Policyholder Behavior to Close the Protection Gap

IIS Executive Insights Life & Health Expert: Ronald Klein, Executive Director, BILTIR

The life insurance industry provides protection against the financial consequences of the premature death of a family breadwinner, disability, or outliving one’s retirement assets. But how are life insurance products actually designed and priced?

Product committees comprising agents, underwriters, actuaries, and senior management sit and discuss what new products should be offered. The agents have vast experience visiting with policyholders to determine their needs. Underwriters set the guidelines on which policyholders will be accepted and/or rated. Smart actuaries (while most would find this redundant, some would call it an oxymoron) assess the potential risks in these products and set a potential price. Senior management listens to agents, underwriters, and actuaries and helps finalize the product design, the guidelines for accepting risks, and the price. The programmers will also have to be contacted to determine the cost of administering the products. Many iterations of these discussions may take place before a product is ready for sale. The entire process could take up to a year.

Some of these products are quite complex, taking into account long-term interest rates and probabilities of death/survival, disability, and lapse. With this lengthy and rigorous process, one would imagine that few mistakes are made. However, this is not the case. What follows are a few examples of major product mistakes which cost the life insurance industry a lot of time, money, and bad publicity.

Life Insurance Product Design Errors

Own Occupation Disability Income

Disability income products pay monthly benefits to policyholders upon the onset of a disability that limits their ability to earn income. Products have varying designs that add or subtract from the cost, including the length of time the person needs to be disabled before the benefits begin, the duration of benefits, and the definition of disability.

Since the idea behind these products is to replace income lost due to disability, one would think that any earned income while disabled would be deducted from the benefit. That is why the definition of disability required that the policyholder lose the ability to work in any occupation, called any occ. However, a new product emerged in the 1980s called own occupation, or own occ. The benefit would pay if you could not participate in the activities of your current or a similar occupation, not any occupation.

If you were a surgeon, for example, and lost the ability to perform surgery, benefits would be paid even if you began another profession. It was the medical profession that product committees discussed and debated. Medical doctors, going through years of training, would do whatever is necessary to return to their profession. And doctors do not participate in any strenuous activities that could easily cause disability, as, for example, construction workers do. Own occ policies should be cheapest for them.

Nothing could be further from the truth. Doctors lapped up these policies in droves, and the claim experience was horrendous. It seems that after a certain age, even a minor injury could turn into a lifetime disability (certified by a fellow doctor). Some of these doctors went on to teach at university hospitals, sometimes earning more than as a doctor, but retained their disability income own occ benefits. It was a disaster for the life insurance industry.

Term-to-100

This is a relatively simply product sold mainly in Canada and Ireland. The benefit amount and the premium payments are level to age 100, at which time the policy expires. No cash values are offered upon lapse of the policy.

Since the premium is level, if a person decides to let the policy lapse after a certain age, it actually improves the insurer’s profitability. There is a threshold beyond which future premiums do not cover expected claims—what actuaries refer to as a lapse-supported product. After a certain duration, lapses are profitable for the insurer.

Actuaries had to determine expected lapse rates as one of the assumptions and landed upon 2-4% in later durations; this is what other long-term products, such as whole life insurance, were exhibiting. However, whole life has a cash value, and the premiums are higher than for term-to-100. These products experienced lapse rates of lower than 1% at later durations, which caused the product to be very unprofitable for life insurers.

Select-and-Ultimate Term

This product tried to make better use of medical underwriting by offering customers a cheaper rate for recent underwriting. For example, a 40-year-old who was underwritten last year would receive a cheaper rate than a 40-year-old who was underwritten five years ago. This “select period” would typically last 10 or 15 years, after which all cohorts of the same age would receive the same rate. A 50-year-old underwritten 20 years ago would receive the same rate as a 50-year-old underwritten 25 years ago, for example.

When designing and pricing this product, insurers felt that since the underwriting process is timely and a bit invasive (application forms, paramedical exams, and blood tests), policyholders would hold on to their policies once accepted. Again, the product committees failed to predict what would happen. Agents would approach customers who purchased products during the past year or two and offer a new policy at a lower rate with a “free medical exam.” Of course, the agents earned a nice first-year commission on new sales versus a much lower renewal commission on existing policies. Early lapse rates were much higher than expected, which lowered the ability for insurers to recover acquisition costs—mainly the cost of underwriting.

In addition, the number of claims for those who did not lapse increased because those in poorer health were unable to purchase new policies; they would not pass the new underwriting standards. Actuaries call these anti-selective risks. Anti-selection and high early lapse rates caused this product to be a huge failure.

While some form of own occ and term-to-100 still exist, the products have much stricter rules and are now priced correctly. Select-and-ultimate term basically disappeared, but similar products also have stricter rules, especially on agent disclosures and commissions.

Besides being a major headache and money losers for insurers, what else do these products have in common? They all became failures because of unforeseen policyholder behaviors. This is one of the most difficult things to predict for product-development teams.

The mere existence of a new product type can change behavior. Own occ changed the behavior of medical doctors; term-to-100 changed lapse rates in longer durations; select-and-ultimate term changed short-duration lapse rates. And it is only recently that insurance companies are taking the behaviors behind these decisions more seriously. Insurers and reinsurers now have staff and even entire departments dedicated to the study of behavioral sciences, with the goal of learning how to better reach potential customers and better understand how they will react under certain scenarios. And when insurers are not dedicating resources to behavioral sciences, they rely upon reinsurers to do it for them.

Flat Sales of Life Insurance

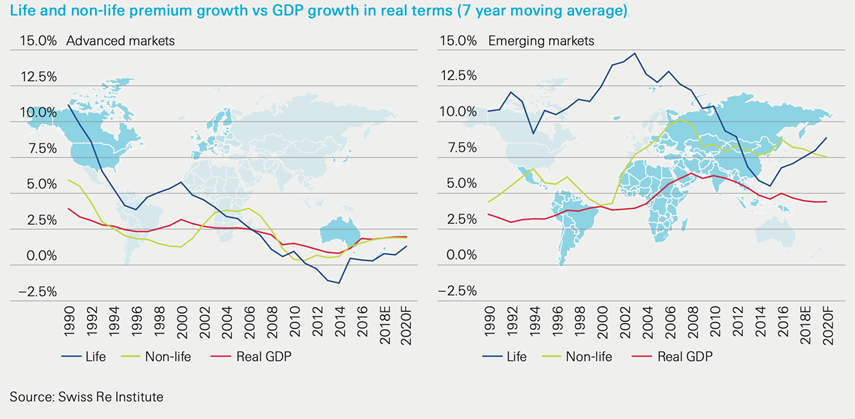

Better understanding policyholder behavior will not only improve product design and possible pitfalls, but it could also increase the flat sales that the life insurance industry has endured for decades in most mature markets (see Figure 1). Even emerging markets have shown a decrease in premium since their highs in the early 2000s.

Figure 1: Life and Non-Life Premium Growth vs. GDP

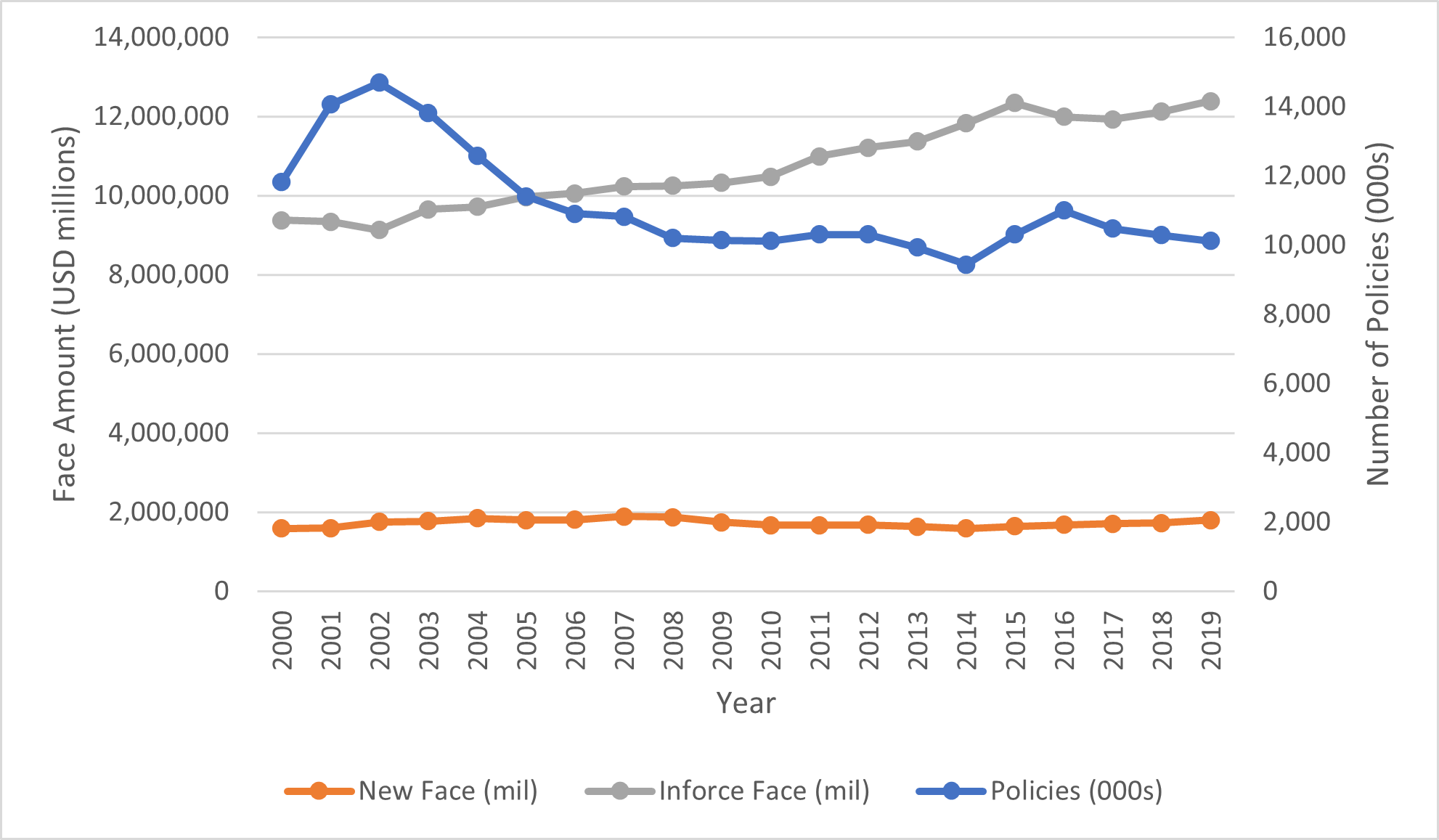

In the United States, the largest life insurance market in the world, new sales have been flat since 2000, as shown by the orange line and left-hand scale (see Figure 2). Number of policies is actually declining, as shown by the blue line and the right-hand scale. And while in-force life insurance has been steadily growing, the annualized yearly growth rate averaged less than 1.5% from 2000 to 2019. According to the Life Insurance Marketing and Research Association (LIMRA), new business premiums are down 1% whereas face amount and number of policies increased by 5% and 2%, respectively, through the first three quarters of 2020 compared with the same period in 2019.[i] One might expect a larger increase in life insurance sales during a pandemic that has claimed more than 450,000 lives in the US as of the writing of this paper.

Figure 2: US Life Insurance Purchases by Year

Source: ACLI Life Insurers Fact Book 2020

Source: ACLI Life Insurers Fact Book 2020

Understanding Behavioral Science Theories

Big tech companies have made use of behavioral sciences for years and experienced rapid growth. Customers are now accustomed to pop-up messages after online purchases telling them that “customers who purchased this product also purchased….” After filling a cart but failing to hit the Buy button, customers often receive an email that says, “You qualify for a 5% discount if you order today!” These techniques are not random. Well-researched theory sits behind them, based on customer surveys and extensive studies.

However, the field of behavioral economics was always considered a fringe discipline by so-called real economists. The field of economics is based on rational decision-making and had no room for behavior. In a recent interview, Daniel Ariely, professor of behavioral economics at the Fuqua School of Business at Duke University, said that conventional economists “don't really like this stuff too much. For a long time, their line of defense was that these are just small decisions of little people. They would say … if you only took this and gave it to professionals making big, important decisions with a lot of money, all the mistakes will go away.”[ii]

Only after Daniel Kahneman, a psychologist at Princeton University, won the 2002 Nobel Memorial Prize in Economic Sciences, was the field of behavioral economics catapulted to the forefront of everyday decision-making. In his book Thinking, Fast and Slow, Kahneman explains many characteristics that humans possess. Exploring two of the main themes may shine a light onto why life insurance sales have remained flat since 2000 and what steps insurers may be able to take to overcome these biases.

System 1 vs System 2 Thinking

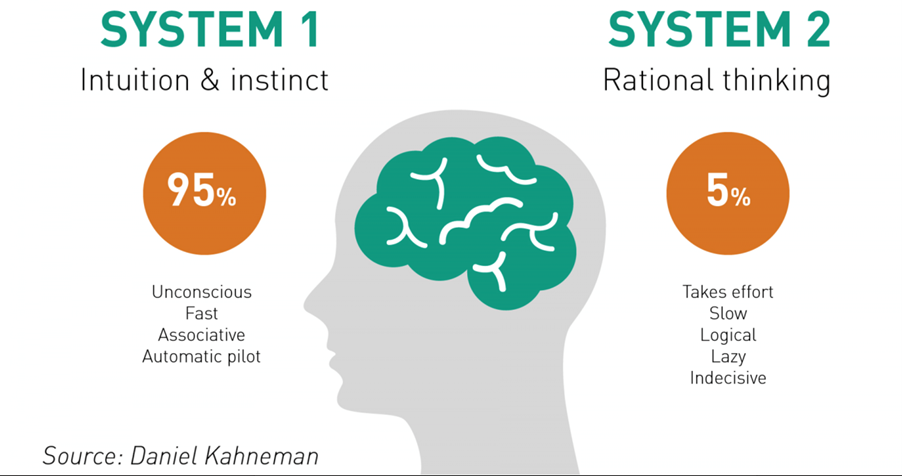

Kahneman describes the two systems in the human brain: the automatic and instant System 1, and the logical and conscious System 2 (see Figure 3).[iii] Both systems are necessary to make the brain operate efficiently. An example of System 1 at work is when a person ducks when hearing a gun shot. The person does not take time to determine from where the noise is coming, in which direction it was fired, or whether it is a real gun. This reaction is key for survival.

System 2 is much more time-consuming and uses analytical skills. A person may rely on System 2 when deciding whether he or she can afford a house or when filling out a job application. This system requires time to think and analyze the situation.

Figure 3

Kahneman goes on to say that the human brain is lazy and relies too much on System 1. In many situations, people use System 1 even when there is enough information and time to use System 2. This is probably the case with many potential life insurance purchasers. Instead of trying to understand how a life insurance product works, how much it should cost, and the value that it would bring to a family, potential policyholders may simply resort to System 1 and determine that the product is too expensive. In LIMRA’s 2020 Insurance Barometer Study, a survey of nearly 2,000 Americans showed that 85% overestimated the cost of insurance; the majority of respondents thought that life insurance was three to eight times more expensive than the actual cost.[iv]

In the same survey, more than 50% of respondents were more likely to purchase simplified underwriting products, whereas only about 10% were less likely. This could show that the life insurance purchasing process is too time-consuming and complicated for many, if not most, potential purchasers. The most positive result of the survey, conducted during the pandemic, was the sharp increase in those intending to buy life insurance in the next 12 months. The rate of 36% in 2020 was much better than the low of 10% in 2014. However, consumer behavior may change as the pandemic subsides.

How can the life insurance industry make use of Kahneman’s System 1-versus-System 2 model? Either the industry needs to solicit more people to use System 2, or it must design its products to appeal to System 1. Using System 2 needs analysis that will only come with more education. Financial literacy is one way to better educate school children to understand how insurance works, when it is needed, and when it is not needed. This can only be accomplished with a worldwide effort to include financial literacy in school curricula. Governments should include this important topic at all levels of education. This will take some time, but the benefits will be well worth it.

To better appeal to System 1, insurers need to simplify the process of purchasing life insurance. Surveys show that people intend to purchase insurance and would like the process to be simplified. This may be accomplished more easily through group and association insurance than through individual insurance. Individual insurance still works well, as evidenced by the more than 10 million new individual life insurance sold in the US in 2019.[v] But to reach a different cohort of people, new techniques must be employed. Worksite marketing is a great tool for those in traditional office environments during non-pandemic times. Reaching people in the gig economy may be more challenging. Forming associations for gig workers with options to purchase insurance could be an interesting tool. These associations could be modeled after France’s highly successful Association Française d’Épargne et de Retraite (AFER). This association has grown in its 40 years to hold more than 55 billion euros’ worth of assets.

Anchoring

In Thinking, Fast and Slow, Kahneman described what he calls anchoring: “People make estimates by starting from an initial value that is adjusted to yield the final answer. The initial value…may be suggested by the…problem, or it may be the result of a partial computation. In either case, adjustments are typically insufficient. That is, different starting points yield different estimates, which are biased toward the initial values.”[vi] The starting point significantly biases the outcome.

Customers encounter anchoring in everyday life and thus fail to realize their biases. Take, for instance, the purchase of an automobile. Sitting in the window is the manufacturer’s suggested retail price (MSRP) sticker. When negotiating the price below the MSRP, a customer feels as if he or she received a good deal. However, it is the auto manufacturer that actually sets the MSRP. Somehow that price sets the anchor for negotiations.

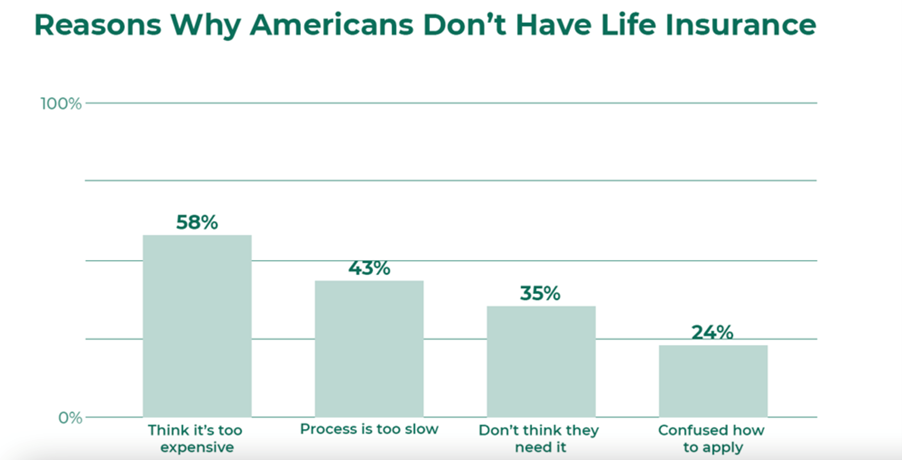

The main reason cited on various studies as to why people do not buy life insurance is that it is too expensive. The online life insurer Bestow surveyed 1,123 Americans in 2018 and found that 58% said they did not own individual life insurance because they thought it was too expensive (see Figure 4).[vii] For these individuals, no matter what the price is, it will be deemed as too expensive. Resetting an anchor is very difficult. The anchor is not necessarily the actual price of life insurance, it is the belief that life insurance is expensive.

Figure 4

A well-tested alternative to resetting an anchor is to change to the business model. In most advanced economies, clean, potable water is delivered to most people for little or no cost. However, companies began to see a market after a few high-profile cases involved contaminated water supplies. Today, bottled water is a multibillion-dollar industry expected to reach over $330 billion in the US alone by the year 2023.[viii]

This industry took a freely available product and changed the business model to charge for it. To reach those people who think that insurance is too expensive, who intend to purchase insurance and get stuck, or who don’t think that they need insurance, the industry must figure out a way to provide this valuable and necessary financial tool in new and unique ways. The life insurance industry must reset the anchor.

One way to do this would be to provide services instead of cash as a benefit. This technique has been successful in many areas, including product warranties. When a pair of headphones breaks after six months of use, the customer is not interested in a partial refund. Instead, the consumer would like a new set of headphones, even if they are simply refurbished to look new. Just giving cash would force the customer to research new headphones and go out to purchase them.

Not all life insurance purchasers want cash upon the death of a breadwinner. Perhaps providing such “free” services as an accountant to look over finances, groceries, continued contributions to retirement savings, or house maintenance and cleaning would be more helpful. These services could have a duration of a few years until the family has a chance to return to a new normal way of life, then the insurer could pay a lump sum. Local providers could contract with insurers to create a network that reduces costs. These services could be invaluable to a widow or widower who has to worry about going to work or caring for children, for example.

Conclusion

Better understanding policyholder behavior can not only assist in increasing life insurance sales, it can help product-development teams avoid costly mistakes. This will require researching topics that traditional actuaries, accountants, and economists are not very comfortable with. The groundwork has already been laid by pioneers in this discipline, such as Daniel Kahneman. Theories must be tested in the field of insurance with surveys, studies, and other research. The benefits will be well worth the effort.

Making insurance appeal to the brain’s System 1 by making life insurance products and the purchasing process simpler could help to boost sales. Improving financial literacy beginning in grade schools could help more people rely on System 2 when making those important insurance-purchasing decisions. Resetting anchors by changing life insurance business models to pay claims in services rather than cash can take the emphasis off of price.

The life insurance industry will continue to be an important part of society. This has become even more evident during the current pandemic. Those who had the foresight to purchase life insurance, disability income coverage, and annuity products have the security that they will receive a much-needed benefit upon the death or disability of an insured and monthly payments upon retirement. This security allows policyholders a certain peace of mind that is difficult to explain. However, even during a pandemic, sales have been subpar, and the much-reported insurance gap continues to grow. It is critical that the life insurance industry use its System 2 to make the correct decisions and invest time and resources into policyholder behavior to help close the protection gap.

3.2021

Endnotes

[i] “Global Bottled Water Market (2020 to 2026) - Featuring PepsiCo, Nongfu Spring & Nestle Among Others,” Business Wire, May 12, 2020, https://www.businesswire.com/news/home/20200512005445/en/Global-Bottled-Water-Market-2020-to-2026---Featuring-PepsiCo-Nongfu-Spring-Nestle-Among-Others---ResearchAndMarkets.com (accessed March 10, 2021).

[ii] “Dan Ariely Interview—A Primer on Behavioral Economics,” TheBestSchools.org, October 29, 2020, https://thebestschools.org/features/dan-ariely-interview-behavioral-economics/ (accessed March 10, 2021).

[iii] Daniel Kahneman, Thinking, Fast and Slow (New York: Farrar, Straus and Giroux, 2011).

[iv] “2020 Insurance Barometer,” LIMRA, 2020, www.njltc.com/documents/2020%20LIMRA.pdf (accessed March 10, 2021).

[v] “Life Insurers Fact Book 2020,” American Council of Life Insurers, 2020, https///www.acli.com/-/media/ACLI/Files/Fact-Books-Public/2020LifeInsurersFactBook.ashx?la=en.pdf (accessed March 10, 2021).

[vi] Kahneman, Thinking, Fast and Slow.

[vii] Cristy Lynch, “Survey: Most Americans Don’t Have Individual Life Insurance Coverage,” February 16, 2018, https://www.bestow.com/blog/life-insurance-research-findings/ (accessed March 10, 2021).

[viii] “Global Bottled Water Market (2020 to 2026) - Featuring PepsiCo, Nongfu Spring & Nestle Among Others,” Business Wire, May 12, 2020, https://www.businesswire.com/news/home/20200512005445/en/Global-Bottled-Water-Market-2020-to-2026---Featuring-PepsiCo-Nongfu-Spring-Nestle-Among-Others---ResearchAndMarkets.com (accessed March 10, 2021).

About the Author:

Ronnie has over 40 years of insurance and reinsurance experience having worked and lived in 3 countries. In his current role, Ronnie serves as Executive Director to the Bermuda International Long-Term Insurers and Reinsurers (BILTIR) association. He also is a Collaborating Expert of Health and Ageing for The Geneva Association located in Zürich. Ronnie is Co-Chair of the Programming Committee for the ReFocus Conference and served on the Board of Directors of the Society of Actuaries. Before this, Ronnie worked as the Head of Life Reinsurance for Zurich Insurance Group in Zürich, Head of Life Reinsurance for AIG in New York and Global Head of Life Pricing for Swiss Re in London. Ronnie began his career at Mutual of New York. A little-known fact is that Ronnie holds a patent (US20060026092A1) for the first Mortality Bond issued called Vita when he was with Swiss Re.