5 Strategies for Designing Your World - Changing Innovation Agenda

IIS Executive Insights Innovation Expert: Chunka Mui, Futurist and Innovation Advisor

Society at large needs the insurance industry to become an even more powerful catalyst and lubricant for societal innovation. The opportunities for doing so are immense and the taking on of such a role is deep in the history and DNA of the industry. The time to do so is also ripe, given both societal need and the growing attention to corporate purpose on the part of investors, boards of directors and employees.

But, given the disruptions driven by the Covid-19 pandemic, on top of the market and digital transformation challenges that were mounting even before the coronavirus struck, how can there be any time, attention or resources to worry about such lofty goals? How can any insurer focus on anything other than what needs to be done right now to repair, reset and recover?

To find a path to doing so, consider an approach used by Rahm Emanuel. Emanuel left his post as chief of staff to U.S. President Bark Obama to become Mayor of Chicago. During his two terms as mayor, Emanuel always kept two to-do lists in his coat pocket. One was a daily list filled with the urgent, attention-needing items for that day. The second was a weekly list filled with critical items he needed to address that week.

Emanuel also kept a third list. This third list, which he kept in his top desk drawer, dealt with his biggest, most ambitious 20 to 30-year goals for his hometown. But that list wasn’t just about wishful thinking; it focused on things Emanual could accomplish in the next two or three years that would materially address the opportunities and challenges that he knew Chicago would face in that longer timeframe.

For example, Emanual’s Third List aspirations included providing free universal Pre-K and college education for Chicago residents, eliminating gaping health, wealth and opportunities inequities, modernizing O’Hare airport, solving the city’s pension problem and addressing climate change. None of these critical issues could be solved during Emanuel’s term, but what progress he made (or not) would materially shape whether they were achievable in the next 20 to 30 years.

Taking Emanuel’s model, there are no doubt endless challenges to overfill your first and second lists. What’s on your Third List? What are your biggest, most ambitious goals? What might you and your colleagues accomplish in the next several years that have the potential to reshape your organization, the insurance industry and perhaps even the world in the next 20 to 30 years? What are the accomplishments that will define your legacy?

Ripe opportunities lie at the intersection of two massive gaps, as I laid out in Part 1 of this series. How can the underleveraged tools in your organization’s Technology Gap be applied to address the Risk Protection Gap faced by the stakeholders and communities that you could serve? Here are five strategies for identifying them.

1. Expose and model the gap

“Once risk is disclosed, it cannot be ignored—and that is the biggest opportunity for our industry that we will see in our careers, and likely in our lifetimes,” observed Rowan Douglas. Douglas was referring to disclosure of climate change related risk, but his observation applies to many slices of the risk protection gap.

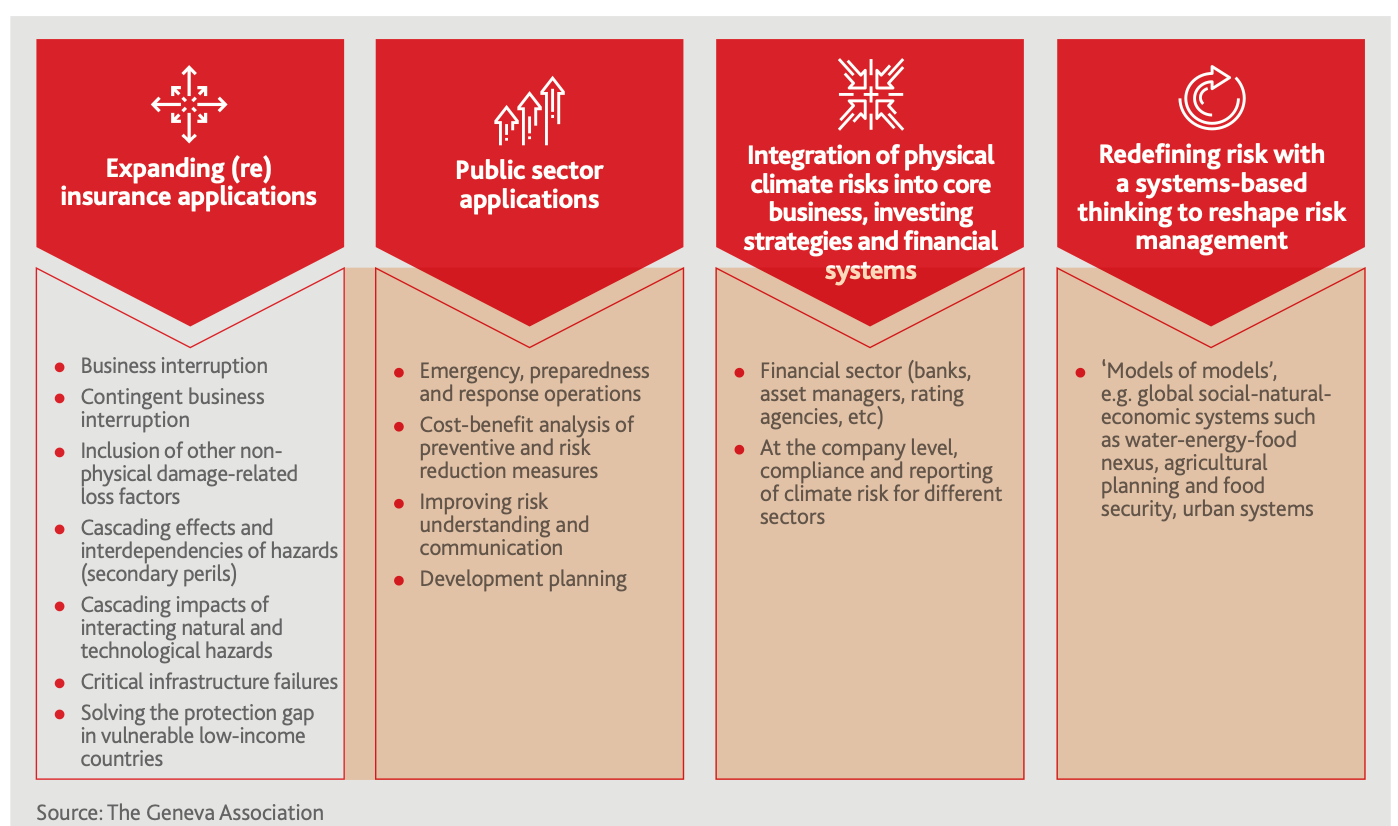

Rapid advances in technology-enabled data gathering and analysis tools provide enormous opportunities to better expose and model more slices of uncovered risk. The Geneva Association, in a smart report, explores numerous opportunities for extending traditional catastrophe risk models based on backward-looking losses with new data-driven, forward-looking risk modeling and mapping tools. Those models can then support product and service innovations to better manage physical climate risk.

New tools and techniques include leveraging advances in climate science and modeling, such high resolution global and regional climate models, weather and climate change simulation and forecasting capabilities and real-world data from space, ocean and terrestrial platforms.

Modelling innovations enables a number of opportunities for strengthening disaster and climate risk management in the future, as shown in the Figure 1.

Figure 1: Opportunities for strengthening the future of disaster and climate risk management (Source: The Geneva Association)

AI-augmented models crunching big data are also emerging to address other protection gaps, such as business interruption, contingent business interruption, supply chain fragility, manufacturing and production risk, economic demand surges (and plunges) and the impact of climate risk on financial modeling and investment risk analysis.

These capabilities, argues John Sviokla, allow underwriters to more effectively predict risk, while simultaneously identifying new types of risk that can be analyzed and underwritten. Sviokla refers to this as “quantum underwriting,” as it is intimately associated with quantum-style probability metrics. Operations insurance, he notes, is evolving rapidly as the Internet of Things brings sensors to the production line, tracking parameters such as efficiency and preventative maintenance. An underwriter can not only hedge against the cost of equipment failure, but also use predictive analytics to optimize maintenance and operations schedules and thus reduce the chance that equipment will fail at all. Other forms of quantum underwriting can catalyze similar forms of preventive care around cybersecurity, fraud, and deceptive practices.

All this analytical power must be deployed with care, however. “Trust is a critical issue,” cautions Ekhosuehi Iyahen, Secretary General of the Insurance Development Forum (IDF). “Stakeholders do not want a black box. They want to be able to interrogate the assumptions. They want to understand in greater detail how you really underwrite the risks.” To enhance model capability, use and trust, the IDF is working with a number of public and private partners to develop and share open and transparent modeling platforms.

2. Innovate for resilience, not just risk financing

Better modeling will likely reinforce the uninsurability of some risks, however. Some risks—like pandemics, earthquakes and wide scale technology failures—are just beyond the strength of insurance industry balance sheets to completely cover.

That’s the nature of insurance. For example, society’s dependence on technology is probably “the biggest class exposure we could ever imagine,” as Mike McGavick, former CEO of XL Group told a group of risk managers. “Insurers [would] love to figure out what to do and get paid to do it,” he continued, “but we've only figured out slight bits.”

The insurance industry’s skill sets and abilities aren’t just in risk financing, however, as Bill Marcoux, Chair of the Law Regulation and Resilience Policies Working Group at the IDF, pointed out to me.

Helping governments, organizations and individuals understand their risk profiles is the critical first step in helping them increase resilience to mitigate risk and reduce losses. Insurers can play a critical role in resilience building by covering just a slice of the risk, when total risk financing is not practical.

For example, asked Marcoux, how might insurers take their modeling of floodplains to the next level to better inform urban development? Yes, better modeling does inform risk financing decisions. Of even more potential value, however, is harnessing insurers’ expertise to enable owners, investors, organizations, sovereign entities and other stakeholders make better decisions regarding strategy, operations and investment.

Marcoux’s scenario is not just theoretical.

Let’s drill down into the challenges for Florida, which was referenced earlier. A recent BlackRock study of the $3.8 trillion municipal bond market concluded that investors are not differentiating between offerings with high and low climate risks. Illustrative of this were utility bonds in Jupiter, FL compared to similar ones in Neptune, NJ. Both had almost identical yields after adjusting for credit quality—even though Jupiter is especially vulnerable to tropical storms, hurricanes and rising sea levels while Neptune is far more insulated against severe storms.

Investors (including insurers) continue to invest in 30-year Florida debt because insurers continue to insure both the debt and the underlying assets. But while mortgage and bond holders accept 30-year terms, hazard insurers make only one-year commitments. As losses mount, hazard insurance will get more and more expensive. If current behavior continues, insurance markets could dry long before Florida is under water. Such an insurance crunch would not only throw existing mortgages into default; it would dry up financing for new debt offerings—unaffordable insurance means no new mortgages or bonds—and send Florida’s economy into a deep spiral.

Rather than blithely marching towards a crunch, insurers could ignite a virtuous cycle of increasing resilience through better information, better underwriting, better pricing, better mitigation and better protection. By getting more precise about exposing, modeling and projecting wind, flood, fire and other climate-related risks, insurers can engage other investors, local politicians, bond issuers, developers and even homeowners on resiliency.

It is just a matter of time, for example, when climate risk becomes a standard input to credit risk. That, as Rowan Douglas once noted, “will make the debate about risk-based pricing for insurance seem like a sideshow.” What is missing right now are the skills, methods, tools, processes and business models to enable that, and therein lie immense innovation opportunities to better price climate risk and, in the process, drive investment that values resiliency.

This model applies not just to climate-related risks. Cyber and operations risk, as mentioned in strategy 1, also loom large as areas ripe for insurers to change their emphasis, to shift from value propositions and business models focused on risk financing to ones that emphasize risk mitigation and resilience.

3. Learn from Global Lessons

Fortunately, there are many early lessons to draw upon.

As Mike Morrissey, who recently retired as President and CEO of the International Insurance Society commented to me, “There are already many groundbreaking efforts to leverage the risk assessment and management skills of the insurance industry and the investment portfolios of insurers to protect more of the world from more perils.”

“People have done things in the last few years,” he noted, “that the insurance industry has never done before, benefitting the world, especially underserved communities.”

The Insurance Development Forum, referenced above, is a public-private partnership that is doing groundbreaking work on how technology can be leveraged to improve resilience, particularly in developing countries. Its lessons, however, are applicable to insurers in all markets. See, for example, the IDF reports on the use of technology to better address sovereign and sub-sovereign risks and how to close the micro-insurance protection gap.

Among the innovative approaches to multi-sovereign risk pooling is the African Risk Capacity (ARC), a specialized agency of the African Union that helps 33 governments plan, prepare and respond to extreme weather events and natural disasters. By its measure, the ARC has enabled more than 600 million in drought risk coverage and assisted more than 2.1 million vulnerable people. The IDF is also synthesizing the lessons learned from numerous single sovereign and sub-sovereign programs from around the world and harnessing the tremendous capacities within the insurance industry to drive much needed solutions.

The United Nations Development Program (UNDP) has launched a program that provides project management, technical assistance and up to $5 billion in insurance-industry capacity for 20 developing countries, prioritized by their vulnerability to climate risks and readiness to accelerate the integration of risk analysis and management into their development plans to increase resilience. This program is part of a broader partnership with the IDF, industry partners and national governments.

Later this year, UNDP will launch its first ever insurance and refinancing facility. It will be, as Jan Kellett, special advisor to the UNDP for external engagement, described it to me, “essentially a one-stop shop for all of the agency’s 170 program countries.” It will provide technical expertise, some amount of capacity and a conduit for the insurance industry to maximize its work and to help make insurance a part of what the UNDP does on a daily basis. This effort is part of a larger UN effort to increase adaptation and resilience to climate risks for 500 million people.

Another rich vein of learning is the wide range of individual micro-insurance efforts at the intersection of the protection and technology gaps. Take Blue Marble Microinsurance, a startup with a mission to provide socially impactful, commercially viable insurance protection to the underserved. Blue Marble is developing and scaling business models that offer parametric weather insurance products in South America and Africa. Its CaféSeguro program, launched in partnership with Nespresso and Colombia insurer Seguros Bolivar, now protects more than 3,000 smallholder coffee farmers in from vulnerability to adverse weather. It has also entered into a long-term agreement with the United Nations World Food Program to become a provider of weather index insurance solutions across Africa.

Blue Marble is also a case study of learning how to learn. The venture is sponsored by nine insurance giants with the higher goal of learning from Blue Marble’s real-world experience in applying parametric insurance to emerging markets.

Joan Lamm-Tennant, Blue Marble’s founding CEO, described this approach of entering emerging markets as “forced innovation.” Blue Marble put itself in a new marketplace with a new set of customers. Instead of repurposing off-the-shelf products, it had to build an entire business model to meet the needs of both those farmers and other stakeholders in the coffee value chain. She is now building on those learnings to help small businesses in the U.S.

Blue Marble was also a reverse innovation strategy for its founding partners, which included AIG, Zurich and Marsh McLennan. To date, a number of the sponsoring organizations’ employees have been seconded to Blue Marble. They gained getting real-world experience on ventures, capability building and operations they can bring back to their parent organizations. These lessons, applied broadly, could reap more dividends to the sponsors than the venture itself.

(See also Joan Lamm-Tennant’s recent IIS essay on [Stakeholder Capitalism Essay Final Title])

Another exciting set of innovations awaiting broader adoption is the extension of insurance of natural assets, rather than just manmade infrastructure. The Reef Rescue Initiative, for example, is working to extend parametric insurance to the entire Mesoamerican Reef System. This is the largest coral reef in the Atlantic. It provides economic support to marine and coastal communities spanning Mexico, Belize, Guatemala and Honduras. Insuring the reef covers the cost of rapid response to damage, such as after a hurricane, and encourages further investment in maintaining and preserving them. See the Nature Conservancy’s “Guide to How to Insure A Natural Asset,” for an excellent treatment of this topic.

The future of insurance is already here, to paraphrase William Gibson, it’s just not evenly distributed. The key is finding applicable lessons out of the numerous early ones to be had.

4. Lean into Local Gaps

It is hard to contemplate the many layers of the risk protection gap, whether it be pandemics, fires, droughts, heatwaves, earthquakes, hurricanes, floods, rising oceans, crippling healthcare costs, fragile technologies, tenuous supply chains, cyber incursions and climate change, and not be humbled by the scale of each.

At its heart, however, protection and resilience are very local issues. Natural assets in the form of lakes, rivers, aquifers, urban forests and so on are everywhere, for example, and provide tangible financial benefits to local stakeholders and the surrounding economies. Exposing, modeling, insuring and mitigating the risk to these assets requires deep local knowledge and community engagement, as illustrated by Reef Rescue Initiative in the Caribbean, even as global actors work out the macro level issues.

Likewise, almost every locale in every region in every economy—whether we think of them as “developing” or “developed” economies—have sizeable underserved segments. These are opportunities for insurers to work with sovereign and sub-sovereign governments to fashion innovative schemes to enlarge the safety net, as Blue Marble Insurance did in Columbia. And there are enormous protection gaps where insurance is available but too many still do not buy it. Classic (and very dangerous) examples are earthquake and fire insurance in California, heat insurance in Arizona, and life, health and flood insurance everywhere.

Focusing on the risk protection gaps of the communities that we serve heightens the emotional resonance and turns “purpose” from corporate press speak into something very real. It provides a very tangible place with all its complexities to start and to “force” innovation. And, in doing so, provide a solid base of learnings that can be spread far and wide.

5. Start with the Future

To bring the previous four lessons together and generate a list of options for your Third List, start with a simple question:

What would it be ridiculous for your hometown not to have in the next 20 or 30 years to address its protection gaps?

The previous four strategies imply some thought questions that should help address this the first one.

- What are the most pressing protection gaps in the communities that you currently serve?

- How might those gaps evolve over the next several decades, especially for those who are the most underserved?

- What evolving technological capabilities might help narrow those gaps—especially as they continue to progress following the Laws of Zero?

- How might you apply leading these edge tools to better expose, model, project and communicate meaningful slices of corresponding risks?

- What early lessons from innovators and early adopters around the world might be adapted to your community’s evolving challenges?

Now, assume that you and your company will be the ones to make your community’s world a better place by providing these ridiculous-not-to-have solutions. What would the future look like if you succeed? How might you forge a path to that future? What might you be able to accomplish in the next two or three years on that path to accelerate towards that future?

* * *

These are the germs of the world-changing ideas that might deserve to be on every insurance company’s innovation agenda. One a personal level, society’s challenges provide legacy-worthy opportunities for every industry leader—and all those who aspire to lead.

Success will require a long march. But, as the Chinese philosopher Lao Tzu said, “A journey of a thousand miles begins with a single step.” The first step is to embrace the journey.

In future articles and podcasts, we will explore additional questions on how to assemble and execute on this type of game-changing innovation agenda. How do you create an innovation portfolio that aggressively but pragmatically balances your first, second and third lists? How do you pursue a systematic approach to innovation? How do you think big, start small and learn fast? How you nurture an organizational culture that embraces rather than suffocates your Third List? We hope you will join us.

1.2021

About the Author:

Chunka Mui is a futurist and innovation advisor who helps organizations design and stress test innovation strategies. He is the best-selling author of four books on strategy and innovation including The New Killer Apps: How Large Companies Can Out-Innovate Start-Ups and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years. Chunka is also a regular contributor to Forbes. Chunka was previously managing partner and chief innovation officer of Diamond Management and Technology Consultants (now part of PWC) and co-founder and director of Vanguard. Chunka holds a B.S. in computer science and engineering from MIT.