mbps and latencies of 25 to 60 ms on land. These satellites enable precision farming, fleet management, public transport, and direct-to-cell (D2C) text messaging over mobile phones. Satellite broadband communication on aircraft and ships in motion meet an increasing need for continuous connectivity along travel routes: Low LEO satellites will benefit connectivity and functioning in agriculture and mining.

As a global enterprise, no single entity can regulate the entire industry, so governments must collaborate. Operators today navigate national and international regulations to secure landing rights, service licenses, ground equipment, and ground station gateway licenses from individual regulators, which is why only a few achieve global scale.

Some countries balk at granting operating licenses with concerns over sovereignty and cybersecurity. Expanding LEO satellite numbers increases the risk of more RF congestion and interference, so ITU may have to revise its thinking on spectrum allocation to establish frameworks and standards on how satellite frequencies can be shared.

This would end the practice of spectrum warehousing, where operators reserve spectrum to block competitors. ITU has already implemented regulations to curb this practice and free up underutilized spectrum bands. By 2040, 100,000 defunct LEO satellites could be in orbit. Space debris is not the current purview of the ITU and is done at the country level. This should change to international collaboration under a clear regulatory body for space debris.

Ground stations enable communications with satellites and grow proportionally. Because of the speed of technology development, legislation and regulations related to ground stations are laggard, with different countries having specific regulations. At the ITU Plenipotentiary Conference in 2022,xlviii member states raised important issues to enhance ITU’s role in regulating the use of satellite communications and long-term sustainability of the RF spectrum and associated orbit resources in non‑GEO.

Outdated space treaties and sluggish domestic regulatory frameworks mean there is little modern governance in outer space. The 1967 Outer Space Treaty and the 1972 Liability Convention form the cornerstone of international space law. Responsibility for outer space activities falls on the country that carried out the launch or situations where a country fails to prevent or punish private players whose conduct violates international law.

There are some norms established, such as the United Nations Committee on the Peaceful Uses of Outer Space (COPUOS),xlix the European Union Code of Conduct,l International Code of Conduct for Outer Space Activities,li and industrial standards; but they have no teeth. Licences at the country level remain the governance and all are at different speeds of development. Many do not have laws that mandate orbital debris removal and legal implications for noncompliance.

Space Situational Awareness (SSA)

In the worst-case scenario, space debris can destroy a satellite, so preventative collision avoidance manoeuvres are required. These manoeuvres are more frequent due to the congested space environment; they burn up fuel and shorten a mission’s lifespan. ESA is therefore actively supporting and undertaking clean-up activities as shown below.

Source: ESA

Earth’s orbit could be likened to a graveyard for spacecraft. Space debris is caused by non-operational satellites, spent rocket upper stages, launch adapters, and lens covers. Debris events are caused by spacecraft explosions, ASAT testing, and non-fragmentation debris such as copper wiring from space missions.

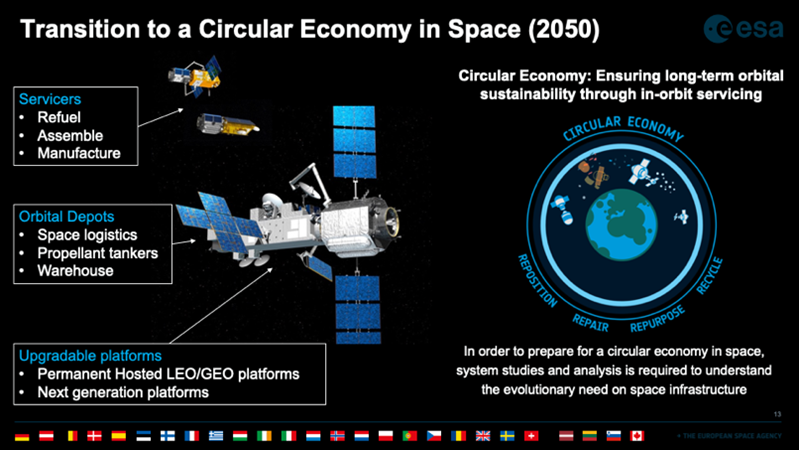

ClearSpace-1lii, launching in 2026, plans to capture a piece of debris left by a rocket in 2013 and bring it down for safe atmospheric re-entry, where spacecraft and debris will burn up. Other removal concepts include laser remote energy impact, full or partial recycling, capture and tug by another spacecraft, and methods of slowing down and deorbiting the debris. Although there have been no clear commitments from governments yet, it seems clear that the only way forward is for the removal of space debris to be publicly funded. The following diagram shows a transition to recycling.

Source: ESA

SSA is the way to understand and manage the crowded space environment. It involves tracking, identifying, and characterizing space objects, including active satellites and debris, to ensure safe space operations and mitigate collision risks. Data sharing is a key component, enabling entities to exchange information for improved space safety and involves data collection methods, sharing protocols, international cooperation, and applications in space debris mitigation.

Detailed data sharing on satellite orbits, manoeuvres, RF emissions, space weather, and debris monitoring help satellite operators avoid collisions, reduce radio interference, and track risks, enabling better space traffic management (STM). Many operators keep their satellite data proprietary. Data silos undermine SSA as data sharing is critical as satellites increase and operators compete for market share.

Challenges are data privacy laws, moving data at rest, and sharing large volumes of satellite data, which require investment in tools, platforms, and standardization. These high costs can deter data transparency efforts.

There is no gold standard for formatting or communicating satellite data between different operators. Clearer policy frameworks could require stakeholders across the space sector to come together and build a cooperative foundation for broader data sharing, with strict transparency requirements for launch or orbital licenses and technical standards for data exchange. The growth of large constellations could be the catalyst to get these standards and regulations in place.

There is a need to access AI and SSA in conjunction when looking at data sharing for space debris. The capacity to collect/analyse large data volumes, predict a course of action, and make autonomous decisions enables more accurate identification of space debris orbits and collision risks, as well as a distinction between non-functional and functional space objects.

The Space Sustainability Rating (SSR) is an organization that provides a rating system informed by dataset assessments of sustainability levels, space missions, and operations, and a shift on how sustainability practices are measured. By voluntarily engaging with the SSR, space actors demonstrate commitment to a composite index to reduce the risk of space debris, on-orbit collisions, and unsustainable space operations.

The Lloyds Market Association (LMA)liii is collaborating with governments and industry experts to develop a Kitemark for sustainable space exploration.liv A Kitemark is a UK quality trademark used to identify products where safety is of paramount importance. Lloyds insured the first commercial satellite in 1965 and is highlighting space debris dangers by launching Our Fragile Space, a touring exhibit that illustrates the impact of the increasing amount of space debris in the near-space environment.lv

Causality and Causal Reasoning (Causal AI)

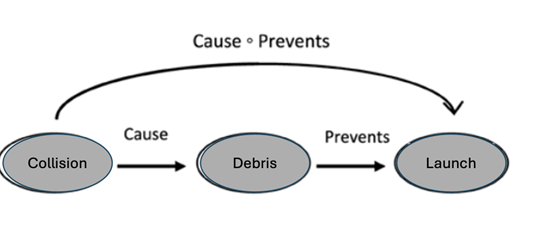

NASA used causal analysis for early space projects to arrive at viable solutions as experimentation via statistical methods could result in catastrophic destruction of spacecraft and crew. Thousands of experiments would be required to land and return spacecraft to Earth. The space debris problem can be analysed as a tragedy of the commons cause.

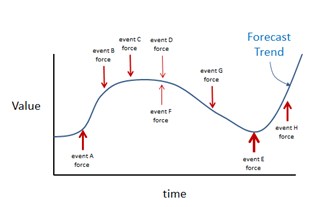

Causal AI can determine the efficacy of debris mitigation/remediation by explaining the root cause of the problem. Causal diagrams showcase the problem to identify causal relationships. The causal links between variables will identify recurring behaviour and develop baselines. Back testing and reinforcing feedback closes the gap between the actual and desired outcomes.

Source: Author

A baseline is made up of positive and negative forces relevant to the space debris issue. Events apply upward and downward forces, causing the forecast trend to increase or decrease over time. This is direction. The magnitude of the event forces is indicated by the size of their respective arrows. If these forces are known, the forecast trend can be determined at any point in time and predicted for future periods across timelines and move outcomes generated to the desired outcome using the magnitude and direction vectors.

Source: Eumonics lvi

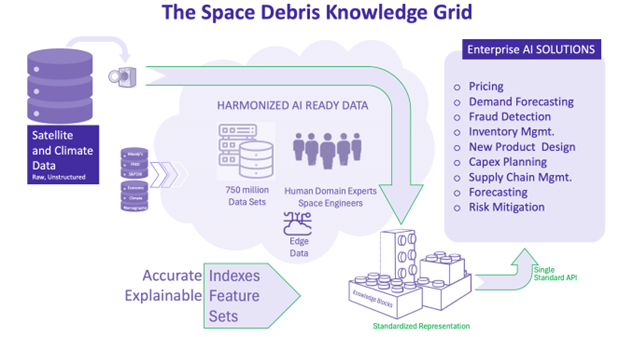

This enables prediction of future problems and explanation of past ones. The observed space debris environment is accurately reproduced using ensemble modelling.lvii The Knowledge Grid is a wholesale platform that encompasses embedded high-value solutions around a subject matter to leverage knowledge, in this case space debris. This is the capture, storage, and reuse of knowledge from space subject matter experts.

Source: Vulcain.AI lviii

Causal concepts have rarely been applied to understand the holistic view of the space debris problem. Engineering-based approaches are linear, whereas causality external force implications highlight the importance of observational data. Existing causal models concluded that space debris would continue to grow and that orbit-carrying capacity was nearing the maximum.

The interaction between variables involved in the problem is visualised by explaining the relationship between the variables, what causes what, and how it affects either positively or negatively. Datasets derive from NASA, ESA, and other space agencies and subject matter experts are used with other sector datasets.

Causal diagrams contain the number of successful and failed satellite launches, and the number of satellites carried by each mission. Both the self-removal and external removal methods are expensive because enough fuel needs to be in the rocket body to move inactive satellites into the LEO region after EOL. Since these debris fragments are no longer functional, it is challenging to manoeuvre them into low orbits where atmospheric drag can gradually reduce the orbital energy until they finally reach LEO.

There is a reinforcing loop between variables collision probability and collisions. As the collision probability rises, so does the number of collisions. As the number of collisions increases, the collision fragments will collide with already accumulated debris and active satellites, and the size of the debris will decrease to subcritical sizes that would be difficult to label or catalogue. In addition, the lifespan of the satellite is a variable as it can be 5 to 15 years depending on orbital position, atmospheric drag, radiation exposure, and design quality. A causal loop diagram addresses space debris here.

In-Orbit Servicing (IOS)

IOS is the ability to refuel and repair satellites in space such as the Mission Extension Vehicle (MEV), a spacecraft that extends the functional lifetime of another spacecraft in orbit. The emergence of IOS is underpinned by technology trends and funded by private and public markets in direct response to secure the orbital environment and establish a circular space economy.

Insurers can liaise with IOS providers to determine the cost of decommissioning satellites and underwrite accordingly, both at the nose (existing satellites) and tail of the risk where no cover is currently available. The extent of this cover depends on the operator’s paying additional premium and underwriters’ risk appetite.

In excess of 20,000 pieces of trackable space debris orbit the Earth, and more than 12,000 satellite launches are planned in the next decade, which will then need to be placed in designated orbits.

Source: Secure World Foundation (SWF)

If space debris causes inaccurate placement in orbit from launch, excess stored satellite fuel is consumed, limiting satellite lifespan and value delivery, causing a reassessment of insurance risk models and pricing.

The risk assessment complexity grows in line with the volume of space debris. Clauses specific to space debris mitigation measures, collision avoidance protocols, and EOL disposal plans are now entering insurance policies, such as allowing satellites to re-enter the stratosphere and burn down before crashing on Earth. There is a reliance on satellite tracking systems, manufacturers, spacecraft owner-operators, payload users, and launch service providers to provide data.

Source: ESA

Another factor is that 2025 has a high level of solar activity caused by the peak in the current solar cycle. This intense space weather causes an increase in atmospheric drag, which contributes to accelerated re-entry times. Despite the improvement in mitigation efforts, a lack of compliance and remediation meant that 2023 still saw a net growth of the space debris population.

ESA aims to limit the production of debris in Earth and lunar orbits by 2030 through the Zero Debris approachlix and the Zero Debris Charter,lx which has been signed by 12 countries and 100 commercial/non-commercial entities. Even if no new space debris was created, it would not be enough to avoid exponential collisions and fragmentations, as shown below.

Source: ESA

ESA conducts active debris removal via missions such as ClearSpace-1, attempting to deorbit legacy defunct satellites such as Aeolus,lxi PROBA-1,lxii and Cluster.lxiii Existing objects must be remediated. Mitigation of future debris creation will not reduce the operational and environmental risks of existing objects. Risk from large debris objects in LEO results from legacy governmental activities from space nations.

Commercial SSA and non-Earth imaging capabilities help profile debris objects for safe rendezvous operations. The Astroscale company,lxiv funded by the Japanese Aerospace Exploration Agency (JAXA),lxv is performing the ADRAS-Jlxvi mission to remove a large piece of debris using remote proximity operations (RPO) with a discarded rocket that has been orbiting Earth for 20 years. By taking pictures of the debris to better define the orbit and spin rate, Astroscale can then capture and deorbit it. Most of the pilot programs for debris remediation are in Europe, the UK, and Japan.

Source: Centre for Space Policy and Strategylxvii

Liability Issues

Space debris is a third-party liability issue rather than a first-party loss and lacks attribution. If losses caused by space debris are borne by the injured party rather than by the polluting operator, then that operator lacks incentive to remove debris. Removing debris must be a benefit for the whole space community; requiring an equitable cost split between operators.

Currently the insurance penetration is low, which prevents the economics of debris removal working well. As 99%t of LEO satellites are currently uninsured, mass adoption must be achieved. The traditional insurance market offers property and liability insurance for satellites, with coverage up to 15 years available and likely soon to extend coverage to IOS costs.

The challenges are a lack of governance to remove defunct satellites and assigning attribution. Multiple insurers participate in one launch because of large loss potential. The insurance industry needs to see compliance in STM to require the use of ADR to achieve high post-mission disposal PMD rates. Lloyd’s set up a precedent for salvage returns when underwriters hired the space shuttle Discovery in 1984 to recover two misaligned satellites, Palapa and Westar,lxviiiand bring them back to Earth to avoid a total loss.

Third-party liability is determined by international law such as the UN Space Liability Convention where the launch country is ultimately liable. Through licensing and contracts, the liability is transferred to the launch service providers and spacecraft owner-operators who insure their own liabilities. Tracing the cause (debris impact) to a particular manmade space object can result in a claim against the launching country, but attribution is difficult.

Any damage claim must be presented to the launching state through diplomatic channels within one year of the date of the damages or identification of the responsible party. If they cannot reach a mutual resolution, then a claims commission (arbitration panel) is constituted of one member chosen by each state and a chairperson chosen jointly by both parties under the UN Liability Convention. Private citizens cannot claim directly but can use the Liability Convention to recover for damages domestic tort laws.

A running down insurance clauselxix (RDC) provides coverage for legal liability for claims arising out of collisions and is used in the shipping industry. RDC covers negligence of the party that results in the damage to the property of others and can be used for satellites.

The Reinsurance Solution Proposal for Space Debris Problem

The proposal is to create financial incentives via a space equivalent of tried and tested solutions for other risks in the traditional reinsurance market. This introduces a space debris reclamation bond (SDRB), guaranteeing the funding required for the safe deorbiting of spacecraft at EOL.

Adopting causal reasoning in the modelling would lead to better attribution. A protected cell company and collective buying makes sense for a space station captive association using a rate per satellite. Surplus contributions are invested to boost cash reserves for future claim payments and the majority of the cover comes from the international reinsurance market. The ability to pool cash reserves is beneficial in a volatile industry with a relatively low number of claims yet a relatively high potential cost to individual insurers.

Source: Author adaption from Cymar lxx

This would be established specifically to protect operators for space debris risk. Using protected/segregated cell captive insurance methodology with a parametric policy proposes a gold standard to provide protection capabilities that do not exist or where current risk transfer strategies in the space sector do not meet the growing challenges of space debris risk.

The approach was previously adopted by the insurance industry to cater for insuring capacity risks with common underlying needs such as nuclear power stations, drilling rigs, terrorism and war risk associations, and the International Group of P&I Clubs (IG).lxxi The IG represents 12 individual mutual P&I clubs, which look after the liability needs for some 90 percent of the world’s largest ship operators. The clubs come together collectively under the IG to purchase reinsurance (IG reinsurance contractlxxii, share knowledge, and act as the international representative body to the UN and governance associations.

The SDRB derives from a surety bond issued by insurers to guarantee satisfactory completion of a project by a contractor. The underwriter guarantees an amount equal to the decommissioning sum in return for an arrangement fee and premium. These bonds are used in other industries that operate in extreme environments, such as offshore wind, maritime, and mining, where they are applied to decommissioning operational equipment at EOL and coupled with subsidies and tax incentives. The trigger of the SDRB would be the failure of the satellite, followed by the financial inability of the operator to remedy the issue.

SDRBs provide mandatory financial guarantees for satellite operators to deorbit defunct satellites. If operators fail to deorbit their satellites, insurers will cover the costs, which are around 1 percent of the total decommissioning price based on a 99% or higher successful PMD rate. This means funds are available for deorbiting operations, even if a satellite operator bankrupts. Underwriters evaluate the financial strength of space operators, making it relevant to the bond pricing and discount solvent operators.

The global insurance market has shown support for up to $500 million per operator, provided that they can demonstrate the ability to manage third-party space debris and that regulatory bodies make financial guarantees/bonds mandatory on launch. A decommissioning security agreementlxxiii (DSA) as used in the oil industry needs to be adopted to make the proposal work. DSAs hold monies in trust and have collateralisation provisions such as letters of credit for the smaller operators. Decommissioning expenses are covered by monies held in trust to ensure the space environment is returned to its natural state.

Operators need to commit to the practice of decommissioning their own satellites. For LEO, they are directed to burn up in Earth’s atmosphere and for GEO, to initially move into a graveyard orbit. If the operator is unable/unwilling to do this, then the bond is triggered. Given this requirement, SDRBs would only be available to operators which can deorbit their satellites. Advances in IOS would greatly enhance the proposal.

Lobbying governments to make this mandatory would be ideal; but using operator assets as collateral would be an alternative to fund IOS costs at EOL or after an incident. The SDRB is protecting against the tail risk of a catastrophic black swan event such as the Kessler Syndrome. However, more reinsurance layers are likely to be needed, such as a reinsurance pool government backstop or through insurance-linked securitieslxxiv (ILS) which finance SDRBs with contingent capital.

Parametric Insurance

Parametric insurance uses predetermined agreements with clients to pay out on a specific event rather than on indemnity. This can be applied to space debris risk if the data and the triggers are the result of accurate analysis and independent third-party acceptance such as NASA or ESA. Basis risk can occur when the predetermined triggers do not match the actual loss suffered by a business and may be less or more than what is needed. This risk can be mitigated by data integrity and model accuracy in magnitude and direction.

Value proposition is a speedy claims payment and bespoke solutions that can bridge gaps in conventional insurance policies. Inaccurate or insufficient historical data can lead to a mismatch between the index and actual losses. Also, historical data might not be a reliable predictor of future conditions due to climate change or some other non-linear evolving factor; small errors in models can lead to basis risk.

Cross-border insurance policies face additional complexity from differing legal systems, which can contribute to basis risk. Policies must accurately define the triggering event, such as satellite collision, to establish the extent of coverage, design parameters, and select appropriate data sources. Causality reduces the basis risk fear.

Public-Private Partnerships (P3)

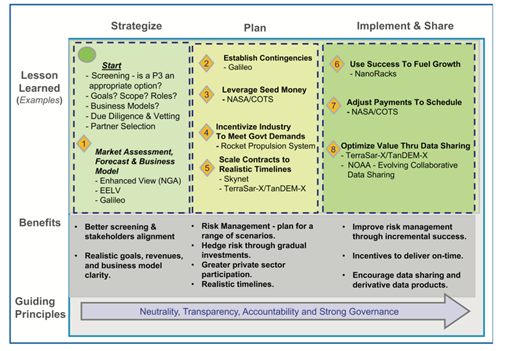

After the Cold War, competition commercialised the space industry, driving down costs. This expansion of the private space industry gives governments the opportunity to advance their space capabilities such as satellite communications, navigation, and Earth monitoring and exploration via P3, which allows the government sector to retain some level of control as space-related P3s proliferate for capital intensive projects and public-private data-sharing.

Historically, the space industry has spun off new technologies such as precision GPS, memory foam, and digital camera sensors. Now the space sector is attracting investors from other technologies such as cloud computing, 3D printing, and artificial intelligence.

Source: Aerospace Corporation lxxv

Dubai's Mohammed bin Rashid Space Centre (MBRSC)lxxvi has launched the World Space Sustainability Association (WSSA), aimed at tackling environmental challenges while the United Arab Emirates (UAE) grows its space-tech ecosystem. This includes an institute to tackle space debris and develop a sustainable space sector.

Launched in collaboration with the insurance firm Elsecolxxvii and the law firm Herbert Smith Freehills, the WSSA will focus on supporting efforts to build a sustainable space sector by inviting its biggest stakeholders to address challenges in space. In October 2021, MBRSC launched Space Ventures,lxxviii an incubator for space start-ups in the UAE. Fast-expanding satellite networks are also prompting concerns: in 2024, the International Astronomical Union launched its Dark and Quiet Skies global outreach project,lxxix which aims to limit the light and radio interference stemming from new swarms of satellites.

Correlation to Climate Change

Space debris burning up in Earth's atmosphere creates air pollution affecting climate with satellite-based pollutants such as aluminium, which have been detected with concentrations higher than those caused by cosmic dust evaporation or meteorites. Aluminium oxide destroys the ozone layer, leading to temperature changes in the stratosphere. Debris at high altitudes will not fall to Earth, meaning concentrations will rise.

Mega-constellations increase the number of satellites launched into orbit and are designed to fall back to Earth and burn up at EOL, with a shelf life of 5 to 10 years. Air pollution from satellites burning up in Earth's atmosphere could become an environmental problem which regulators need to address at the manufacturing stage. The world's first wood-panelled satellite, LignoSat,lxxx has been launched into space to test the suitability of timber as a renewable building material in future space exploration. Made in Japan, the 900g satellite will go to the ISS on a SpaceX mission and will be released into orbit.

The decreasing density of the upper atmosphere due to climate change is worsening the space debris issue, increasing the orbital lifetimes of active satellites. Climate change leads to global warming at ground level, but increased concentration of greenhouse gases causes global cooling in the middle to upper atmosphere, which causes part of the atmosphere to shrink, reducing the air density in the thermosphere where thousands of LEO satellites reside, including the ISS. The rate at which the atmosphere sends satellites back down to the ground is affected when the density of the atmosphere decreases, thus reducing atmospheric drag, so orbital lifetimes of satellites increase and lead to the accumulation of space debris.

Correlation to Cybersecurity

Cybersecurity vulnerabilities in space debris-clearing operations could result in more debris being created due to loss of spacecraft control. Many existing satellites are not cybersecure by design, leaving the spacecraft’s attack surface vulnerable to jamming of spacecraft command, telemetry, GPS links, or a satellite engaging in rendezvous and proximity operations (RPO). The latest satellites are digitally enabled, interconnected, and crucial for both commercial enterprises and national security. The speed at which the space industry is evolving has hamperedlxxxi the space community in addressing cybersecurity challenges.

There are five crucial data touchpoints where cyber mitigation is essential: space itself, ground stations, user GPS devices, links to communication networks, and launch assets. Cloud services are adopted across the space industry and can pose cybersecurity challenges and there is an increase in ransomware.lxxxii Regulations must align with the rapid evolution of space technologies.

Space operators do not control all five space touchpoints and one vulnerability in any touchpoint can interfere with operations. For example, malicious code can be implanted before the hardware is installed in a satellite and lay dormant until the device is deployed and operational. This poses significant threats to space systems, as compromised hardware aboard deployed satellites cannot be replaced.

Integrating cybersecurity by design throughout the engineering, manufacturing, and operations life cycles is important to defensive cyber operations to avoid retrofit and include a secure supply chain

The space network’s weak links can be addressed with IOS. To mitigate cyberattacks on space systems requires defensive tactics such as a Science Operations Centre (SOC) inspace,lxxxiii with tools enabled by AI to enhance threat detection analytics of space systems and recognize unusual signal patterns to mitigate the impact of intrusion and strengthen the cyber defence posture.

Adopting basic cyber hygiene practices and signing data in space with hash keys can help create situational awareness. Adversaries could disable the satellite and/or make it collide with other satellites, creating new debris. There is a need to provision a full end-to-end chain of custody for Earth observation data.

Satellites produce petabytes of data which rapidly become exabytes, cloud computing processes this magnitude of data. This data must be protected from cyberattacks, human errors, and accidental corruption by using digital trust anchors to reveal where the data was coming from, who accessed the data, who processed it, and how and what happened with it as it went through the value chain. This is crucial for better data security traceability and understanding information origins.

Source: Guardtime

In 2020, ESA introduced trust anchor functions to its Earth observation asset management called EOGuard.lxxxiv This is advanced cryptography to ensure integrity and security of ESA Earth observation data sets in real time.

The Future

Second-generation LEO satellites will have larger antennas and inter-satellite links to provide signals that are five times faster than the first., with half the latency and fewer ground stations. New players including Amazon, Google, AT&T, and Telesat, along with existing players that plan to launch over 45,000 new LEO satellites.

Third-generation satellites are already in development and will handle video data-rich applications, enabling broadband in remote areas for edge devices, metaverse applications, automotive connectivity, and disaster response, creating $20 billion of market value by 2030.lxxxv

The vision of a fully connected world can be realised for consumers and industrialists as ground devices communicate with LEO satellites, terrestrial mobile networks, and high-altitude platform stations for data transfer across the globe. Mobile phones will adapt with 24/7 ground multi-orbit devices that can switch between LEO, GEO, and MEO to maintain constant connectivity.

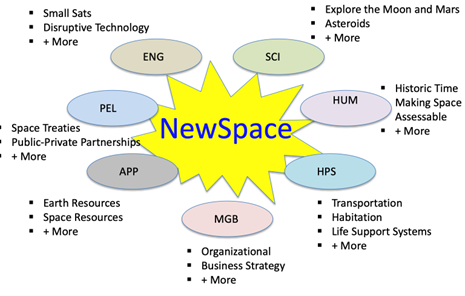

New industries like space tourism, reusable rockets, and private space stations will emerge as the ISS will be retired.lxxxvi Companies are creating satellite platforms off the shelf, giving rise to clients who do fast payloads. There is an emerging arena called NewSpacelxxxvii projecting the future, including manufacturing in microgravity and using the Moon as an outpost to launch further out. All of this can be at risk if the clean-up in space is not achieved.

Source: NASA

Conclusions

By 2033, the annual amount of incinerated debris could reach 3,600 metric tons, more than 20 percent of the amount of natural space rock as 16,000 metric tons of meteorites burn up every year.lxxxviii However, satellites reduce emissions in aviation and shipping by optimising flight paths and sea routes. They measure global carbon emissions more accurately and help farmers boost yields for food security. The world cannot do without them, so we need to look at the large constellation players to assist with debris clean-up before their good work accidentally becomes a tragedy of the commons.

With mega-constellations of cube-satellites (CubeSats) being launched by private and governmental entities, stakeholders must manage the risk of two black swan satellite-related catastrophes: satellites in decaying orbits plummeting to Earth and satellites colliding into one another. Modelling of space debris should be done also on a non-linear basis using ensemble modelling, causal reasoning, and predictive analysis, and not just one point in history reimagining history for better outcomes. Regulation tops the agenda, as shown in this summary chart.

Source: Future Horizons adapted by Graham Thurrock, ESA

Sustainability in space is imperative as we cannot risk compromising the long-term viability of space as a shared resource. By utilizing responsible and explainable AI, the knowledge exchange can be accelerated and drive continuous improvement. Sustainability preserves long-term operational access to space, growth of the space economy, and the well-being of current and future generations; otherwise, humanity could be drawn back to the situation that existed 50 years ago and that would indeed be a tragedy of the commons.

Acknowledgements

The author would like to recognize both Quentin Parkerlxxxix and Michael Mainelli for their dedication to addressing the important issue of space debris.

References

i https://www.presidency.ucsb.edu/documents/address-the-assembly-hall-the-paulskirche-frankfurt

ii https://www.presidency.ucsb.edu/documents/address-the-assembly-hall-the-paulskirche-frankfurt

iii https://spacegeneration.org/beyond-mitigation-progress-and-challenges-of-orbital-debris-remediation

iv https://www2.deloitte.com/us/en/insights/industry/public-sector/defending-against-cyber-threats-space-systems.html

v https://swfound.org/

vi https://lucyintheskywithdebris.com/Significant-Space-Debris-Events

vii https://edition.cnn.com/2025/01/02/science/kenya-space-object-intl-latam/index.html

viii https://www.space.com/space-debris-florida-family-nasa-lawsuit

ix https://www.esa.int/

x https://www.nasa.gov/international-space-station/

xi https://en.wikipedia.org/wiki/Mission_Extension_Vehicle

xii https://www.nasa.gov/

xiii https://www.spacefoundation.org/2024/07/18/the-space-report-2024-q2/#:~:text=The%20global%20space%20economy%20totaled,space%20economy%20a%20decade%20ago.

xivhttps://en.wikipedia.org/wiki/Polluter_pays_principle#:~:text=In%20environmental%20law%2C%20the%20polluter,done%20to%20the%20natural%20environment.

xv https://en.wikipedia.org/wiki/Sputnik_1

xvi https://en.wikipedia.org/wiki/Combined_Space_Operations_Center

xvii https://en.wikipedia.org/wiki/Kessler_syndrome

xviii https://www.mainelli.org/?page_id=3711

xix https://www.unoosa.org/oosa/en/ourwork/spacelaw/treaties/introouterspacetreaty.html

xx https://www.unoosa.org/oosa/en/ourwork/spacelaw/treaties/introouterspacetreaty.html

xxi https://www.unoosa.org/oosa/en/ourwork/spacelaw/treaties/registration-convention.html

xxii https://www.unoosa.org/oosa/en/ourwork/spacelaw/treaties/liability-convention.html

xxiii https://www.unoosa.org/oosa/en/ourwork/spacelaw/treaties/introrescueagreement.html

xxiv https://www.starlink.com/

xxv https://swfound.org/industryasatstatement/

xxvi https://www.nasa.gov/wp-content/uploads/2022/10/04_kunstadter_space_insurance_update_axa_xl_scaf_220111.pdf

xxvii https://www.spacex.com/

xxviii https://www.cshlaw.com/resources/the-current-universe-of-space-insurance/

xxix https://www.space.com/vega-c-failure-rocket-nozzle-flaw-investigation-report

xxx https://www.pcmag.com/news/viasat-suffers-malfunction-with-a-second-satellite

xxxi https://www.intelsat.com/newsroom/intelsat-reports-is-33e-satellite-loss/

xxxii https://www.nasa.gov/centers-and-facilities/white-sands/micrometeoroids-and-orbital-debris-mmod/

xxxiii https://ntrs.nasa.gov/citations/20190022535

xxxiv https://software.nasa.gov/software/MSC-25457-1

xxxv https://www.unoosa.org/

xxxvi https://www.obruta.com/

xxxvii https://conference.sdo.esoc.esa.int/proceedings/sdc6/paper/139/SDC6-paper139.pdf

xxxviii https://orbitaldebris.jsc.nasa.gov/modeling/legend.html

xxxix https://www.investopedia.com/terms/m/montecarlosimulation.asp

xl https://www.esa.int/Space_Safety/Space_Debris/ESA_leads_the_way_towards_a_Zero_Debris_future

xli https://www.oecd.org/en/blogs/2024/07/managing-space-debris-to-protect-our-access-to-the-stars.html

xlii https://www.space-track.org/auth/login

xliii https://www.oecd.org/en/publications/the-economics-of-space-sustainability_b2257346-en.html

xliv http://www.satmagazine.com/story.php?number=1230886530

xlv https://www.itu.int/pub/R-REG-RR/en

xlvi https://www.itu.int/en/ITU-R/terrestrial/broadcast/Pages/MIFR.aspx

xlvii https://www.bcg.com/publications/2024/regulating-the-next-generation-of-satellites#:~:text=The%20global%20satellite%20communications%20market,that%20existing%20satellites%20do%20not.

xlviii https://pp22.itu.int/en/en/about/about-pp22/

xlix https://www.unoosa.org/oosa/en/ourwork/copuos/index.html

l https://commission.europa.eu/about/service-standards-and-principles/ethics-and-good-administration/commissioners-and-ethics/code-conduct-members-european-commission_en#:~:text=The%20Code%20of%20Conduct%20sets,force%20on%201%20February%202018.

li https://www.eeas.europa.eu/sites/default/files/space_code_conduct_draft_vers_31-march-2014_en.pdf

lii https://www.esa.int/Space_Safety/ClearSpace-1

liii https://www.lmalloyds.com/LMA/Underwriting/LMA/Underwriting/Underwriting.aspx?hkey=0d9205c4-507f-4836-b8da-391d56b7e227

liv https://www.evona.com/blog/sustainable-space-kitemark/

lv https://www.lloyds.com/about-lloyds/our-market/what-we-insure/space/crowded-space

lvi https://www.eumonics.com/

lvii https://builtin.com/machine-learning/ensemble-model

lviii https://vulcain.ai/

lix https://www.esa.int/Space_Safety/Clean_Space/ESA_s_Zero_Debris_approach

lx https://www.esa.int/Space_Safety/Clean_Space/The_Zero_Debris_Charter

lxi https://www.esa.int/Applications/Observing_the_Earth/FutureEO/Aeolus

lxii https://earth.esa.int/eogateway/missions/proba-1

lxiii https://www.esa.int/Science_Exploration/Space_Science/Cluster/Cluster_overview

lxiv https://astroscale.com/

lxv https://global.jaxa.jp/

lxvi https://astroscale.com/missions/adras-j/

lxvii https://aerospace.org/sites/default/files/2021-01/adr%20paper.pdf

lxviii https://www.nasa.gov/history/40-years-ago-sts-51a-the-ace-repo-company/

lxix https://www.lsd.law/define/running-down-clause#:~:text=A%20running%2Ddown%20clause%20is,they%20need%20after%20a%20collision.

lxx https://www.cymar.org/

lxxi https://www.igpandi.org/

lxxii https://www.igpandi.org/article/reinsurance-contract-gxl-structure-for-202425/

lxxiii https://www.lexisnexis.co.uk/legal/guidance/decommissioning-decommissioning-security-agreement

lxxiv https://www.artemis.bm/library/what-are-insurance-linked-securities/

lxxv https://aerospace.org/

lxxvi https://www.mbrsc.ae/

lxxvii https://www.else.co/

lxxviii https://wired.me/science/space/uae-sends-out-call-for-space-startups/

lxxix https://wired.me/science/space/astronomers-want-to-save-dark-skies-from-satellite-swarms/

lxxx https://www.bbc.com/news/articles/c5y3qzd5ql9o

lxxxi https://www.esa.int/Space_Safety/New_cyber-security_centre_will_safeguard_ESA_assets_and_missions2

lxxxii https://www2.deloitte.com/us/en/insights/industry/public-sector/government-ransomware-attacks.html

lxxxiii https://www.esa.int/Space_Safety/New_cyber-security_centre_will_safeguard_ESA_assets_and_missions2

lxxxiv https://guardtime.com/eoguard

lxxxv https://www.bcg.com/publications/2024/regulating-the-next-generation-of-satellites

lxxxvi https://www.npr.org/2024/02/21/1232639289/international-space-station-retirement-space-stations-future

lxxxvii https://www.earthdata.nasa.gov/s3fs-public/2023-11/newspace_nasa.pdf

lxxxviii https://www.technologyreview.com/2024/12/09/1108076/satellite-reentry-atmospheric-pollution/

lxxxix https://www.scmp.com/author/quentin-parker

1.2025

About the Author:

David Piesse is CRO of Cymar. David has held numerous positions in a 40-year career including Global Insurance Lead for SUN Microsystems, Asia Pacific Chairman for Unirisx, United Nations Risk Management Consultant, Canadian government roles and staring career in Lloyds of London and associated market. David is an Asia Pacific specialist having lived in Asia 30 years with educational background at the British Computer Society and the Chartered Insurance Institute.